Global Swine Feed Anticoccidials Market

Market Size in USD Billion

CAGR :

%

USD

1.72 Billion

USD

2.56 Billion

2024

2032

USD

1.72 Billion

USD

2.56 Billion

2024

2032

| 2025 –2032 | |

| USD 1.72 Billion | |

| USD 2.56 Billion | |

|

|

|

|

Swine Feed Anticoccidials Market Size

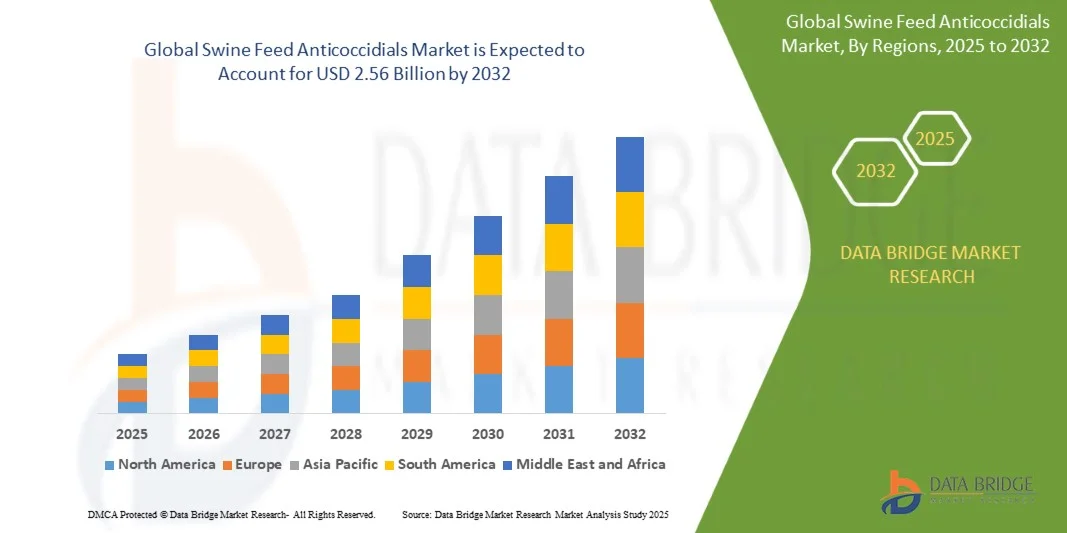

- The global swine feed anticoccidials market size was valued at USD 1.72 billion in 2024 and is expected to reach USD 2.56 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of coccidiosis in swine production, driving the need for effective preventive feed additives that improve animal health and farm productivity. Rising awareness among producers regarding the economic impact of parasitic infections and the benefits of incorporating anticoccidials into feed formulations is further supporting market expansion

- Furthermore, the growing focus on enhancing feed efficiency, ensuring high-quality pork production, and complying with stringent animal health regulations is encouraging the adoption of scientifically proven anticoccidial solutions. These factors, combined with advancements in feed formulation technologies and rising demand for residue-free products, are significantly accelerating the growth of the swine feed anticoccidials market

Swine Feed Anticoccidials Market Analysis

- Swine feed anticoccidials, used to prevent and control coccidiosis in pigs, are essential feed additives that promote better growth rates, improved feed conversion, and reduced mortality in commercial swine operations. They play a vital role in maintaining gut health and productivity, especially in large-scale and intensive pig farming systems where disease management is critical

- The growing demand for safe, high-performance feed solutions, coupled with increasing industrialization of pig farming, is driving steady adoption of anticoccidials across major livestock-producing regions. In addition, ongoing innovation in natural and combination formulations is enhancing the market’s growth potential by addressing both efficacy and sustainability concerns

- Asia-Pacific dominated the swine feed anticoccidials market in 2024, due to the region’s strong swine production base, increasing focus on animal health management, and rising demand for high-quality pork

- North America is expected to be the fastest growing region in the swine feed anticoccidials market during the forecast period due to high adoption of advanced feed technologies, intensive swine production systems, and increasing investments in animal health research

- Oral segment dominated the market with a market share of 73.7% in 2024, due to its convenience of administration through feed or water, ensuring uniform dosage across swine populations. Oral anticoccidials are widely used in feed mills and integrated farms for mass prophylactic treatment, offering efficiency and scalability. The ability to combine oral anticoccidials with other nutritional supplements enhances compliance and effectiveness. Moreover, oral delivery reduces stress on animals compared to injectable methods, supporting its market dominance

Report Scope and Swine Feed Anticoccidials Market Segmentation

|

Attributes |

Swine Feed Anticoccidials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Swine Feed Anticoccidials Market Trends

“Growing Use of Natural and Residue-Free Anticoccidials”

- The global swine feed anticoccidials market is evolving rapidly as producers increasingly adopt natural and residue-free solutions to control coccidiosis while meeting consumer and regulatory expectations for antibiotic-free meat production. The shift from conventional ionophores and synthetic drugs to botanical and enzyme-based alternatives reflects the growing emphasis on sustainable and preventive animal health management

- For instance, companies such as Cargill, Incorporated and Phibro Animal Health Corporation have launched plant-extract-based and probiotic-driven anticoccidial feed additives that mitigate intestinal infections without leaving chemical residues. These innovations are designed to support animal welfare while enabling compliance with global restrictions on antibiotic growth promoters

- The rising consumer demand for “clean label” pork and natural production methods is accelerating the development of organic and herbal anticoccidials derived from essential oils, herbs, and organic acids. These formulations enhance gut health and immunity while providing effective coccidiosis prevention across intensive swine production systems

- Advancements in microencapsulation and delivery technologies are further improving the stability and bioavailability of natural anticoccidials in feed. Controlled-release systems ensure uniform dosage and consistent protection throughout the swine growth cycle, optimizing productivity and feed conversion efficiency

- The increasing integration of data-driven livestock health monitoring systems enables precise dosing and timely intervention against protozoan infections. This digital convergence enhances the effectiveness of both natural and synthetic anticoccidials within precision livestock farming frameworks

- As the industry continues to shift toward antibiotic stewardship and sustainability, the adoption of residue-free anticoccidials offers an effective balance between disease prevention, performance improvement, and market acceptability. This trend underscores the broader transformation of global livestock nutrition toward safer, eco-friendly, and regulation-compliant solutions

Swine Feed Anticoccidials Market Dynamics

Driver

“Rising Focus on Preventive Health and Feed Efficiency”

- The growing emphasis on preventive health management in intensive pig farming is driving demand for efficient anticoccidial feed additives. Farmers are increasingly using these products to avoid productivity losses associated with coccidiosis, a parasitic infection known to impair growth and feed utilization in swine herds

- For instance, Elanco Animal Health and Zoetis Inc. have introduced advanced anticoccidial formulations designed to enhance gut health, reduce infection severity, and improve overall feed conversion ratios. These innovations align with the industry’s ongoing transition from curative treatment to preventive health solutions

- Feed anticoccidials play a critical role in maintaining optimal nutrient absorption and gut microbiota balance, particularly in young piglets exposed to high pathogen loads during weaning. Preventive use ensures stable weight gain and reduced veterinary intervention, thereby supporting economic efficiency in production systems

- The increasing integration of health-promoting additives such as prebiotics, enzymes, and probiotics with anticoccidials reflects a comprehensive approach to animal nutrition and disease prevention. This multi-functional feed strategy enhances performance and also strengthens immunity against recurring parasitic infections

- As global pork demand continues to rise, producers are prioritizing efficient feed utilization and preventive parasite control to sustain profitability and animal welfare. This ongoing focus on proactive herd management is expected to remain a key growth driver for the swine feed anticoccidials market

Restraint/Challenge

“Strict Regulations on Chemical-Based Additives”

- Stringent regulatory restrictions on the use of chemical anticoccidials and antibiotic-based feed additives are creating significant challenges for market participants. Regulatory agencies in the EU, U.S., and Asia-Pacific are tightening approval frameworks to minimize drug residues in animal-derived food products and mitigate resistance risks

- For instance, companies such as Bayer AG and Huvepharma faced heightened scrutiny over the approval of ionophore-based formulations in Europe due to concerns regarding antimicrobial resistance and environmental persistence. These policy changes have compelled producers to shift toward natural alternative solutions or reformulated products

- Extended approval timelines, complex residue testing requirements, and higher costs of compliance reduce the pace of product innovation in the chemical additive category. Smaller manufacturers often find it difficult to meet varying regional standards, limiting their competitiveness in international markets

- The phase-out of antibiotic-linked anticoccidial agents also creates performance management gaps during transitional phases, especially in regions where access to alternative natural additives is limited. Maintaining consistent efficacy without compromising safety remains a key technical and regulatory challenge

- Addressing these issues requires continued R&D in plant-derived, enzyme-based, and microbiome-friendly anticoccidials that meet regulatory compliance while delivering reliable performance. Strengthening global harmonization in feed additive regulation will also be critical to fostering innovation and ensuring safe coccidiosis control in the swine industry

Swine Feed Anticoccidials Market Scope

The market is segmented on the basis of type, swine, source, and mode of consumption.

• By Type

On the basis of type, the swine feed anticoccidials market is segmented into Monensin, Lasalocid, Salinomycin, Nicarbazin, Diclazuril, Narasin, DOT (Dinitro-o-Toluamide), and Others. The Monensin segment dominated the market with the largest revenue share in 2024, driven by its proven efficacy in controlling Eimeria infections and improving feed efficiency in swine production. Monensin’s cost-effectiveness and long-standing use in commercial pig farming have made it a preferred choice among producers. Its ability to enhance nutrient absorption and promote growth performance contributes to its strong adoption, especially in regions with intensive livestock farming operations. The segment’s dominance is also supported by its broad availability and consistent regulatory approvals in key livestock-producing countries.

The Diclazuril segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its targeted action against multiple coccidial species and minimal residue concerns in meat production. Diclazuril offers high efficacy even at low dosages, reducing the risk of resistance development, which makes it attractive for modern, residue-conscious feed formulations. The growing demand for advanced, residue-free anticoccidials in both organic and high-value pork production systems further supports its market expansion. Increased focus on sustainable and safe feed additives is also accelerating the shift toward Diclazuril-based products.

• By Swine

On the basis of swine, the market is segmented into Starter, Grower, and Sows. The Grower segment accounted for the largest market share in 2024, attributed to the higher feed consumption rates and longer growth cycles during this phase. Producers heavily rely on anticoccidials for growers to prevent outbreaks that can significantly impact weight gain and feed conversion ratios. The widespread use of medicated feed during the grower phase ensures optimal performance and reduces mortality, driving steady product demand. This segment also benefits from the rising emphasis on maintaining consistent productivity in large-scale swine operations.

The Starter segment is projected to grow at the fastest rate from 2025 to 2032, due to the increased focus on early-stage immunity and disease prevention in piglets. Young pigs are more susceptible to coccidiosis, making early prophylactic use of anticoccidials crucial. Rising adoption of specialized starter feed formulations enriched with low-toxicity anticoccidials is propelling segment growth. In addition, producers are prioritizing early-life interventions to minimize long-term performance losses and improve overall herd health, further supporting this segment’s rapid expansion.

• By Source

On the basis of source, the market is divided into Chemical and Natural. The Chemical segment dominated the market in 2024, owing to its established effectiveness, wide availability, and consistent performance across varied production conditions. Chemical anticoccidials are preferred in large-scale operations for their reliable prevention capabilities and proven record in reducing morbidity. Their precise dosage control and immediate impact on parasite control strengthen their position among commercial swine producers. In addition, ongoing innovations in chemical formulations aimed at reducing resistance risks have sustained segment growth.

The Natural segment is anticipated to record the fastest growth from 2025 to 2032, driven by the growing preference for antibiotic-free and residue-safe feed additives. Natural anticoccidials derived from plant extracts and essential oils are gaining traction as sustainable alternatives amid stricter regulations on synthetic additives. The increasing consumer demand for organic and chemical-free pork products is further enhancing adoption. Rising research investments in phytogenic compounds and probiotics that improve gut health while combating coccidia are expected to strengthen this segment’s future outlook.

• By Mode of Consumption

On the basis of mode of consumption, the market is categorized into Oral and Injection. The Oral segment held the largest market share of 73.7% in 2024, primarily due to its convenience of administration through feed or water, ensuring uniform dosage across swine populations. Oral anticoccidials are widely used in feed mills and integrated farms for mass prophylactic treatment, offering efficiency and scalability. The ability to combine oral anticoccidials with other nutritional supplements enhances compliance and effectiveness. Moreover, oral delivery reduces stress on animals compared to injectable methods, supporting its market dominance.

The Injection segment is expected to witness the fastest growth during 2025–2032, owing to its precise dosing capability and rapid onset of action. Injectable anticoccidials are increasingly preferred for targeted treatment in high-value breeding stock or severe outbreak conditions. The segment’s growth is supported by advances in long-acting formulations that provide sustained protection with fewer applications. The rising adoption of veterinary care services and individualized dosing strategies in intensive pig farms is further propelling the uptake of injection-based anticoccidial solutions.

Swine Feed Anticoccidials Market Regional Analysis

- Asia-Pacific dominated the swine feed anticoccidials market with the largest revenue share in 2024, driven by the region’s strong swine production base, increasing focus on animal health management, and rising demand for high-quality pork

- Expanding commercial pig farming operations and adoption of medicated feed to prevent coccidiosis are fueling market growth

- In addition, supportive government initiatives toward livestock productivity and growing awareness of feed hygiene are strengthening regional demand for anticoccidial solutions

China Swine Feed Anticoccidials Market Insight

China held the largest share in the Asia-Pacific swine feed anticoccidials market in 2024, owing to its dominance in global pork production and the presence of large-scale, vertically integrated farms. The country’s emphasis on controlling parasitic infections and enhancing feed efficiency is driving the widespread adoption of anticoccidials. Government-backed programs promoting livestock biosecurity and continuous innovation in feed formulation are further strengthening market growth. The availability of cost-effective solutions and strong domestic manufacturing capacity continue to reinforce China’s leadership position.

India Swine Feed Anticoccidials Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding pig farming operations, rising pork consumption, and increased awareness regarding preventive animal health measures. The growing adoption of medicated feed in emerging livestock hubs, supported by favorable government initiatives, is enhancing demand. In addition, the shift toward natural and residue-free anticoccidials, coupled with increased investments in feed production infrastructure, is driving rapid market expansion across the country.

Europe Swine Feed Anticoccidials Market Insight

The Europe swine feed anticoccidials market is expanding steadily, supported by stringent feed safety regulations, high animal welfare standards, and strong demand for premium-quality pork. The region’s focus on sustainable farming practices and reduced antibiotic dependency is encouraging the adoption of effective anticoccidial feed solutions. In addition, ongoing research into natural feed additives and residue-free formulations is fostering innovation in the European market.

Germany Swine Feed Anticoccidials Market Insight

Germany’s swine feed anticoccidials market is driven by its advanced livestock management systems, strong veterinary infrastructure, and growing emphasis on preventive healthcare. The country’s regulations limiting antibiotic residues are accelerating the adoption of high-efficacy anticoccidials in feed formulations. Its strong research collaborations and focus on sustainable production are further contributing to steady market expansion.

U.K. Swine Feed Anticoccidials Market Insight

The U.K. market is supported by increasing awareness of animal health and welfare, stringent quality standards, and growing demand for traceable pork products. Post-Brexit shifts toward domestic feed production and enhanced biosecurity are boosting reliance on regulated anticoccidial solutions. The country’s rising focus on sustainable farming and innovation in natural feed additives continues to shape market growth.

North America Swine Feed Anticoccidials Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by high adoption of advanced feed technologies, intensive swine production systems, and increasing investments in animal health research. The region’s emphasis on maximizing feed efficiency, improving herd immunity, and maintaining biosecurity standards is fostering steady market expansion. In addition, ongoing product innovations and collaborations between feed manufacturers and veterinary institutes are accelerating growth.

U.S. Swine Feed Anticoccidials Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by its extensive commercial pork industry, advanced feed manufacturing capabilities, and strong regulatory focus on feed safety. The increasing adoption of precision feeding systems and medicated feed additives to enhance growth performance is driving demand. The presence of leading feed producers and continuous R&D investments in innovative anticoccidial formulations further reinforce the U.S.’s dominant position in the regional market.

Swine Feed Anticoccidials Market Share

The swine feed anticoccidials industry is primarily led by well-established companies, including:

- Elanco Animal Health Incorporated (U.S.)

- Huvepharma (Bulgaria)

- Phibro Animal Health Corporation (U.S.)

- Ceva Santé Animale (France)

- Zoetis Inc. (U.S.)

- Impextraco NV (Belgium)

- Kemin Industries, Inc. (U.S.)

- Merck Animal Health (U.S.)

- Virbac (France)

- Zydus Animal Health (India)

- Bioproperties Pty Ltd (Australia)

- Qilu Animal Health Products Co., Ltd. (China)

Latest Developments in Global Swine Feed Anticoccidials Market

- In August 2023, Zoetis expanded its anticoccidial product line by introducing IntestiGuard, a next-generation feed additive designed to enhance gut integrity and immunity in swine. This development reflects Zoetis’s strategic move toward integrated gut health solutions targeting both prevention and performance improvement. The product’s launch strengthens the company’s position in the global swine feed anticoccidials market, addressing the increasing demand for sustainable and residue-free solutions aligned with modern livestock management standards

- In March 2022, Virbac announced the commercial rollout of its Coximune® anticoccidial formulation, specifically developed for use in piglets to prevent early-stage coccidiosis infections. This innovation highlights Virbac’s commitment to early-life disease prevention and feed efficiency enhancement in intensive swine production systems. The introduction of Coximune® supports market growth by expanding product availability in the natural and low-residue anticoccidial segment, catering to growing consumer preference for safe and antibiotic-free pork production

- In May 2021, Elanco Animal Health Incorporated launched ZoaShieldä in the U.S., offering poultry producers a proven and flexible zoalene solution for effective coccidiosis control in an easy, manageable way. The product’s successful adoption reinforces Elanco’s leadership in anticoccidial innovation and enhances its capacity to diversify applications across livestock species, including swine feed formulations

- In October 2020, Huvepharma produced Monimax®, a proven coccidiosis control solution that gained EU approval following strong global rollout. The product’s approval enhanced Huvepharma’s market presence in regulated regions and strengthened confidence in combination anticoccidial therapies designed for multiple livestock applications, including swine

- In September 2020, Huvepharma obtained European registration for Monimax®, a combination of monensin and nicarbazin, for use in broiler chickens, turkeys, and chickens reared for laying. This regulatory milestone expanded the company’s product footprint in the global anticoccidial segment and contributed to increasing adoption of multi-ingredient formulations aimed at improving feed performance and disease prevention in livestock production systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.