Global Swine Feed Antioxidants Market

Market Size in USD Million

CAGR :

%

USD

438.10 Million

USD

662.20 Million

2025

2033

USD

438.10 Million

USD

662.20 Million

2025

2033

| 2026 –2033 | |

| USD 438.10 Million | |

| USD 662.20 Million | |

|

|

|

|

Swine Feed Antioxidants Market Size

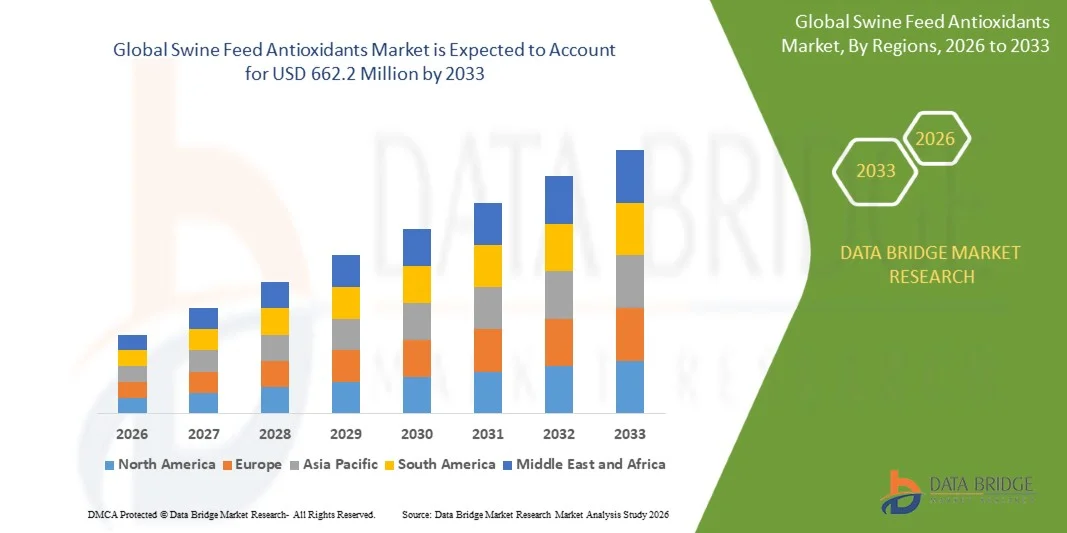

- The global swine feed antioxidants market size was valued at USD 438.1 Million in 2025 and is expected to reach USD 662.2 Million by 2033, at a CAGR of 5.30% during the forecast period

- The market growth is largely fuelled by the rising demand for high-quality pork production, supported by increasing awareness regarding the benefits of antioxidants in improving animal health and feed stability

- The growing focus on preventing oxidative stress in swine, improving immunity, and enhancing overall productivity is further accelerating the adoption of natural and synthetic antioxidants across commercial farms

Swine Feed Antioxidants Market Analysis

- The swine feed antioxidants market is witnessing consistent growth as producers prioritize nutrient preservation, extended shelf life, and improved feed efficiency across intensive farming operations

- Growing concerns regarding disease outbreaks, coupled with the need for maintaining optimal gut health and minimizing economic losses, are encouraging feed manufacturers to incorporate effective antioxidant solutions across various feed types

- Asia-Pacific dominated the swine feed antioxidants market with the largest revenue share in 2025, driven by the rapid expansion of commercial swine production and rising demand for high-quality feed additives

- North America region is expected to witness the highest growth rate in the global swine feed antioxidants market, driven by advanced livestock management practices, strong presence of key feed additive manufacturers, and rising demand for premium-quality pork

- The Synthetic Antioxidants segment held the largest market revenue share in 2025 driven by its high stability, strong oxidative protection, and cost-effectiveness in large-scale feed production. Synthetic solutions such as BHT, BHA, and ethoxyquin offer consistent performance across varied storage conditions, making them a preferred choice among commercial feed manufacturers

Report Scope and Swine Feed Antioxidants Market Segmentation

|

Attributes |

Swine Feed Antioxidants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Swine Feed Antioxidants Market Trends

Rise of Natural and Functional Antioxidant Solutions

- The increasing shift toward natural antioxidants such as plant extracts, essential oils, and herbal blends is reshaping the swine feed antioxidants market. Producers are prioritizing clean-label and residue-free additives to meet consumer demand for safer and healthier pork products, driving strong adoption across commercial farms. This transition is also supported by rising awareness of environmental sustainability and the need to minimize synthetic chemical use in feed production

- The rising need to maintain feed quality, prevent oxidation, and enhance the shelf-life of compound feed is accelerating the use of advanced antioxidant formulations. These solutions help minimize nutrient degradation, protect fatty acids, and improve overall feed stability, particularly under fluctuating storage conditions. Consistent feed quality is becoming essential for large-scale operations seeking higher profitability and reduced wastage

- Growing preference for functional additives that support gut health, immunity, and growth performance is influencing product innovation. Manufacturers are increasingly incorporating multifunctional antioxidants into feed premixes to deliver broader physiological benefits to swine. This trend is stimulating R&D investments aimed at developing synergistic blends that combine antioxidant protection with enhanced nutritional value

- For instance, in 2024, several feed producers in Southeast Asia adopted natural rosemary and green tea extract-based antioxidants to reduce feed spoilage during high-temperature seasons, resulting in improved feed efficiency and lower production losses. These natural ingredients helped maintain feed freshness, particularly in regions with tropical climates. The success of these integrations is prompting wider regional adoption of similar plant-derived solutions

- While natural antioxidant solutions continue gaining traction, their long-term success depends on cost optimization, consistent quality, and formulation advancements that match the efficacy of synthetic alternatives. Manufacturers must ensure reliable performance in diverse environmental and storage conditions. Strategic collaborations across the feed supply chain are becoming increasingly important to support scale and efficiency

Swine Feed Antioxidants Market Dynamics

Driver

Rising Focus on Swine Health, Feed Efficiency, and Meat Quality

- Increasing emphasis on improving swine immunity, growth rates, and disease resistance is driving higher adoption of feed antioxidants. These additives help reduce oxidative stress, enhancing overall animal performance and contributing to healthier pork outputs. Producers are increasingly investing in premium feed solutions to meet stringent market and export quality standards

- Growing awareness among farmers about feed oxidation challenges, including rancidity, nutrient loss, and reduced palatability, is boosting the use of antioxidants in commercial feed formulations. Producers are actively seeking solutions that ensure feed stability throughout storage and transportation. Efficient antioxidant use is becoming a critical factor in minimizing feed wastage and improving operational returns

- Regulatory support promoting safer and more sustainable feed ingredients is also shaping market expansion. As countries tighten restrictions on harmful additives, the demand for compliant and effective antioxidant alternatives continues to grow. This is encouraging feed manufacturers to reformulate products using safer compounds that align with evolving global guidelines

- For instance, in 2023, several European feed manufacturers introduced updated antioxidant premixes aligned with new feed safety guidelines, resulting in increased adoption across large-scale swine production systems. These revised formulations improved feed consistency and reduced oxidative spoilage. The shift also helped producers maintain compliance and strengthen consumer trust in pork quality

- While demand is accelerating, consistent farmer education, quality assurance, and improved distribution networks remain essential to sustain long-term market growth. Increasing access to technical support and training can help farmers optimize antioxidant use. Expanded collaborations among suppliers, nutritionists, and producers are expected to further strengthen industry adoption

Restraint/Challenge

High Cost of Natural Antioxidants and Limited Availability of Quality Raw Materials

- Natural antioxidant sources such as botanical extracts and organic compounds often come with higher production costs compared to synthetic variants. This pricing gap limits adoption among cost-conscious farmers and small-scale feed producers. The challenge is further intensified by rising global demand for natural ingredients across multiple industries

- Supply chain constraints, including seasonal variability of plant-based raw materials and inconsistent sourcing from global suppliers, affect the availability and pricing of premium antioxidants. These challenges can lead to fluctuations in feed formulation costs. Dependency on specific regions for raw materials also increases the risk of market instability

- The complexity of developing stable and effective natural antioxidant blends requires advanced processing and formulation technologies, which may not be accessible to all manufacturers. Smaller companies often struggle to balance performance, affordability, and regulatory compliance. This limits the pace at which natural alternatives can replace synthetic options across developing markets

- For instance, in 2024, feed producers in Latin America reported delays in acquiring natural tocopherol supplies due to constrained global production, resulting in higher operating costs and slowed product output. Such shortages disrupt planned feed formulations and force producers to adopt costlier substitutes. Long-term solutions will require diversified sourcing and enhanced ingredient processing capabilities

- While innovation and expanded raw material sourcing may reduce dependency challenges, overcoming cost and supply limitations remains critical for unlocking wider market penetration and ensuring steady industry growth. Collaborative efforts between ingredient suppliers and feed manufacturers will help create more accessible natural antioxidant solutions. Scaling sustainable farming of botanical sources may also gradually ease supply pressures

Swine Feed Antioxidants Market Scope

The market is segmented on the basis of type and form

- By Type

On the basis of type, the swine feed antioxidants market is segmented into Synthetic Antioxidants and Natural Antioxidants. The Synthetic Antioxidants segment held the largest market revenue share in 2025 driven by its high stability, strong oxidative protection, and cost-effectiveness in large-scale feed production. Synthetic solutions such as BHT, BHA, and ethoxyquin offer consistent performance across varied storage conditions, making them a preferred choice among commercial feed manufacturers.

The Natural Antioxidants segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rising demand for clean-label feed ingredients and growing preference for plant-derived extracts. Natural antioxidants such as tocopherols, rosemary extract, and green tea polyphenols are gaining popularity due to their safety profile and ability to enhance feed quality while supporting healthier pork production.

- By Form

On the basis of form, the swine feed antioxidants market is segmented into Liquid and Dry. The Dry segment held the largest market revenue share in 2025 owing to its longer shelf-life, ease of blending in compound feed, and suitability for bulk storage in commercial operations. Dry antioxidant formulations offer improved handling convenience and maintain stability during transportation, making them widely adopted across integrated feed mills.

The Liquid segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its high absorption efficiency and superior dispersion in fat-rich feed formulations. Liquid antioxidants are increasingly preferred for their rapid action, uniform distribution, and enhanced protection against lipid oxidation in specialty feed blends. Their rising use in customized and high-performance feed applications is supporting segment expansion.

Swine Feed Antioxidants Market Regional Analysis

- Asia-Pacific dominated the swine feed antioxidants market with the largest revenue share in 2025, driven by the rapid expansion of commercial swine production and rising demand for high-quality feed additives

- Producers in the region increasingly prioritize feed stability, nutrient preservation, and cost-effective additive solutions to improve animal health and performance across intensive farming systems

- This widespread adoption is further supported by growing meat consumption, accelerated industrialization of livestock operations, and stronger emphasis on feed safety, positioning the region as a key consumer of both natural and synthetic antioxidants

China Swine Feed Antioxidants Market Insight

The China swine feed antioxidants market captured the largest revenue share in 2025 within Asia-Pacific, driven by the country’s vast swine population and strong focus on improving feed efficiency. Rising concerns over feed spoilage, lipid oxidation, and nutrient degradation are increasing the use of advanced antioxidant formulations. In addition, the rapid expansion of vertically integrated swine farms and ongoing modernization of feed mills support significant adoption. The presence of major domestic feed manufacturers further strengthens market growth.

Japan Swine Feed Antioxidants Market Insight

The Japan swine feed antioxidants market is expected to witness notable growth from 2026 to 2033 due to the country’s strict feed safety standards and strong emphasis on high-quality livestock production. Antioxidants are increasingly used to prevent feed oxidation, improve shelf life, and support better animal health outcomes.There is a rising shift toward natural antioxidants such as tocopherols and plant-based polyphenols, supported by Japan’s growing consumer preference for clean-label, residue-free pork products. Local feed manufacturers are also exploring innovative antioxidant sources such as chestnut-derived polyphenols to enhance both feed stability and functional benefits.

Europe Swine Feed Antioxidants Market Insight

The Europe swine feed antioxidants market is expected to witness notable growth from 2026 to 2033, driven by stringent regulatory standards promoting safer and high-quality feed ingredients. European producers are increasingly shifting toward natural antioxidant alternatives such as botanical extracts and tocopherols to meet sustainability goals and consumer preference for clean-label pork products. The region also benefits from technologically advanced feed production systems and high adoption of precision livestock farming practices.

Germany Swine Feed Antioxidants Market Insight

The Germany swine feed antioxidants market is expected to witness strong growth from 2026 to 2033 due to heightened focus on animal health, welfare, and environmentally sustainable feeding systems. German feed manufacturers emphasize the use of premium antioxidant blends to maintain feed integrity, particularly in high-fat diets used in performance-driven swine operations. The growing integration of natural antioxidants and strict compliance requirements further stimulate market adoption.

U.K. Swine Feed Antioxidants Market Insight

The U.K. swine feed antioxidants market is expected to grow steadily from 2026 to 2033, driven by the region’s increasing emphasis on premium pork quality, stricter feed safety regulations, and rising demand for natural feed additives. Producers are shifting toward clean-label and plant-based antioxidant solutions to align with consumer preferences for sustainably produced meat. Ongoing advancements in feed formulation technologies, combined with strong regulatory compliance frameworks, are further accelerating the integration of both synthetic and natural antioxidants across commercial swine operations.

North America Swine Feed Antioxidants Market Insight

The North America swine feed antioxidants market is expected to witness steady growth from 2026 to 2033, driven by modernization of feed mills, increasing demand for stable and nutrient-rich feed, and the rising use of precision feeding technologies. Producers in the U.S. and Canada increasingly rely on antioxidants to prevent rancidity, maintain feed freshness during long-distance transportation, and support overall animal productivity. Continued innovation in antioxidant blends and strong presence of global feed additive companies contribute to sustained market development.

U.S. Swine Feed Antioxidants Market Insight

The U.S. swine feed antioxidants market is expected to witness steady growth from 2026 to 2033, supported by the country’s large-scale pork production systems and rising focus on feed efficiency and animal health. Increasing adoption of advanced antioxidant blends to prevent feed spoilage, enhance shelf-life, and maintain nutrient integrity is driving market expansion. Strong investments in precision livestock farming, coupled with growing interest in natural antioxidant alternatives among producers and consumers, continue to shape product innovation and accelerate uptake across industrial swine farms.

Swine Feed Antioxidants Market Share

The Swine Feed Antioxidants industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Novozymes (Denmark)

- Alltech (U.S.)

- Perstorp (Sweden)

- DuPont (U.S.)

- Impextraco NV (Belgium)

- Cargill, Incorporated (U.S.)

- Biomin (Austria)

- DSM (Netherlands)

- Akzo Nobel N.V. (Netherlands)

- Nutreco N.V. (Netherlands)

- Adisseo (France)

- ADDCON GmbH (Germany)

- Kemin Industries, Inc. (U.S.)

- Lucta (Spain)

- VEMO 99 Ltd (U.K.)

- BERTOL COMPANY s.r.o. (Czech Republic)

- JH Biotech, Inc. (U.S.)

- Nutrex (Bahamas)

- ADM (U.S.)

- Chr. Hansen Holdings A/S (Denmark)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.