Global Synthetic Vision System Market

Market Size in USD Million

CAGR :

%

USD

281.16 Million

USD

384.79 Million

2025

2033

USD

281.16 Million

USD

384.79 Million

2025

2033

| 2026 –2033 | |

| USD 281.16 Million | |

| USD 384.79 Million | |

|

|

|

|

What is the Global Synthetic Vision System Market Size and Growth Rate?

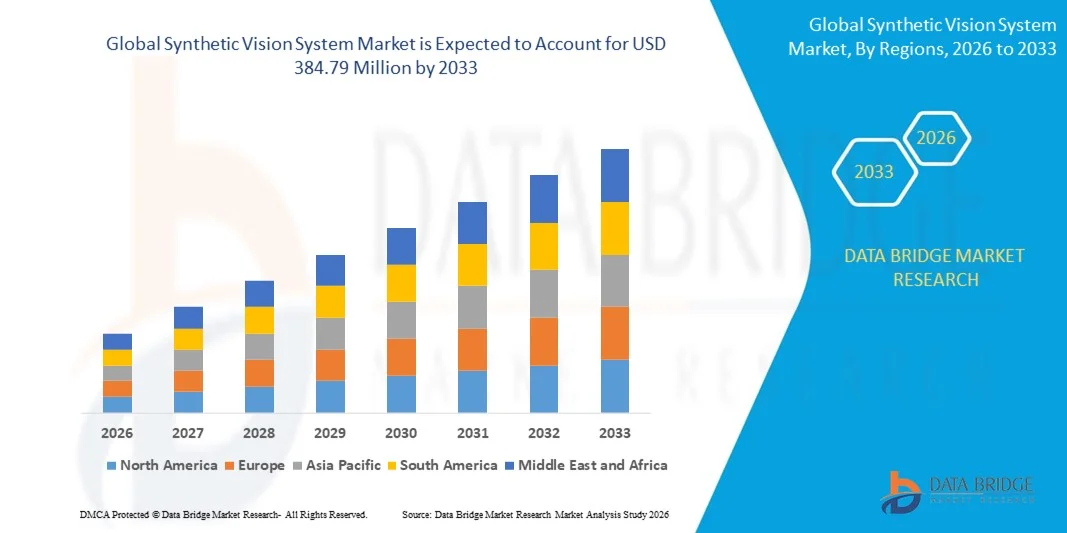

- The global synthetic vision system market size was valued at USD 281.16 million in 2025 and is expected to reach USD 384.79 million by 2033, at a CAGR of4.0% during the forecast period

- Increasing reliable operations at poor visibility, increasing requirement of enhanced aircraft safety in limited visibility environment such as in rain, fog, snow and haze, growing demand of aircrafts with advanced technological innovations, prevalence of smaller airports with inadequate infrastructure, increasing preferences of the consumer regarding safety and situational awareness are some of the major as well as vital factors which will likely to augment the growth of the synthetic vision system market

What are the Major Takeaways of Synthetic Vision System Market?

- Increasing growth of the retrofit and aftermarkets along with increasing demand of standard fit for business jets and operational efficiency for aircraft which will further contribute by generating massive opportunities that will lead to the growth of the synthetic vision system market

- Increasing cost of technology along with growing number of industry regulations which will such asly to act as market restraints factor for the growth of the synthetic vision system in the above mentioned projected timeframe. Increasing need to create awareness among the aircraft operators which will become the biggest and foremost challenge for the growth of the market

- North America dominated the synthetic vision system market with a 33.98% revenue share in 2025, driven by strong adoption of advanced avionics, 3D terrain-mapping systems, and enhanced cockpit technologies across commercial, business, and military aviation sectors in the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 6.9% from 2026 to 2033, driven by rapid aviation fleet expansion, growing commercial air traffic, and increasing investments in avionics upgrades across China, Japan, India, South Korea, and Southeast Asia

- The Displays segment dominated the market with a 41.6% share in 2025, driven by the widespread integration of high-resolution Primary Flight Displays (PFDs) and Multi-Function Displays (MFDs) in commercial, business, and general aviation aircraft

Report Scope and Synthetic Vision System Market Segmentation

|

Attributes |

Synthetic Vision System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Synthetic Vision System Market?

Increasing Shift Toward High-Speed, Compact, and PC-Based Synthetic Vision Systems

- The synthetic vision system (SVS) market is experiencing rapid adoption of compact, high-processing, and software-defined systems that enhance situational awareness, flight safety, and real-time 3D terrain visualization for both commercial and military aircraft

- Aviation manufacturers are integrating lightweight, high-bandwidth, and sensor-fusion–enabled SVS platforms that combine GPS, accelerometers, terrain databases, and advanced cockpit displays for seamless operational efficiency

- Rising demand for cost-efficient, portable, and field-deployable SVS technologies is accelerating their use across training simulators, business jets, general aviation, and next-gen avionics programs

- For instance, companies such as Honeywell, Garmin, Collins Aerospace, and Thales have introduced advanced SVS suites with 3D synthetic imagery, runway depiction systems, enhanced FOQA data, and cloud-linked analytics

- Increasing need for precise navigation, reduced pilot workload, and safer low-visibility operations is driving adoption of compact, PC-integrated SVS architectures

- As flight decks evolve toward greater automation and digitalization, SVS will remain central to improving pilot decision-making, operational safety, and next-generation cockpit transformation

What are the Key Drivers of Synthetic Vision System Market?

- Growing demand for enhanced situational awareness, reduced pilot fatigue, and improved safety during poor visibility, night operations, and complex terrain approaches is strongly driving SVS adoption across aviation segments

- For instance, in 2025, leading avionics companies such as Honeywell, Garmin, Collins Aerospace, and Avidyne advanced their SVS offerings with higher-resolution terrain databases, 3D runway mapping, and predictive hazard alerts

- Increasing aircraft deliveries, rising commercial air traffic, and expansion of business aviation and general aviation fleets across the U.S., Europe, and Asia-Pacific boost the installation of advanced cockpit visualization systems

- Advancements in sensor technology, terrain mapping algorithms, high-speed processors, and seamless integration with PFD/MFD cockpit displays are enhancing SVS accuracy and responsiveness

- Rising adoption of autonomous systems, smart avionics, and next-generation flight management systems is accelerating demand for high-performance SVS platforms

- Supported by continuous investment in aviation safety, regulatory improvements, and global avionics modernization, the Synthetic Vision System market is expected to sustain strong long-term growth

Which Factor is Challenging the Growth of the Synthetic Vision System Market?

- High costs associated with advanced avionics suites, high-resolution terrain databases, and multi-sensor fusion platforms limit adoption among smaller aircraft operators and cost-sensitive general aviation fleets

- For instance, during 2024–2025, increasing avionics component prices, specialized sensor shortages, and extended certification cycles raised integration costs for multiple global OEMs

- Complexity in integrating SVS with older cockpit displays, legacy flight decks, and mixed avionics architectures creates technical challenges and requires additional engineering expertise

- Limited awareness among smaller operators regarding SVS capabilities, safety benefits, and regulatory compliance slows adoption in emerging markets

- Competition from alternative cockpit enhancement technologies—such as Enhanced Vision Systems (EVS), HUDs, and hybrid synthetic-intelligent displays—creates pricing pressure and affects product differentiation

- To address these challenges, manufacturers are focusing on modular architectures, software-centric designs, AI-enhanced visualization tools, and more affordable SVS packages to expand global adoption

How is the Synthetic Vision System Market Segmented?

The market is segmented on the basis of component and platform.

- By Component

On the basis of component, the synthetic vision system (SVS) market is segmented into Displays, Cameras, Processing Unit, Sensors, and Control Electronics. The Displays segment dominated the market with a 41.6% share in 2025, driven by the widespread integration of high-resolution Primary Flight Displays (PFDs) and Multi-Function Displays (MFDs) in commercial, business, and general aviation aircraft. Advanced cockpit displays provide pilots with real-time 3D terrain rendering, runway visualization, and flight path guidance, making them essential for situational awareness and low-visibility operations. Improved brightness, anti-glare technology, and seamless avionics integration further reinforce their adoption across modern flight decks.

The Sensors segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising use of GPS, inertial sensors, air-data sensors, and terrain imaging technologies that enhance SVS accuracy and reliability. Increasing demand for data-rich, sensor-fusion–enabled platforms is further boosting adoption. Overall, advancements in avionics digitalization continue to elevate demand for high-performance SVS components.

- By Platform

On the basis of platform, the synthetic vision system market is segmented into Fixed Wing and Rotary Wing. The Fixed Wing segment dominated the market with a 68.9% share in 2025, driven by widespread installation of SVS across commercial aircraft, business jets, cargo aircraft, and general aviation fleets. Fixed-wing operators increasingly rely on synthetic terrain imaging, runway visualization, and hazard awareness tools to enhance operational safety during night flights, mountainous approaches, and adverse weather conditions. The growing adoption of advanced avionics suites, along with stringent aviation safety regulations, continues to expand SVS integration across global fixed-wing fleets.

The Rotary Wing segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for precision navigation, low-visibility support, and terrain avoidance systems in helicopters used for defence, emergency medical services, search-and-rescue, offshore operations, and urban mobility. The need for enhanced situational awareness in challenging flight environments is driving rapid SVS deployment in rotary-wing aircraft worldwide.

Which Region Holds the Largest Share of the Synthetic Vision System Market?

- North America dominated the synthetic vision system market with a 33.98% revenue share in 2025, driven by strong adoption of advanced avionics, 3D terrain-mapping systems, and enhanced cockpit technologies across commercial, business, and military aviation sectors in the U.S. and Canada. Growing modernization of aircraft fleets, rising demand for improved flight safety, and increasing integration of digital flight displays continue to accelerate SVS adoption across fixed-wing and rotary-wing platforms

- Leading aerospace manufacturers and avionics suppliers in North America are introducing next-generation Synthetic Vision Systems with higher-resolution graphics, improved terrain databases, real-time obstacle detection, and advanced sensor fusion capabilities, reinforcing the region’s technological strength

- Strong aerospace R&D infrastructure, regulatory support for flight safety enhancement, and rapid digital cockpit upgrades further strengthen North America’s leadership in the global market

U.S. Synthetic Vision System Market Insight

The U.S. is the largest contributor in North America, supported by extensive avionics innovation, rapid modernization of commercial aircraft, and strong defense investments in advanced cockpit technologies. Rising demand for pilot-assist systems, precision navigation, and low-visibility operational tools continues to fuel SVS integration in both fixed-wing and rotorcraft. Strong presence of major aerospace OEMs, avionics suppliers, and simulation technology firms drives continuous development of high-performance Synthetic Vision Systems across the country.

Canada Synthetic Vision System Market Insight

Canada plays a significant role in regional growth, driven by increasing fleet upgrades, rising adoption of advanced cockpit systems, and strong investments in aviation safety technologies. Growing focus on enhancing situational awareness for regional aircraft, business jets, and rotary-wing platforms supports SVS deployments. Canadian aerospace R&D programs, aviation training centers, and expanding MRO activities further boost market penetration.

Asia-Pacific Synthetic Vision System Market

Asia-Pacific is projected to register the fastest CAGR of 6.9% from 2026 to 2033, driven by rapid aviation fleet expansion, growing commercial air traffic, and increasing investments in avionics upgrades across China, Japan, India, South Korea, and Southeast Asia. Rising aircraft deliveries, expansion of regional airlines, and growing emphasis on flight safety and terrain-awareness technologies are accelerating demand for high-performance Synthetic Vision Systems. Strong growth in aerospace manufacturing, pilot training infrastructure, and digital cockpit modernization continues to strengthen regional market growth.

China Synthetic Vision System Market Insight

China is the largest contributor within Asia-Pacific, supported by massive aircraft procurement programs, expanding domestic aviation manufacturing, and strong government focus on modernizing cockpit technologies. Rising adoption of SVS for commercial jets, business aircraft, and military aviation drives widespread installations across the country.

Japan Synthetic Vision System Market Insight

Japan demonstrates steady growth driven by high-precision avionics manufacturing, modernization of defence and commercial aircraft, and strong emphasis on flight safety enhancement. Demand for reliable, high-quality Synthetic Vision Systems remains strong across fixed-wing and rotorcraft fleets.

India Synthetic Vision System Market Insight

India is emerging as a major growth hub, supported by rising aircraft fleet expansion, government-backed aviation development programs, and increasing investments in cockpit digitalization. Growing adoption of SVS in commercial aviation, pilot training, and defence aircraft strengthens market penetration.

South Korea Synthetic Vision System Market Insight

South Korea contributes significantly due to strong aerospace R&D capabilities, rapid modernization of military aircraft, and rising demand for advanced cockpit systems in both commercial and defence platforms. Increasing focus on situational awareness and precision navigation fuels Synthetic Vision System adoption across the country.

Which are the Top Companies in Synthetic Vision System Market?

The synthetic vision system industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- Collins Aerospace (U.S.)

- Thales Group (France)

- Elbit Systems Ltd. (Israel)

- Rockwell Collins, Inc. (U.S.)

- TransDigm Group, Inc. (U.S.)

- Astronics Corporation (U.S.)

- MBDA (France)

- Opgal Optronic Industries Ltd. (Israel)

- FLIR Systems, Inc. (U.S.)

- CIRRUS DESIGN CORPORATION d/b/a Cirrus Aircraft (U.S.)

- Embraer Group (Brazil)

- Bombardier (Canada)

- General Dynamics Corporation (U.S.)

- Dassault Aviation (France)

- Safran (France)

- Airbus S.A.S. (France)

- NexAir Avionics (U.S.)

- Aspen Avionics, Inc. (U.S.)

- Avidyne Corporation (U.S.)

- Cobham, plc. (U.K.)

- ForeFlight LLC (U.S.)

What are the Recent Developments in Global Synthetic Vision System Market?

- In February 2024, the joint venture Collins Elbit Vision Systems, formed by Elbit Systems, Ltd. and Collins Aerospace, revealed the delivery of the F-35 Helmet Mounted Display System (HMDS) to the Joint Strike Fighter, marking a significant advancement in fighter aircraft avionics. The F-35 Gen III HMDS provides pilots intuitive access to essential flight, tactical, and sensor information, with over 20,000 systems supplied to warfighters and 1 million flight hours accumulated across multiple aircraft platforms, reinforcing operational readiness globally

- In February 2024, Garmin launched a high-definition synthetic vision system (SVS) upgrade for business jets, enhancing terrain awareness and flight safety in low-visibility conditions, supporting safer navigation, and offering improved situational awareness for pilots across global aviation sectors

- In June 2023, Honeywell International, Inc. agreed to acquire heads-up-display (HUD) assets from Saab, intending to integrate the technology into its avionics portfolio, while collaborating with Saab to advance the HUD product line, improve situational awareness, and enhance pilot safety, strengthening Honeywell’s competitive position in avionics innovation

- In April 2020, Aspen Avionics announced price reductions on multi-display systems and prepared the Evolution Synthetic Vision standard for new installations of the MAX series of primary and multi-function displays, aiming to make advanced avionics more accessible, while supporting wider adoption of high-quality avionics solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Synthetic Vision System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Synthetic Vision System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Synthetic Vision System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.