Global Synchronous Condenser Market

Market Size in USD Billion

CAGR :

%

USD

2.75 Billion

USD

3.80 Billion

2024

2032

USD

2.75 Billion

USD

3.80 Billion

2024

2032

| 2025 –2032 | |

| USD 2.75 Billion | |

| USD 3.80 Billion | |

|

|

|

|

Synchronous Condenser Market Size

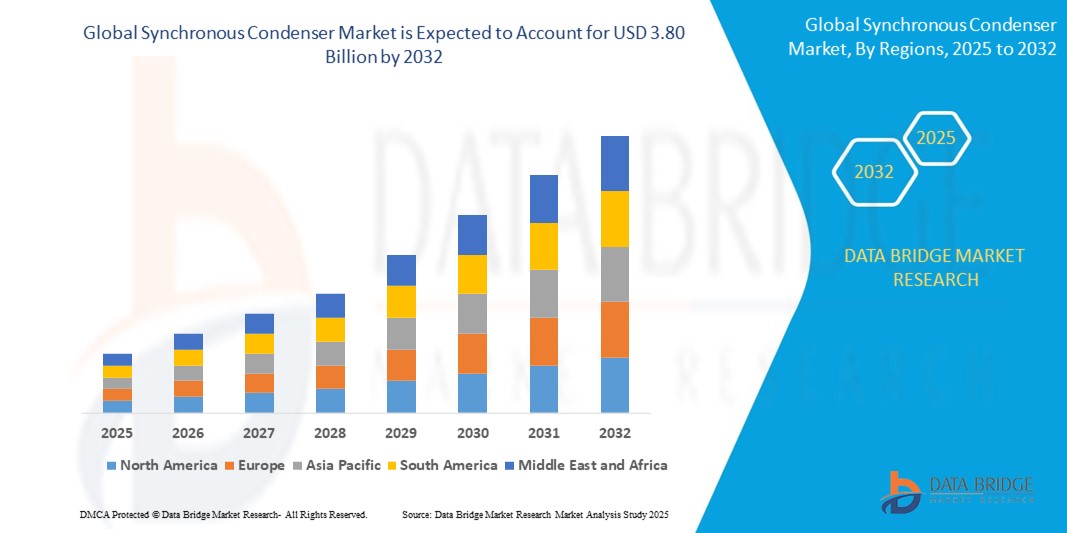

- The global synchronous condenser market size was valued at USD 2.75 billion in 2024 and is expected to reach USD 3.80 billion by 2032, at a CAGR of 4.1% during the forecast period

- The market growth is largely fueled by the increasing integration of renewable energy sources such as wind and solar into power grids, which has created a critical need for technologies that can provide voltage regulation, inertia, and dynamic reactive power support

- Furthermore, the retirement of conventional synchronous generators and the modernization of aging grid infrastructure are accelerating the deployment of synchronous condensers as a reliable solution for maintaining grid stability and operational flexibility across utility networks

Synchronous Condenser Market Analysis

- Synchronous condensers are rotating electrical machines that do not generate active power but supply or absorb reactive power to maintain voltage levels in transmission systems. They also contribute inertia and short-circuit power, making them essential in renewable-rich grids where conventional generators are being phased out

- The rising demand for synchronous condensers is primarily driven by global grid decarbonization efforts, expansion of high-voltage transmission networks, and increasing regulatory focus on grid reliability in the face of growing intermittent renewable generation

- North America dominated the synchronous condenser market with a share of 34.83% in 2024, due to the increasing need for grid stability and reactive power compensation in the face of rising renewable energy penetration

- Asia-Pacific is expected to be the fastest growing region in the synchronous condenser market during the forecast period due to rapid urbanization, industrial expansion, and the escalating integration of renewables in emerging economies

- Refurbished synchronous condenser segment dominated the market with a market share of 58.3% in 2024, due to the increasing preference among utilities and industries for cost-effective grid stabilization solutions that utilize existing infrastructure. Refurbishing decommissioned turbine generators into synchronous condensers significantly reduces capital expenditure and lead time compared to new installations, while still delivering essential reactive power support and inertia to modern power grids. This approach also aligns with sustainability goals by extending the lifecycle of older equipment and minimizing environmental impact

Report Scope and Synchronous Condenser Market Segmentation

|

Attributes |

Synchronous Condenser Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Synchronous Condenser Market Trends

“Rising Demand for Hydrogen-Cooled Synchronous Condensers”

- The synchronous condenser market is evolving quickly as energy infrastructure modernization, grid reliability, and renewable integration fuel the need for advanced solutions such as hydrogen-cooled units, which provide superior cooling efficiency for high-capacity installations

- For instance, hydrogen-cooled synchronous condensers are increasingly being deployed by major utilities in North America and Europe for grid applications above 200 MVAr, appealing due to high efficiency, low maintenance, and the ability to handle greater load fluctuations compared to air- or water-cooled variants

- The shift towards hydrogen cooling supports the operational reliability of synchronous condensers by reducing internal temperatures, minimizing energy losses, and extending equipment lifespan—key for supporting power system inertia and voltage stability as thermal power plants are decommissioned

- Growing adoption of large-scale renewable energy is placing greater demands on grid stability, prompting investment in hydrogen-cooled systems to regulate voltage, supply reactive power, and support dynamic grid operations

- Advances in design, such as enhanced insulation and digital monitoring for hydrogen systems, are improving operational safety and facilitating predictive maintenance, further encouraging market uptake among transmission operators

- Regulatory policies endorsing grid stability and carbon reduction are supporting R&D and pilot projects for hydrogen-cooled synchronous condensers, which align with decarbonization and critical infrastructure resilience goals

Synchronous Condenser Market Dynamics

Driver

“Growing Need for Integrated Systems in Power Plants”

- Increasing grid complexity, distributed energy resources, and fluctuating demand patterns are driving the need for integrated synchronous condenser systems capable of providing both inertia and fast-reactive support within modern power plants

- For instance, major OEMs such as Siemens Energy and GE Vernova are supplying turnkey synchronous condenser solutions integrated with digital controls, automation software, and real-time monitoring for seamless deployment in new and upgraded grid installations

- Power plants are investing in integrated synchronous condenser packages—including low-inertia designs and advanced protection relays—to regulate voltage, maintain frequency, and absorb power transients amid growing wind and solar penetration

- Demand for multi-functional grid-support systems is rising as transmission operators seek equipment able to adapt to dynamic load profiles, power quality fluctuations, and emergency scenarios

- Integrated systems enable remote diagnostics, predictive analytics, and better lifecycle asset management, optimizing both capital expenditure and operational efficiency for plant operators

Restraint/Challenge

“Availability of Low-Cost Substitutes”

- Market adoption of synchronous condensers faces persistent competition from lower-cost alternatives—such as static VAR compensators (SVCs), STATCOMs, and capacitor banks—which can offer reactive power support with reduced capital and maintenance outlays in less demanding grid environments

- For instance, utility clients in emerging markets may prefer SVCs or capacitor banks instead of synchronous condensers due to shorter installation timelines and lower upfront capital requirements, especially where inertia contribution is less critical to grid stability

- Rapid technological advances in power electronics are narrowing the performance gap for voltage regulation and reactive power, providing grid operators with easier-to-integrate or more budget-friendly solutions in some scenarios

- Static solutions often offer modular expansion and remote operation benefits, making them attractive for rapid deployment or for applications where space constraints, resource availability, and cost minimization are paramount

- The need for highly skilled personnel, complex commissioning, and ongoing hydrogen maintenance can further increase operational costs for synchronous condensers, driving cost-conscious utilities toward alternatives until value differentials are justified by grid needs

Synchronous Condenser Market Scope

The market is segmented on the basis of cooling technology, starting method, reactive power rating, end user, type, design, number of poles, and excitation system type.

- By Cooling Technology

On the basis of cooling technology, the synchronous condenser market is segmented into hydrogen cooled, air-cooled, and water-cooled synchronous condensers. The hydrogen cooled segment accounted for the largest revenue share in 2024, owing to its superior heat dissipation properties and higher efficiency in large-capacity power systems. Hydrogen's high thermal conductivity and low density allow for compact equipment design while maintaining optimal temperature control, making it a preferred choice in high-voltage utility applications. Utilities favor hydrogen-cooled condensers for their ability to sustain performance under continuous heavy loads in grid stabilization roles.

The air-cooled segment is projected to register the fastest growth rate from 2025 to 2032, driven by its lower operational and maintenance complexity. Air-cooled condensers eliminate the need for specialized gas management systems, making them more viable for installations in remote or space-constrained areas. This cooling method is gaining popularity among smaller grid networks and industrial facilities looking for simplified and cost-effective reactive power solutions.

- By Starting Method

On the basis of starting method, the market is segmented into static frequency convertor, pony motor, and others. The static frequency convertor segment led the market in 2024, primarily due to its ability to start large synchronous condensers without auxiliary motors or grid disturbances. It provides flexible voltage and frequency control during startup, improving overall operational stability and integration into modern power systems.

The pony motor segment is expected to expand at the highest CAGR during the forecast period, benefiting from its cost-efficiency and reliability in medium-capacity installations. Pony motors are often preferred in legacy systems or regions with limited access to advanced power electronics, where proven mechanical solutions are still widely implemented.

- By Reactive Power Rating

On the basis of reactive power rating, the market is segmented into above 200 MVAR, 101–200 MVAR, 61–100 MVAR, 31–60 MVAR, and 0–30 MVAR. The above 200 MVAR segment dominated the market share in 2024 due to the rising deployment of high-capacity synchronous condensers in large utility-scale transmission networks to maintain voltage regulation and grid stability. Their role becomes critical in renewable-integrated grids, where large dynamic reactive power is needed to compensate for intermittency.

The 31–60 MVAR segment is projected to grow at the fastest pace through 2032, as these mid-capacity units are increasingly installed in regional substations and industrial zones to support local grid operations. This category offers an optimal balance between performance and capital cost, making it suitable for both utility and non-utility sectors.

- By End User

On the basis of end user, the synchronous condenser market is divided into electrical utilities and industrial sectors. The electrical utilities segment secured the highest revenue in 2024, driven by the surge in grid modernization projects and the decommissioning of conventional synchronous generators. Utilities are investing in synchronous condensers to provide inertia, short-circuit support, and voltage stability in grids with high renewable penetration.

The industrial sectors segment is expected to record the fastest CAGR from 2025 to 2032, as large manufacturing and processing facilities demand power quality solutions to maintain equipment reliability. Synchronous condensers offer robust reactive power compensation and dynamic voltage support, which are essential for energy-intensive operations prone to voltage fluctuations.

- By Type

On the basis of type, the market is segmented into new synchronous condenser and refurbished synchronous condenser. The refurbished synchronous condenser segment accounted for the largest market share of 58.3% in 2024, due to the increasing preference among utilities and industries for cost-effective grid stabilization solutions that utilize existing infrastructure. Refurbishing decommissioned turbine generators into synchronous condensers significantly reduces capital expenditure and lead time compared to new installations, while still delivering essential reactive power support and inertia to modern power grids. This approach also aligns with sustainability goals by extending the lifecycle of older equipment and minimizing environmental impact.

The new synchronous condenser segment is anticipated to grow at the highest rate through 2032, supported by higher adoption in greenfield utility projects and the integration of advanced monitoring and excitation technologies. These units are typically designed with higher efficiency, extended lifespan, and compatibility with modern grid architectures.

- By Design

On the basis of design, the market is categorized into salient pole design and cylindrical rotor design. The salient pole design segment led the market in 2024, owing to its suitability for low- to medium-speed applications and cost-effective construction. Salient pole machines are commonly deployed in systems requiring frequent starts and stops, such as regional substations or industrial facilities.

The cylindrical rotor design is projected to grow fastest during the forecast period, driven by its applicability in high-speed, high-capacity synchronous condensers. These designs offer improved mechanical strength and smoother operation under fluctuating grid conditions, making them favorable for advanced utility-scale deployments.

- By No. of Poles

On the basis of number of poles, the market is segmented into 4 to 8 poles, less than 4 poles, and more than 8 poles. The 4 to 8 poles segment held the largest market share in 2024, as it provides a versatile configuration for a wide range of grid applications, offering a balance between speed and torque. This range supports most medium to high-voltage setups, commonly found in national transmission networks.

The more than 8 poles segment is expected to witness the fastest growth, driven by demand in low-speed, high-torque applications requiring greater mechanical leverage. These units are essential in specific industrial operations and renewable energy projects requiring large inertia contributions.

- By Excitation System Type

On the basis of excitation system type, the synchronous condenser market is segmented into static excitation and brushless excitation system. The static excitation system segment dominated in 2024, supported by its responsiveness, precise voltage regulation, and integration with digital control systems. It enables better control during dynamic grid events and is widely preferred in modern utility applications.

The brushless excitation system segment is projected to grow at the fastest CAGR from 2025 to 2032, due to its maintenance-free nature and enhanced operational reliability. This system is favored in harsh or remote environments where minimizing downtime and maintenance costs is critical, such as offshore wind facilities and isolated industrial grids.

Synchronous Condenser Market Regional Analysis

- North America dominated the synchronous condenser market with the largest revenue share of 34.83% in 2024, driven by the increasing need for grid stability and reactive power compensation in the face of rising renewable energy penetration

- Utilities across the region are investing heavily in modernizing electrical infrastructure, replacing conventional power generators with synchronous condensers to ensure voltage regulation, inertia support, and frequency stability

- The region benefits from a mature energy sector, strong policy backing for grid reliability, and the presence of key industry players actively deploying synchronous condenser solutions across large-scale transmission networks

U.S. Synchronous Condenser Market Insight

The U.S. synchronous condenser market accounted for the largest revenue share within North America in 2024, fueled by the accelerated decommissioning of fossil-fueled power plants and a strategic push to maintain grid stability. As the U.S. expands its renewable energy portfolio—particularly wind and solar—utilities are increasingly relying on synchronous condensers to provide critical ancillary services such as reactive power support, short-circuit strength, and inertia. Investments in large-scale transmission upgrades and the strategic deployment of synchronous condensers at key nodes are playing a vital role in enhancing the resilience and flexibility of the national grid. The U.S. market also benefits from advanced R&D capabilities and early adoption of next-generation excitation and control systems.

Europe Synchronous Condenser Market Insight

Europe is poised to witness significant growth in the synchronous condenser market during the forecast period, underpinned by stringent regulations surrounding grid stability and the aggressive integration of renewable energy. As several European countries phase out coal and nuclear energy, synchronous condensers are being installed to fill the resulting inertia gap and ensure voltage regulation in real-time. The shift toward cleaner energy, coupled with a growing number of offshore and onshore wind installations, is driving demand for dynamic reactive power solutions. Furthermore, the presence of well-established grid operators and interconnection infrastructure across the region enhances the feasibility of synchronous condenser integration in both new and existing substations.

U.K. Synchronous Condenser Market Insight

The U.K. synchronous condenser market is expected to grow at a notable CAGR throughout the forecast period, largely influenced by the nation’s decarbonization strategy and the rise in intermittent renewable generation. With the U.K. grid facing increased pressure from variable energy sources, synchronous condensers are becoming essential for stabilizing voltage and providing fault current support. National Grid has already implemented several synchronous condenser projects as part of its Stability Pathfinder program. These investments are aimed at preserving operational stability without relying on carbon-intensive generators. The U.K.'s favorable policy framework and continued investment in flexible grid infrastructure are expected to bolster market growth further.

Germany Synchronous Condenser Market Insight

Germany’s synchronous condenser market is set to expand significantly, driven by the country’s ambitious energy transition program (Energiewende), which is phasing out nuclear and coal plants while promoting renewable sources. This transformation necessitates robust grid stabilization tools, and synchronous condensers are emerging as critical components in Germany’s evolving power system. Utilities are increasingly deploying these systems to provide dynamic voltage regulation, inertia, and fault ride-through capabilities. The German market benefits from a highly advanced engineering and manufacturing base, strong environmental policy backing, and cross-border interconnections that require reliable power balancing solutions.

Asia-Pacific Synchronous Condenser Market Insight

The Asia-Pacific synchronous condenser market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, industrial expansion, and the escalating integration of renewables in emerging economies. Countries such as China, India, and Japan are investing heavily in power grid enhancements to meet rising electricity demand and stabilize networks with high renewable penetration. Government initiatives aimed at grid reliability and modernization are further encouraging the adoption of synchronous condensers across transmission networks. The region also benefits from low manufacturing costs and growing technical expertise, allowing for more cost-effective deployment across both developed and developing countries.

Japan Synchronous Condenser Market Insight

Japan’s synchronous condenser market is gaining momentum, supported by the country’s advanced technological environment and strong emphasis on energy security. As Japan diversifies its energy mix away from nuclear and seeks to integrate more renewable sources, grid reliability has become a top priority. Synchronous condensers are being adopted to provide necessary voltage stability and reactive power in areas with high photovoltaic and wind installations. Japan's focus on disaster resilience, compact infrastructure design, and automation-friendly technologies aligns well with the deployment of smart synchronous condenser systems. Demand is also expected to rise in commercial and industrial applications that require uninterrupted power quality.

China Synchronous Condenser Market Insight

China held the largest market revenue share in the Asia-Pacific synchronous condenser market in 2024, driven by the country’s expansive renewable energy growth and large-scale grid transformation efforts. As China continues to lead globally in wind and solar installations, the demand for reliable grid stabilization technologies is rising sharply. Synchronous condensers are being deployed across key transmission corridors to manage voltage fluctuations and enhance inertia, particularly in regions experiencing rapid urbanization and energy demand. The government’s focus on smart grid development and the presence of several domestic manufacturers are contributing to the rapid scaling of synchronous condenser projects across the country.

Synchronous Condenser Market Share

The synchronous condenser industry is primarily led by well-established companies, including:

- General Electric (U.S.)

- ABB (Switzerland)

- Siemens Energy (Germany)

- Eaton (Ireland)

- WEG (Brazil)

- Ansaldo Energia (Italy)

- Shanghai Electric (China)

- INGETEAM, S.A. (Spain)

- Hitachi Energy Ltd. (Switzerland)

- Mitsubishi Electric Power Products, Inc. (Japan)

- Baker Hughes Company (U.S.)

- Power Systems & Controls, Inc. (U.S.)

- IDEAL ELECTRIC POWER CO. (U.S.)

- Doosan Škoda Power (Czech Republic)

- ANDRITZ (Austria)

Latest Developments in Global Synchronous Condenser Market

- In February 2025, Ansaldo Energia advanced its position in the global grid stability sector by commissioning five new synchronous condensers, a move that reinforces the growing demand for dynamic reactive power solutions. This development enhances the stability and reliability of transmission networks and also underscores Ansaldo's commitment to supporting renewable energy integration and energy security. The deployment of multiple units in a single initiative signals strong market momentum, particularly in regions transitioning away from conventional generation

- In June 2024, ANDRITZ marked a significant entry into the Indian market by launching its synchronous condensers during a high-profile roadshow themed “Synchronous Condensers – Enabling Green Energy Transition.” The event, attended by key stakeholders such as CEA, Grid India, NRPC, and CTUIL, emphasized the strategic importance of synchronous condensers in supporting India’s rapidly growing renewable energy landscape. This initiative is expected to catalyze adoption across India's transmission sector, positioning ANDRITZ as a key player in enabling voltage regulation and grid resilience in one of the fastest-growing power markets

- In June 2024, GE Vernova Inc. announced the construction of two synchronous condenser facilities rated at 115 kV in New York, awarded by National Grid’s upstate New York operations. This project plays a critical role in bolstering the state’s grid infrastructure to accommodate increasing levels of renewable energy while maintaining system stability. By contributing to New York’s goal of reducing carbon emissions by 85% by 2050, GE Vernova’s involvement showcases the pivotal role of synchronous condensers in achieving long-term decarbonization targets and solidifies the company’s footprint in the North American grid modernization space

- In November 2023, Siemens has introduced a hybrid grid stabilization solution at Shannon bridge B in Ireland. This innovative system combines a synchronous condenser with flywheel technology alongside a 160 MWh battery. This marks the first integration of these two technologies into a unified grid connection solution. The primary objective is to enhance grid stability while maximizing the utilization of renewable energy sources. By leveraging this advanced hybrid system, Siemens aims to address grid challenges effectively and facilitate the transition towards a more sustainable energy infrastructure

- In November 2023, General Electric announced that a consortium comprising GE Vernova’s Power Conversion business and Eiffage Énergie Systèmes (consortium manager) has been selected by EDF SEI to provide and install a turnkey synchronous condenser system at the EDF SEI TAC Jarry Sud plant in Guadeloupe, France. This solution played a crucial role in stabilizing the island's electrical grid, addressing the growing challenges of grid instability amidst global efforts to reduce carbon emissions through increased renewable energy reliance. This benefited company to strengthen its relationship with government

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Synchronous Condenser Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Synchronous Condenser Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Synchronous Condenser Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.