Global Swine Feed Micronutrients Market

Market Size in USD Billion

CAGR :

%

USD

1.65 Billion

USD

2.61 Billion

2024

2032

USD

1.65 Billion

USD

2.61 Billion

2024

2032

| 2025 –2032 | |

| USD 1.65 Billion | |

| USD 2.61 Billion | |

|

|

|

|

Swine Feed Micronutrients Market Size

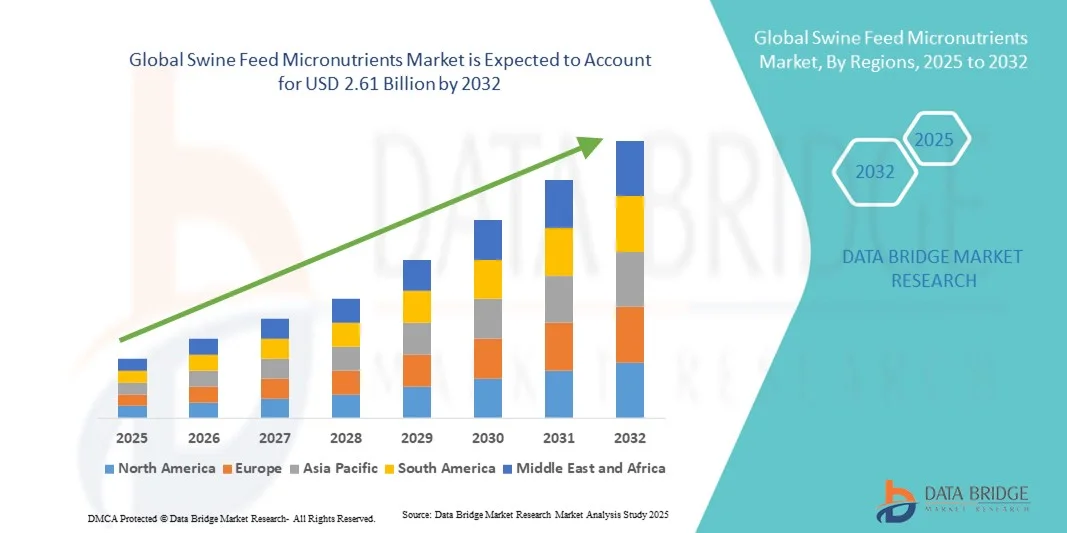

- The global swine feed micronutrients market size was valued at USD 1.65 billion in 2024 and is expected to reach USD 2.61 billion by 2032, at a CAGR of 5.90% during the forecast period

- The market growth is largely fueled by the increasing focus on improving animal health, productivity, and nutritional balance in swine farming, driving the demand for essential micronutrients such as trace minerals and vitamins in feed formulations. Advancements in feed technology and growing awareness among farmers regarding nutrient optimization are enhancing the adoption of fortified feed solutions across commercial and small-scale pig farms

- Furthermore, the rising need to replace antibiotic growth promoters with safe and sustainable alternatives is boosting the integration of micronutrients in feed to strengthen immunity and enhance growth performance. These factors are collectively accelerating the use of micronutrient-based feed solutions, thereby significantly driving the market’s expansion

Swine Feed Micronutrients Market Analysis

- Swine feed micronutrients, comprising trace minerals, vitamins, and other essential elements, play a crucial role in supporting growth, reproduction, and disease resistance among pigs, making them vital components of balanced nutrition programs in modern livestock production

- The rising demand for high-quality pork, coupled with an increasing emphasis on feed efficiency and sustainable animal husbandry practices, is propelling the global swine feed micronutrients market. Continuous innovations in bioavailable formulations and precision feeding are further enhancing nutrient absorption and overall herd performance

- Asia-Pacific dominated the swine feed micronutrients market with a share of over 42% in 2024, due to the region’s large swine population, rapid expansion of commercial pig farming, and rising demand for nutrient-enriched feed formulations

- North America is expected to be the fastest growing region in the swine feed micronutrients market during the forecast period due to the modernization of swine farming, rising focus on feed optimization, and increasing demand for premium pork

- Solid segment dominated the market with a market share of 64.8% in 2024, due to its stability, easy storage, and compatibility with bulk feed manufacturing processes. Solid formulations are cost-effective and have a longer shelf life, making them suitable for large-scale commercial swine operations. The widespread use of premixes and powdered additives for uniform nutrient distribution also contributes to the strong demand for the solid form

Report Scope and Swine Feed Micronutrients Market Segmentation

|

Attributes |

Swine Feed Micronutrients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Swine Feed Micronutrients Market Trends

Rising Use of Bioavailable Micronutrient Formulations

- The swine feed micronutrients market is increasingly shifting toward the adoption of bioavailable and chelated micronutrient formulations that enhance nutrient absorption, promote animal health, and improve feed efficiency. These advanced formulations are allowing producers to meet nutritional demands more effectively while optimizing growth performance in swine production systems

- For instance, Zinpro Corporation has developed a range of organic trace mineral supplements that feature high bioavailability and stability in gastrointestinal conditions, enabling efficient mineral uptake and improved immune response in pigs. This innovation reflects the industry’s move toward next-generation feed formulations designed to maximize nutrient utilization and minimize environmental waste

- The growing understanding of trace mineral interactions and their role in metabolic processes is driving demand for precise, bioavailable supplement blends containing zinc, copper, manganese, and selenium. Such products ensure consistent nutrient delivery and help reduce the negative impacts associated with excessive inorganic mineral supplementation

- Feed manufacturers are investing in research to develop micronutrient complexes that maintain stability during pelleting and mixing processes. These improved formulations preserve nutrient potency and also enhance overall feed palatability, supporting better feed intake and weight gain in swine herds

- Increasing regulatory attention toward environmental sustainability has encouraged the use of optimized micronutrients that reduce heavy metal excretion. For instance, DSM-Firmenich offers EcoTrace minerals designed to support efficient mineral absorption and reduce the environmental footprint of livestock production through improved nutrient bioefficiency

- The continued development of bioavailable swine feed micronutrient formulations aligns with the global shift toward precision livestock nutrition. As producers prioritize animal health, productivity, and sustainability, the integration of advanced micronutrient technologies will remain central to the modernization of swine feed management practices

Swine Feed Micronutrients Market Dynamics

Driver

Growing Focus on Sustainable and Antibiotic-Free Swine Nutrition

- The move toward sustainable and antibiotic-free swine production is a key driver promoting the use of essential micronutrients in feed formulations. Producers are increasingly relying on trace minerals, vitamins, and organic additives to maintain optimal animal health and performance while reducing dependence on pharmaceutical interventions

- For instance, Cargill Incorporated has expanded its portfolio of nutritional solutions incorporating trace minerals and vitamins aimed at supporting gut health and reducing oxidative stress in pigs raised under antibiotic-free systems. These diets are formulated to improve immune function naturally and comply with evolving global regulations on antibiotic use in livestock

- Rising consumer demand for sustainably produced pork and tightening antibiotic regulations in regions such as the European Union and North America are stimulating innovation in micronutrient-enriched feed. Micronutrients such as zinc, copper, and selenium play vital roles in immunity building, bone strength, and reproductive efficiency, making them indispensable in antibiotic-free nutrition programs

- Feed manufacturers are developing integrated micronutrient programs that promote long-term herd productivity while reducing environmental impact. By enhancing nutrient utilization and minimizing excretion, these programs support improved sustainability metrics throughout the supply chain

- The increasing focus on health-oriented animal nutrition and ecological responsibility continues to strengthen market growth. As global meat producers adopt antibiotic-free and resource-efficient feeding systems, sustainable micronutrient solutions will remain a key growth pillar for the swine feed industry in the coming years

Restraint/Challenge

High Cost of Premium Feed Additives

- The high cost associated with premium feed additives and bioavailable micronutrient formulations poses a significant challenge in the swine feed micronutrients market. Advanced organic and chelated minerals often require specialized production processes and raw materials, making them more expensive than conventional inorganic alternatives

- For instance, small and mid-sized feed producers in developing regions face cost constraints when adopting high-end formulations such as those offered by Balchem Corporation and Alltech. These products, while highly efficient, raise overall feed costs, which can impact profitability, particularly in price-sensitive pork markets

- Fluctuating prices of mineral sources such as zinc sulfate, copper sulfate, and selenium compounds contribute to pricing volatility in feed formulations. Variations in currency exchange rates and transportation costs further exacerbate market challenges, especially for import-dependent regions

- Producers may also encounter difficulties in justifying the cost of premium additives without immediate visible improvements in productivity or feed conversion ratios. This issue is especially relevant among small-scale farms with limited access to technical advisory services for nutrient optimization

- To mitigate these challenges, manufacturers are introducing cost-effective formulations and developing region-specific products that balance performance and affordability. Scaling up production, improving supply chain efficiency, and promoting education on the long-term benefits of bioavailable additives will be crucial in achieving broader market adoption and cost balance in the swine feed micronutrients industry

Swine Feed Micronutrients Market Scope

The market is segmented on the basis of product, form, and swine type.

- By Product

On the basis of product, the swine feed micronutrients market is segmented into trace minerals and vitamins. The trace minerals segment dominated the market with the largest market revenue share in 2024, driven by their essential role in supporting metabolic functions, immune response, and bone development in swine. Farmers increasingly prefer trace minerals such as zinc, copper, and iron to improve feed efficiency and growth performance. The demand is further enhanced by the rising focus on maintaining animal health and reducing antibiotic dependence, which makes mineral supplementation a vital component of modern swine nutrition.

The vitamins segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing inclusion of vitamin blends in feed formulations to enhance reproduction, immunity, and stress tolerance in pigs. Vitamins such as A, D, and E are widely incorporated to ensure balanced nutrition, particularly in intensive farming systems. Rising awareness regarding the importance of vitamins for preventing deficiencies and improving overall productivity is expected to accelerate segment growth during the forecast period.

- By Form

On the basis of form, the swine feed micronutrients market is segmented into solid and liquid. The solid segment dominated the market with the largest market revenue share of 64.8% in 2024, attributed to its stability, easy storage, and compatibility with bulk feed manufacturing processes. Solid formulations are cost-effective and have a longer shelf life, making them suitable for large-scale commercial swine operations. The widespread use of premixes and powdered additives for uniform nutrient distribution also contributes to the strong demand for the solid form.

The liquid segment is projected to register the fastest CAGR from 2025 to 2032, driven by its high absorption rate and suitability for precision feeding applications. Liquid micronutrients enable accurate dosing and are increasingly used in automated feeding systems, enhancing efficiency and reducing nutrient wastage. Their growing use in smaller farms and specialized breeding units highlights the trend toward more flexible and targeted nutrition solutions in the swine industry.

- By Swine Type

On the basis of swine type, the market is segmented into Berkshire, Chester White, Duroc, Hampshire, Landrace, Poland China, Spotted, and Yorkshire. The Yorkshire segment dominated the market with the largest share in 2024, due to its high adaptability, rapid growth rate, and superior reproductive performance. Farmers widely prefer Yorkshire pigs for commercial production, as they respond effectively to micronutrient-enriched diets that enhance meat quality and feed conversion efficiency. The breed’s widespread global presence and favorable genetic traits further boost its demand in the market.

The Duroc segment is expected to witness the fastest growth from 2025 to 2032, owing to the breed’s increasing popularity for its excellent meat marbling and growth characteristics. Duroc pigs benefit significantly from micronutrient supplementation that supports muscle development and immune health. Growing consumer demand for high-quality pork and the expanding focus on premium meat breeds are expected to drive the accelerated adoption of micronutrient-enriched feed for Duroc pigs during the forecast period.

Swine Feed Micronutrients Market Regional Analysis

- Asia-Pacific dominated the swine feed micronutrients market with the largest revenue share of over 42% in 2024, driven by the region’s large swine population, rapid expansion of commercial pig farming, and rising demand for nutrient-enriched feed formulations

- Growing awareness regarding animal health management and productivity enhancement has significantly contributed to regional growth

- The presence of cost-efficient feed manufacturing facilities and increasing government support for livestock nutrition programs are further supporting market expansion

China Swine Feed Micronutrients Market Insight

China held the largest share in the Asia-Pacific swine feed micronutrients market in 2024, owing to its position as the world’s leading pork producer and consumer. The country’s large-scale pig farming industry, rising focus on feed efficiency, and investments in advanced nutrition technologies are key drivers. Furthermore, government policies promoting food safety and sustainable livestock production are encouraging the use of trace minerals and vitamins in feed formulations to maintain herd health and improve meat quality.

India Swine Feed Micronutrients Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by the rapid expansion of its livestock sector, increasing urbanization, and rising protein consumption. The country’s growing focus on modern pig farming practices, along with government-led initiatives to boost animal husbandry, is supporting the adoption of high-quality feed micronutrients. In addition, rising awareness about disease prevention, nutritional balance, and productivity enhancement is expected to accelerate the market’s growth trajectory.

Europe Swine Feed Micronutrients Market Insight

The Europe swine feed micronutrients market is expanding steadily, supported by stringent feed quality regulations, high awareness of animal welfare, and strong demand for premium pork products. The region emphasizes sustainable livestock nutrition, encouraging the use of bioavailable trace minerals and vitamins to improve health and environmental outcomes. Technological advancements in feed formulation and the rising trend of antibiotic-free production are further contributing to regional market growth.

Germany Swine Feed Micronutrients Market Insight

Germany’s market is driven by its advanced feed industry, strong focus on swine genetics, and high-quality meat production standards. The country’s leading feed manufacturers are investing in micronutrient optimization to improve animal performance while maintaining environmental sustainability. Increased R&D in trace mineral bioavailability and precision feeding is enhancing swine health management and productivity across commercial farms.

U.K. Swine Feed Micronutrients Market Insight

The U.K. market benefits from its growing focus on animal nutrition innovation, sustainable farming, and reduced antibiotic use in livestock production. Investments in R&D for nutrient-efficient formulations and advanced feed supplements are propelling market demand. In addition, the rising preference for locally sourced and high-quality pork products is encouraging farmers to adopt nutrient-balanced feed strategies, strengthening the micronutrient market in the country.

North America Swine Feed Micronutrients Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by the modernization of swine farming, rising focus on feed optimization, and increasing demand for premium pork. The region’s strong animal nutrition research base and growing use of precision feeding systems are promoting the adoption of micronutrient-enriched feed solutions. In addition, the emphasis on sustainable livestock production and animal welfare is shaping innovation in feed formulation.

U.S. Swine Feed Micronutrients Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by its highly developed pork industry, advanced feed technology infrastructure, and extensive adoption of customized nutrition solutions. Growing consumer demand for high-quality meat, coupled with initiatives to reduce antibiotic reliance, is fueling the use of trace minerals and vitamins in swine feed. The presence of major feed producers and strong distribution networks further strengthens the U.S.’s market dominance.

Swine Feed Micronutrients Market Share

The swine feed micronutrients industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- NOVUS INTERNATIONAL (U.S.)

- Kemin Industries Inc. (U.S.)

- RIDLEY USA INC. (U.S.)

- Coromandel International (India)

- Phibro Animal Health Corporation (U.S.)

- Koninklijke DSM N.V. (Netherlands)

- Alltech (U.S.)

- Nutreco (Netherlands)

- Mercer Milling Co. Inc. (U.S.)

- Pancosma (Switzerland)

- Dow (U.S.)

- Vamso Biotec Pvt. Ltd. (India)

- Aries Agro Limited (India)

- Nutrien Ag Solutions (Canada) Inc. (Canada)

- Haifa Group (Israel)

- Helena Agri-Enterprises, LLC (U.S.)

- Lallemand Inc. (Canada)

- Zinpro Corporation (U.S.)

- QualiTech (U.S.)

Latest Developments in Global Swine Feed Micronutrients Market

- In February 2024, the market experienced a boost with the development of advanced micronutrient blends targeting livestock, particularly swine, to enhance immune health and reduce antibiotic dependency. This innovation reflects the industry’s transition toward sustainable and preventive animal nutrition practices, encouraging farmers to adopt high-quality micronutrient-enriched feed formulations. The launch strengthened the market’s position in promoting health-oriented feed solutions aligned with global sustainability goals

- In April 2023, Evonik Industries AG launched an advanced amino-acid-enriched premix formulation for swine feed designed to optimize nutrient absorption and improve feed conversion efficiency. This product innovation supports the growing demand for performance-enhancing and environmentally responsible feed solutions. By introducing this formulation, Evonik reinforced its presence in the global animal nutrition sector, driving market competitiveness through innovation and sustainability

- In January 2023, Cargill Incorporated expanded its partnership with BASF SE to co-develop and market enzyme and micronutrient products for the animal nutrition industry, with a strong focus on swine feed applications. This collaboration is expected to accelerate innovation in nutrient delivery and enhance production efficiency across swine farming operations. The strategic partnership strengthened both companies’ capabilities in R&D and global market penetration, positively influencing market expansion

- In November 2022, Nutreco N.V. acquired Mosegården A/S, a Denmark-based livestock nutrition company specializing in mineral and feed additives for pigs and cattle. This acquisition enabled Nutreco to broaden its product portfolio and enhance its footprint in the European swine feed micronutrients market. The move also allowed the company to leverage Mosegården’s regional expertise and strengthen its supply chain network, supporting consistent product availability and quality

- In November 2022, Elanco Animal Health Incorporated entered into a distribution and promotion agreement with Tonisity International Limited for gut-enhancing porcine products, including Tonisity Px and PxW, across several European markets. This collaboration enhanced Elanco’s position in the swine nutrition segment by expanding access to innovative gut-health solutions. The agreement aligns with rising demand for functional feed products that improve swine performance, supporting long-term market growth through product diversification

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.