Global Swine Specialty Feed Additives Market

Market Size in USD Million

CAGR :

%

USD

179.00 Million

USD

270.57 Million

2024

2032

USD

179.00 Million

USD

270.57 Million

2024

2032

| 2025 –2032 | |

| USD 179.00 Million | |

| USD 270.57 Million | |

|

|

|

|

What is the Global Swine Specialty Feed Additives Market Size and Growth Rate?

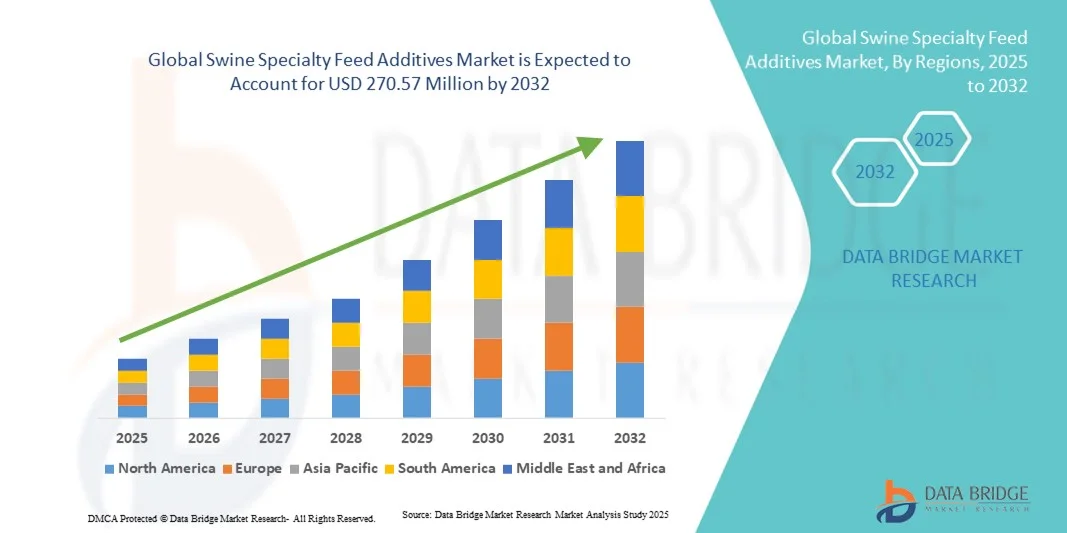

- The global swine specialty feed additives market size was valued at USD 179.0 million in 2024 and is expected to reach USD 270.57 million by 2032, at a CAGR of 5.30% during the forecast period

- The adding up of specialty feed additives such as sweeteners and flavors helps to improve the deliciousness of the feed. This in turn leads to a high feed eating by the livestock animals making them perform in good health as is also flourishing the growth of the swine specialty feed additives market

- Increasing incidences of disease outbreaks in livestock will also accelerate the demand for swine specialty feed additives market

- Likewise, adverse impact on the environment, innovations in animal husbandry and increasing consumption of animal products such as meat, dairy products and eggs are also some of key determinants expected to drive the swine specialty feed additives market growth

What are the Major Takeaways of Swine Specialty Feed Additives Market?

- Encapsulation in feed acidifiers, modernization in animal husbandry, growing epidemic outbreaks in livestock, undesirable impacts on the environment owing to emission of greenhouse gasses, increasing consumption of meat and animal products will also have positive impact the swine specialty feed additives market. The main factor contributing to the thriving rise in global demand for swine specialty feed additives is the currently high disease infliction rate among typical farm animals

- Moreover, the increasing animal product utilization and rising occurrence of diseases and infections in the livestock animals boost the safety and worry issues and are the most important aspects for the swine specialty feed additives market

- Asia-Pacific dominated the swine specialty feed additives market with the largest revenue share of 34.3% in 2024, driven by the expanding livestock sector, rapid urbanization, and growing demand for high-quality animal protein

- The North America swine specialty feed additives market is projected to grow at the fastest CAGR of 12.7% from 2025 to 2032, driven by advancements in feed technology and the growing emphasis on sustainable livestock production

- The vitamins segment dominated the market in 2024 with the largest revenue share of 38.6%, driven by their critical role in supporting growth, immunity, and reproduction in swine

Report Scope and Swine Specialty Feed Additives Market Segmentation

|

Attributes |

Swine Specialty Feed Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Swine Specialty Feed Additives Market?

Rising Adoption of Functional and Nutrient-Enriched Feed Additives

- A key and accelerating trend in the global swine specialty feed additives market is the increasing focus on functional and nutrient-enriched additives designed to improve gut health, feed efficiency, and overall productivity in swine farming. The emphasis is shifting toward natural, sustainable ingredients that enhance animal performance while reducing environmental impact

- For instance, Evonik Industries AG and DSM have collaborated on precision nutrition solutions, introducing additives that optimize amino acid balance and reduce nitrogen emissions from pig farming. Such innovations are driving sustainable livestock production

- The growing demand for probiotics, enzymes, and organic acids is transforming traditional feed formulations by promoting better nutrient absorption and reducing dependency on antibiotic growth promoters. Companies are investing heavily in R&D to develop advanced formulations that improve swine immunity and gut microbiota balance

- This transition toward bio-based and performance-enhancing additives aligns with global efforts to ensure food safety, environmental sustainability, and efficient resource utilization in animal agriculture. As a result, manufacturers are focusing on producing next-generation additives that support both animal health and profitability in the long term

- Major players such as BASF SE and Cargill, Incorporated are expanding their product portfolios with sustainable and customized additive solutions to meet evolving consumer preferences and regulatory standards

- This trend reflects a shift toward precision feeding and environmentally conscious livestock management, shaping the future of the global Swine Specialty Feed Additives market

What are the Key Drivers of Swine Specialty Feed Additives Market?

- The primary growth driver for the swine specialty feed additives market is the increasing focus on improving swine health and feed efficiency amid the rising global demand for pork. Producers are prioritizing additives that enhance growth rate, nutrient absorption, and disease resistance

- For instance, in March 2024, Adisseo launched a new enzyme complex aimed at improving phosphorus and amino acid utilization, thereby reducing feed costs and enhancing sustainability in swine production. Such initiatives by key players continue to strengthen market growth

- In addition, the ban on antibiotic growth promoters (AGPs) in several countries has accelerated the shift toward natural alternatives such as probiotics, prebiotics, and organic acids, further driving market demand

- The rising demand for high-quality animal protein, increasing swine farming mechanization, and the integration of data-driven nutrition management tools are creating favorable conditions for market expansion

- Moreover, the emergence of precision livestock farming (PLF) technologies is enabling producers to tailor feed additive combinations to specific animal health requirements, boosting productivity and profitability

Which Factor is Challenging the Growth of the Swine Specialty Feed Additives Market?

- A significant challenge hindering the growth of the swine specialty feed additives market is the high cost of advanced feed additives and raw material price volatility. The production of premium additives such as enzymes, amino acids, and probiotics requires specialized technology and stringent quality control, making them costlier than conventional feed ingredients

- For instance, fluctuations in raw material prices, including corn and soybean meal, directly impact additive formulation costs, limiting adoption among small and medium-scale swine producers, particularly in developing regions

- Furthermore, stringent regulatory frameworks governing additive approvals, labeling, and safety testing can delay product commercialization and restrict the entry of new players. Companies such as Evonik and Nutreco N.V. are heavily investing in compliance and sustainability certifications to meet evolving market standards

- Another growing concern is the lack of farmer awareness regarding the long-term benefits of specialty additives, which often results in underutilization of such products despite their proven efficacy

- Addressing these challenges through cost optimization, education programs, and government incentives for sustainable animal feed solutions will be crucial for ensuring steady market growth over the coming years

How is the Swine Specialty Feed Additives Market Segmented?

The market is segmented on the basis of type, form, and function.

- By Type

On the basis of type, the swine specialty feed additives market is segmented into vitamins, antioxidants, flavors and sweeteners, minerals, binders, acidifiers, and others. The vitamins segment dominated the market in 2024 with the largest revenue share of 38.6%, driven by their critical role in supporting growth, immunity, and reproduction in swine. Vitamins such as A, D, and E are widely incorporated into feed formulations to prevent deficiencies and enhance animal productivity. Their versatility and necessity in balanced feed make them a staple across both commercial and small-scale swine operations.

The acidifiers segment is expected to witness the fastest CAGR from 2025 to 2032, owing to growing emphasis on improving gut health and nutrient absorption while minimizing antibiotic use. These additives help maintain optimal pH levels and control pathogenic bacteria, aligning with sustainable livestock management practices.

- By Form

On the basis of form, the swine specialty feed additives market is segmented into liquid feed, dry feed, and others. The dry feed segment held the largest market revenue share of 57.3% in 2024, attributed to its convenience in handling, longer shelf life, and compatibility with automated feeding systems. Dry additives are easy to mix and store, providing consistent nutrient delivery and reducing wastage during distribution. Their stability under varying environmental conditions further enhances their preference in commercial feed production.

The liquid feed segment is projected to record the fastest growth rate from 2025 to 2032, driven by its superior bioavailability and improved palatability. Liquid formulations allow uniform nutrient distribution and can be easily sprayed or mixed into feed, improving digestion and feed efficiency—making them increasingly favored in intensive swine farming systems.

- By Function

On the basis of function, the swine specialty feed additives market is segmented into palatability enhancement, mycotoxin management, gut health and digestive performance, preservation of functional ingredients, and others. The gut health and digestive performance segment dominated the market in 2024 with a market share of 41.8%, as producers prioritize digestive efficiency and immune resilience in swine. Additives under this category promote nutrient absorption, stabilize gut microbiota, and improve feed conversion ratios, leading to better overall productivity.

The mycotoxin management segment is anticipated to witness the fastest CAGR from 2025 to 2032, owing to rising awareness of feed contamination risks and regulatory emphasis on feed safety. Mycotoxin binders and deactivators are increasingly integrated into formulations to prevent toxin-related losses and safeguard animal health, driving their rapid market adoption.

Which Region Holds the Largest Share of the Swine Specialty Feed Additives Market?

- Asia-Pacific dominated the swine specialty feed additives market with the largest revenue share of 34.3% in 2024, driven by the expanding livestock sector, rapid urbanization, and growing demand for high-quality animal protein

- Rising meat consumption in countries such as China, Japan, and India, along with government initiatives promoting feed efficiency and animal health, has accelerated the use of specialty additives in swine nutrition

- In addition, the region’s strong manufacturing base, availability of cost-effective raw materials, and advancements in feed formulation technologies have further strengthened its leadership position in the global market

China Swine Specialty Feed Additives Market Insight

The China swine specialty feed additives market captured the largest revenue share of 68% in 2024 within Asia-Pacific, driven by the country’s vast swine production base and increased focus on disease prevention. With growing consumer awareness of pork quality and safety, Chinese producers are prioritizing feed enrichment with vitamins, minerals, and acidifiers to enhance animal health and productivity. Strong domestic production capabilities and supportive government regulations for sustainable livestock development continue to bolster market expansion, making China a critical growth hub in the region.

Japan Swine Specialty Feed Additives Market Insight

The Japan swine specialty feed additives market is witnessing steady growth, supported by a highly advanced feed industry and emphasis on animal welfare. Producers are focusing on premium-quality feed enriched with gut health enhancers and antioxidants to improve productivity and meat quality. Japan’s technological leadership in precision feeding systems and integration of digital monitoring tools also supports efficient additive usage. Moreover, the increasing shift toward antibiotic-free feed formulations aligns with Japan’s sustainability goals, positioning the country as a key contributor to regional innovation and feed quality improvement.

India Swine Specialty Feed Additives Market Insight

The India swine specialty feed additives market is expected to grow significantly during the forecast period, fueled by the modernization of pig farming and the adoption of scientifically formulated feeds. Rising pork demand in urban centers, coupled with the government’s support for small-scale livestock producers, is promoting the use of additives that improve nutrient absorption and animal growth rates. With the expansion of local feed mills and growing awareness of animal nutrition management, India is emerging as a strong developing market within the Asia-Pacific region.

Which Region is the Fastest-Growing Region in the Swine Specialty Feed Additives Market?

The North America swine specialty feed additives market is projected to grow at the fastest CAGR of 12.7% from 2025 to 2032, driven by advancements in feed technology and the growing emphasis on sustainable livestock production. Increasing consumer preference for antibiotic-free meat and the adoption of precision farming solutions are boosting additive use in swine feed. Moreover, the presence of leading feed manufacturers, strong research infrastructure, and regulatory support for functional feed ingredients are accelerating market expansion across the region.

U.S. Swine Specialty Feed Additives Market Insight

The U.S. swine specialty feed additives market accounted for 83% of the North American revenue share in 2024, supported by strong demand for performance-enhancing additives and functional feed products. The rising focus on optimizing feed conversion ratios and improving animal gut health has driven widespread adoption of enzymes, acidifiers, and antioxidants. The market also benefits from advanced R&D capabilities, sustainability-focused regulations, and strategic partnerships between feed producers and technology providers to improve production efficiency and meat quality.

Which are the Top Companies in Swine Specialty Feed Additives Market?

The swine specialty feed additives industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Cargill, Incorporated (U.S.)

- Evonik Industries AG (Germany)

- DSM (Netherlands)

- DuPont (U.S.)

- NOVUS INTERNATIONAL (U.S.)

- Impextraco NV (Belgium)

- Biomin (Austria)

- Akzo Nobel N.V. (Netherlands)

- Nutreco N.V. (Netherlands)

- Novozymes (Denmark)

- Alltech (U.S.)

- Adisseo (France)

- ADDCON GmbH (Germany)

- Kemin Industries, Inc. (U.S.)

- Lucta (Spain)

- Brookside Agra (U.S.)

- MIAVIT GmbH (Germany)

- JH Biotech, Inc. (U.S.)

- ADM (U.S.)

- Chr. Hansen Holdings A/S (Denmark)

What are the Recent Developments in Global Swine Specialty Feed Additives Market?

- In April 2025, Cargill, Incorporated launched a specialty feed additive that combines a postbiotic (XPC) with a phytogenic to enhance gut health and immunity in poultry. The formulation helps mitigate the impact of avian pathogenic E. coli (APEC), improves egg production in layers, reduces mortality rates, and minimizes pre-harvest foodborne pathogens. This innovation reflects Cargill’s ongoing commitment to advancing animal health and sustainable poultry nutrition

- In January 2025, International Flavors & Fragrances Inc. (U.S.) introduced Enviva® DUO, a pioneering direct-fed microbial (DFM) solution for poultry production. This blend of two non-spore-forming bacterial strains is developed to promote beneficial gut bacteria growth under stressful conditions and support a balanced nutribiotic state. The launch marks IFF’s continued progress in next-generation gut health technologies for improved poultry performance

- In October 2024, Nutreco (Netherlands) inaugurated the world’s first dedicated food-grade powder production facility for cell feed in Boxmeer, Netherlands. The new facility aims to produce cost-effective and sustainable cell culture media, supporting the expanding cultivated protein sector and enabling scalable production. This development underscores Nutreco’s strategic focus on innovation and sustainability in alternative protein production

- In September 2024, Alltech (U.S.) and EnviroEquine (U.S.) entered into a strategic licensing partnership to integrate Alltech’s advanced technologies into EnviroEquine’s equine nutritional supplements. The collaboration is designed to enhance product efficacy with science-backed solutions and expand market presence across North America and Europe. This alliance reinforces both companies’ shared mission to deliver sustainable and high-quality animal nutrition

- In June 2024, Kemin Industries Inc. (U.S.) introduced FORMYL, a novel feed acidifier for swine formulated with encapsulated calcium formate and citric acid. The product supports gut health, reduces gastrointestinal pH, minimizes diarrhea incidence, and improves digestion without relying on antibiotics. This launch reflects Kemin’s dedication to providing safe, innovative, and sustainable feed solutions for the livestock industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.