Global Synthetic Aesthetic Injectable Fillers Market

Market Size in USD Billion

CAGR :

%

USD

2.81 Billion

USD

6.09 Billion

2024

2032

USD

2.81 Billion

USD

6.09 Billion

2024

2032

| 2025 –2032 | |

| USD 2.81 Billion | |

| USD 6.09 Billion | |

|

|

|

|

Synthetic Aesthetic Injectable Fillers Market Size

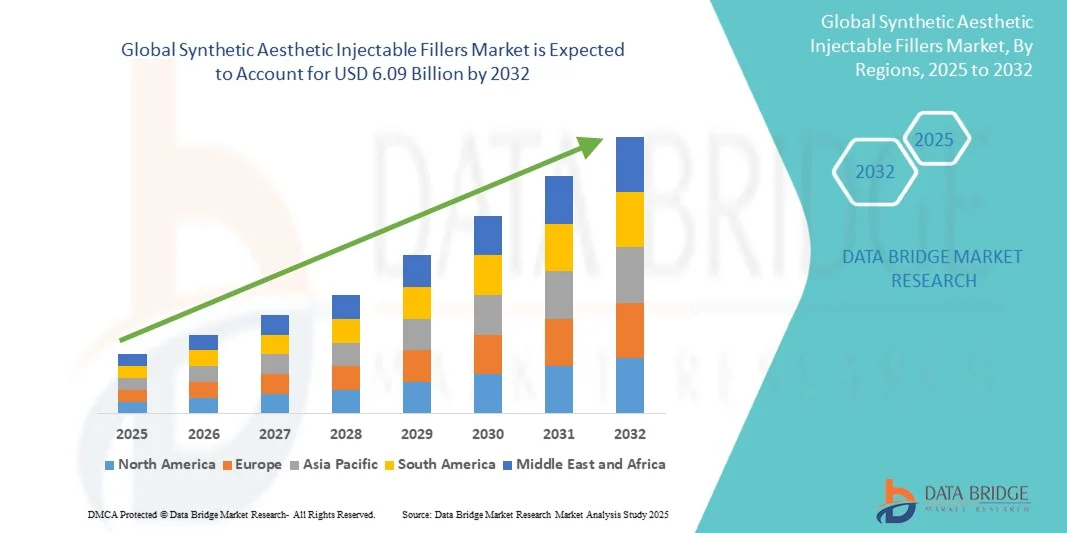

- The global synthetic aesthetic injectable fillers market size was valued at USD 2.81 billion in 2024 and is expected to reach USD 6.09 billion by 2032, at a CAGR of 10.13% during the forecast period

- The market growth is largely fueled by the increasing demand for non-invasive facial rejuvenation procedures, advancements in filler technologies, and the growing preference for personalized aesthetic treatments

- Furthermore, rising consumer awareness about the benefits of synthetic fillers, coupled with the expansion of aesthetic clinics and dermatology centers, is establishing synthetic injectable fillers as a preferred choice for facial enhancement. These converging factors are accelerating the adoption of synthetic aesthetic injectable fillers, thereby significantly boosting the industry's growth

Synthetic Aesthetic Injectable Fillers Market Analysis

- Synthetic aesthetic injectable fillers, comprising man-made substances such as hyaluronic acid, poly-L-lactic acid, calcium hydroxylapatite, and polymethyl methacrylate, are increasingly vital in modern aesthetic and dermatology treatments due to their minimally invasive nature, predictable outcomes, and ability to restore facial volume and reduce wrinkles

- The escalating demand for synthetic fillers is primarily fueled by rising consumer preference for non-surgical facial rejuvenation, increasing awareness of cosmetic procedures, and technological advancements that improve filler safety, longevity, and precision in aesthetic applications

- North America dominated the synthetic aesthetic injectable fillers market with the largest revenue share of 39% in 2024, characterized by high aesthetic awareness, advanced healthcare infrastructure, and a strong presence of key industry players. The U.S. experienced substantial growth in filler procedures, driven by innovations from leading pharmaceutical companies, enhanced formulations, and growing adoption in both dermatology clinics and cosmetic surgery centers

- Asia-Pacific is expected to be the fastest-growing region in the synthetic aesthetic injectable fillers market during the forecast period due to rising disposable incomes, increasing urban populations, and growing awareness and acceptance of aesthetic treatments among younger demographics

- Hyaluronic acid fillers dominated the synthetic aesthetic injectable fillers market with a market share of 45.9% in 2024, driven by their biocompatibility, reversibility, and widespread use for lip enhancement, cheek augmentation, and wrinkle reduction procedures

Report Scope and Synthetic Aesthetic Injectable Fillers Market Segmentation

|

Attributes |

Synthetic Aesthetic Injectable Fillers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Synthetic Aesthetic Injectable Fillers Market Trends

“Advanced Formulations and Personalized Treatment Approaches”

- A significant and accelerating trend in the global synthetic aesthetic injectable fillers market is the development of advanced formulations and personalized filler treatments, offering tailored solutions for facial rejuvenation and contouring

- For instance, Juvederm Volite allows practitioners to customize hydration and skin quality improvements based on patient-specific needs, enhancing treatment outcomes

- Innovative fillers with combined effects, such as volumizing and biostimulatory properties, are enabling practitioners to address multiple aesthetic concerns in a single procedure

- Furthermore, integration of imaging technologies and AI-assisted treatment planning facilitates precise filler placement and optimized facial symmetry for each patient

- The trend toward combination therapies with botulinum toxin and fillers is growing, allowing holistic facial rejuvenation with minimal interventions

- Increasing adoption of long-lasting synthetic fillers that reduce the frequency of repeat procedures is enhancing convenience for patients and improving clinic efficiency

- This trend toward highly personalized, minimally invasive aesthetic treatments is reshaping patient expectations and driving demand for sophisticated filler solutions

- The adoption of next-generation fillers that combine safety, longevity, and ease of use is increasing rapidly across dermatology clinics and aesthetic centers, as consumers prioritize natural-looking, long-lasting results

Synthetic Aesthetic Injectable Fillers Market Dynamics

Driver

“Rising Demand for Non-Surgical Facial Rejuvenation”

- The growing preference for minimally invasive cosmetic procedures over surgical interventions is a significant driver for the heightened demand for synthetic injectable fillers

- For instance, Allergan reported increasing uptake of Juvederm and Voluma products in 2024 due to non-surgical anti-aging treatments gaining popularity among middle-aged and younger demographics

- As consumers seek to address wrinkles, fine lines, and volume loss without downtime, synthetic fillers provide a safe, effective, and rapid solution

- Increasing awareness about aesthetic procedures through social media, influencer campaigns, and dermatology clinics is further boosting adoption rates

- Expansion of medical aesthetics services in emerging markets is driving regional growth and increasing accessibility of injectable fillers

- Technological advancements, such as needle-free injection systems and precision microcannulas, are improving safety, reducing side effects, and attracting more consumers

- The convenience of in-office procedures, customizable treatments, and immediate visible results are key factors propelling the use of synthetic fillers in both emerging and mature markets

- Rising investment in aesthetic clinics, coupled with the availability of training programs for practitioners, is supporting broader adoption and market expansion globally

Restraint/Challenge

“Side Effects and Regulatory Compliance Hurdles”

- Concerns regarding adverse effects such as bruising, swelling, and rare allergic reactions pose a challenge to broader market adoption of synthetic injectable fillers

- For instance, reports of granulomas or nodules in certain patients receiving polymethyl methacrylate (PMMA) fillers have made some consumers cautious about procedures

- Strict regulatory guidelines across different regions require companies to conduct extensive clinical testing and obtain approvals, which can delay product launches

- High treatment costs for premium fillers and repeat sessions can limit accessibility for price-sensitive consumers, particularly in developing markets

- Variability in practitioner expertise and lack of standardized training can result in inconsistent outcomes, affecting consumer confidence

- Limited awareness among patients regarding proper post-procedure care may lead to complications, hindering market growth

- Consumer hesitancy stemming from potential side effects and limited awareness about proper practitioner qualifications may slow adoption rates in certain regions

- Overcoming these challenges through enhanced safety protocols, practitioner training, patient education, and development of cost-effective formulations will be crucial for sustained market growth

Synthetic Aesthetic Injectable Fillers Market Scope

The market is segmented on the basis of material type, application, end user, and distribution channel.

- By Material Type

On the basis of material type, the market is segmented into Hyaluronic Acid (HA), Poly-L-Lactic Acid (PLLA), Calcium Hydroxylapatite (CaHA), and Polymethyl Methacrylate (PMMA). Hyaluronic Acid (HA) dominated the market with the largest revenue share of 45.9% in 2024 due to its biocompatibility, reversibility, and versatility in aesthetic treatments. HA fillers are widely used for wrinkle reduction, lip enhancement, cheek augmentation, and overall facial rejuvenation. The popularity is further strengthened by minimal downtime, low risk of side effects, and the ability to achieve natural-looking results. HA-based fillers also benefit from high physician familiarity and patient preference for temporary yet reliable outcomes. The segment’s dominance is supported by continuous product innovations, such as longer-lasting formulations and cross-linked HA for enhanced durability. Moreover, HA fillers are frequently combined with other aesthetic treatments, increasing their adoption across dermatology and cosmetic clinics.

Poly-L-Lactic Acid (PLLA) is anticipated to witness the fastest growth rate from 2025 to 2032 due to its collagen-stimulating properties and long-lasting effects. PLLA fillers address volume loss in deeper facial structures, making them attractive for anti-aging applications among older populations. The growing consumer preference for minimally invasive procedures that offer gradual, natural-looking improvement is driving the segment. Technological advances in PLLA formulations have improved safety and consistency, encouraging more practitioners to adopt these fillers. Emerging markets in Asia-Pacific and Latin America are increasingly adopting PLLA due to rising disposable incomes and aesthetic awareness. The combination of effectiveness, durability, and non-permanent characteristics positions PLLA as a rapidly growing subsegment in the global market.

- By Application

On the basis of application, the market is segmented into facial line correction, lip enhancement, facelift, scar treatment, cheek augmentation, and chin augmentation. Facial Line Correction dominated the market in 2024, as it addresses one of the most common aesthetic concerns: wrinkles and fine lines. This application is widely adopted across all age groups, with patients seeking minimally invasive solutions to maintain youthful appearances. Dermatology clinics and cosmetic centers frequently use synthetic fillers for targeted facial line treatments, enhancing patient satisfaction. The popularity is driven by fast, visible results with minimal recovery time. Marketing campaigns, social media influence, and the increasing number of trained aesthetic professionals further support the segment’s dominance. Continuous product innovation and combination therapies also reinforce demand in this application.

Lip Enhancement is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising desire for fuller, well-defined lips among younger demographics. Social media trends, celebrity influence, and increased aesthetic awareness have made lip augmentation a high-demand procedure globally. Advanced synthetic fillers provide precise volume control, shaping, and contouring, enhancing patient confidence and satisfaction. The procedure’s minimally invasive nature, immediate results, and short downtime contribute to rapid adoption. Clinics are increasingly offering lip-specific filler packages, driving segment growth. Technological improvements in filler viscosity and longevity further accelerate lip enhancement uptake in both mature and emerging markets.

- By End User

On the basis of end user, the market is segmented into dermatology clinics, hospitals, and ambulatory surgical centers. Dermatology Clinics dominated the market in 2024, driven by their specialization in aesthetic procedures and high patient footfall. These clinics offer personalized treatment plans, combining filler therapies with other non-invasive cosmetic treatments. Patients prefer dermatology clinics for professional expertise, safety, and follow-up care. The dominance is supported by advanced equipment, skilled practitioners, and a focus on minimally invasive solutions. Dermatology clinics also benefit from brand recognition and marketing that builds consumer trust. Additionally, high adoption of innovative filler products in these clinics sustains their leadership in the market.

Ambulatory Surgical Centers are anticipated to witness the fastest growth from 2025 to 2032, fueled by convenience, affordability, and increasing availability in urban and semi-urban areas. These centers allow patients to receive treatments without hospital admission, reducing cost and downtime. Growing awareness and acceptance of cosmetic procedures in emerging regions are increasing footfall at ambulatory centers. Technological advancements and trained staff in these centers enable safe, effective filler procedures. Their expansion into multiple cities and integration with wellness and cosmetic services further drives growth. The shift toward outpatient aesthetic procedures positions ambulatory surgical centers as a rapidly growing end-user segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, drug stores, and online pharmacy. Direct Tender dominated the market in 2024, primarily due to strong B2B relationships between filler manufacturers and dermatology clinics, hospitals, and cosmetic centers. This channel ensures reliable supply, timely delivery, and access to professional guidance on product usage. Bulk procurement through direct tenders helps clinics manage costs while maintaining high-quality inventory. Manufacturers also use direct tenders to provide training and marketing support, enhancing adoption. The dominance of this channel is reinforced by trust, product authenticity, and strong post-sale service support. Strategic collaborations between leading filler companies and key clinics further sustain its leadership in the market.

Online Pharmacy is expected to witness the fastest CAGR from 2025 to 2032, driven by the convenience of digital procurement and increasing e-commerce penetration in emerging markets. Online platforms allow small clinics and ambulatory centers to access a wider range of synthetic fillers without geographical constraints. Rapid delivery, competitive pricing, and ease of product comparison contribute to the growing adoption of online channels. Digital platforms also offer educational resources and customer support to facilitate safe usage. The trend toward e-commerce and contactless procurement, especially in post-pandemic years, positions online pharmacies as a fast-growing distribution channel.

Synthetic Aesthetic Injectable Fillers Market Regional Analysis

- North America dominated the synthetic aesthetic injectable fillers market with the largest revenue share of 39% in 2024, characterized by high aesthetic awareness, advanced healthcare infrastructure, and a strong presence of key industry players

- Consumers in the region highly value the safety, efficacy, and predictable results offered by synthetic fillers for facial rejuvenation, lip enhancement, and contouring procedures

- This widespread adoption is further supported by high disposable incomes, a strong presence of experienced dermatologists and aesthetic clinics, and growing awareness of minimally invasive aesthetic treatments, establishing synthetic fillers as a preferred solution for both residential and commercial cosmetic services

U.S. Synthetic Aesthetic Injectable Fillers Market Insight

The U.S. market captured the largest revenue share of around 40% in 2024, fueled by the high adoption of non-surgical cosmetic procedures and the growing trend of aesthetic enhancement. Consumers are increasingly prioritizing minimally invasive facial rejuvenation, including wrinkle correction, lip augmentation, and cheek volumization. The rising preference for personalized treatment plans, combined with the availability of advanced formulations such as hyaluronic acid and PLLA, further propels the market. Moreover, the integration of AI-assisted imaging and precision injection technologies is significantly contributing to improved treatment outcomes and patient satisfaction.

Europe Synthetic Aesthetic Injectable Fillers Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by high aesthetic awareness and strong healthcare infrastructure. The growing demand for minimally invasive cosmetic procedures, supported by strict safety and regulatory standards, is fostering adoption. European consumers value the quality, safety, and predictable results offered by synthetic fillers. Significant growth is observed across dermatology clinics, cosmetic surgery centers, and medical spas, with procedures being incorporated into both new clinic offerings and aesthetic service expansions.

U.K. Synthetic Aesthetic Injectable Fillers Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing demand for non-surgical facial rejuvenation and rising disposable incomes. Concerns about aging, appearance, and professional image are encouraging both men and women to opt for injectable fillers. The U.K.’s well-established aesthetic clinics, robust marketing campaigns, and strong consumer awareness are expected to continue stimulating market growth. Social media influence and celebrity endorsements also play a key role in driving adoption.

Germany Synthetic Aesthetic Injectable Fillers Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by high consumer awareness, advanced medical infrastructure, and demand for technologically sophisticated filler solutions. Germany’s emphasis on innovation and quality in aesthetic procedures promotes the adoption of both temporary and long-lasting fillers. The integration of treatment planning software and minimally invasive techniques is becoming increasingly prevalent. Consumers show strong preference for safe, effective, and clinically approved solutions, aligning with local regulatory expectations.

Asia-Pacific Synthetic Aesthetic Injectable Fillers Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period, driven by rising disposable incomes, increasing urban populations, and growing awareness of aesthetic procedures in countries such as China, Japan, and India. The region’s expanding middle class and acceptance of minimally invasive cosmetic treatments are key adoption factors. Furthermore, the proliferation of aesthetic clinics, social media influence, and the availability of affordable filler options are expanding the consumer base.

Japan Synthetic Aesthetic Injectable Fillers Market Insight

The Japan market is gaining momentum due to the country’s high aesthetic consciousness, aging population, and demand for safe, minimally invasive treatments. Consumers prefer high-quality synthetic fillers combined with advanced delivery techniques for precise facial enhancements. The integration of AI-assisted treatment planning and imaging technology in clinics is fueling growth. Moreover, Japan’s trend of early adoption of innovative cosmetic technologies supports continued market expansion across residential and clinical applications.

India Synthetic Aesthetic Injectable Fillers Market Insight

The India market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, rising disposable incomes, and increasing aesthetic awareness. India is emerging as a key market for non-surgical facial rejuvenation, with synthetic fillers gaining popularity in dermatology clinics, cosmetic centers, and medical spas. Government initiatives promoting health and wellness, the rise of medical tourism, and the availability of cost-effective filler solutions from domestic and international manufacturers are driving market growth.

Synthetic Aesthetic Injectable Fillers Market Share

The Synthetic Aesthetic Injectable Fillers industry is primarily led by well-established companies, including:

- Ipsen Pharma (France)

- REVANCE. (U.S.)

- HUGEL, Inc. (South Korea)

- Medytox (South Korea)

- AbbVie (U.S.)

- GALDERMA (Switzerland)

- Sinclair Pharma (U.K.)

- Bioxis Pharmaceuticals (France)

- Suneva Medical, Inc. (U.S.)

- Prollenium Medical Technologies, Inc. (Canada)

- Croma Pharma (Austria)

- Zimmer Biomet (U.S.)

- Marllor Biomedical (China)

- Dermax Med (China)

- CGBio Co., Ltd. (South Korea)

- Anika Therapeutics, Inc. (U.S.)

- Teoxane S.A. (Switzerland)

- Shanghai Haohai Biological Technology Co., Ltd. (China)

- Skin Tech Pharma Group (Spain)

What are the Recent Developments in Global Synthetic Aesthetic Injectable Fillers Market?

- In September 2025, Allergan Aesthetics launched the "Naturally You with Injectable Hyaluronic Acid Fillers" campaign to provide clear, factual education about HA injectable fillers. This initiative focuses on correcting misinformation and elevating understanding of the safe, natural-looking outcomes possible with hyaluronic acid injectable fillers. The campaign aims to celebrate the benefits of HA fillers and promote informed decision-making among consumers

- In September 2025, Galderma presented six posters with the latest updates from its science-backed aesthetic portfolio at the Aesthetic & Anti-Aging Medicine World Congress (AMWC) in Dubai. The company showcased its leadership in injectable aesthetics through updates on its scientific innovations and community education. Galderma's participation in AMWC Dubai underscores its commitment to advancing the field of injectable aesthetics and educating healthcare professionals

- In September 2025, Allergan Aesthetics announced the expansion of SKINVIVE® by JUVÉDERM® into 35 additional markets worldwide, reinforcing its commitment to advancing global skin quality. This expansion brings the total number of international launches to 57 in 2025, highlighting the growing demand for skin quality treatments. SKINVIVE® is the longest-lasting hydrating injectable on the market, delivered in one treatment, and has been well-received for its ability to improve facial skin quality

- In February 2025, Evolus announced the FDA approval of Evolysse™ Form and Evolysse™ Smooth injectable hyaluronic acid gels, expanding their portfolio for nasolabial fold treatments. These products are designed to smooth dynamic wrinkles, particularly nasolabial folds and smile lines, offering a natural-looking appearance. The approval marks a significant advancement in hyaluronic acid dermal fillers, providing patients with more options for facial rejuvenation

- In January 2025, the Financial Times reported that the popularity of aesthetic injections has surged among baby boomers and users of weight loss drugs such as Ozempic, leading to increased demand for facial rejuvenation treatments. This trend, often referred to as "Ozempic face," has driven a significant rise in the use of injectable fillers to address facial volume loss associated with rapid weight loss. The demand for such treatments reflects a broader societal focus on appearance and the desire to maintain a youthful look

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.