Global Swine Feed Supplements Market

Market Size in USD Billion

CAGR :

%

USD

2.60 Billion

USD

4.03 Billion

2024

2032

USD

2.60 Billion

USD

4.03 Billion

2024

2032

| 2025 –2032 | |

| USD 2.60 Billion | |

| USD 4.03 Billion | |

|

|

|

|

Swine Feed Supplements Market Size

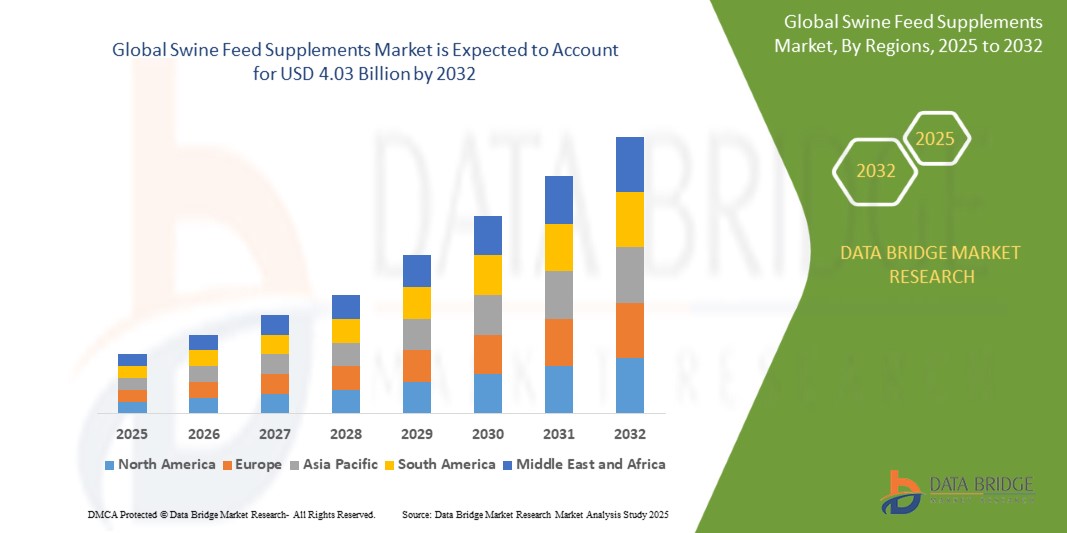

- The global swine feed supplements market size was valued at USD 2.60 billion in 2024 and is expected to reach USD 4.03 billion by 2032, at a CAGR of 5.60% during the forecast period

- The market growth is largely fuelled by the rising demand for high-quality pork products, increasing awareness among farmers regarding the nutritional needs of swine, and growing focus on enhancing animal productivity and immunity through balanced dietary supplementation

- Increasing concerns over livestock disease outbreaks and their impact on meat safety have further driven the use of targeted supplements to boost swine immunity and reduce mortality rates, thereby ensuring stable pork supply across key markets

Swine Feed Supplements Market Analysis

- The market is witnessing a steady shift toward functional and customized feed solutions aimed at improving swine health, growth rate, and feed conversion efficiency

- Supplements such as amino acids, vitamins, enzymes, and probiotics are being increasingly incorporated into pig diets to optimize gut health, nutrient absorption, and resistance to infections

- Asia-Pacific dominated the swine feed supplements market with the largest revenue share of 43.26% in 2024, driven by the region’s strong pork production base and rising awareness regarding animal health and feed efficiency among farmers

- North America region is expected to witness the highest growth rate in the global swine feed supplements market, driven by advancements in feed formulation technologies, increasing emphasis on sustainable animal nutrition, and strong presence of key industry players across the region

- The conventional segment dominated the market with the largest revenue share in 2024, primarily due to its widespread availability, affordability, and established usage across intensive swine farming operations. Farmers often prefer conventional products for their predictable nutritional output and lower cost-per-unit benefits, particularly in commercial swine production systems where cost-efficiency is key. The reliability and scale of conventional feed production further strengthen its hold across both developed and emerging markets

Report Scope and Swine Feed Supplements Market Segmentation

|

Attributes |

Swine Feed Supplements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Swine Feed Supplements Market Trends

Increased Use of Functional Additives to Improve Swine Health and Performance

- The swine feed supplements market is witnessing a steady rise in demand for functional additives such as probiotics, prebiotics, enzymes, and organic acids. These ingredients are being increasingly used to enhance gut health, improve nutrient absorption, and support immune functions in pigs. The trend is gaining ground as producers seek alternatives to antibiotic growth promoters amid tightening regulations

- Producers are prioritizing supplements that enhance feed efficiency and promote faster weight gain while ensuring animal welfare. Functional ingredients are helping reduce the incidence of gastrointestinal disorders and respiratory issues, which are common in high-density pig farming operations. These supplements ultimately contribute to higher yield and better meat quality

- The shift toward preventive health strategies is reinforcing the use of immune-boosting additives that help pigs resist infections and recover quickly from stress-related conditions. With swine herds often vulnerable to viral outbreaks, health-focused feed strategies are gaining increased traction

- For instance, in 2023, several commercial pig farms in Vietnam reported significant improvement in average daily weight gain and feed conversion ratios after incorporating enzyme blends and organic acids into finishing diets. This not only optimized production outcomes but also reduced veterinary costs

- The continued push toward antibiotic-free production systems, combined with rising global pork consumption, is expected to accelerate the adoption of functional feed supplements as a sustainable and health-oriented approach to swine nutrition

Swine Feed Supplements Market Dynamics

Driver

Rising Demand for High-Quality Pork and Shift Toward Scientific Feeding Practices

- The increasing global demand for high-quality pork is pushing swine producers to adopt nutrient-dense and targeted feed formulations. Consumers, especially in urban markets, are more conscious of meat safety, nutritional value, and animal welfare. This is prompting producers to improve feed regimes through specialized supplements that boost pig health and meat quality

- Scientific feeding practices, such as phase feeding and precision nutrition, are gaining popularity across commercial farms. These methods optimize nutritional intake at different growth stages, reducing wastage and improving feed efficiency. Feed supplements play a critical role in this approach by balancing deficiencies and enhancing metabolic performance

- Governments and private players are supporting capacity-building initiatives and farmer training programs that emphasize the benefits of using scientifically formulated supplements. This has led to greater awareness and uptake among small- and medium-scale producers

- For instance, in 2024, a government-led program in Brazil introduced swine farmers to custom supplement packages tailored to local feed ingredients and climatic conditions, resulting in improved herd performance and reduced feed costs

- With the pork industry facing intense pressure to reduce environmental impact and antibiotic use, the demand for high-quality, scientifically backed feed supplements is poised to increase steadily across all production scales

Restraint/Challenge

High Cost of Specialized Feed Ingredients and Supply Chain Volatility

- The cost of functional and high-performance feed additives remains a major barrier for small- and mid-scale pig producers. Ingredients such as enzyme complexes, essential oils, and encapsulated amino acids are expensive and often imported, making them less accessible in price-sensitive markets. This limits their adoption and restricts innovation in local feed formulations

- Market volatility, particularly in raw material prices and international logistics, affects the consistent availability of key feed supplement ingredients. Disruptions in supply chains lead to fluctuating costs and limit the ability of manufacturers to maintain uniform quality, especially in developing regions

- Inconsistent quality and adulteration issues also deter farmers from trusting unfamiliar supplement brands, especially in informal market setups. Lack of awareness and limited extension support further compound the problem in rural swine farming communities

- For instance, during the first half of 2023, several Southeast Asian feed mills reported delays in receiving vitamin and mineral premixes due to supply chain disruptions caused by global trade tensions, affecting feed quality and herd performance in local farms

- Overcoming this challenge will require improved local sourcing strategies, price stabilization mechanisms, and greater transparency in the supplement value chain to ensure reliable access to effective, affordable products across markets

Swine Feed Supplements Market Scope

The market is segmented on the basis of nature, form, ingredients, application, product, and supplements.

• By Nature

On the basis of nature, the swine feed supplements market is segmented into conventional and organic. The conventional segment dominated the market with the largest revenue share in 2024, primarily due to its widespread availability, affordability, and established usage across intensive swine farming operations. Farmers often prefer conventional products for their predictable nutritional output and lower cost-per-unit benefits, particularly in commercial swine production systems where cost-efficiency is key. The reliability and scale of conventional feed production further strengthen its hold across both developed and emerging markets.

The organic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer preference for organically raised meat and growing demand for sustainable livestock practices. Rising awareness regarding chemical-free feed, coupled with government support for organic farming methods, is pushing swine producers toward organic feed solutions. As regulations around animal feed transparency tighten, the organic segment is gaining momentum in premium and niche markets.

• By Form

On the basis of form, the market is segmented into pellets, crumbles, and mash. The pellets segment held the largest market revenue share in 2024, owing to their ease of storage, reduced wastage, and uniform nutrient distribution. Pellets are favored by commercial pig farmers for their efficiency in feeding and minimized feed losses during consumption, resulting in higher feed conversion ratios. Their compatibility with automated feeding systems also supports widespread adoption.

The crumbles segment is expected to witness the fastest growth rate from 2025 to 2032, due to its suitability for weaning piglets and starter pigs. Crumbled feed combines the benefits of mash and pellets, offering digestibility with a granular structure that encourages feed intake. Its increasing application in early-stage pig nutrition is fuelling growth among specialty swine nutrition manufacturers.

• By Ingredients

Based on ingredients, the market is categorized into cereals, oil seed meal, oils, molasses, and others. The cereals segment accounted for the largest revenue share in 2024, driven by its high carbohydrate content, affordability, and widespread availability. Ingredients such as corn and wheat are key energy sources in pig diets, forming the base of many feed formulations. The consistent supply and scalability of cereal crops further reinforce their market dominance.

The oil seed meal segment is expected to witness the fastest growth rate from 2025 to 2032. Rich in protein and amino acids, ingredients such as soybean meal are becoming increasingly critical in boosting swine growth and muscle development. As protein optimization becomes a focal point in pig nutrition, the demand for high-quality oil seed meal continues to rise, particularly in high-performance commercial farms.

• By Application

On the basis of application, the market is segmented into foliar spray, soil treatment, seed treatment, and others. The foliar spray segment led the market in 2024, attributed to its rapid absorption rate and targeted nutrient delivery. While primarily linked with crop inputs, this application is gaining interest in integrated feed crop systems where micronutrients play a role in improving the quality of feed-grade plants.

The soil treatment segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising focus on improving the nutrient profile of forage crops used in feed preparation. This segment contributes indirectly to the swine feed market by enhancing feed input quality and yield, particularly among vertically integrated producers and sustainability-focused farms.

• By Product

By product type, the swine feed supplements market is segmented into starter feed, grower feed, sow feed, pig grower feed, and others. The grower feed segment captured the largest share in 2024, due to high feed consumption rates during the mid-growth phase of pigs, where nutritional requirements are high for optimal weight gain. Formulations in this segment focus on protein balance and energy supply, driving repeat purchase volumes in commercial operations.

The starter feed segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increased investments in early-stage piglet health and survival. Enhanced starter feeds with improved digestibility and immunity-boosting additives are being prioritized to reduce mortality and boost lifetime productivity, making this a key growth area in swine nutrition.

• By Supplements

On the basis of supplements, the market is segmented into antibiotics, vitamins, antioxidants, amino acids, enzymes, acidifiers, and others. The amino acids segment held the largest market share in 2024, underpinned by its essential role in growth performance and protein synthesis in pigs. Lysine, methionine, and threonine are among the most commonly added amino acids, addressing specific nutritional gaps and improving feed efficiency.

The enzyme segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by its ability to enhance digestibility and nutrient absorption. As producers aim to reduce feed costs and minimize environmental impact, enzyme-based supplements are gaining traction as sustainable and performance-boosting alternatives, especially in high-density swine operations.

Swine Feed Supplements Market Regional Analysis

- Asia-Pacific dominated the swine feed supplements market with the largest revenue share of 43.26% in 2024, driven by the region’s strong pork production base and rising awareness regarding animal health and feed efficiency among farmers

- Growing investments in livestock nutrition, combined with supportive government initiatives for animal husbandry, have amplified demand for advanced feed solutions. In addition, the presence of several key players and the increasing adoption of high-quality supplements in countries such as China, India, and Vietnam are bolstering market expansion

- The region’s large swine population, rapid urbanization, and shifting consumer preferences toward protein-rich diets are further fueling supplement adoption in commercial pig farming operations

China Swine Feed Supplements Market Insight

The China swine feed supplements market accounted for the largest revenue share in the Asia-Pacific region in 2024, owing to the country’s dominance in global pork production. The government's focus on improving feed quality and ensuring swine health post-African swine fever outbreak has significantly driven supplement consumption. Moreover, local manufacturers are emphasizing the development of cost-effective, nutrient-rich formulations, while increasing adoption of scientifically formulated diets continues to push growth in both small-scale and commercial farms

Japan Swine Feed Supplements Market Insight

The Japan swine feed supplements market is expected to witness the fastest growth rate from 2025 to 2032, supported by a shift towards high-performance feed solutions and increasing investment in animal welfare. The country’s stringent quality standards and emphasis on traceability and safe meat production have led to increased incorporation of vitamins, amino acids, and enzyme-based additives in swine diets. Furthermore, Japanese pig farmers are increasingly opting for organic and sustainable feed alternatives, aligning with consumer demand for premium and eco-friendly meat products

North America Swine Feed Supplements Market Insight

The North America swine feed supplements market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising awareness regarding feed optimization and swine health. Technological advancements in feed formulation and delivery systems, along with regulatory support for safe additives, are promoting the use of high-performance supplements. The commercial swine industry’s emphasis on productivity, efficiency, and reduced antibiotic usage is pushing demand for functional and customized supplement solutions

U.S. Swine Feed Supplements Market Insight

The U.S. swine feed supplements market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increased commercial pig farming and strong emphasis on sustainable meat production. American producers are investing in feed technologies that enhance gut health, growth rate, and immunity without relying on antibiotics. The rise in demand for non-GMO and organic meat has also stimulated the need for clean-label feed additives, prompting manufacturers to diversify their supplement offerings

Europe Swine Feed Supplements Market Insight

The Europe swine feed supplements market is expected to witness the fastest growth rate from 2025 to 2032, underpinned by strict regulatory frameworks surrounding animal feed safety and sustainability. The ban on antibiotic growth promoters and growing interest in alternative nutrition strategies have opened up opportunities for natural and functional feed supplements. Countries such as Spain, Germany, and France are leading in swine production, with farmers increasingly adopting precision nutrition practices

Germany Swine Feed Supplements Market Insight

The Germany swine feed supplements market is expected to witness the fastest growth rate from 2025 to 2032, driven by the nation’s commitment to animal welfare, environmental sustainability, and innovation in livestock nutrition. German farmers are focusing on reducing feed waste and improving feed conversion ratios by using tailored supplement blends. The country’s strong research infrastructure and collaborations between academia and industry are contributing to continuous advancements in supplement development and application

U.K. Swine Feed Supplements Market Insight

The U.K. swine feed supplements market is expected to witness the fastest growth rate from 2025 to 2032, backed by a shift toward organic farming and high consumer awareness regarding meat quality. The British pork industry is increasingly adopting supplements that support animal health, reduce antibiotic reliance, and enhance meat tenderness. Furthermore, the nation’s strategic push for sustainable agriculture and its emphasis on reducing carbon emissions in animal farming are prompting the integration of innovative, eco-friendly feed additives into swine diets

Swine Feed Supplements Market Share

The Swine Feed Supplements industry is primarily led by well-established companies, including:

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- Lallemand Inc. (Canada)

- BASF SE (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Kent Foods (U.K.)

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- Associated British Foods plc (U.K.)

- Alltech (U.S.)

- Charoen Pokphand Group (Thailand)

- Land O'Lakes, Inc. (U.S.)

- ForFarmers (Netherlands)

- Kyodo Shiryo Co Ltd (Japan)

- "Sodrugestvo" Group of Companies (Russia)

- Hueber Feed, LLC. (U.S.)

- Ballance Agri-Nutrients Ltd. (New Zealand)

- J. D. HEISKELL & CO. (U.S.)

- Nutreco (Netherlands)

- Keystone Mills (U.S.)

Latest Developments in Global Swine Feed Supplements Market

- In January 2023, Cargill and BASF broadened their collaboration in the animal nutrition sector by enhancing their research and development capabilities and exploring new markets. This expanded partnership built upon their existing feed enzymes distribution agreements, enabling them to jointly develop, produce, market, and sell tailored enzyme products and solutions for various animals, including swine

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.