Global System On Module Market

Market Size in USD Billion

CAGR :

%

USD

2.46 Billion

USD

6.77 Billion

2024

2032

USD

2.46 Billion

USD

6.77 Billion

2024

2032

| 2025 –2032 | |

| USD 2.46 Billion | |

| USD 6.77 Billion | |

|

|

|

|

System on Module Market Size

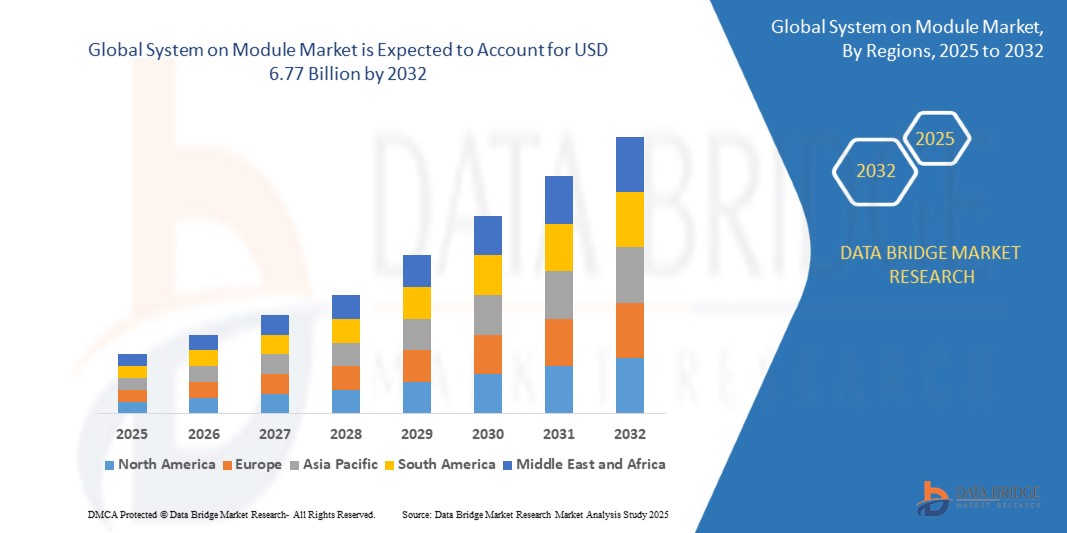

- The global system on module (SoM) market was valued at USD 2.46 billion in 2025 and is projected to reach USD 6.77 billion by 2032, growing at a robust CAGR of 15.56% during the forecast period.

- Growth is driven by increased demand for compact, high-performance embedded computing platforms in applications such as industrial automation, healthcare electronics, and autonomous systems.

System on Module Market Analysis

- A System on Module (SoM) integrates a CPU, GPU, RAM, storage, and peripherals onto a single, compact board. These plug-and-play solutions are ideal for space-constrained, performance-critical applications.

- The rise of Industry 4.0, IoT, and AI at the edge is driving adoption of SoMs across sectors like smart factories, robotics, energy management, and medical imaging.

- ARM-based SoMs are dominant due to their low power consumption, scalability, and widespread support for real-time operating systems (RTOS) and Linux distributions. x86-based SoMs continue to find use in legacy industrial and automation environments.

- Modular design and scalability across performance tiers enable SoMs to be reused across multiple product generations, significantly reducing time-to-market and development costs for OEMs and ODMs.

- Technological advancements in AI acceleration, wireless communication, and miniaturized power-efficient chipsets are further enhancing SoM capabilities for edge AI, digital signage, and wearables.

Report Scope and System on Module (SoM) Market Segmentation

|

Attributes |

System on module (SoM) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

System on Module Market Trends

AI-Ready Modular Platforms, Open Standards, and Edge-Centric Customization

- AI and GPU-Enhanced SoMs: The integration of AI accelerators, NPUs, and GPU cores into SoMs is growing, supporting real-time video analytics, object recognition, and ML inferencing at the edge.

- Rise of Open Hardware Standards: Standards like SMARC, Qseven, and COM-HPC are enabling vendor interoperability and faster development cycles for embedded applications.

- Edge-Centric SoM Deployment: There’s a growing preference for SoMs optimized for edge computing, including support for low-latency data processing, remote monitoring, and real-time control in resource-constrained environments.

- Modular AIoT Systems: SoMs are enabling scalable AIoT applications across smart agriculture, energy grids, and smart cities, combining sensor input, AI processing, and wireless communication in a compact package.

- Security and Certification Focus: SoMs are being developed with hardware-based security modules (TPMs), secure boot, and compliance with IEC/UL/ISO safety certifications, especially in medical and industrial sectors.

System on Module Market Dynamics

Driver

Accelerated Need for Scalable, Compact, and High-Performance Embedded Platforms

- SoMs allow faster product development through plug-and-play integration, reducing hardware design complexity and accelerating time-to-market for OEMs and system integrators.

- The rise of AI edge inferencing, robotics, wearable tech, and remote medical diagnostics is driving demand for modular computing systems that can scale without redesigning entire hardware systems.

- SoMs support a wide range of customization options via carrier boards, enabling vertical-specific hardware adaptations in transportation, aerospace, and automated test systems.

- Growing deployment of real-time embedded systems in smart grids, factories, and mission-critical applications benefits from SoM features like low power draw, long lifecycle support, and rugged build.

Restraint/Challenge

Integration Complexity, Cost Barriers, and Thermal Constraints in High-Performance Use Cases

- SoMs, while modular, often require custom carrier boards, which may increase initial development costs and time for startups or budget-constrained integrators.

- Thermal dissipation becomes a challenge for high-compute SoMs in compact enclosures, especially in passive cooling environments such as remote IoT nodes.

- Compatibility issues across SoM vendors and custom firmware support add to integration complexity, particularly when using real-time operating systems (RTOS) or custom Linux kernels.

- In cost-sensitive markets, the perceived premium pricing of industrial or medical-grade SoMs may hinder adoption despite long-term reliability benefits.

System on Module Market Scope

The market is segmented based on type, standard, application, and end user, reflecting the broad use of SoMs in diverse embedded system deployments.

• By Type

Includes ARM Architecture, x86 Architecture, Power Architecture, and Others. ARM-based SoMs dominate in 2025, driven by their power efficiency, cost-effectiveness, and widespread use in IoT and smart embedded devices. x86 architecture remains strong in high-performance and industrial applications.

• By Standard

Covers COM Express, Qseven, SMARC, ETX, and Others. COM Express leads in 2025 due to its performance scalability, thermal flexibility, and widespread adoption in embedded computing. SMARC and Qseven standards are gaining traction for low-power mobile and multimedia applications.

• By Application

Includes Industrial Automation, Medical, Transportation, Entertainment, Test & Measurement, Aerospace & Defense, and Others. Industrial automation dominates due to increasing use of SoMs in robot controllers, PLCs, and predictive maintenance systems. Medical electronics is the fastest-growing application with SoMs embedded in diagnostic equipment, portable imaging systems, and health monitoring devices.

• By End User

Segmented into OEMs, ODMs, and System Integrators. OEMs hold the largest share in 2025, as they integrate SoMs into a wide array of proprietary embedded products. ODMs and system integrators are also adopting SoMs for faster prototyping and deployment across verticals.

System on Module Market Regional Analysis

- North America leads the global market due to robust demand for AIoT systems, industrial robotics, and medical electronics. The U.S. is home to several early adopters across defense, healthcare, and smart infrastructure.

- Europe shows strong growth in automotive, smart energy, and aerospace sectors, especially in Germany, France, and the U.K., where SoMs are integrated into ADAS, EV platforms, and flight control systems.

- Asia-Pacific is the fastest-growing region, driven by consumer electronics, edge AI deployment, and smart manufacturing initiatives across China, India, Japan, and South Korea.

- Middle East and Africa (MEA) is witnessing increasing SoM use in industrial automation, oil & gas systems, and digital government infrastructure, particularly in UAE, Saudi Arabia, and South Africa.

- South America, especially Brazil and Argentina, is seeing growing use of SoMs in public transportation, energy monitoring, and agritech automation, supported by digitization of industrial processes.

U.S.

The U.S. leads in 2025 due to widespread use of SoMs in medical devices, defense electronics, and edge AI platforms. Local OEMs and government projects fuel demand for rugged, high-reliability SoMs.

Germany

Germany drives adoption in industrial automation, precision agriculture, and vehicle electronics, with demand for long-lifecycle, COM Express and SMARC-based modules meeting EU compliance and durability standards.

China

China is investing heavily in domestic SoM production and AI-optimized embedded platforms. Applications span robotics, telecom base stations, and smart city surveillance systems.

India

India’s embedded computing market is expanding rapidly due to smart grid projects, remote healthcare diagnostics, and education-sector computing solutions powered by ARM SoMs.

Japan

Japan utilizes SoMs in medical robotics, factory automation, and transportation, with a preference for real-time-capable and power-efficient systems supporting long-term support and quality control.

System on Module Market Share

The global system on module (SoM) market 222is primarily led by well-established companies, including:

- Kontron AG (Germany)

- Advantech Co., Ltd. (Taiwan)

- Congatec GmbH (Germany)

- Avnet, Inc. (including Avnet Embedded & MSC Technologies) (U.S.)

- AAEON Technology Inc. (Taiwan)

- SECO S.p.A. (Italy)

- Technexion Ltd. (Taiwan)

- ADLINK Technology Inc. (Taiwan)

- SolidRun Ltd. (Israel)

- Emtrion GmbH (Germany)

Latest Developments in Global System on Module Market

- In April 2025, Congatec GmbH launched a new COM-HPC Mini SoM platform designed for ultra-compact edge devices and mobile robotics, delivering up to 45W performance for AI and industrial workloads.

- In March 2025, Advantech Co., Ltd. introduced its i.MX 93-based SMARC module, targeting medical and industrial IoT applications with edge AI acceleration and enhanced security features.

- In February 2025, SECO S.p.A. unveiled its next-gen SoM portfolio based on NXP i.MX 8M Plus, focused on smart building controls and embedded vision applications in smart cities.

- In January 2025, AAEON Technology Inc. released the UP Xtreme i14, a powerful x86 SoM with Intel 14th Gen CPU support, tailored for AI-based traffic management and public safety applications.

- In December 2024, SolidRun Ltd. announced an Arm Cortex-A72 SoM with integrated neural processing unit (NPU), enabling high-performance inferencing for smart energy and agriculture edge devices.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.