Global Swipe Sensors Market

Market Size in USD Billion

CAGR :

%

USD

2.92 Billion

USD

9.34 Billion

2024

2032

USD

2.92 Billion

USD

9.34 Billion

2024

2032

| 2025 –2032 | |

| USD 2.92 Billion | |

| USD 9.34 Billion | |

|

|

|

|

Swipe Sensors Market Size

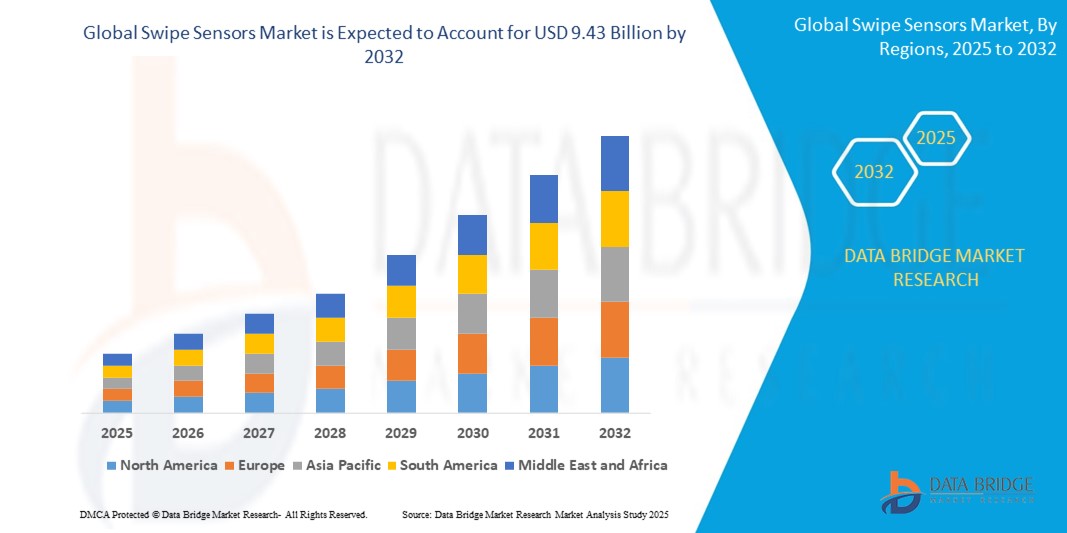

- The global swipe sensors market size was valued at USD 2.92 billion in 2024 and is expected to reach USD 9.43 billion by 2032, at a CAGR of 15.75% during the forecast period

- The market growth is largely fuelled by the increasing adoption of biometric authentication in smartphones, tablets, and laptops, growing demand for secure and user-friendly access control systems, and rising integration of swipe sensors in financial and government sectors for identity verification.

- In addition, advancements in sensor technology and the miniaturization of components are enabling broader applications across consumer electronics, automotive, and healthcare industries.

Swipe Sensors Market Analysis

- The swipe sensors market is witnessing steady expansion as companies focus on enhancing user authentication experiences across smart devices and industrial systems

- Growing emphasis on seamless integration and compact sensor designs is influencing product innovations to meet evolving consumer expectations

- North America dominated the swipe sensors market with the largest revenue share in 2024, driven by the early adoption of biometric technologies across consumer electronics and enterprise security systems

- Asia-Pacific region is expected to witness the highest growth rate in the global swipe sensors market, driven by rising adoption of biometric technologies across smartphones, banking services, and government identification programs, along with rapid urbanization and expanding digital infrastructure.

- The capacitive segment held the largest market revenue share in 2024, owing to its high accuracy and responsiveness in fingerprint recognition. Capacitive sensors are widely integrated into smartphones and laptops due to their compact size, low power consumption, and enhanced durability, making them ideal for high-frequency usage

Report Scope and Swipe Sensors Market Segmentation

|

Attributes |

Swipe Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Swipe Sensors Market Trends

“Rising Integration of Swipe Sensors in Contactless Payment Systems”

- Swipe sensors are increasingly being embedded into contactless payment devices to enhance security and improve transaction speed

- Financial institutions are incorporating biometric swipe sensors into smart cards and mobile payment terminals to ensure identity verification and fraud prevention

- For instance, companies such as Mastercard and Visa have rolled out biometric-enabled cards featuring swipe sensors to allow secure, PIN-free transactions

- Retailers and e-commerce platforms are adopting swipe sensor technology in handheld payment devices and kiosks to deliver faster and safer checkout experiences

- For instance, biometric payment terminals using swipe sensors have been deployed by retailers such as Carrefour and Amazon Go to streamline contactless purchases

Swipe Sensors Market Dynamics

Driver

“Growing Demand for Biometric Authentication in Consumer Electronics”

- Increasing reliance on biometric authentication for both personal and enterprise-level security is a major factor driving the swipe sensors market

- Swipe sensors are commonly used in smartphones, tablets, and laptops to provide secure and convenient identity verification

- Consumers prefer swipe sensors for their cost-effectiveness and balance between accuracy and usability in everyday devices

- Major electronics brands are embedding swipe-based fingerprint sensors to replace traditional PINs and passwords

- For instance, Samsung integrated swipe fingerprint sensors in earlier Galaxy models to improve user security and ease of access

- The rise in online banking and digital transactions is boosting the adoption of biometric systems for safe and seamless access

Restraint/Challenge

“Performance Limitations Compared to Advanced Biometric Technologies”

- Swipe sensors have limitations in accuracy, speed, and user-friendliness compared to advanced biometric technologies such as capacitive and ultrasonic sensors

- Users must drag their finger across a narrow sensor area, which often results in inconsistent readings due to incorrect speed or angle

- These issues can lead to repeated authentication attempts, causing frustration and reducing overall device efficiency

- Swipe sensors are less suitable for high-security or high-traffic environments where faster and more reliable authentication methods are needed

- For instance, airports and financial institutions prefer touch-based or facial recognition systems for smoother and more secure user experiences

- Environmental conditions such as dust, moisture, or physical wear can further affect the performance of swipe sensors, limiting their reliability in outdoor or industrial settings

Swipe Sensors Market Scope

The swipe sensors market is segmented on the basis of technology, material, application, and distribution channel.

- By Technology

On the basis of technology, the swipe sensors market is segmented into capacitive, optical, thermal, and others. The capacitive segment held the largest market revenue share in 2024, owing to its high accuracy and responsiveness in fingerprint recognition. Capacitive sensors are widely integrated into smartphones and laptops due to their compact size, low power consumption, and enhanced durability, making them ideal for high-frequency usage.

The optical segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness and ability to capture high-resolution images of fingerprints. Optical swipe sensors are commonly used in access control systems and biometric devices, especially in government and commercial security applications where visual clarity is crucial.

- By Material

On the basis of material, the swipe sensors market is segmented into optical prism, sapphire, adhesive, piezoelectric material, urethane, silicon, anaerobic, epoxy resins, ultrasonic, coating material, pyroelectric material, and others. The silicon segment held the largest share in 2024 due to its widespread availability, flexibility in sensor design, and compatibility with consumer electronics. Silicon-based swipe sensors are preferred in portable devices for their balance between performance, cost, and integration ease.

The sapphire segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its exceptional hardness and resistance to scratches and wear. Sapphire materials are favored in premium smartphones and high-security systems, where long-term durability and protection against surface damage are critical.

- By Application

On the basis of application, the swipe sensors market is segmented into consumer electronics, travel & immigration, government & law enforcement, military, defense & aerospace, banking & finance, commercial security, healthcare, smart homes, and others. The consumer electronics segment dominated the market in 2024, driven by the growing integration of biometric features in smartphones, tablets, and laptops. Swipe sensors offer compact, secure, and cost-efficient solutions that align with the rising demand for enhanced device security.

The banking & finance segment is expected to witness the fastest growth rate from 2025 to 2032, due to increased emphasis on fraud prevention and secure access. Financial institutions are deploying swipe sensors in ATMs, smart cards, and payment systems to authenticate users and protect sensitive data.

- By Distribution Channel

On the basis of distribution channel, the swipe sensors market is segmented into online and offline. The offline segment accounted for the largest market share in 2024, supported by established supply chains and the availability of technical support and demonstrations in physical retail and distribution outlets. Customers in industrial and enterprise sectors often prefer in-person consultations and installations.

The online segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increasing popularity of e-commerce platforms and the convenience of browsing, comparing, and purchasing biometric hardware from remote locations. Online channels also provide easy access to a wide range of product options and global brands.

Swipe Sensors Market Regional Analysis

- North America dominated the swipe sensors market with the largest revenue share in 2024, driven by the early adoption of biometric technologies across consumer electronics and enterprise security systems

- The region’s strong presence of leading technology providers and growing use of fingerprint authentication in smartphones, laptops, and financial services contribute significantly to market demand

- Enhanced data protection regulations and the focus on secure identity verification continue to promote widespread adoption across sectors such as banking and law enforcement

U.S. Swipe Sensors Market Insight

The U.S. swipe sensors market held the majority share within North America in 2024, supported by the rapid integration of biometric solutions across government, healthcare, and consumer electronics. The country has witnessed strong demand from smartphone manufacturers and payment service providers for secure user authentication. As the trend of digital banking and identity-based access control rises, swipe sensors remain a preferred biometric method for efficient and cost-effective security solutions.

Europe Swipe Sensors Market Insight

The Europe swipe sensors market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing concerns over data privacy, identity theft, and digital fraud. The adoption of swipe-based fingerprint sensors in immigration control and banking systems is gaining momentum due to strict compliance with biometric standards. The region is also investing in modernizing infrastructure with secure access controls across public and private facilities, enhancing the demand for swipe sensor-based solutions.

U.K. Swipe Sensors Market Insight

The U.K. swipe sensors market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for contactless identification technologies and enhanced digital access controls. Swipe sensors are being increasingly used in retail, financial institutions, and law enforcement to improve both user experience and security. The country's growing shift towards smart infrastructure and e-governance services supports wider deployment of fingerprint-based biometric systems.

Germany Swipe Sensors Market Insight

The Germany swipe sensors market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's focus on advanced security systems and industrial digitization. As swipe sensors offer a compact and economical solution, their integration into access management systems and industrial IoT applications is increasing. Germany’s emphasis on technological innovation and privacy-focused consumer behavior aligns with the adoption of biometric security across residential, commercial, and defense sectors.

Asia-Pacific Swipe Sensors Market Insight

The Asia-Pacific swipe sensors market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid smartphone penetration, digital banking, and government-led identity verification programs. Countries such as China, India, and South Korea are seeing high demand for cost-effective and scalable biometric solutions. The region benefits from strong local manufacturing and the increasing affordability of sensor components, making swipe sensors accessible across a wide range of applications.

Japan Swipe Sensors Market Insight

The Japan swipe sensors market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s commitment to technological advancement and personal data protection. Swipe sensors are widely integrated into consumer electronics and workplace access systems, enabling secure and efficient user verification. With Japan's focus on contactless technology and an aging population seeking user-friendly solutions, swipe sensors provide reliable authentication across residential and commercial applications.

China Swipe Sensors Market Insight

The China swipe sensors market accounted for the largest share in Asia Pacific in 2024, backed by widespread digital transformation, urbanization, and strong domestic production capabilities. Swipe fingerprint sensors are extensively adopted in smartphones, digital payments, and government ID programs. The country's emphasis on smart city development and integration of biometric systems in public safety, education, and fintech sectors continues to drive robust market expansion.

Swipe Sensors Market Share

The Swipe Sensors industry is primarily led by well-established companies, including:

- Synaptics Incorporated (U.S.)

- Fingerprint Cards (Sweden)

- Shenzhen Goodix Technology Co., Ltd. (China)

- Egis Technology Inc. (Taiwan)

- IDEMIA (France)

- IDEX ASA (Norway)

- Gemalto NV (Netherlands)

- Crossmatch (U.S.)

- HID Global Corporation/ASSA ABLOY AB (U.S./Sweden)

- Hanman (China)

- BIO-key (U.S.)

- Precise Biometrics AB (Sweden)

- Shanghai Sili Microelectronics Technology Co., Ltd. (China)

Latest Developments in Global Swipe Sensors Market

- In February 2024, German sensor manufacturer Sick introduced a new development with the launch of the W10 photoelectric proximity sensor featuring a built-in touchscreen display. This innovative swipe-up interface, combined with easy-to-understand icons, aims to simplify setup and teach-in processes for users. The sensor comes with pre-configured settings and offers functionalities such as background and foreground suppression within a single device. This advancement is expected to enhance operational efficiency by reducing installation time and user errors. The introduction of intuitive touch-based controls in industrial sensors could influence broader adoption and set new usability standards in the sensor market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Swipe Sensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Swipe Sensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Swipe Sensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.