Global Synthetic Suede Market

Market Size in USD Billion

CAGR :

%

USD

2.96 Billion

USD

4.73 Billion

2025

2033

USD

2.96 Billion

USD

4.73 Billion

2025

2033

| 2026 –2033 | |

| USD 2.96 Billion | |

| USD 4.73 Billion | |

|

|

|

|

Synthetic Suede Market Size

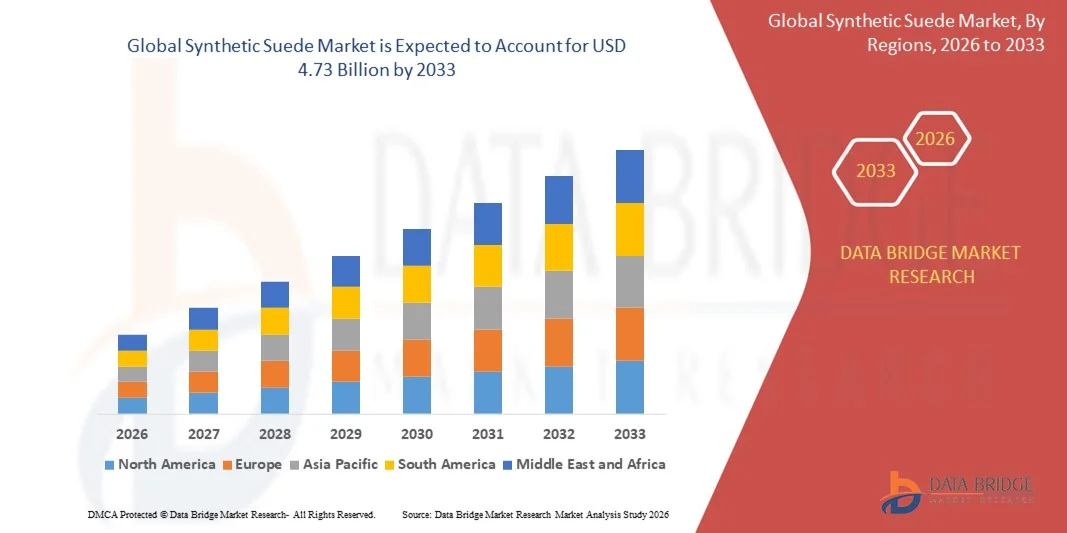

- The global synthetic suede market size was valued at USD 2.96 billion in 2025 and is expected to reach USD 4.73 billion by 2033, at a CAGR of 6.0% during the forecast period

- The market growth is largely driven by the rising demand for high-quality, animal-free materials across fashion, automotive, and upholstery applications, as manufacturers shift toward sustainable and cruelty-free alternatives to natural suede. In addition, continuous advancements in microfiber technologies and improved finishing processes are elevating the performance, durability, and aesthetic appeal of synthetic suede, reinforcing its acceptance across multiple end-use industries

- Furthermore, the increasing preference for premium yet eco-aligned materials among consumers is positioning synthetic suede as a desirable option for brands seeking to balance luxury and sustainability. These converging factors are accelerating product development and adoption, thereby supporting strong market expansion

Synthetic Suede Market Analysis

- Synthetic suede, engineered through advanced microfiber constructions, is emerging as a preferred material across footwear, apparel, automotive interiors, and home furnishings due to its softness, abrasion resistance, and visual resemblance to natural suede. Its ability to provide consistent quality, stain resistance, and design flexibility makes it a competitive alternative across high-volume applications

- The increasing adoption of synthetic suede is primarily fueled by sustainability-driven product shifts in the fashion and automotive sectors, growing awareness of animal-welfare concerns, and rising demand for durable performance materials across global manufacturing. This expanding use case landscape continues to enhance the market’s overall growth trajectory

- Asia-Pacific dominated the synthetic suede market with a share of 47.28% in 2025, due to expanding apparel manufacturing, rising demand for premium vegan materials, and strong presence of large-scale textile production hubs

- North America is expected to be the fastest growing region in the synthetic suede market during the forecast period due to rising demand for sustainable, durable, and premium-quality materials across automotive, footwear, and furniture industries

- Single leather segment dominated the market with a market share of 58.9% in 2025, due to its extensive use across footwear, apparel, and accessory manufacturing. Manufacturers prefer single leather synthetic suede because it offers a soft texture, lightweight structure, and high breathability suitable for mass-produced consumer goods. Its lower production cost combined with high abrasion resistance strengthens its adoption among fashion brands aiming for premium aesthetics without premium pricing. Rising demand for sustainable and animal-free materials further supports the dominance of single leather in global markets, especially across Asia-Pacific’s thriving apparel hubs

Report Scope and Synthetic Suede Market Segmentation

|

Attributes |

Synthetic Suede Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Synthetic Suede Market Trends

Growing Adoption of Eco-Friendly and Bio-Based Synthetic Suede

- The synthetic suede market is rapidly evolving with a strong trend toward eco-friendly and bio-based materials. Consumers and manufacturers alike are increasingly prioritizing sustainable and animal-friendly alternatives, driving innovation in recycled polyester, bio-based polyurethanes, and closed-loop manufacturing processes. This evolution enables synthetic suede to offer a luxurious handfeel similar to natural suede while reducing environmental impact through the use of renewable raw materials and recyclable fibers

- For instance, Toray Industries and Mitsubishi Chemical Holdings have introduced bio-based synthetic suede products for automotive interiors and fashion applications. Their development combines durable, stain-resistant surfaces with sustainable polymer blends, aligning with rising global regulations and consumer demand for responsible material sourcing

- Advancements in non-woven and woven fabric technologies allow customization of texture, thickness, and color, improving performance and versatility. Incorporation of digital printing and computerized tufting facilitates intricate and multi-hued designs that appeal to premium fashion and automotive markets, thereby broadening product reach

- The market growth is also supported by global efforts to reduce animal leather consumption and environmental pollution associated with PVC and traditional synthetic materials. Government initiatives backing sustainable fashion and innovative R&D efforts further stimulate awareness and market penetration

- In addition, regional manufacturing hubs in Asia-Pacific, Europe, and North America are optimizing supply chains by partnering with local polymer suppliers to mitigate tariff impacts and improve turnaround times. E-commerce and omnichannel retail models enhance consumer access and foster customization trends in home textiles, footwear, and upholstery

- This surge in sustainable innovation and consumer awareness signals a transformational phase for synthetic suede, positioning it as a key material across luxury segments seeking to balance aesthetics, environmental responsibility, and product performance

Synthetic Suede Market Dynamics

Driver

Rising Demand from Fashion and Automotive Interiors

- Increasing demand for synthetic suede across fashion and automotive interiors is a primary growth driver supporting market expansion. The material’s lightweight, durable, and easy-care properties make it an attractive alternative to natural suede, especially as consumers favor cruelty-free and sustainable products in apparel, footwear, and vehicle interiors

- For instance, automotive OEMs such as BMW and Toyota are integrating synthetic suede in seat covers, door panels, and headliners to improve cabin aesthetics while meeting sustainability targets. Leading fashion brands are adopting synthetic suede for garments and accessories to capitalize on ethical consumer trends and premium textural appeal

- The versatility of synthetic suede enables diverse applications beyond fashion and automotive, including upholstery, sports equipment, and home décor. Its high heat retention, low stretchability, and resistance to stains and wear contribute to increased product lifespan and customer satisfaction

- As luxury and mid-tier brands enhance their product portfolios with eco-conscious materials, synthetic suede demand in these sectors is expected to grow consistently

- The rising popularity of premium, shared mobility services and lifestyle-oriented automotive designs accentuates product uptake

Restraint/Challenge

High Production Costs Associated with Advanced Manufacturing Processes

- High production costs related to advanced manufacturing technologies present a key challenge for the synthetic suede market. Producing bio-based and recycled variants requires sophisticated blending, coating, and finishing techniques involving specialized equipment and process controls, which elevate capital and operational expenditures

- For instance, companies such as Toray and DSM incur significant R&D and processing expenses to maintain product consistency, quality, and functionality while meeting stringent environmental standards. These costs often translate into higher retail prices, limiting accessibility in cost-sensitive markets

- Material sourcing complexities—including availability and price fluctuations for bio-based polymers—and the need for waste management and process optimization add to production challenges. Lengthy certification and compliance processes further delay market entry and add overhead costs

- The competitive landscape also poses pressure to innovate cost-effectively without compromising product aesthetics and durability. Scaling advanced manufacturing to meet growing demand while controlling expenses remains a critical hurdle

- Addressing these challenges will require continued investment in process automation, raw material diversification, and strategic partnerships. Expanding infrastructure for closed-loop recycling and scaling bio-based polymer production are essential to reduce costs and accelerate market adoption of eco-friendly synthetic suede

Synthetic Suede Market Scope

The market is segmented on the basis of type, product, and application.

- By Type

On the basis of type, the synthetic suede market is segmented into single leather and double-sided leather. The single leather segment dominated the market with the largest revenue share of 58.9% in 2025 due to its extensive use across footwear, apparel, and accessory manufacturing. Manufacturers prefer single leather synthetic suede because it offers a soft texture, lightweight structure, and high breathability suitable for mass-produced consumer goods. Its lower production cost combined with high abrasion resistance strengthens its adoption among fashion brands aiming for premium aesthetics without premium pricing. Rising demand for sustainable and animal-free materials further supports the dominance of single leather in global markets, especially across Asia-Pacific’s thriving apparel hubs.

The double-sided leather segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by expanding use in luxury products, automotive interiors, and high-end furniture upholstery. Double-sided synthetic suede provides enhanced durability and a premium feel on both sides, making it suitable for products requiring reversible surfaces or higher tactile performance. Its ability to mimic natural suede more closely supports adoption in premium handbag lines and designer footwear collections. Increasing R&D investments toward developing double-sided variants with improved water repellence and colorfastness further accelerate segment growth. Automakers and furniture manufacturers adopting upscale material finishes add strong traction to this segment’s expansion outlook.

- By Product

On the basis of product, the synthetic suede market is segmented into warp synthetic suede and weft synthetic suede. The warp synthetic suede segment dominated the market in 2025 owing to its superior structural stability, high tensile strength, and suitability for demanding industrial applications. Warp-knitted synthetic suede delivers consistent thickness and uniform surface quality, making it ideal for high-usage areas such as car seats, industrial gloves, and performance footwear. Manufacturers favor warp products for their enhanced durability and low pilling behavior, ensuring longer product lifespans in heavy-duty environments. The segment benefits from large-scale adoption across automotive OEMs and furniture producers seeking durable, vegan alternatives to natural suede.

The weft synthetic suede segment is expected to grow at the fastest rate from 2026 to 2033 due to increasing use in fashion garments, accessories, and soft-touch consumer applications. Weft-knitted suede offers superior stretchability and drape, making it suitable for apparel designers aiming for smooth fabric flow and enhanced comfort. Its ability to support vibrant color penetration and artistic fabric finishes drives strong uptake in apparel manufacturing hubs. Growing consumer demand for comfortable and lightweight fabric textures further supports the rise of weft suede across premium clothing and lifestyle segments. Technological advancements enabling finer fibers and softer textures also strengthen its growth trajectory.

- By Application

On the basis of application, the synthetic suede market is segmented into fashion industrial, consumer electronics, furniture, and automobile. The fashion industrial segment dominated the market with the highest revenue share in 2025 due to strong global demand for jackets, handbags, footwear, and accessories made from sustainable non-animal materials. Synthetic suede’s premium appearance, combined with its affordability and customizable colors, makes it a preferred choice across international fashion houses. The segment benefits from seasonal fashion cycles, rapid trend adoption, and expansion of fast fashion brands adopting eco-friendly materials. Increased focus on cruelty-free fashion and regulatory pressures on natural leather production further support this segment’s leadership position.

The automobile segment is projected to witness the fastest growth rate from 2026 to 2033, driven by rising adoption of soft-touch interior materials in vehicles. Automakers increasingly incorporate synthetic suede into car seats, door trims, dashboards, and steering wheels to elevate cabin aesthetics and comfort. Growing demand for luxury and electric vehicles accelerates the need for premium, lightweight, and easy-to-maintain material solutions. Synthetic suede’s resistance to UV degradation and its ability to retain texture over long usage periods enhance its suitability for automotive interiors. The shift toward sustainable and vegan interior components across leading OEMs significantly fuels this segment’s rapid expansion.

Synthetic Suede Market Regional Analysis

- Asia-Pacific dominated the synthetic suede market with the largest revenue share of 47.28% in 2025, driven by expanding apparel manufacturing, rising demand for premium vegan materials, and strong presence of large-scale textile production hubs

- The region’s cost-effective manufacturing environment, increasing investments in advanced fabric technologies, and growing exports of synthetic leather substitutes are accelerating market expansion

- Availability of skilled labor, supportive government initiatives for textile industry growth, and rapid industrialization across developing economies are contributing to increased consumption of synthetic suede in fashion, automotive, and furniture applications

China Synthetic Suede Market Insight

China held the largest share in the Asia-Pacific synthetic suede market in 2025, supported by its dominance in textile and apparel manufacturing along with large-scale production capabilities for microfiber-based materials. Strong supply chain networks, rising investments in eco-friendly fabric technologies, and an extensive export base for footwear, garments, and accessories reinforce China’s lead. Growing adoption of synthetic suede in automotive interiors and furniture upholstery further strengthens market growth.

India Synthetic Suede Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by rapid expansion of the fashion and apparel sector, increasing domestic production of vegan leather materials, and investments in modern textile infrastructure. Government policies encouraging textile modernization and rising demand from footwear and automotive accessory manufacturers are supporting market acceleration. Expanding export activity in ready-made garments and growing focus on sustainable materials are contributing to India’s strong growth trajectory.

Europe Synthetic Suede Market Insight

The Europe synthetic suede market is expanding steadily, supported by increasing demand for high-quality microfiber fabrics, rising adoption of sustainable materials, and strong presence of premium automotive and furniture manufacturers. The region prioritizes stringent quality standards, environmental compliance, and advanced material engineering, particularly across Germany, Italy, and France. Growing use of synthetic suede in luxury goods, custom upholstery, and performance footwear is further enhancing market expansion.

Germany Synthetic Suede Market Insight

Germany’s synthetic suede market is driven by its advanced automotive manufacturing ecosystem, strong heritage in engineered materials, and emphasis on precision-based textile technologies. Well-established R&D collaborations between industrial players and research institutions foster innovation in high-performance microfiber materials. Increasing use of synthetic suede in premium vehicle interiors, designer footwear, and customized furniture is strengthening market demand.

U.K. Synthetic Suede Market Insight

The U.K. market is supported by a mature fashion landscape, rising demand for cruelty-free materials, and increasing adoption of synthetic suede in luxury accessories and upholstery products. Efforts to strengthen textile and materials supply chains, combined with research-focused collaborations in advanced fabrics, are contributing to steady market development. The growing influence of premium fashion brands and expanding applications in interior décor continue to support the U.K.'s role in the European market.

North America Synthetic Suede Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for sustainable, durable, and premium-quality materials across automotive, footwear, and furniture industries. Increased focus on advanced manufacturing technologies, innovation in microfiber production, and growing applications in high-end consumer goods are boosting market expansion. Strengthening reshoring activities and rising partnerships between fabric producers and automotive OEMs are supporting long-term growth.

U.S. Synthetic Suede Market Insight

The U.S. accounted for the largest share in the North America market in 2025 due to its strong presence of automotive manufacturers, expanding demand for premium upholstery materials, and advanced infrastructure for engineered textiles. Focus on sustainability, high-performance materials, and innovation in vegan leather alternatives is encouraging adoption across multiple industries. Presence of leading brands and well-established distribution networks further reinforces the U.S.'s leading position in the regional market.

Synthetic Suede Market Share

The synthetic suede industry is primarily led by well-established companies, including:

- Asahi Kasei Corporation (Japan)

- TORAY INDUSTRIES, INC. (Japan)

- KURARAY CO., LTD. (Japan)

- Kolon Industries, Inc. (South Korea)

- MIKO srl (Italy)

- Nevotex AB (Sweden)

- ECOLORICA MICROFIBER SRL (Italy)

- Tapis Corp (U.S.)

- SEIREN Co., Ltd. (Japan)

- Winiw International Co., Ltd. (China)

- Velveleen (U.S.)

- The Mitchell Group (U.S.)

- Textile Innovations Ltd (U.K.)

- Daimler AG (Germany)

- Fiat Chrysler Automobiles (U.S./Italy)

- Nissan Motor Corporation, Ltd. (Japan)

- Responsive Industries Ltd. (India)

- TALWAR FABRIKS (India)

- Colence Private Limited (India)

- Brentano Fabrics (U.S.)

Latest Developments in Global Synthetic Suede Market

- In April 2025, BASF showcased its low-emission Haptex technology at PU TECH 2025, introducing a synthetic leather solution engineered to deliver substantially lower greenhouse gas emissions than conventional materials. This advancement reinforces BASF’s commitment to sustainable innovation and supports the transition toward cleaner production systems in automotive and upholstery applications. The development highlights the rising industry-wide emphasis on environmentally responsible materials, strengthening the position of synthetic suede in premium interior solutions

- In March 2025, BASF expanded its sustainable materials portfolio through the introduction of its “Loop” recycled-PU range, designed to reduce dependency on virgin polyurethane within synthetic suede manufacturing. This launch underscores BASF’s focus on circular-economy practices while enhancing the availability of eco-friendly feedstocks in the market. The initiative demonstrates the growing significance of sustainable raw materials in meeting global demand for high-performance synthetic suede solutions

- In March 2025, Toray introduced Ultrasuede BX, a next-generation synthetic suede featuring around 30 percent plant-based polyester and polyurethane, representing the highest bio-content within its category. This product launch reflects Toray’s dedication to advancing environmentally conscious material alternatives without compromising on softness, texture, or durability. The development strengthens the shift toward bio-based materials, appealing to fashion, automotive, and interior manufacturers seeking sustainable premium fabrics

- In February 2025, Toray expanded production capacity for its Ultraseude™ product line across its Shiga and Gifu facilities to address increasing global demand for premium synthetic suede. This strategic expansion reinforces Toray’s market leadership and improves supply reliability for downstream sectors requiring high-end microfiber materials. The initiative supports the broader adoption of synthetic suede in luxury automotive interiors, designer goods, and performance-driven upholstery applications

- In February 2025, Xuchuan Chemical and An’an Co. established a joint innovation laboratory focused on advancing polyurethane resin technologies used in synthetic leather and suede applications. This collaboration enhances technical capabilities in material performance, cost efficiency, and next-generation product development. The initiative highlights the growing importance of R&D-focused partnerships in driving innovation within the synthetic suede market and supporting long-term competitive growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Synthetic Suede Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Synthetic Suede Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Synthetic Suede Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.