Global Synthetic Fruit Flavor Market

Market Size in USD Billion

CAGR :

%

USD

6.38 Billion

USD

10.48 Billion

2025

2033

USD

6.38 Billion

USD

10.48 Billion

2025

2033

| 2026 –2033 | |

| USD 6.38 Billion | |

| USD 10.48 Billion | |

|

|

|

|

What is the Global Synthetic Fruit Flavor Market Size and Growth Rate?

- The global synthetic fruit flavor market size was valued at USD 6.38 billion in 2025 and is expected to reach USD 10.48 billion by 2033, at a CAGR of6.40% during the forecast period

- The rise in demand for packaged foods among consumers across the globe acts as one of the major factors driving the growth of the synthetic fruit flavor market. The increase in the demand for processed and comfort food and the increased consumption of confectionery items and the continuous demand for sweet flavors accelerate the market growth

What are the Major Takeaways of Synthetic Fruit Flavor Market?

- Technological advancements in the food and beverage industry such as microencapsulation technology and non-thermal treatments, including HPP and PEF to enhance flavor retention further influence the market

- In addition, the surge in disposable income, rise in population, digitalization of the retail industry and urbanization positively affect the synthetic fruit flavor market. Furthermore, innovative raw material sources, use in functional foods, and launch of advanced products extend profitable opportunities to the market players

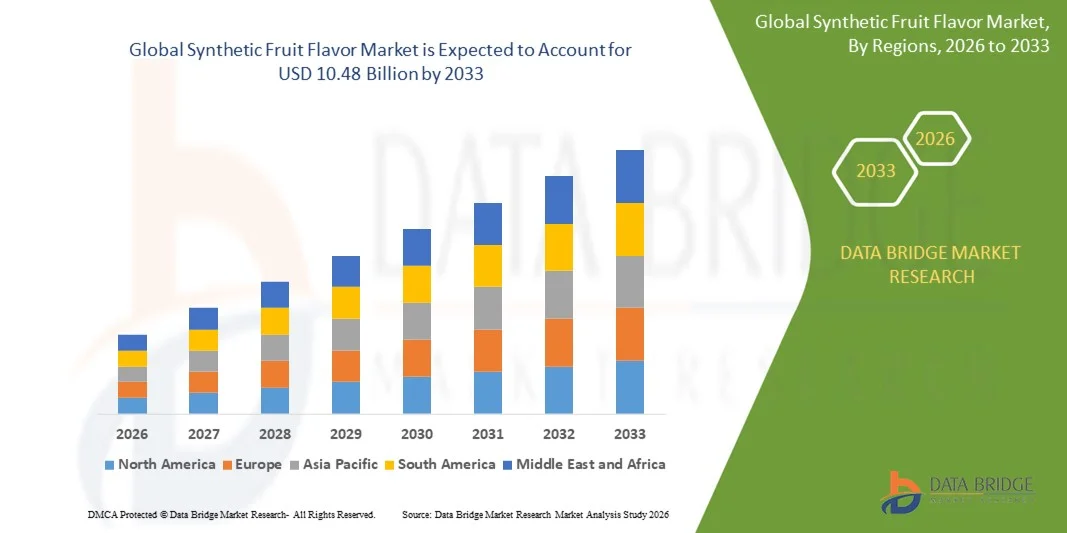

- Asia-Pacific dominated the synthetic fruit flavor market with an estimated 44.3% revenue share in 2025, driven by large-scale food and beverage manufacturing, rapid urbanization, and rising consumption of packaged foods across China, India, Japan, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 9.24% from 2026 to 2033, driven by rising demand for functional foods, flavored beverages, nutraceuticals, and sugar-reduced products

- The Solutions segment dominated the market with a 68.4% revenue share in 2025, driven by rising demand for high-density racks, cable-optimized structures, tool-less designs, PDUs, and mounting accessories essential for modern data centre buildouts

Report Scope and Synthetic Fruit Flavor Market Segmentation

|

Attributes |

Synthetic Fruit Flavor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Synthetic Fruit Flavor Market?

Increasing Shift Toward Clean-Label, Stable, and Cost-Optimized Synthetic Fruit Flavors

- The synthetic fruit flavor market is witnessing growing adoption of chemically stable, heat-resistant, and shelf-life-enhanced formulations to meet the requirements of processed foods, beverages, and bakery applications

- Manufacturers are focusing on high-intensity, low-dosage synthetic flavors that deliver consistent taste profiles while reducing formulation costs for large-scale food producers

- Rising preference for uniform flavor performance across batches and geographies is accelerating demand for standardized synthetic fruit flavor solutions

- For instance, companies such as IFF, Givaudan, Symrise, and Kerry Group have expanded their portfolios with application-specific synthetic fruit flavors for beverages, confectionery, dairy, and nutraceuticals

- Increasing demand for cost-efficient alternatives to natural fruit extracts, particularly during raw material supply volatility, is reinforcing the role of synthetic fruit flavors

- As global food processing scales and formulation consistency becomes critical, Synthetic Fruit Flavors will remain essential for mass-market food and beverage production

What are the Key Drivers of Synthetic Fruit Flavor Market?

- Rising demand for affordable, stable, and flavor-consistent ingredients in processed foods, ready-to-drink beverages, confectionery, and bakery products

- For instance, during 2024–2025, leading flavor manufacturers such as IFF, Givaudan, and Sensient introduced cost-optimized synthetic fruit flavor blends to support high-volume food manufacturing

- Rapid growth of packaged foods, carbonated drinks, flavored dairy, and energy beverages across the U.S., Europe, and Asia-Pacific is boosting market demand

- Advancements in flavor chemistry, encapsulation technologies, and aroma enhancement have improved taste accuracy and application flexibility

- Increasing use of synthetic fruit flavors in functional foods, supplements, and fortified products due to their stability and predictable sensory profiles

- Supported by expanding food processing capacity and rising urban consumption, the Synthetic Fruit Flavor market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Synthetic Fruit Flavor Market?

- Growing consumer preference for natural, organic, and clean-label flavors is limiting adoption in premium and health-focused food segments

- For instance, during 2024–2025, stricter labeling regulations and reformulation trends in Europe increased pressure on synthetic flavor usage

- Regulatory scrutiny related to food additives, artificial ingredients, and permissible flavor compounds raises compliance complexity for manufacturers

- Negative consumer perception regarding artificial taste and health concerns affects demand in certain markets

- Competition from natural fruit flavors, extracts, and bio-based alternatives is intensifying pricing and innovation pressure

- To address these challenges, companies are investing in regulatory-compliant formulations, transparency initiatives, and hybrid flavor solutions to sustain Synthetic Fruit Flavor market adoption

How is the Synthetic Fruit Flavor Market Segmented?

The market is segmented on the basis of flavor type, form, and application.

- By Flavor Type

On the basis of flavor type, the synthetic fruit flavor market is segmented into Berries Flavors, Stone Fruit Flavors, Tropical & Exotic Flavors, Citrus Flavors, Apple & Pears Flavors, and Others. The Citrus Flavors segment dominated the market with an estimated 34.6% share in 2025, driven by extensive usage in carbonated beverages, juices, flavored waters, confectionery, and bakery products. Citrus flavors such as orange, lemon, and lime are widely preferred due to their refreshing taste profile, high consumer acceptance, cost efficiency, and strong stability across processing conditions. Their compatibility with both food and beverage formulations further supports widespread adoption.

The Tropical & Exotic Flavors segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising consumer interest in unique taste experiences, premium beverages, energy drinks, and functional foods. Increasing innovation in mango, pineapple, passion fruit, and mixed tropical profiles is accelerating demand, particularly across Asia-Pacific and emerging markets.

- By Form

On the basis of form, the synthetic fruit flavor market is segmented into Liquid, Powder, and Syrup. The Liquid segment dominated the market with a 46.2% share in 2025, owing to its ease of blending, rapid dispersion, and precise dosage control in beverages, dairy products, sauces, and processed foods. Liquid synthetic fruit flavors are widely used in large-scale food manufacturing due to their consistent performance, quick solubility, and suitability for automated production lines. Their flexibility across hot and cold applications further strengthens adoption.

The Powder segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for dry mixes, bakery products, confectionery, instant beverages, and nutritional supplements. Longer shelf life, reduced transportation costs, and improved stability under varying storage conditions are key factors supporting rapid growth of powdered synthetic fruit flavors.

- By Application

On the basis of application, the synthetic fruit flavor market is segmented into Food & Beverage, Pet Food, Pharmaceutical, Personal Care & Cosmetic, and Others. The Food & Beverage segment dominated the market with a 58.9% share in 2025, supported by extensive use in soft drinks, flavored dairy, confectionery, bakery, ready-to-eat foods, and functional beverages. Synthetic fruit flavors offer consistent taste, cost efficiency, and high stability, making them essential ingredients for mass-market food production.

The Pharmaceutical segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for flavored syrups, chewable tablets, gummies, and pediatric medicines. Synthetic fruit flavors help mask unpleasant tastes, improve patient compliance, and maintain formulation stability, supporting growing adoption across global pharmaceutical manufacturing.

Which Region Holds the Largest Share of the Synthetic Fruit Flavor Market?

- Asia-Pacific dominated the synthetic fruit flavor market with an estimated 44.3% revenue share in 2025, driven by large-scale food and beverage manufacturing, rapid urbanization, and rising consumption of packaged foods across China, India, Japan, South Korea, and Southeast Asia. High demand for cost-effective flavoring solutions in carbonated drinks, confectionery, bakery, dairy, and instant foods strongly supports regional growth

- Strong presence of flavor manufacturing hubs, abundant raw material availability, and expanding middle-class population fuel sustained demand for synthetic fruit flavors

- Rising investments in food processing infrastructure, private-label brands, and export-oriented production further reinforce Asia-Pacific’s leadership

China Synthetic Fruit Flavor Market Insight

China is the largest contributor in Asia-Pacific, supported by massive food processing capacity, strong beverage manufacturing output, and rising demand for flavored snacks and ready-to-drink products. Cost efficiency, formulation consistency, and scalability make synthetic fruit flavors essential across domestic and export-oriented food production.

India Synthetic Fruit Flavor Market Insight

India shows strong growth driven by rapid expansion of packaged foods, flavored dairy, beverages, and confectionery. Rising urban consumption, growth of organized retail, and increasing demand for affordable flavor solutions accelerate market adoption.

Japan Synthetic Fruit Flavor Market Insight

Japan contributes steadily due to mature food manufacturing standards, high-quality flavor formulations, and strong demand for consistent taste profiles in beverages, bakery, and confectionery products.

North America Synthetic Fruit Flavor Market

North America is projected to register the fastest CAGR of 9.24% from 2026 to 2033, driven by rising demand for functional foods, flavored beverages, nutraceuticals, and sugar-reduced products. Increasing reformulation activities to balance cost, taste consistency, and shelf stability are boosting adoption of synthetic fruit flavors. Strong presence of global flavor manufacturers, advanced R&D capabilities, and innovation in beverage and confectionery segments support accelerated growth

U.S. Synthetic Fruit Flavor Market Insight

The U.S. leads North America due to high consumption of flavored beverages, energy drinks, confectionery, and functional foods. Synthetic fruit flavors are widely used to ensure taste uniformity, cost optimization, and formulation stability across mass-market food products.

Canada Synthetic Fruit Flavor Market Insight

Canada contributes through growing demand for packaged foods, flavored dairy, and bakery products. Increasing private-label food production and emphasis on scalable flavor solutions support steady market expansion.

Which are the Top Companies in Synthetic Fruit Flavor Market?

The synthetic fruit flavor industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- ADM (U.S.)

- Givaudan (Switzerland)

- Kerry Group (Ireland)

- International Flavors & Fragrances, Inc. (U.S.)

- Firmenich SA (Switzerland)

- Symrise (Germany)

- MANE (France)

- Taiyo International (U.S.)

- T. Hasegawa Inc. (Japan)

- Synergy Flavors (U.S.)

- Sensient Technologies Corporation (U.S.)

- Bell Flavors & Fragrances (U.S.)

- Flavorchem (U.S.)

- Takasago International Corporation (Japan)

- Keva Flavours Pvt Ltd (India)

- Huabao International Holdings Limited (China)

- Tate & Lyle (U.K.)

- Robertet (France)

- McCormick & Company, Inc. (U.S.)

- Wanxiang International Ltd (China)

- TREATT (U.K.)

- China Flavors & Fragrances Co. Ltd. (China)

- Lucta (Spain)

- Solvay (Belgium)

What are the Recent Developments in Global Synthetic Fruit Flavor Market?

- In May 2025, McCormick & Company introduced Aji Amarillo as its Flavour of the Year, emphasizing the pepper’s fruity and tropical taste profile with moderate heat, reflecting the company’s focus on global taste exploration and evolving consumer preferences, thereby reinforcing its leadership in flavor innovation

- In September 2024, The Hershey Company announced the launch of Kit Kat Vanilla, featuring crisp wafers coated in vanilla-flavored crème and offered in standard and king sizes across nationwide retail channels, strengthening brand diversification and expanding consumer choice

- In April 2024, Glanbia PLC expanded its better nutrition platforms by acquiring Flavor Producers LLC from Aroma Holding Co., LLC for an initial USD 300 million plus deferred consideration, enhancing its flavor solutions portfolio and growth potential

- In September 2023, ADM completed the acquisition of Ziegler Group’s natural citrus flavor business, broadening its capabilities in natural citrus flavors, extracts, and essential oils, supporting portfolio expansion and value-added ingredient offerings

- In June 2022, Givaudan announced the opening of a new innovation center in Switzerland focused on R&D of natural ingredients for food, beverage, and beauty applications, strengthening its innovation ecosystem and sustainability-driven development efforts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Synthetic Fruit Flavor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Synthetic Fruit Flavor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Synthetic Fruit Flavor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.