Global Tablet Coatings Market

Market Size in USD Billion

CAGR :

%

USD

8.78 Billion

USD

13.57 Billion

2025

2033

USD

8.78 Billion

USD

13.57 Billion

2025

2033

| 2026 –2033 | |

| USD 8.78 Billion | |

| USD 13.57 Billion | |

|

|

|

|

Tablet Coatings Market Size

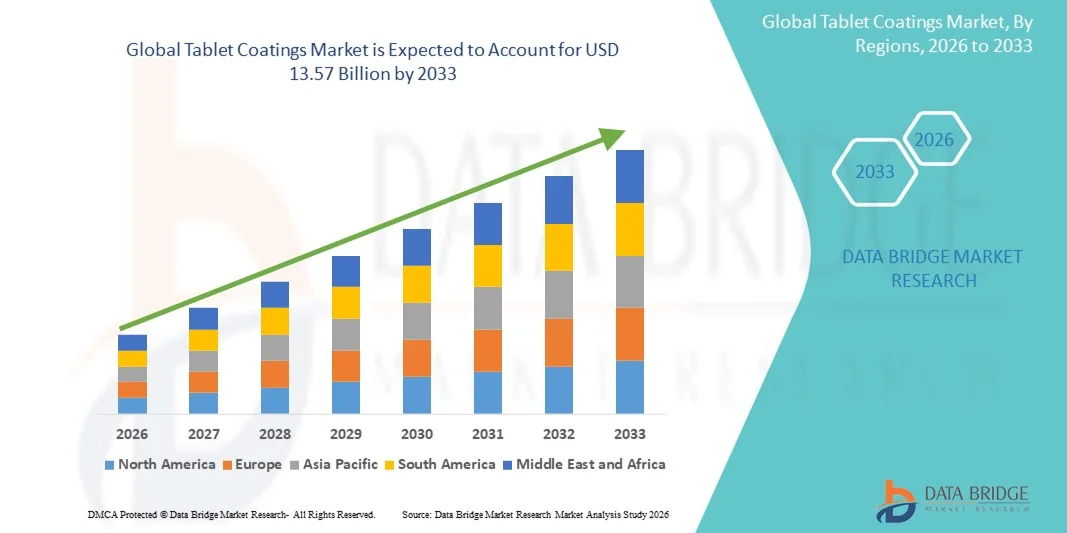

- The global tablet coatings market size was valued at USD 8.78 billion in 2025 and is expected to reach USD 13.57 billion by 2033, at a CAGR of 5.60% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within pharmaceutical formulation techniques and advanced drug delivery systems, leading to enhanced efficacy and patient compliance in both generic and branded drugs

- Furthermore, rising demand for improved drug stability, taste masking, and controlled release formulations is accelerating the uptake of Tablet Coatings solutions, thereby significantly boosting the industry's growth

Tablet Coatings Market Analysis

- Advanced pharmaceutical formulation techniques and rising demand for enhanced drug stability, taste masking, and controlled-release formulations are increasingly driving the adoption of tablet coatings in both generic and branded drugs

- The escalating demand is primarily fueled by the need for improved patient compliance, extended shelf life, and novel drug delivery systems

- North America dominated the tablet coatings market with the largest revenue share of 37% in 2025, supported by well-established pharmaceutical infrastructure, high adoption of advanced drug formulations, and a strong presence of key industry players, with the U.S. experiencing substantial growth due to increasing production of coated tablets and rising focus on patient-centric drug delivery

- Asia-Pacific is expected to be the fastest growing region in the tablet coatings market during the forecast period due to increasing pharmaceutical manufacturing capabilities, rising healthcare expenditure, and growing demand for oral solid dosage forms in countries such as China, India, and Japan

- The Immediate Release segment dominated with 52.1% revenue share in 2025, due to high demand in OTC medications, fast-acting therapies, and nutraceuticals. Immediate-release coatings allow rapid onset of action, simplify dosing regimens, and improve patient compliance

Report Scope and Tablet Coatings Market Segmentation

|

Attributes |

Tablet Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Colorcon (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Tablet Coatings Market Trends

Growing Demand Due to Enhanced Drug Stability and Patient Compliance

- The increasing prevalence of chronic diseases and the rising demand for oral medications are significant drivers for the heightened adoption of advanced tablet coatings

- For instance, in April 2025, a leading pharmaceutical company announced the launch of a novel film coating technology designed to improve the stability of sensitive active pharmaceutical ingredients (APIs) under varying environmental conditions. Such technological advancements are expected to drive Tablet Coatings industry growth in the forecast period

- Tablet coatings help mask unpleasant taste, improving patient adherence, especially for pediatric and geriatric populations. Furthermore, coated tablets enhance drug stability by protecting against moisture, light, and oxidation, ensuring consistent efficacy throughout the product’s shelf life

- The convenience of controlled-release and immediate-release formulations allows for optimized therapeutic outcomes and reduces dosing frequency. The increasing demand for targeted drug delivery, particularly for chronic and critical diseases, contributes to the growth of coated tablet formulations

- Coatings also facilitate better handling, reduce tablet friability, and improve appearance, encouraging manufacturer adoption. The rising trend of personalized medicine and modified-release oral therapies supports innovative coating technologies

- Tablet coatings are critical in reducing drug interactions in combination therapies by controlling API release profiles. Regulatory approvals and guidelines for film-coated and sugar-coated tablets reinforce product adoption

- Manufacturers are investing in advanced coating technologies that enhance solubility, bioavailability, and patient compliance. Overall, enhanced stability, patient adherence, and formulation flexibility are key factors driving Tablet Coatings market growth

Tablet Coatings Market Dynamics

Driver

Rising Demand for Enhanced Drug Stability and Patient Compliance

- A key trend in the global Tablet Coatings market is the increasing adoption of advanced coating technologies to improve drug stability, solubility, and patient adherence

- For instance, recent years have seen a surge in multi-layer and film coating techniques designed to protect sensitive active pharmaceutical ingredients (APIs) from moisture, light, and oxidation

- These coatings also mask unpleasant taste, facilitating easier administration for pediatric and geriatric populations

- Coated tablets are increasingly being used in controlled-release and modified-release formulations to optimize therapeutic outcomes

- Manufacturers are investing in personalized coating technologies that allow for targeted drug delivery, reducing side effects and enhancing efficacy

- Rising consumer awareness about medication adherence and convenience is encouraging pharmaceutical companies to innovate in coating technologies

- Tablet coatings also enhance tablet handling, reduce friability, and improve aesthetic appeal, supporting brand differentiation in competitive markets. Technological advancements in coating materials, such as water-soluble polymers and enteric coatings, are gaining traction globally

- Film-coated tablets are increasingly preferred over sugar-coated ones due to faster production times and reduced manufacturing costs. The trend toward combination therapies and multi-API formulations has further fueled demand for advanced coatings that prevent drug-drug interactions

- Regulatory encouragement for quality, stability, and patient-centric formulations is accelerating adoption of innovative coatings. Overall, the shift toward more stable, effective, and patient-friendly tablet formulations is a defining trend shaping the market landscape

Restraint/Challenge

High Manufacturing Costs and Technical Complexity

- High costs associated with advanced coating technologies pose a significant challenge to broader adoption, particularly for small-scale manufacturers

- For instance, the implementation of precision coating equipment requires substantial capital investment, which may limit access for emerging pharmaceutical companies

- Technical complexity in achieving uniform coating, controlling thickness, and ensuring consistent drug release profiles can hinder production efficiency. Variability in coating quality may lead to batch-to-batch inconsistencies, raising regulatory compliance concerns

- In addition, certain coating materials can interact with APIs, requiring extensive formulation optimization and stability testing. The relatively long processing time and additional steps in manufacturing coated tablets increase operational costs

- While technological advancements have reduced some production challenges, premium coating technologies still remain expensive compared to standard tablet manufacturing. Limited availability of specialized polymers and excipients for coating further adds to the production cost and complexity

- In developing regions, cost constraints and limited access to advanced coating equipment slow market penetration. Manufacturers must balance cost, performance, and patient compliance to remain competitive

Addressing these challenges through process optimization, efficient coating technologies, and training programs for skilled personnel is crucial for sustained market growth. Overall, high manufacturing costs and technical challenges remain key restraints, particularly for small and mid-sized pharmaceutical companies

Tablet Coatings Market Scope

The market is segmented on the basis of type, polymer type, functionality, application, and end-users.

- By Type

On the basis of type, the Tablet Coatings market is segmented into Film Coated, Sugar Coated, Enteric Coated, and Others. The Film Coated segment dominated the largest market revenue share of 45.6% in 2025, driven by its ability to improve stability, mask unpleasant taste, and enhance patient compliance. Film coatings offer superior protection against moisture, light, and oxidation, making them ideal for sensitive active pharmaceutical ingredients (APIs). They are extensively used in both prescription and over-the-counter formulations, supporting both immediate and modified-release profiles. The market also benefits from the ease of large-scale production and faster coating times associated with film coating technology. Increasing demand in pediatric and geriatric formulations, where taste-masking is essential, further boosts segment adoption. Pharmaceutical companies prefer film coatings for their flexibility in controlled-release and sustained-release applications. Multi-layered film coatings are increasingly used to deliver complex formulations, enabling precise drug release and minimizing side effects. Regulatory emphasis on quality, stability, and patient adherence is encouraging manufacturers to adopt film-coated tablets. The versatility, cost-effectiveness, and aesthetic appeal of film coatings make them a preferred choice over sugar-coated tablets in modern formulations. Overall, the segment’s combination of functional benefits and production efficiency solidifies its dominance in the market.

The Enteric Coated segment is anticipated to witness the fastest CAGR of 8.7% from 2026 to 2033, driven by its ability to protect acid-sensitive drugs from gastric degradation and target drug release in the intestines. Enteric-coated tablets are crucial for drugs like proton pump inhibitors, certain antibiotics, and enzymes that require delayed release for optimal efficacy. Increasing prevalence of gastrointestinal disorders and demand for oral delivery of sensitive biologics support growth. Pharmaceutical R&D investments in targeted delivery and modified-release therapies further enhance adoption. The segment benefits from multiparticulate systems and combination therapies for precise dosing. Enteric coatings help reduce gastric irritation and improve therapeutic outcomes, which is particularly relevant for pediatric and geriatric patients. Market growth is bolstered by the rising trend toward patient-centric drug formulations. Advances in coating materials and techniques improve reliability and scalability, attracting manufacturers. The shift toward personalized medicine, precision dosing, and chronic disease management therapies further accelerates adoption. Strong demand from pharmaceutical companies to differentiate products in crowded markets drives continued investment. Increased awareness among physicians about the benefits of enteric-coated tablets also supports growth. Overall, enteric coatings are rapidly gaining preference for specialized and high-value oral drug delivery.

- By Polymer Type

On the basis of polymer type, the market is segmented into Vinyl Derivatives, Cellulosic Polymers, Acrylic Polymers, and Others. The Cellulosic Polymers segment dominated the market with 41.9% revenue share in 2025, owing to their versatility, chemical stability, and compatibility with a wide range of APIs. Hydroxypropyl methylcellulose (HPMC) and related derivatives are extensively used in immediate and modified-release coatings. These polymers offer excellent film-forming properties, moisture protection, and high reproducibility in large-scale production. The growing emphasis on product consistency, stability, and patient adherence fuels demand. Cellulosic polymers are cost-effective, widely accepted in regulatory frameworks, and suitable for pediatric and geriatric formulations. Their ability to support taste-masking, sustained release, and enteric functionality strengthens their adoption. Manufacturers prefer these polymers for both oral solid and nutraceutical applications. Advances in polymer processing and coating equipment further enhance efficiency and quality outcomes. The segment also benefits from eco-friendly and water-based coating systems gaining traction globally.

The Acrylic Polymers segment is expected to witness the fastest CAGR of 9.1% from 2026 to 2033, driven by their excellent film-forming properties, chemical inertness, and flexibility in achieving sustained, delayed, and targeted drug release. Acrylic polymers are increasingly used in controlled-release, enteric, and taste-masked formulations, particularly in cardiovascular, CNS, and gastrointestinal therapies. Pharmaceutical manufacturers favor acrylic coatings due to their stability across a wide pH range and compatibility with moisture-sensitive APIs. Growth is also supported by the rising adoption of multi-layered and combination therapy tablets that require precise drug-release profiles. Acrylic polymers enable enhanced bioavailability, better patient compliance, and consistent therapeutic outcomes. The trend toward patient-centric dosage forms, including pediatric-friendly and geriatric tablets, fuels adoption. Advances in coating technology and automated machinery allow scalable and uniform application of acrylic coatings. Increased focus on quality assurance, regulatory compliance, and eco-friendly water-based acrylic polymers further supports growth. The segment benefits from rising R&D investments in innovative oral solid dosage forms. Pharmaceutical companies are leveraging acrylic polymers for specialty and high-value drugs. Overall, their versatility and functional advantages drive rapid market expansion.

- By Functionality

On the basis of functionality, the market is segmented into Functional Modifying Coatings, Non-Functional Non-Modifying Coatings, and Functional Non-Modifying Coatings. The Functional Modifying Coatings segment dominated with 48.3% revenue share in 2025, driven by their ability to modify drug release profiles, improve bioavailability, and enhance patient compliance. These coatings are widely used in sustained-release, delayed-release, and targeted drug delivery systems. Pharmaceutical companies increasingly invest in functional coatings to address stability and efficacy challenges. Functional coatings enable precise drug targeting, reduce side effects, and ensure consistent therapeutic outcomes. The adoption is further fueled by regulatory focus on quality, safety, and patient-centric formulations. Functional coatings also allow multi-layered delivery systems and combination therapies, supporting complex dosage forms. The segment is bolstered by rising demand in chronic diseases, nutraceutical applications, and pediatric formulations.

The Non-Functional Non-Modifying Coatings segment is expected to register the fastest CAGR of 8.5% from 2026 to 2033, driven by its role in improving tablet aesthetics, masking unpleasant taste, and providing basic moisture and light protection. These coatings are widely applied in generic drugs, over-the-counter medications, and nutraceutical products. Their low cost, simplicity, and compatibility with diverse APIs make them attractive to manufacturers. Rising demand for visually appealing tablets to enhance patient compliance supports segment growth. Increasing preference for quick-to-market formulations and cost-effective solutions in emerging markets drives adoption. Non-functional coatings are also increasingly applied in multi-dose packaging and combination therapy tablets to simplify manufacturing. The segment benefits from trends in pediatric, geriatric, and OTC medicines requiring taste masking. Manufacturers favor non-functional coatings for their speed of application, process reproducibility, and compatibility with automated coating lines. Improved formulations and eco-friendly coating solutions further accelerate growth. Overall, non-functional non-modifying coatings are rapidly gaining acceptance globally.

- By Application

On the basis of application, the market is segmented into Sustained Release, Immediate Release, and Enteric Release. The Immediate Release segment dominated with 52.1% revenue share in 2025, due to high demand in OTC medications, fast-acting therapies, and nutraceuticals. Immediate-release coatings allow rapid onset of action, simplify dosing regimens, and improve patient compliance. The segment benefits from widespread adoption in chronic disease management, dietary supplements, and generic drug formulations. Pharmaceutical companies prefer immediate-release coatings for their ease of production, cost-effectiveness, and compatibility with a variety of APIs. Increasing urbanization, healthcare access, and patient convenience further support growth. Immediate-release coatings also facilitate faster scale-up and consistent drug performance across batches.

The Sustained Release segment is expected to witness the fastest CAGR of 9.4% from 2026 to 2033, driven by increasing demand for controlled drug release, reduced dosing frequency, and improved patient adherence. Sustained-release coatings are widely adopted in cardiovascular, CNS, and diabetic therapies where consistent plasma concentration is critical. Growth is further supported by R&D investment in modified-release oral dosage forms. Advanced technologies allow combination therapy tablets with multi-layered coatings for sequential drug release. Patients and healthcare providers prefer sustained-release formulations to minimize side effects and enhance therapeutic outcomes. The rising prevalence of chronic diseases requiring long-term management boosts adoption. Nutraceutical applications, including vitamins and herbal supplements, increasingly adopt sustained-release coatings for enhanced absorption. Automation in tablet coating processes ensures uniformity, efficiency, and regulatory compliance. Demand from emerging markets for convenient, patient-friendly formulations supports segment growth. The trend toward personalized medicine and adherence-focused therapies also accelerates adoption. Sustained-release coatings provide manufacturers with differentiation and value-added products. Overall, the segment demonstrates robust growth globally.

- By End-Users

On the basis of end-users, the market is segmented into Nutraceutical Industry, Pharmaceutical Industry, and Others. The Pharmaceutical Industry segment dominated with 58.7% revenue share in 2025, driven by large-scale production of prescription and OTC drugs requiring coated tablets. Pharmaceutical companies adopt advanced coatings to enhance drug stability, efficacy, and patient compliance. The segment benefits from regulatory compliance, quality assurance, and bulk procurement practices. Increasing demand for innovative formulations in chronic disease management and emerging therapies fuels growth.

The Nutraceutical Industry segment is expected to witness the fastest CAGR of 10.2% from 2026 to 2033, fueled by rising health consciousness, demand for dietary supplements, and functional foods. Coated tablets improve taste, stability, and absorption of vitamins, minerals, and herbal ingredients. Growth is supported by the expansion of health supplement markets, increasing consumer preference for convenient dosage forms, and higher disposable incomes in emerging economies. Nutraceutical manufacturers are adopting innovative coating technologies to differentiate products and improve bioavailability. The trend toward preventive healthcare, personalized nutrition, and globally increasing awareness about immune support further boosts demand. The segment benefits from regulatory support, modern production facilities, and advancements in coating materials. Increased e-commerce penetration and direct-to-consumer channels also enhance accessibility and adoption. Patient-friendly coated nutraceutical tablets improve compliance, acceptance, and market competitiveness. Overall, the nutraceutical segment is witnessing rapid expansion globally.

Tablet Coatings Market Regional Analysis

- North America dominated the tablet coatings market with the largest revenue share of 37% in 2025

- Supported by well-established pharmaceutical infrastructure, high adoption of advanced drug formulations, and a strong presence of key industry players

- The market experienced substantial growth due to increasing production of coated tablets and rising focus on patient-centric drug delivery

U.S. Tablet Coatings Market Insight

The U.S. tablet coatings market captured the largest revenue share in 2025 within North America, fueled by increasing demand for oral solid dosage forms and adoption of advanced coating technologies. Pharmaceutical companies are investing in functional coatings to enhance drug stability, taste masking, and controlled-release profiles. Moreover, rising demand for nutraceuticals and sustained-release tablets is significantly contributing to the market's expansion.

Europe Tablet Coatings Market Insight

The Europe tablet coatings market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent regulatory standards, increasing pharmaceutical manufacturing activities, and growing focus on high-quality oral dosage forms. Countries like Germany, France, and the U.K. are witnessing strong growth in functional and enteric-coated tablets for both pharmaceutical and nutraceutical applications.

U.K. Tablet Coatings Market Insight

The U.K. tablet coatings market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising pharmaceutical production, increasing consumer demand for patient-centric formulations, and adoption of innovative coating technologies. The country’s robust regulatory framework and established healthcare industry further support market growth.

Germany Tablet Coatings Market Insight

The Germany tablet coatings market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of functional coatings, high pharmaceutical R&D investments, and a growing focus on customized oral dosage forms. Germany’s strong pharmaceutical manufacturing infrastructure promotes the adoption of innovative tablet coatings for both domestic and export markets.

Asia-Pacific Tablet Coatings Market Insight

The Asia-Pacific tablet coatings market is poised to grow at the fastest CAGR during the forecast period, driven by increasing pharmaceutical manufacturing capabilities, rising healthcare expenditure, and growing demand for oral solid dosage forms in countries such as China, India, and Japan. The region is witnessing rapid expansion in both pharmaceutical and nutraceutical industries, enhancing adoption of film-coated, sugar-coated, and enteric-coated tablets.

Japan Tablet Coatings Market Insight

The Japan tablet coatings market is gaining momentum due to advanced pharmaceutical infrastructure, growing demand for controlled-release formulations, and increasing adoption of innovative coating technologies. Rising focus on high-value oral dosage forms and nutraceuticals is further fueling growth.

China Tablet Coatings Market Insight

The China tablet coatings market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding pharmaceutical manufacturing base, rising healthcare expenditure, and increasing adoption of advanced coating technologies. Growing focus on patient-centric formulations and oral solid dosage production is significantly contributing to the market’s growth.

Tablet Coatings Market Share

The Tablet Coatings industry is primarily led by well-established companies, including:

• Colorcon (U.S.)

• Shin-Etsu Chemical Co., Ltd. (Japan)

• Evonik Industries AG (Germany)

• Merck KGaA (Germany)

• DowDuPont Inc. (U.S.)

• BASF SE (Germany)

• Astek Pharma (India)

• Signet Chemical Corporation (U.S.)

• Enaspol (Poland)

• Roquette Frères (France)

• Abbott (U.S.)

• Sigachi Industries (India)

• Palsgaard A/S (Denmark)

• Shreeji Polymers Pvt. Ltd. (India)

• Shandong Focuschem Co., Ltd. (China)

• Akzo Nobel N.V. (Netherlands)

• Solaronics Ltd. (U.K.)

• Akums Drugs & Pharmaceuticals Ltd. (India)

• FMC Corporation (U.S.)

• Jubilant Life Sciences Ltd. (India)

Latest Developments in Global Tablet Coatings Market

- In December 2024, researchers from the University of Parma published a micro–computed tomography (µCT) analysis showing that tablets coated using aqueous (water‑based) coating systems experienced up to 12% porosity increase compared to uncoated cores. The study highlighted that while aqueous coatings are more environmentally sustainable than solvent-based ones, mechanical changes in the tablet core during compression can lead to structural defects like cracking

- In March 2025, a pioneering study introduced a Digital Formulator + Self‑Driving Tableting DataFactory: an automated, AI-powered platform that optimizes tablet formulations and coatings in just hours. It combines predictive modeling with automated compression and testing, enabling rapid iteration of coating parameters for better quality and efficiency

- In April 2025, the same "Self‑Driving DataFactory" platform was presented at a major continuous manufacturing conference, signaling growing industry interest in linking formulation design with automated production to improve coating uniformity, reduce waste, and shorten development cycles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.