Global Synthetic Food Preservatives Market

Market Size in USD Billion

CAGR :

%

USD

2.00 Billion

USD

3.43 Billion

2024

2032

USD

2.00 Billion

USD

3.43 Billion

2024

2032

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 3.43 Billion | |

|

|

|

|

What is the Global Synthetic Food Preservatives Market Size and Growth Rate?

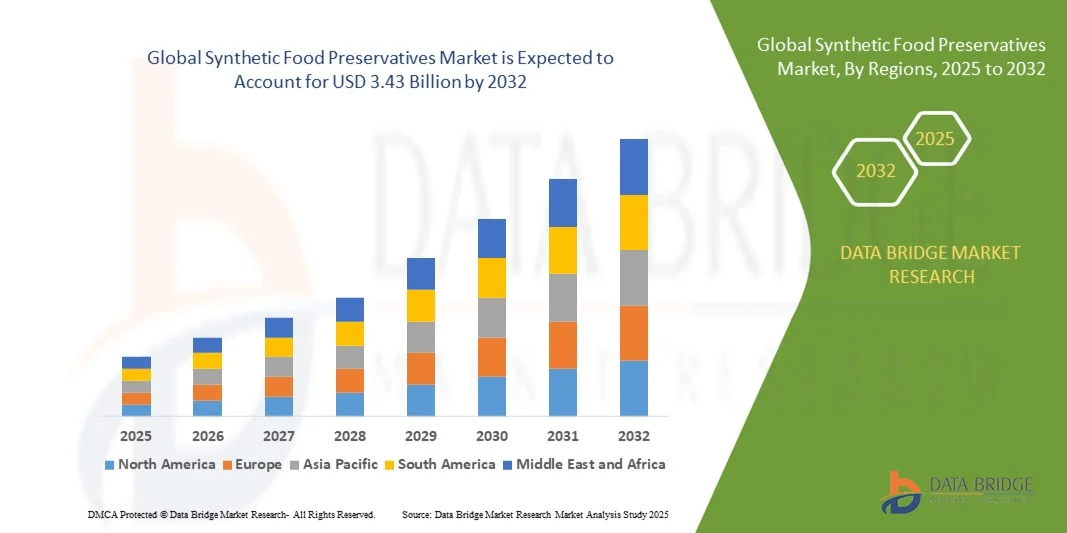

- The global synthetic food preservatives market size was valued at USD 2.00 billion in 2024 and is expected to reach USD 3.43 billion by 2032, at a CAGR of 7.00% during the forecast period

- The major growing factor towards synthetic food preservatives market is the strong demand for soothe foods which has consequences on the categories of preservatives necessary to preserve freshness with products and other synthetic ingredients and fat substitutes

- The prime factor driving the demand for synthetic food preservatives is the rapidly rising food conservation demand. Furthermore, with the rising disposable income and growing dairy industry as well as the large population followed by increasing health awareness among the consumers are also heightening the overall demand for synthetic food preservatives market

What are the Major Takeaways of Synthetic Food Preservatives Market?

- Rising disposable income, high growth in demand for convenience foods, increase in demand for food products with extended shelf life and changes in lifestyle and urbanization of population has resulted in more individuals preferring convenience foods

- Also, the various government bodies and private industries preserve sufficient regulations to maintain a high standard of preservative food quality which is also having a positive impact on the synthetic food preservatives market growth rate

- North America dominated the synthetic food preservatives market with the largest revenue share of 41.5% in 2024, driven by the high demand for processed, packaged, and convenience foods as well as stringent food safety and regulatory standards

- The Asia-Pacific synthetic food preservatives market is poised to grow at the fastest CAGR of 8.34% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and an expanding packaged and processed food industry in countries such as China, Japan, and India

- The antimicrobial segment dominated the market with a revenue share of 46.3% in 2024, driven by its critical role in preventing microbial spoilage, extending shelf life, and ensuring food safety across perishable and processed products

Report Scope and Synthetic Food Preservatives Market Segmentation

|

Attributes |

Synthetic Food Preservatives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Synthetic Food Preservatives Market?

Rising Adoption of Natural-Such as Synthetic Preservatives and Clean Label Solutions

- A notable trend in the global synthetic food preservatives market is the growing demand for natural-such as synthetic preservatives that align with clean label requirements. Manufacturers are increasingly formulating products that maintain extended shelf life while meeting consumer preferences for transparency and fewer artificial ingredients

- For instance, sodium benzoate and potassium sorbate-based solutions are being optimized for improved efficacy in beverages, dairy, and processed foods while minimizing synthetic perception. Similarly, multifunctional preservatives are being developed to address microbial safety and oxidative stability in one solution

- The adoption of advanced formulation technologies enables manufacturers to enhance preservative performance under varying pH, temperature, and food matrix conditions, providing better consistency and safety

- These preservatives are also being integrated into automated production processes, allowing centralized quality control and efficient monitoring of additive levels, ensuring compliance with safety regulations

- This trend toward consumer-friendly, multifunctional preservatives is reshaping formulation strategies across the food industry. Companies such as Mérieux NutriSciences and DSM are innovating in preservative blends that balance functionality, safety, and clean label claims

- The demand for synthetic preservatives that mimic natural behavior while meeting regulatory and sensory expectations is rising sharply, especially in processed foods, beverages, and ready-to-eat segments

What are the Key Drivers of Synthetic Food Preservatives Market?

- The rising consumer demand for safe, long-lasting, and high-quality packaged foods is a primary driver for the synthetic food preservatives market. Food manufacturers are prioritizing preservative solutions to prevent spoilage, maintain flavor, and reduce waste

- In March 2025, DSM introduced an enhanced preservative blend for beverages that extends shelf life without impacting taste, reflecting the growing focus on multifunctional additives. Such initiatives by leading companies are expected to drive market expansion during the forecast period

- Increasing regulatory focus on food safety and hygiene globally is prompting manufacturers to adopt scientifically validated synthetic preservatives. This is particularly crucial in dairy, processed foods, and ready-to-eat segments, where microbial contamination risks are high.

- The expansion of processed and convenience food consumption, coupled with longer supply chains, is fostering adoption. Synthetic preservatives allow producers to maintain product quality from manufacturing to retail shelves

- In addition, cost-effectiveness and scalability of synthetic preservatives compared to some natural alternatives make them attractive for large-scale production. The combination of efficiency, reliability, and regulatory compliance is fueling growth across all food sectors

Which Factor is Challenging the Growth of the Synthetic Food Preservatives Market?

- Growing consumer concerns about artificial ingredients, chemical additives, and potential health effects present a challenge to the synthetic food preservatives market. The rising clean-label trend encourages manufacturers to seek natural alternatives

- For instance, several studies highlighting perceived health risks associated with benzoates and sorbates have increased consumer scrutiny and affected demand in certain regions

- Addressing these concerns requires companies to innovate safer, more transparent preservative solutions while educating consumers about efficacy and safety. Firms such as Cargill and Kerry Group are developing low-concentration or multifunctional blends to reduce chemical load without compromising shelf life

- Furthermore, regulatory limitations in some regions regarding synthetic preservative use can pose market entry barriers. Price sensitivity for premium preservative blends, especially in emerging markets, can also hinder adoption

- While synthetic preservatives remain essential for large-scale food production, overcoming perception challenges through education, clean-label communication, and hybrid preservative solutions is critical for sustained market growth

How is the Synthetic Food Preservatives Market Segmented?

The market is segmented on the basis of function and application.

- By Function

On the basis of function, the synthetic food preservatives market is segmented into antimicrobials, antioxidants, chelating agents, and enzyme inhibitors. The antimicrobial segment dominated the market with a revenue share of 46.3% in 2024, driven by its critical role in preventing microbial spoilage, extending shelf life, and ensuring food safety across perishable and processed products. Antimicrobials are extensively used in beverages, dairy, meat, and seafood products due to their efficacy against bacteria, yeast, and molds. Their adoption is further supported by stringent food safety regulations and increasing demand for long-lasting, ready-to-eat, and packaged foods.

The antioxidant segment is anticipated to witness the fastest CAGR of 19.2% from 2025 to 2032, fueled by rising consumer preference for clean-label, natural-such as preservatives and multifunctional formulations that prevent oxidation, maintain nutritional quality, and enhance shelf stability. Companies are innovating hybrid solutions combining antimicrobial and antioxidant functions to meet diverse industry requirements.

- By Application

On the basis of application, the synthetic food preservatives market is segmented into beverages, oils and fats, bakery, dairy and frozen products, snacks, meat, poultry, seafood products, confectionery, and others. The dairy and frozen products segment dominated the market with a revenue share of 38.7% in 2024, owing to the high perishability of these products and the necessity to maintain microbial safety and freshness throughout storage and distribution. Preservatives in dairy, ice cream, and frozen desserts ensure compliance with regulatory standards while extending shelf life without compromising taste or texture.

The bakery segment is expected to witness the fastest CAGR of 18.5% from 2025 to 2032, driven by the demand for packaged, long-shelf-life baked goods and the growing adoption of preservatives to prevent mold, staling, and oxidation. Innovations in multifunctional preservatives tailored for baked products are further fueling market growth in this segment.

Which Region Holds the Largest Share of the Synthetic Food Preservatives Market?

- North America dominated the synthetic food preservatives market with the largest revenue share of 41.5% in 2024, driven by the high demand for processed, packaged, and convenience foods as well as stringent food safety and regulatory standards

- Consumers and food manufacturers in the region prioritize product safety, extended shelf life, and quality, encouraging widespread adoption of synthetic preservatives across dairy, meat, bakery, and beverages

- This adoption is further supported by robust infrastructure, technologically advanced laboratories, and increasing investment in food research and testing, establishing North America as the leading hub for synthetic preservative usage

U.S. Synthetic Food Preservatives Market Insight

The U.S. synthetic food preservatives market captured the largest revenue share of 79% in 2024 within North America, fueled by a growing packaged and processed foods industry, rising consumer awareness of food safety, and demand for extended shelf life products. Manufacturers are increasingly adopting antimicrobials and antioxidants to comply with FDA regulations and meet quality standards, enhancing market growth. Furthermore, the expansion of retail and e-commerce channels supports distribution of preservative-enabled products nationwide.

Europe Synthetic Food Preservatives Market Insight

The Europe synthetic food preservatives market is projected to grow steadily over the forecast period, driven by strict regulatory frameworks, food safety norms, and increasing urbanization. Rising demand for packaged, convenience, and functional foods is boosting preservative adoption in bakery, dairy, and meat segments. Moreover, European consumers’ focus on quality, shelf life, and food hygiene encourages manufacturers to implement synthetic preservatives across new and renovated food product lines.

U.K. Synthetic Food Preservatives Market Insight

The U.K. synthetic food preservatives market is expected to witness significant growth, supported by the country’s emphasis on food safety, quality control, and growing packaged food consumption. Rising demand for processed snacks, bakery, and dairy products is encouraging manufacturers to adopt preservatives that maintain product integrity and freshness. Government regulations and robust retail infrastructure are also facilitating market expansion.

Germany Synthetic Food Preservatives Market Insight

The Germany synthetic food preservatives market is anticipated to expand at a notable CAGR during the forecast period, owing to the country’s advanced food processing industry and focus on safety and quality standards. Widespread adoption of synthetic preservatives in meat, dairy, and bakery applications ensures compliance with stringent European food regulations. Manufacturers are increasingly integrating preservatives to extend shelf life while maintaining flavor and nutritional value.

Which Region is the Fastest Growing Region in the Synthetic Food Preservatives Market?

The Asia-Pacific synthetic food preservatives market is poised to grow at the fastest CAGR of 8.34% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and an expanding packaged and processed food industry in countries such as China, Japan, and India. Increasing consumer awareness of food safety, combined with government initiatives supporting food quality monitoring, is accelerating preservative adoption.

Japan Synthetic Food Preservatives Market Insight

The Japan synthetic food preservatives market is gaining traction due to growing demand for processed and convenience foods, coupled with high food safety standards. Adoption of antimicrobials and antioxidants ensures extended shelf life and compliance with regulations, particularly in meat, dairy, and seafood products. The country’s advanced food processing technologies further support market growth.

China Synthetic Food Preservatives Market Insight

The China synthetic food preservatives market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly growing middle class, urbanization, and increasing consumption of packaged and processed foods. Strong domestic food manufacturing, government initiatives promoting food safety, and affordability of preservatives are key factors driving market expansion. Rising demand in bakery, dairy, and beverage segments continues to fuel growth.

Which are the Top Companies in Synthetic Food Preservatives Market?

The synthetic food preservatives industry is primarily led by well-established companies, including:

- DSM (dsm firmenich) (Switzerland)

- Cargill, Incorporated (U.S.)

- Tate & Lyle PLC (U.K.)

- Kerry Group plc (Ireland)

- Chr. Hansen Holding A/S (Denmark)

- Hawkins Watts Limited (U.K.)

- Prinova Group LLC (U.S.)

- DuPont (U.S.)

- Arjuna Natural LLC (U.S.)

- Kemin Industries, Inc. (U.S.)

- BASF SE (Germany)

- Corbion (Netherlands)

- Akzo Nobel N.V. (Netherlands)

- Celanese Corporation (U.S.)

- Kilo Ltd (Singapore)

- Ajinomoto Co., Inc. (Japan)

- Jungbunzlauer Suisse AG (Switzerland)

What are the Recent Developments in Global Synthetic Food Preservatives Market?

- In April 2025, Maya East Africa, one of the region’s renowned distributors and manufacturers of raw food ingredients, announced the launch of its Rwandan franchise, strengthening its regional presence and expanding access to high-quality food ingredients in East Africa

- In July 2023, BioVeritas, a Texas-based startup, developed a clean-label mould inhibitor using a proprietary upcycling and fermentation process, derived from upcycled biomass and shown to be as effective as traditional petrochemical-based ingredients in preserving the flavor and texture of baked goods, marking a key step towards sustainable food preservation, and the company plans to establish its first commercial plant in 2026 while exploring applications in processed meat and other food products

- In September 2022, the company introduced propionic acid (PA) and neopentyl glycol (NPG) with a CPF of zero for the first time, highlighting the economic and environmental advantages of airtight silos and improved drying methods for food preservation, reinforcing innovations in sustainable ingredient applications

- In June 2022, Cargill and Delacon announced the formation of a market-leading company for plant-based phytogenic feed additives that promote better animal nutrition, enhancing manufacturing capacity, global presence, and expertise in healthful feed additives, thereby contributing to improved food quality and safety

- In January 2022, Florida Food Products (FFP) launched VegStable Fresh, a new clean-label plant-based antioxidant ingredient, at the International Production & Processing Expo in Atlanta, Georgia, offering extended shelf life and rancidity prevention in meat and poultry products, reflecting the growing trend towards natural and clean-label food preservatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Synthetic Food Preservatives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Synthetic Food Preservatives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Synthetic Food Preservatives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.