Global Synthetic Pesticide Inert Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

6.52 Billion

USD

10.48 Billion

2025

2033

USD

6.52 Billion

USD

10.48 Billion

2025

2033

| 2026 –2033 | |

| USD 6.52 Billion | |

| USD 10.48 Billion | |

|

|

|

|

Synthetic Pesticide Inert Ingredients Market Size

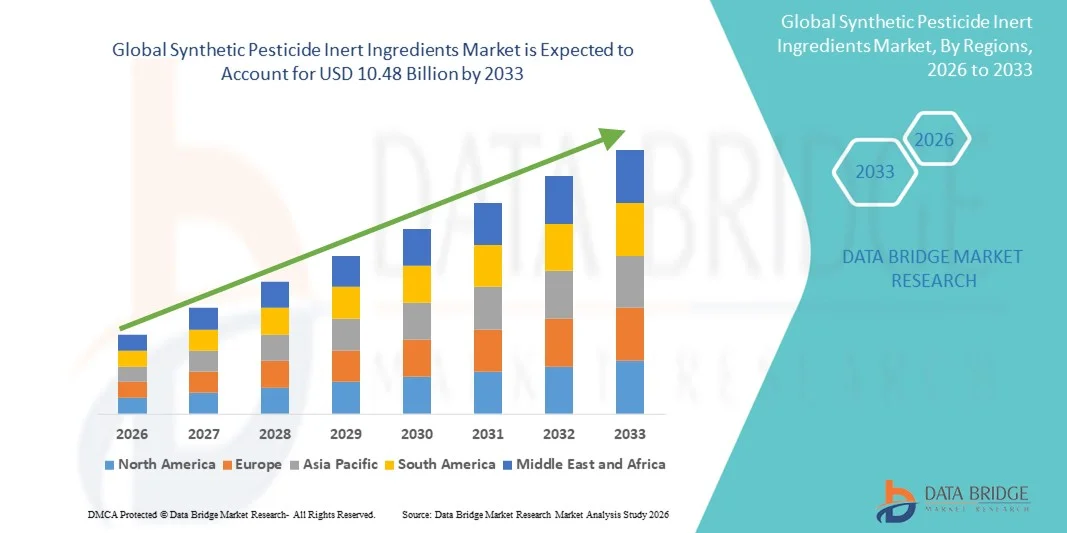

- The global synthetic pesticide inert ingredients market size was valued at USD 6.52 billion in 2025 and is expected to reach USD 10.48 billion by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by the increasing adoption of advanced crop protection formulations that require stabilisers, carriers, surfactants, and adjuvants to enhance pesticide efficiency

- Rising global food demand and the expansion of modern agricultural practices such as precision farming are further boosting the use of inert ingredients

Synthetic Pesticide Inert Ingredients Market Analysis

- Growing emphasis on improving pesticide delivery, spreadability, and adherence is driving the demand for high-performance inert ingredients across herbicides, insecticides, and fungicides

- Manufacturers are increasingly focusing on developing formulation-friendly inert components that improve bioavailability and reduce the overall environmental load, supporting the shift toward more efficient crop protection solutions

- North America dominated the synthetic pesticide inert ingredients market with the largest revenue share in 2025, driven by the widespread adoption of advanced crop protection products and strong demand for high-performance formulations across large-scale farming operations

- Asia-Pacific region is expected to witness the highest growth rate in the global synthetic pesticide inert ingredients market, driven by rising food demand, expanding farming activities, and growing adoption of modern pesticide formulations

- The emulsifiers segment held the largest market revenue share in 2025 driven by their essential role in improving the mixing and dispersion of active ingredients, ensuring consistent spray quality and enhanced field performance. Emulsifiers are widely used across major pesticide formulation types due to their ability to stabilize mixtures and support efficient delivery.

Report Scope and Synthetic Pesticide Inert Ingredients Market Segmentation

|

Attributes |

Synthetic Pesticide Inert Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Synthetic Pesticide Inert Ingredients Market Trends

Rise Of Advanced Formulation Technologies In Crop Protection

- The growing adoption of advanced pesticide formulation technologies is reshaping the synthetic inert ingredients landscape by improving product stability, spreadability, and overall field performance. Modern inert components such as surfactants, carriers, emulsifiers, and stabilisers enable precise delivery of active ingredients, resulting in enhanced efficacy and reduced application frequency. This trend is strongly supported by large-scale farms that rely on consistent and efficient crop protection outcomes

- The increasing demand for high-performance formulations in regions with diverse climatic conditions is accelerating the use of inert ingredients that improve solubility and resistance to degradation. These solutions are especially beneficial where extreme temperatures or humidity variations can affect pesticide effectiveness, allowing farmers to maintain reliable crop protection throughout the season

- The ease of incorporating new inert compounds into existing formulations is encouraging manufacturers to launch next-generation pesticide products. This supports frequent product upgrades without requiring major changes in active ingredient chemistry, helping companies remain competitive while meeting evolving regulatory requirements

- For instance, in 2023, several agrochemical companies introduced enhanced emulsifiable concentrate (EC) and suspension concentrate (SC) formulations using advanced inert carriers that improved shelf stability and spray uniformity. These innovations contributed to better application efficiency and reduced wastage, particularly in large-area cereal and vegetable cultivation

- While advanced formulation technologies are strengthening crop protection outcomes, sustained growth depends on continued R&D investment, compatibility testing, and scalable production. Manufacturers must prioritize cost-effective and regulation-friendly inert solutions to fully leverage this expanding demand

Synthetic Pesticide Inert Ingredients Market Dynamics

Driver

Growing Demand For High-Efficiency Pesticide Delivery Systems

- The increasing pressure to improve crop yields amid rising pest resistance is pushing farmers and agrochemical companies to adopt more efficient pesticide delivery systems. Inert ingredients play a critical role by enhancing adhesion, dispersion, and penetration of active ingredients, ensuring higher effectiveness even at lower application rates. This has significantly boosted demand for specialized inert components

- Farmers are increasingly aware of the economic benefits associated with improved pesticide performance, including reduced reapplication cycles, lower chemical wastage, and better protection across critical growth stages. This awareness is driving consistent use of advanced formulations that rely on sophisticated inert ingredient blends

- Regulatory bodies and agricultural extension agencies are encouraging the shift toward formulations that minimize environmental impact while improving biological performance. Structured guidelines and certification programs are promoting the adoption of inert-enhanced formulations that adhere to safety and efficiency standards

- For instance, in 2022, multiple countries in Asia and South America issued new guidelines supporting the use of enhanced formulation additives to improve pesticide delivery efficiency, leading to increased demand for surfactants, adjuvants, and stabilisers within local manufacturing

- While demand is accelerating, ongoing innovation, compliance with international regulations, and accessibility of advanced inert components remain essential for continued market expansion

Restraint/Challenge

Regulatory Complexity And High Cost Of Developing Advanced Inert Ingredients

- The complex regulatory environment surrounding agrochemical formulations is a major challenge for inert ingredient development. Many inert components must undergo extensive safety evaluations and environmental impact assessments, increasing development timelines and raising costs. This discourages smaller companies from entering the market and limits the pace of innovation

- The high cost associated with producing high-purity or specialized inert ingredients reduces accessibility for small and mid-sized pesticide manufacturers. These companies often rely on conventional formulations due to budget constraints, slowing the adoption of advanced inert technologies across emerging markets

- Supply chain disruptions and limited availability of high-quality raw materials further restrict market penetration, especially in regions with underdeveloped chemical manufacturing infrastructure. This leads to inconsistencies in formulation quality and reduces the performance reliability of end-use pesticide products

- For instance, in 2023, several agrochemical associations across Africa and Southeast Asia reported that over half of local formulators faced difficulty sourcing compliant inert additives due to cost constraints and import delays, hindering production efficiency

- While regulatory oversight ensures safety and environmental compliance, reducing complexity, promoting regional manufacturing, and enabling cost-effective R&D pathways are crucial to overcoming accessibility barriers and supporting long-term market growth

Synthetic Pesticide Inert Ingredients Market Scope

The market is segmented on the basis of type, form, and pesticide type

- By Type

On the basis of type, the synthetic pesticide inert ingredients market is segmented into emulsifiers, solvents, carriers, and others. The emulsifiers segment held the largest market revenue share in 2025 driven by their essential role in improving the mixing and dispersion of active ingredients, ensuring consistent spray quality and enhanced field performance. Emulsifiers are widely used across major pesticide formulation types due to their ability to stabilize mixtures and support efficient delivery.

The solvents segment is expected to witness the fastest growth rate from 2026 to 2033, supported by rising demand for high-purity and formulation-friendly solvent systems that improve solubility and product stability. Solvents remain critical for enabling uniform distribution of actives, making them highly preferred in advanced liquid pesticide formulations.

- By Form

On the basis of form, the synthetic pesticide inert ingredients market is segmented into dry, liquid, and others. The liquid segment held the largest market revenue share in 2025 driven by its compatibility with modern pesticide formulations such as EC, SC, and SL, which require liquid inert components for optimum stability and spreadability. Liquid inerts are commonly used due to their ease of handling and seamless integration into manufacturing processes.

The dry segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by increasing adoption of granular and powder formulations that utilize dry carriers, dispersants, and stabilisers. Dry inerts are preferred for their longer shelf life, reduced storage concerns, and suitability for controlled-release formulations.

- By Pesticide Type

On the basis of pesticide type, the synthetic pesticide inert ingredients market is segmented into insecticides, herbicides, fungicides, rodenticides, and others. The herbicides segment held the largest market revenue share in 2025 driven by the extensive use of herbicide formulations in large-scale crop production, requiring a wide range of inert ingredients to enhance spray uniformity and target weed control efficiency. Herbicides rely heavily on surfactants, solvents, and carriers for optimal field performance.

The insecticides segment is expected to witness the fastest growth rate from 2026 to 2033, supported by the rising need for efficient vector and pest control solutions across horticulture and cereal crops. Inert ingredients play a crucial role in improving penetration, adhesion, and dispersion of insecticidal actives, driving their adoption within advanced insecticide formulations.

Synthetic Pesticide Inert Ingredients Market Regional Analysis

- North America dominated the synthetic pesticide inert ingredients market with the largest revenue share in 2025, driven by the widespread adoption of advanced crop protection products and strong demand for high-performance formulations across large-scale farming operations

- Farmers in the region place strong emphasis on improved pesticide stability, enhanced spreadability, and formulation efficiency, leading to high usage of emulsifiers, surfactants, carriers, and solvent systems

- This widespread adoption is further supported by a well-established agrochemical industry, extensive R&D capabilities, and strong regulatory focus on optimized formulations, positioning inert ingredients as essential components in both conventional and modern pesticide applications

U.S. Synthetic Pesticide Inert Ingredients Market Insight

The U.S. synthetic pesticide inert ingredients market captured the largest revenue share in 2025 within North America, driven by the rapid adoption of advanced agricultural technologies and the expanding use of value-added pesticide formulations. Farmers and manufacturers are increasingly prioritizing inert components that improve delivery efficiency, enhance bioavailability, and support targeted application. The integration of innovative formulation technologies, combined with strong demand for high-quality crop protection solutions, continues to propel market growth in the country.

Europe Synthetic Pesticide Inert Ingredients Market Insight

The Europe synthetic pesticide inert ingredients market is expected to witness the fastest growth rate from 2026 to 2033, largely driven by stringent regulatory standards and growing emphasis on environmentally compliant formulations. The region’s shift toward efficient and sustainable crop protection products is encouraging manufacturers to adopt advanced inert ingredients that enhance performance while meeting regulatory requirements. Rising adoption across cereals, oilseeds, and horticultural applications is further supporting the region’s market expansion

U.K. Synthetic Pesticide Inert Ingredients Market Insight

The U.K. synthetic pesticide inert ingredients market is expected to witness the fastest growth rate from 2026 to 2033, supported by increasing focus on high-efficiency pesticide formulations and heightened awareness of environmental and agricultural safety standards. The growing need to optimize pesticide application, improve stability, and reduce wastage is encouraging both manufacturers and farmers to incorporate advanced inert components in a wide range of crop protection products.

Germany Synthetic Pesticide Inert Ingredients Market Insight

The Germany synthetic pesticide inert ingredients market is expected to witness the fastest growth rate from 2026 to 2033, fuelled by strong emphasis on precision agriculture, technological advancements, and demand for eco-conscious formulation components. Germany’s well-developed agricultural infrastructure, combined with its commitment to innovation, supports the adoption of high-quality inert ingredients that improve formulation stability and field performance. Increasing integration with modern application technologies continues to strengthen market prospects.

Asia-Pacific Synthetic Pesticide Inert Ingredients Market Insight

The Asia-Pacific synthetic pesticide inert ingredients market is expected to witness the fastest growth rate from 2026 to 2033, driven by expanding agricultural activities, rising population-driven food demand, and increased use of modern pesticides in countries such as China, India, and Japan. Government initiatives promoting agricultural modernization and the region’s emergence as a manufacturing hub for agrochemicals are further contributing to the rapid adoption of inert ingredients across diverse crop systems.

Japan Synthetic Pesticide Inert Ingredients Market Insight

The Japan synthetic pesticide inert ingredients market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s focus on high-precision crop protection, technological innovation, and demand for efficient, high-performance formulations. Japan’s agricultural sector emphasizes product quality and application accuracy, driving the adoption of inert components that improve solubility, stability, and delivery efficiency. Increasing integration of modern formulation technologies is further accelerating market growth.

China Synthetic Pesticide Inert Ingredients Market Insight

The China synthetic pesticide inert ingredients market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by rapid agricultural expansion, strong domestic agrochemical manufacturing, and widespread use of formulated pesticides across major crop groups. China’s push toward modern farming practices, combined with its ability to produce cost-effective inert ingredients and formulation additives, is significantly strengthening market adoption. The increasing focus on yield improvement and pest resistance management continues to drive demand across the region.

Synthetic Pesticide Inert Ingredients Market Share

The Synthetic Pesticide Inert Ingredients industry is primarily led by well-established companies, including:

• BASF SE (Germany)

• Dow (U.S.)

• Clariant (Switzerland)

• Croda International Plc (U.K.)

• DuPont (U.S.)

• Eastman Chemical Company (U.S.)

• Huntsman International LLC (U.S.)

• LyondellBasell Industries Holdings B.V. (Netherlands)

• Solvay (Belgium)

• Stepan Company (U.S.)

• Evonik Industries (Germany)

• Akzo Nobel N.V. (Netherlands)

• Royal Dutch Shell (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.