Global Synthetic Food Colors Market

Market Size in USD Million

CAGR :

%

USD

638.83 Million

USD

908.48 Million

2024

2032

USD

638.83 Million

USD

908.48 Million

2024

2032

| 2025 –2032 | |

| USD 638.83 Million | |

| USD 908.48 Million | |

|

|

|

|

Synthetic Food Colors Market Size

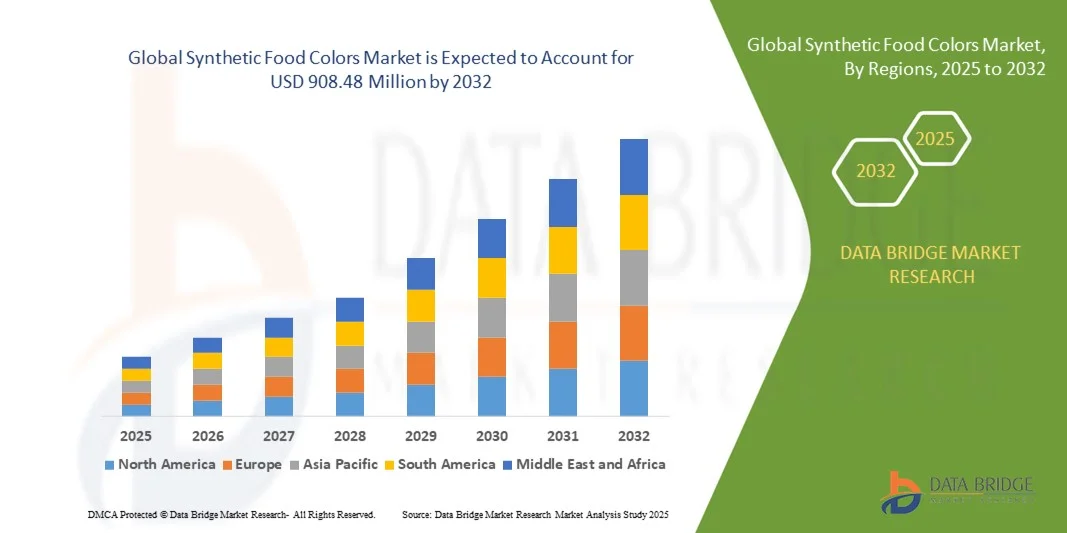

- The global synthetic food colors market size was valued at USD 638.83 million in 2024 and is expected to reach USD 908.48 million by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for vibrant and visually appealing food and beverage products that enhance consumer perception and brand identity

- Rising utilization of synthetic colors in confectionery, beverages, dairy, and processed food sectors due to their high stability, cost-effectiveness, and wide color range is further driving market expansion

Synthetic Food Colors Market Analysis

- The synthetic food colors market is witnessing steady growth as manufacturers increasingly prefer artificial colorants for their superior brightness, extended shelf life, and consistency in large-scale food production

- Continuous innovation in formulation and safety compliance, coupled with growing applications in ready-to-eat and packaged foods, is supporting global market advancement

- Asia-Pacific dominated the synthetic food colors market with the largest revenue share of 39.46% in 2024, driven by the rapid expansion of the food processing industry, urbanization, and growing consumption of packaged and convenience foods. Countries such as China, India, and Japan are major contributors, supported by increasing demand for visually appealing food products and cost-effective color formulations.

- North America region is expected to witness the highest growth rate in the global synthetic food colors market, driven by increasing product diversification in the food and beverage industry and growing adoption of synthetic colorants in ready-to-eat and convenience food applications

- The Red 40/Allura Red segment held the largest market share in 2024, driven by its widespread usage in beverages, confectionery, and bakery products due to its strong coloring intensity and high stability under varying pH and temperature conditions. It is also extensively preferred by global food manufacturers for its cost-effectiveness and consistency in shade across multiple product batches

Report Scope and Synthetic Food Colors Market Segmentation

|

Attributes |

Synthetic Food Colors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• BASF SE (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Synthetic Food Colors Market Trends

Rising Popularity of Vibrant and Visually Appealing Processed Foods

- The increasing consumer inclination toward visually attractive food and beverage products is significantly driving the use of synthetic food colors. Bright and stable pigments enhance product appeal, improving consumer perception and influencing purchasing decisions, particularly in confectionery, bakery, and soft drink segments. Synthetic colors offer superior vibrancy and consistency compared to natural alternatives, making them a preferred choice among manufacturers targeting mass-market appeal. In addition, the ability of synthetic pigments to maintain color intensity during extended shelf life makes them highly suitable for global food supply chains where storage and transportation conditions can vary significantly

- The widespread use of synthetic food colors in ready-to-eat, packaged, and processed foods aligns with the growing urban lifestyle and demand for convenience. These colors are highly stable under various processing and storage conditions, allowing manufacturers to maintain product uniformity and brand identity across global markets. This advantage is particularly crucial for multinational food brands focusing on visual differentiation and long shelf-life. In addition, synthetic colors are cost-effective and easy to incorporate into formulations, making them ideal for high-volume manufacturing, especially in emerging economies witnessing rising packaged food consumption

- Ongoing innovation in color formulation is leading to the development of advanced blends with enhanced solubility and heat resistance. Manufacturers are optimizing synthetic color performance in various applications, such as dairy, sauces, beverages, and baked goods, ensuring vibrant hues and consistent quality throughout processing. The integration of microencapsulation and nano-dispersion technologies is further improving pigment dispersion, light stability, and color retention, leading to superior performance in diverse product types and packaging formats

- For instance, in 2023, several European and North American food color suppliers launched next-generation synthetic pigment systems offering higher pH stability and improved lightfastness, enabling broader use in acidic beverages and baked products without color degradation. These advanced pigment systems are designed to meet both regulatory and performance standards, ensuring safety while maximizing aesthetic impact. In addition, suppliers are investing in localized manufacturing and customized shade development to cater to specific cultural and regional preferences in color intensity and tone

- While synthetic colors continue to dominate mass-market applications due to affordability and versatility, regulatory scrutiny regarding artificial additives remains a challenge. However, advancements in safety testing and compliance documentation are expected to sustain steady market adoption across emerging and developed economies. Moreover, collaborations between research institutions and food manufacturers are focusing on developing safer, more bio-compatible synthetic alternatives with reduced allergenic potential, strengthening long-term consumer trust and industry growth

Synthetic Food Colors Market Dynamics

Driver

Extensive Use in Packaged and Convenience Foods

- The global expansion of the processed food industry is a major growth driver for synthetic food colors. They are widely used in snacks, confectionery, beverages, and baked goods to restore or enhance color lost during processing, ensuring appealing aesthetics and consumer satisfaction. The demand for attractive, uniform coloring has become essential for maintaining brand consistency, especially as competition among food and beverage brands intensifies globally

- Rising urbanization and busier lifestyles are fueling the demand for convenient, ready-to-eat food products that rely on stable and cost-effective colorants. Synthetic food colors provide the desired hue intensity, shelf stability, and compatibility across diverse food matrices, which makes them indispensable in large-scale manufacturing. Furthermore, these pigments enable manufacturers to create visually consistent product batches, enhancing reliability and consumer confidence in product quality

- Their superior performance under varying temperature, moisture, and pH conditions gives synthetic colors a competitive edge over natural options. This consistency supports global product standardization, ensuring that consumers receive the same color experience regardless of geography. In addition, synthetic colorants exhibit strong resistance to oxidation and chemical degradation, making them ideal for packaged foods with long distribution cycles

- For instance, in 2023, leading snack and beverage producers across Asia-Pacific increased their reliance on FD&C-certified colors to achieve stronger brand recognition and visual differentiation in expanding product portfolios. This trend has been further accelerated by the region’s expanding retail infrastructure and the rising popularity of impulse-purchase items such as candies, chips, and soft drinks. Manufacturers are increasingly investing in bright color palettes to attract young consumers and enhance shelf visibility

- The growing adoption of vibrant color profiles in modern packaging and branding strategies further strengthens the demand for synthetic food colors, positioning them as key additives in processed food formulations. In addition, the expansion of e-commerce food sales is amplifying the importance of color consistency, as product appearance in digital marketing directly affects consumer purchasing behavior. The combination of visual appeal and affordability continues to sustain synthetic color dominance in the global processed food industry

Restraint/Challenge

Health Concerns and Stringent Regulatory Restrictions

- Rising consumer awareness regarding potential health risks associated with artificial additives is posing a challenge to the synthetic food colors market. Concerns related to hyperactivity in children and allergenic effects have prompted stricter safety assessments and labeling regulations across multiple regions, including Europe and North America. These regulations often require manufacturers to conduct additional toxicity and exposure tests, thereby increasing compliance costs and time-to-market for new color formulations

- Governments are imposing tighter restrictions on permissible dosage levels and approving fewer new synthetic colorants, which can limit market expansion. Compliance with region-specific standards, such as the EU’s EFSA and the U.S. FDA, requires extensive documentation, increasing operational costs for manufacturers. The variation in global regulatory frameworks also creates hurdles for companies trying to standardize product lines across multiple markets, adding complexity to supply chains

- The growing preference for natural and clean-label alternatives is compelling companies to reassess formulations and adopt hybrid strategies combining synthetic and natural pigments. This transition can increase production costs and affect color performance in certain food types. In addition, consumer advocacy groups continue to pressure brands to minimize artificial color use, compelling manufacturers to invest in reformulation and communication strategies to maintain trust and transparency

- For instance, in 2023, several confectionery producers in the U.K. and Germany reformulated products by reducing artificial color content in response to consumer advocacy group campaigns and evolving food safety norms. These shifts, while supporting regulatory alignment, have also pushed producers to adopt innovative blending techniques to maintain the same visual appeal with reduced synthetic input. The balance between safety compliance and visual performance continues to challenge manufacturers across developed markets

- Although regulatory challenges persist, synthetic colors remain essential for high-volume, cost-sensitive production. Continued research to ensure safety compliance, improve bio-compatibility, and reduce allergenic potential will be crucial for maintaining market stability and consumer trust. In addition, global harmonization of safety standards and increased transparency in labeling can help rebuild consumer confidence while supporting sustainable growth in the synthetic food colors market

Synthetic Food Colors Market Scope

The synthetic food colors market is segmented on the basis of product, form, solubility, and application.

- By Product

On the basis of product, the synthetic food colors market is segmented into Red 40/Allura Red, Yellow No. 5, Yellow No. 6, and Others. The Red 40/Allura Red segment held the largest market share in 2024, driven by its widespread usage in beverages, confectionery, and bakery products due to its strong coloring intensity and high stability under varying pH and temperature conditions. It is also extensively preferred by global food manufacturers for its cost-effectiveness and consistency in shade across multiple product batches.

The Yellow No. 5 segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its increasing use in processed snacks, dairy desserts, and flavored drinks. The growing demand for bright, visually appealing yellow shades in packaged foods and confectionery is further fuelling its adoption across both developed and emerging economies.

- By Form

On the basis of form, the market is segmented into Liquid, Gel, and Powder. The Liquid segment accounted for the largest market share in 2024, owing to its superior dispersibility, ease of blending, and compatibility with large-scale industrial production. Liquid synthetic colors are widely used in beverages, sauces, and bakery fillings due to their uniform color distribution and strong tinting strength.

The Powder segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its longer shelf life, ease of transportation, and reduced risk of microbial contamination. Powdered colors are preferred in dry mix applications such as instant foods, powdered drinks, and confectionery coatings, where stability and reconstitution properties are critical.

- By Solubility

On the basis of solubility, the synthetic food colors market is categorized into Dye and Lake. The Dye segment dominated the market in 2024, primarily due to its excellent solubility in water, high color intensity, and ability to create vibrant, uniform hues in liquid and semi-liquid applications. Dyes are extensively used in beverages, syrups, and ice creams where high tint strength and visual clarity are required.

The Lake segment is expected to witness the fastest growth rate from 2025 to 2032, as it provides superior stability in oil-based and low-moisture food matrices. Lakes are particularly suitable for applications such as coated tablets, bakery icings, and fat-based confectionery, where water-insoluble colorants are needed to maintain consistency and prevent color bleeding.

- By Application

On the basis of application, the market is segmented into Food and Beverages. The Food segment held the dominant share in 2024, driven by the extensive use of synthetic colors in confectionery, bakery, snacks, and processed foods to enhance visual appeal and brand differentiation. The cost efficiency and versatility of synthetic pigments make them indispensable in high-volume food manufacturing environments.

The Beverages segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing demand for brightly colored soft drinks, energy beverages, and flavored water. Synthetic colors in liquid form are ideal for beverage formulations, as they ensure stability and uniformity even under extended storage and variable temperature conditions.

Synthetic Food Colors Market Regional Analysis

- Asia-Pacific dominated the synthetic food colors market with the largest revenue share of 39.46% in 2024, driven by the rapid expansion of the food processing industry, urbanization, and growing consumption of packaged and convenience foods. Countries such as China, India, and Japan are major contributors, supported by increasing demand for visually appealing food products and cost-effective color formulations.

- The region’s strong manufacturing capabilities, combined with low production costs and an expanding export base for processed foods, have further strengthened its dominance.

- Growing investments in advanced pigment technology and the rising presence of both global and local colorant manufacturers are enhancing product innovation, making Asia-Pacific a leading hub for synthetic food color production and application.

China Synthetic Food Colors Market Insight

The China synthetic food colors market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by its strong food and beverage manufacturing base, expanding middle-class population, and rising demand for affordable processed foods. The country’s growing packaged food and beverage sector is a major consumer of synthetic dyes such as Red 40 and Yellow No. 6, valued for their vibrancy and consistency. Moreover, China’s position as a global production hub and the presence of key domestic manufacturers continue to propel market growth.

Japan Synthetic Food Colors Market Insight

The Japan synthetic food colors market is expected to witness the fastest growth rate from 2025 to 2032, supported by its high-quality food manufacturing sector and technological innovation in color formulations. The market benefits from advanced R&D capabilities focusing on pH stability, solubility, and safety compliance. Growing applications in beverages, dairy, and confectionery are driving steady adoption. Furthermore, Japan’s emphasis on maintaining consistent product aesthetics and regulatory compliance continues to shape market development.

North America Synthetic Food Colors Market Insight

The North America synthetic food colors market is expected to witness the fastest growth rate from 2025 to 2032, driven by the region’s high consumption of processed foods, beverages, and confectionery products. The demand for visually attractive and stable colorants remains strong, supported by an established manufacturing base and broad retail presence. Manufacturers are focusing on innovation in safe, high-performance pigments to meet evolving consumer expectations while complying with FDA regulations.

U.S. Synthetic Food Colors Market Insight

The U.S. synthetic food colors market is expected to witness the fastest growth rate from 2025 to 2032, supported by large-scale adoption in beverages, snacks, and bakery products. Synthetic colors such as Yellow No. 5 and Red 40 remain widely used due to their stability and cost efficiency. Increasing consumer awareness regarding additives has prompted leading producers to adopt reformulated and certified synthetic color systems that align with health and safety standards, ensuring sustained market growth.

Europe Synthetic Food Colors Market Insight

The Europe synthetic food colors market is expected to witness the fastest growth rate from 2025 to 2032, driven by demand from the confectionery, bakery, and dairy sectors. The region maintains strict safety regulations, promoting the use of compliant, high-quality synthetic colorants. European manufacturers are focusing on developing improved formulations with enhanced stability and lower allergenic potential. In addition, the growing popularity of vibrant color profiles in premium food categories continues to support the market’s expansion.

Germany Synthetic Food Colors Market Insight

The Germany synthetic food colors market is expected to witness the fastest growth rate from 2025 to 2032, driven by its advanced food production infrastructure and high standards for product quality. The demand for color-stable and temperature-resistant pigments is particularly strong across beverage and dairy segments. Germany’s commitment to innovation and compliance with EU safety regulations continues to encourage the development of next-generation synthetic color solutions tailored to industrial needs.

U.K. Synthetic Food Colors Market Insight

The U.K. synthetic food colors market is expected to witness the fastest growth rate from 2025 to 2032, supported by its large packaged food and bakery sectors. Increasing investments in product innovation and compliance with evolving labeling requirements are driving reformulations among manufacturers. The rising popularity of vibrant and visually appealing confectionery and beverage products is further stimulating market demand, ensuring continued adoption of synthetic colors across retail and foodservice channels.

Synthetic Food Colors Market Share

The Synthetic Food Colors industry is primarily led by well-established companies, including:

• BASF SE (Germany)

• Vinayak Ingredients India Pvt Ltd. (India)

• Kolorjet Chemicals Pvt Ltd. (India)

• Rung International (India)

• Denim Colourchem (P) Limited (India)

• Nestlé (Switzerland)

• Alliance Organics LLP. (India)

• Cargill, Incorporated. (U.S.)

• Arun Colour Chem Private Limited (India)

• Jamsons (India)

• Rexza Colours (India)

• San-Ei Gen F.F.I., Inc. (Japan)

• ADM (U.S.)

• Dow (U.S.)

• Sensient Technologies Corporation (U.S.)

• Sunfoodtech (India)

• Matrix Pharma Chem (India)

• Red Sun Dye Chem. (India)

• AJANTA CHEMICAL INDUSTRIES. (India)

• Parshwanath Dye Stuff Industries. (India)

• Thomas Publishing Company. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Synthetic Food Colors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Synthetic Food Colors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Synthetic Food Colors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.