Global Syngas Catalyst Market

Market Size in USD Million

CAGR :

%

USD

784.24 Million

USD

1,451.57 Million

2025

2033

USD

784.24 Million

USD

1,451.57 Million

2025

2033

| 2026 –2033 | |

| USD 784.24 Million | |

| USD 1,451.57 Million | |

|

|

|

|

What is the Global Syngas Catalyst Market Size and Growth Rate?

- The global syngas catalyst market size was valued at USD 784.24 million in 2025 and is expected to reach USD 1451.57 million by 2033, at a CAGR of8.00% during the forecast period

- Rise in the demand from governments of various countries is the vital factor escalating the market growth, also increase in the demand for this chemical, rise in the disposable income and rise in the research and development activities in the market are the major factors among others driving the syngas catalyst market

What are the Major Takeaways of Syngas Catalyst Market?

- Rise in the technological advancements and modernization in the production techniques and rise in the demand from emerging economies will further create new opportunities for the syngas catalyst market

- However, rise in the cost of research and development activities in the market is the major factor among others acting as a restraint, and will further challenge the growth of syngas catalyst market

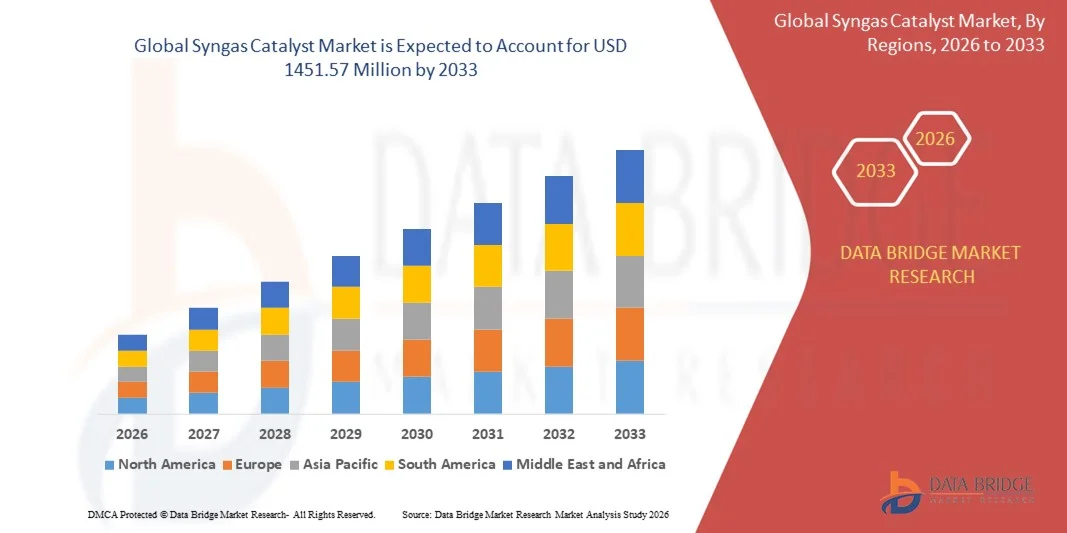

- North America dominated the syngas catalyst market with a 42.26% revenue share in 2025, driven by strong demand from oil & gas processing, petrochemicals, hydrogen production, and ammonia synthesis across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.15% from 2026 to 2033, driven by rapid expansion of chemical manufacturing, fertilizer production, and syngas-based fuels across China, India, Japan, South Korea, and Southeast Asia

- The Petrochemicals & Fertilizers segment dominated the market with a 41.6% share in 2025, driven by extensive syngas utilization in large-scale ammonia, methanol, and downstream chemical production

Report Scope and Syngas Catalyst Market Segmentation

|

Attributes |

Syngas Catalyst Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Syngas Catalyst Market?

Increasing Shift Toward High-Efficiency, Durable, and Process-Optimized Syngas Catalysts

- The syngas catalysts market is witnessing a strong shift toward high-activity and long-life catalysts designed to enhance conversion efficiency in processes such as Fischer–Tropsch synthesis, methanol production, ammonia synthesis, and hydrogen generation

- Manufacturers are increasingly developing advanced metal-based and supported catalysts, including cobalt, nickel, iron, and ruthenium systems, offering improved thermal stability, sulfur resistance, and selectivity under high-pressure and high-temperature operating conditions

- Growing demand for low-carbon fuels, synthetic fuels, and hydrogen is driving innovation in catalyst formulations that improve syngas utilization efficiency while reducing energy consumption and emissions

- For instance, companies such as Clariant, Johnson Matthey, Haldor Topsøe, BASF, and Linde are introducing next-generation syngas catalysts optimized for gas-to-liquids (GTL), coal-to-chemicals (CTC), and biomass-to-syngas applications

- Increasing integration of carbon capture, utilization, and storage (CCUS) technologies with syngas production is accelerating demand for catalysts compatible with variable feedstocks and cleaner production routes

- As energy transition accelerates globally, Syngas Catalysts will remain critical for enabling efficient synthesis of fuels, chemicals, and hydrogen in sustainable and low-emission industrial pathways

What are the Key Drivers of Syngas Catalyst Market?

- Rising demand for synthetic fuels, hydrogen, methanol, and ammonia is a primary driver, as syngas remains a foundational intermediate in downstream chemical and fuel production

- For instance, in 2025, leading catalyst manufacturers such as Haldor Topsøe, Clariant, and Johnson Matthey expanded catalyst portfolios to support high-efficiency GTL, hydrogen, and ammonia projects globally

- Growing investments in clean energy, hydrogen economy initiatives, and sustainable fuel infrastructure across Asia-Pacific, Europe, and the Middle East are boosting syngas catalyst consumption

- Advancements in catalyst design, nano-structuring, and support materials have improved activity, selectivity, and lifespan, lowering operating costs for industrial users

- Increasing utilization of biomass, waste-to-energy, and coal gasification processes is creating demand for catalysts capable of handling diverse and impurity-rich feedstocks

- Supported by large-scale investments in refining, petrochemicals, and energy transition projects, the syngas catalysts market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Syngas Catalyst Market?

- High costs of precious metals and advanced catalyst formulations restrict adoption among small and mid-scale syngas production facilities

- For instance, during 2024–2025, volatility in prices of cobalt, nickel, and noble metals increased production costs for syngas catalysts, impacting procurement decisions

- Catalyst deactivation due to poisoning, sintering, and carbon deposition under harsh operating conditions increases replacement frequency and operational expenses

- Technical complexity in optimizing catalysts for varying feedstocks such as coal, natural gas, biomass, and waste gases limits standardization

- Competition from alternative process technologies, including electrification-based hydrogen production and direct electrochemical routes, creates long-term substitution pressure

- To address these challenges, manufacturers are focusing on cost-effective formulations, regeneration technologies, extended catalyst lifecycles, and feedstock-flexible designs to enhance global adoption of Syngas Catalysts

How is the Syngas Catalyst Market Segmented?

The market is segmented on the basis of end-use and application.

- By End-Use

On the basis of end-use, the syngas catalysts market is segmented into Oil & Gas, Petrochemicals & Fertilizers, Polymers, Biofuels, and Pharmaceuticals. The Petrochemicals & Fertilizers segment dominated the market with a 41.6% share in 2025, driven by extensive syngas utilization in large-scale ammonia, methanol, and downstream chemical production. Syngas catalysts are critical in ensuring high conversion efficiency, selectivity, and operational stability in fertilizer plants and petrochemical complexes. Continuous capacity expansions, especially in Asia-Pacific and the Middle East, further strengthen segment leadership.

The Biofuels segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising investments in sustainable fuels, biomass gasification, and waste-to-energy projects. Increasing focus on decarbonization, renewable feedstocks, and synthetic fuels is accelerating adoption of advanced syngas catalysts tailored for bio-based production pathways.

- By Application

On the basis of application, the syngas catalysts market is segmented into Hydrogen Synthesis, Ammonia Synthesis, and Methanol Synthesis. The Ammonia Synthesis segment dominated the market with a 38.9% share in 2025, owing to sustained global demand for fertilizers and nitrogen-based chemicals. Syngas catalysts play a vital role in achieving high hydrogen-nitrogen conversion efficiency, long catalyst life, and stable performance in high-pressure ammonia plants. Large-scale production facilities in China, India, and the Middle East continue to drive consistent catalyst demand.

The Hydrogen Synthesis segment is projected to register the fastest CAGR from 2026 to 2033, fueled by rapid expansion of the hydrogen economy, growth in clean energy initiatives, and increasing deployment of syngas-based hydrogen for refining, chemicals, and fuel applications. Advancements in catalyst efficiency and compatibility with low-carbon processes further support accelerated growth.

Which Region Holds the Largest Share of the Syngas Catalyst Market?

- North America dominated the syngas catalyst market with a 42.26% revenue share in 2025, driven by strong demand from oil & gas processing, petrochemicals, hydrogen production, and ammonia synthesis across the U.S. and Canada. Widespread adoption of advanced syngas catalysts in steam methane reforming (SMR), partial oxidation, and autothermal reforming supports efficient large-scale syngas generation

- Leading companies in North America continue to invest in high-performance catalyst formulations, improved selectivity, longer catalyst life, and compatibility with low-carbon and blue hydrogen processes, strengthening regional leadership

- Strong R&D infrastructure, availability of feedstock, established chemical manufacturing bases, and sustained investments in clean hydrogen and carbon-reduction technologies further reinforce North America’s market dominance

U.S. Syngas Catalyst Market Insight

The U.S. leads the Syngas Catalyst market due to strong demand from hydrogen production, ammonia synthesis, methanol manufacturing, and refining operations. Large-scale deployment of steam methane reforming and autothermal reforming technologies drives catalyst consumption. Continuous investments in blue hydrogen, carbon capture integration, and low-emission syngas processes, along with the presence of major catalyst manufacturers, support sustained market growth.

Canada Syngas Catalyst Market Insight

Canada shows steady growth supported by rising investments in hydrogen production, petrochemicals, and natural gas processing. Increasing focus on clean energy, carbon-reduction strategies, and ammonia-based fuel development boosts demand for advanced syngas catalysts. Strong government support for energy transition projects and integration of carbon capture technologies further strengthen catalyst adoption across industrial facilities.

Asia-Pacific Syngas Catalyst Market

Asia-Pacific is projected to register the fastest CAGR of 7.15% from 2026 to 2033, driven by rapid expansion of chemical manufacturing, fertilizer production, and syngas-based fuels across China, India, Japan, South Korea, and Southeast Asia. Rising demand for ammonia, methanol, synthetic fuels, and hydrogen, combined with large-scale industrialization and energy security initiatives, significantly boosts syngas catalyst consumption. Increasing investments in coal-to-chemicals, biomass gasification, and green hydrogen projects further accelerate regional market growth.

China Syngas Catalyst Market Insight

China dominates Asia-Pacific due to extensive coal-to-chemicals operations, fertilizer production, and methanol capacity expansion. High domestic demand for ammonia and synthetic fuels, combined with strong government backing for industrial self-sufficiency, drives large-scale syngas catalyst usage. Ongoing investments in gasification technologies and cleaner syngas processes further accelerate market expansion.

Japan Syngas Catalyst Market Insight

Japan’s Syngas Catalyst market benefits from advanced chemical processing capabilities and clean hydrogen initiatives. Strong emphasis on high-efficiency, low-emission catalyst systems supports adoption across ammonia and hydrogen synthesis plants. Continuous modernization of industrial infrastructure, combined with focus on sustainability and energy efficiency, ensures stable long-term demand for premium syngas catalysts.

India Syngas Catalyst Market Insight

India is emerging as a high-growth market driven by expanding fertilizer manufacturing, refinery upgrades, and national hydrogen mission initiatives. Rising investments in coal gasification, bio-based syngas, and green hydrogen projects increase demand for advanced catalysts. Growing domestic chemical production and government-backed industrial policies further accelerate market penetration.

South Korea Syngas Catalyst Market Insight

South Korea experiences steady growth supported by strong petrochemical capacity, hydrogen economy development, and advanced manufacturing capabilities. Increasing adoption of syngas catalysts in methanol production and hydrogen processing enhances market demand. Technological innovation, focus on energy efficiency, and rising investments in low-carbon industrial processes drive long-term market growth.

Which are the Top Companies in Syngas Catalyst Market?

The syngas catalyst industry is primarily led by well-established companies, including:

- Clariant (Switzerland)

- Johnson Matthey (U.K.)

- Haldor Topsøe (Denmark)

- SUN CHEMICAL CO LTD (Japan)

- BASF SE (Germany)

- Unicat Catalyst Technologies (U.S.)

- The Linde Group (Ireland)

What are the Recent Developments in Global Syngas Catalyst Market?

- In July 2025, Swiss startup Synhelion successfully showcased its solar gasoline by powering a 1985 Audi Sport quattro at the Supercar Owners Circle Classic event in Andermatt, Switzerland, demonstrating syngas-derived fuel produced using solar energy as a direct substitute for conventional fuels without engine modification, highlighting the commercial viability of solar-based syngas fuels

- In May 2025, POSCO Holdings and LG Chem formed a carbon capture and utilization (CCU) consortium in South Korea to lower emissions from steelmaking by capturing carbon dioxide from POSCO’s Pohang steel plant and converting it into syngas for sustainable aviation fuel production or reuse in steel manufacturing, strengthening the role of syngas in industrial decarbonization

- In March 2025, Coal India Limited signed a memorandum of understanding with IIT Hyderabad to establish the Centre of Clean Coal Energy and Net Zero (CLEANZ), focusing on coal gasification and syngas utilization technologies in line with India’s net-zero goals, supporting long-term advancement of domestic syngas capabilities

- In November 2023, Charwood Energy entered into a partnership with Verallia Group to develop a greenfield biomass pyrogasification facility for syngas production, a move aimed at expanding renewable syngas capacity and strengthening the company’s competitive position in the syngas market

- In May 2023, Air Products and Chemicals, Inc. collaborated with the Government of Uzbekistan and Uzbekneftegaz JSC to acquire a USD 1 billion natural gas-to-syngas processing facility in Qashqadaryo Province, enhancing regional syngas infrastructure and reinforcing Air Products’ global syngas footprint

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Syngas Catalyst Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Syngas Catalyst Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Syngas Catalyst Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.