Global Tamarind Gum Market

Market Size in USD Million

CAGR :

%

USD

197.28 Million

USD

287.06 Million

2025

2033

USD

197.28 Million

USD

287.06 Million

2025

2033

| 2026 –2033 | |

| USD 197.28 Million | |

| USD 287.06 Million | |

|

|

|

|

Tamarind Gum Market Size

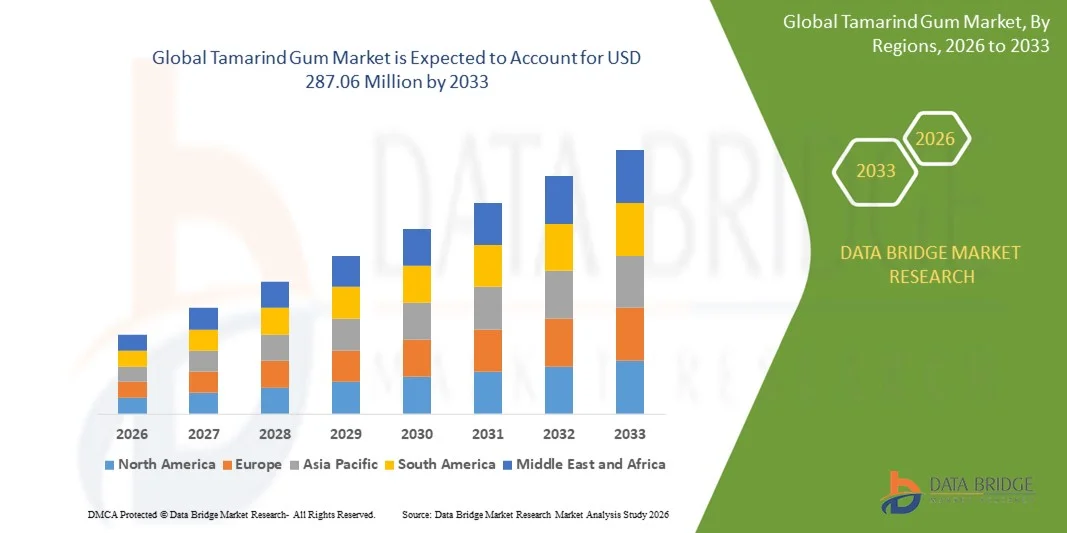

- The global tamarind gum market size was valued at USD 197.28 million in 2025 and is expected to reach USD 287.06 million by 2033, at a CAGR of 4.80% during the forecast period

- The market growth is largely fueled by the rising demand for natural, clean-label, and plant-based ingredients across food, beverage, pharmaceutical, and cosmetic industries, driving widespread adoption of tamarind gum as a multifunctional thickening, stabilizing, and emulsifying agent

- Furthermore, increasing consumer awareness regarding health, nutrition, and sustainable sourcing is encouraging manufacturers to replace synthetic additives with natural gums, establishing tamarind gum as a preferred functional ingredient in various formulations. These converging factors are accelerating adoption across multiple sectors, thereby significantly boosting market growth

Tamarind Gum Market Analysis

- Tamarind gum, a natural hydrocolloid extracted from tamarind seeds and pods, is increasingly vital for improving texture, stability, and shelf life in food, beverage, pharmaceutical, and personal care products due to its versatile functional properties and plant-based origin

- The escalating demand for tamarind gum is primarily fueled by the growing preference for clean-label and natural ingredients, rising production of processed and functional foods, expanding pharmaceutical applications as an excipient, and increasing incorporation in cosmetic and personal care formulations

- Asia-Pacific dominated the tamarind gum market with a share of over 60% in 2025, due to expanding food and pharmaceutical manufacturing, rising demand for natural and plant-based ingredients, and a strong presence of tamarind-producing countries such as India and Thailand

- North America is expected to be the fastest growing region in the tamarind gum market during the forecast period due to growing demand for natural and functional ingredients in food, beverages, pharmaceuticals, and personal care

- Conventional tamarind gum segment dominated the market with a market share of 65.8% in 2025, due to the extensive availability of raw tamarind pods and well-established supply chains in major producing countries. Food and industrial manufacturers often prefer conventional tamarind gum for its cost-effectiveness and consistent quality, making it the preferred choice for large-scale production. Its widespread adoption in multiple applications, including food, pharmaceuticals, and animal feed, reinforces its leading market position. The reliable processing methods and compatibility with existing manufacturing practices further support its dominance

Report Scope and Tamarind Gum Market Segmentation

|

Attributes |

Tamarind Gum Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tamarind Gum Market Trends

Rising Adoption of Natural and Clean-Label Ingredients

- The growing consumer preference for natural, plant-based, and clean-label ingredients is significantly driving the global tamarind gum market as manufacturers seek functional alternatives to synthetic additives for food, beverage, pharmaceutical, and cosmetic applications to meet increasing consumer awareness regarding health and sustainability

- For instance, Ingredion Incorporated has expanded its tamarind gum portfolio to cater to the rising demand for clean-label and plant-based formulations, enabling food and beverage manufacturers to develop products with natural thickeners and stabilizers, thereby improving product appeal and compliance with regulatory standards

- The increasing trend towards health-conscious and sustainable consumption patterns is encouraging companies to incorporate tamarind gum in nutraceuticals, functional foods, beverages, and personal care products to enhance product quality and meet evolving consumer expectations

- The versatility of tamarind gum in improving texture, shelf-life, and stability across diverse applications is enhancing its adoption across multiple industries, driving innovation in product formulations and process optimization, while allowing manufacturers to reduce reliance on synthetic additives

- Manufacturers are leveraging the functional properties of tamarind gum to differentiate their offerings in competitive markets, resulting in wider market penetration, stronger brand positioning, and increased consumer acceptance across various segments

- The growing focus on plant-based and sustainable ingredients, coupled with its multifunctional applications across food, pharmaceutical, and cosmetic sectors, is consolidating tamarind gum as a preferred natural hydrocolloid for industry-wide adoption, ensuring long-term growth potential and market expansion

Tamarind Gum Market Dynamics

Driver

Increasing Demand from Food, Pharmaceutical, and Cosmetic Industries

- The expanding food, pharmaceutical, and cosmetic industries are fueling demand for tamarind gum as a natural functional ingredient with stabilizing, thickening, and emulsifying properties, enabling companies to improve product performance and appeal

- For instance, Altrafine Gums has scaled up production to meet rising requirements from global food and pharmaceutical manufacturers, enhancing market availability, supporting product innovation, and ensuring steady supply to meet growing industrial demand

- Rising demand for plant-based and clean-label formulations is encouraging manufacturers to replace synthetic additives with tamarind gum, resulting in increased adoption across functional foods, beverages, nutraceuticals, and personal care products, while aligning with consumer health trends and sustainability goals

- The growth of processed food and ready-to-eat meals, coupled with the need for extended shelf-life and improved texture, is supporting higher consumption of tamarind gum in various applications, enhancing product quality and reducing dependence on artificial stabilizers

- The increasing use of tamarind gum in pharmaceutical formulations as an excipient and in cosmetic products for texture enhancement and stabilization is further driving its market adoption, establishing it as a key functional ingredient across multiple industries and boosting its commercial relevance

Restraint/Challenge

Supply Chain Constraints and Seasonal Raw Material Availability

- The reliance on tamarind pods as a raw material makes the tamarind gum market susceptible to seasonal fluctuations, climatic variations, and regional production capacities, which can impact consistent supply and pricing stability

- For instance, delays in harvesting or logistical challenges faced by companies such as Nahar Exports can lead to temporary supply shortages, affecting production schedules, delivery timelines, and overall market competitiveness

- Limited availability of high-quality raw materials may constrain production volumes for food, pharmaceutical, and cosmetic manufacturers, slowing down market expansion and impacting the introduction of new product lines

- The dependency on a few key producing countries increases vulnerability to export restrictions, crop failures, and price volatility, posing challenges for global supply chains and requiring strategic planning for procurement and inventory management

- Addressing these supply chain constraints through better sourcing strategies, improved processing technologies, and diversification of raw material procurement is essential for stabilizing production, ensuring sustained market growth, and maintaining industry resilience against unforeseen disruptions

Tamarind Gum Market Scope

The market is segmented on the basis of application, formulation type, source type, end-user, and distribution channel.

- By Application

On the basis of application, the Tamarind Gum market is segmented into food industry, pharmaceuticals, cosmetics and personal care, industrial applications, and animal feed. The food industry segment dominated the market with the largest market revenue share in 2025, driven by the widespread use of tamarind gum as a natural thickening, stabilizing, and emulsifying agent in processed foods and beverages. Food manufacturers often prefer tamarind gum for its ability to enhance texture and shelf life while meeting clean-label and natural ingredient demands. The rising consumer preference for plant-based and functional food products further fuels demand in the food sector. Manufacturers also leverage tamarind gum for sauces, jams, bakery products, and dairy alternatives, expanding its application portfolio and reinforcing its market dominance.

The pharmaceuticals segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of tamarind gum as a natural excipient, binder, and controlled-release agent in tablets and capsules. For instance, companies such as Glenmark Pharmaceuticals have incorporated tamarind gum in novel drug formulations to enhance stability and bioavailability. The growing interest in natural and safe excipients in drug delivery systems drives its rapid adoption in pharmaceutical manufacturing. Its biocompatibility, non-toxicity, and multifunctional properties further support its expansion in this sector.

- By Formulation Type

On the basis of formulation type, the Tamarind Gum market is segmented into powdered tamarind gum, liquid tamarind gum, and granulated tamarind gum. The powdered tamarind gum segment dominated the market in 2025 due to its ease of handling, versatility, and longer shelf life compared with liquid formulations. Food and pharmaceutical manufacturers often favor powdered tamarind gum for its convenient incorporation into dry mixes, bakery products, and tablet formulations. Its ability to absorb moisture, stabilize emulsions, and form gels makes it highly valuable across multiple industries. The growing trend toward plant-based ingredients and clean-label products further strengthens the dominance of the powdered form.

Liquid tamarind gum is expected to witness the fastest CAGR from 2026 to 2033, driven by its ready-to-use nature and compatibility with beverage, cosmetic, and industrial applications. For instance, companies such as Ingredion have launched liquid tamarind gum solutions to simplify formulation processes in sauces and skincare products. The ease of blending, rapid hydration, and ability to achieve consistent viscosity in formulations contribute to its increasing adoption. In addition, liquid forms support modern manufacturing processes that require streamlined ingredient integration.

- By Source Type

On the basis of source type, the Tamarind Gum market is segmented into organic tamarind gum and conventional tamarind gum. The conventional tamarind gum segment dominated the market with the largest share of 65.8% in 2025 due to the extensive availability of raw tamarind pods and well-established supply chains in major producing countries. Food and industrial manufacturers often prefer conventional tamarind gum for its cost-effectiveness and consistent quality, making it the preferred choice for large-scale production. Its widespread adoption in multiple applications, including food, pharmaceuticals, and animal feed, reinforces its leading market position. The reliable processing methods and compatibility with existing manufacturing practices further support its dominance.

Organic tamarind gum is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising consumer preference for natural and sustainable ingredients. For instance, companies such as Organic India have leveraged organic tamarind gum in functional food and nutraceutical products to meet clean-label requirements. The increasing demand in health-conscious and premium product segments drives rapid adoption of organic variants. Sustainability, traceable sourcing, and certification standards also enhance its appeal in global markets.

- By End-User

On the basis of end-user, the Tamarind Gum market is segmented into food manufacturers, pharmaceutical companies, cosmetic companies, and livestock feed manufacturers. The food manufacturers segment dominated the market in 2025 due to the high consumption of tamarind gum in processed foods, beverages, and culinary preparations. Food manufacturers often utilize tamarind gum to enhance texture, improve stability, and extend shelf life in a cost-effective manner. Growing awareness regarding functional and natural food ingredients reinforces its application in bakery, dairy, and confectionery products. The scalability of tamarind gum for industrial food production and its compatibility with diverse recipes also strengthen its leading market share.

Cosmetic companies are expected to witness the fastest CAGR from 2026 to 2033, driven by increasing use of tamarind gum in skincare, haircare, and personal care formulations. For instance, companies such as Dabur have incorporated tamarind gum as a natural thickening and moisturizing agent in shampoos and lotions. Rising demand for plant-based, chemical-free cosmetic products accelerates adoption in this sector. Its multifunctional properties, including film formation, hydration, and emulsion stabilization, make it ideal for modern cosmetic applications.

- By Distribution Channel

On the basis of distribution channel, the Tamarind Gum market is segmented into direct sales, online sales, and wholesale distribution. The wholesale distribution segment dominated the market in 2025 due to its ability to supply bulk quantities to food, pharmaceutical, and industrial manufacturers efficiently. Manufacturers often rely on wholesalers for cost-effective procurement, consistent quality, and logistical support across regions. Established relationships between wholesalers and end-users facilitate streamlined supply chains and ensure timely delivery of tamarind gum. Its scalability and compatibility with large-scale operations reinforce its dominance in the distribution landscape.

Online sales are anticipated to witness the fastest growth rate from 2026 to 2033, driven by increasing e-commerce penetration and digital adoption in B2B and B2C markets. For instance, platforms such as Alibaba and Amazon Business have expanded their tamarind gum listings to cater to small- and medium-sized manufacturers and home users. Ease of access, quick delivery, and direct sourcing from producers support rapid growth in online channels. In addition, digital marketplaces provide transparency in pricing and product specifications, enhancing consumer confidence and adoption.

Tamarind Gum Market Regional Analysis

- Asia-Pacific dominated the tamarind gum market with the largest revenue share of over 60% in 2025, driven by expanding food and pharmaceutical manufacturing, rising demand for natural and plant-based ingredients, and a strong presence of tamarind-producing countries such as India and Thailand

- The region’s cost-effective agricultural and processing landscape, increasing investments in functional food and nutraceutical production, and growing exports of tamarind gum are accelerating market expansion

- The availability of skilled labor, favorable government policies supporting organic farming, and rapid industrialization across developing economies are contributing to increased consumption of tamarind gum in food, pharmaceuticals, and personal care sectors

China Tamarind Gum Market Insight

China held the largest share in the Asia-Pacific tamarind gum market in 2025, owing to its growing food processing and pharmaceutical industries and investments in natural ingredient production. The country’s strong industrial base, government incentives for functional food and nutraceutical manufacturing, and extensive export capabilities for natural gums are major growth drivers. Demand is also supported by rising adoption of plant-based ingredients in bakery, beverage, and cosmetic applications.

India Tamarind Gum Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by being one of the largest producers of tamarind pods and growing demand from food, pharmaceutical, and cosmetic sectors. Government initiatives promoting organic agriculture and natural product exports, along with rising investments in value-added processing of tamarind gum, are strengthening market growth. Increasing consumption in processed foods, dairy alternatives, and nutraceuticals is contributing to robust expansion.

Europe Tamarind Gum Market Insight

The Europe tamarind gum market is expanding steadily, supported by high demand for natural and clean-label ingredients in food, beverages, and personal care products. Stringent food safety and quality regulations, increasing focus on sustainable sourcing, and growing investment in nutraceutical and cosmetic manufacturing are driving market adoption. Rising consumer awareness of plant-based functional ingredients further enhances market growth.

Germany Tamarind Gum Market Insight

Germany’s tamarind gum market is driven by its advanced food and personal care industries, strong R&D capabilities, and preference for natural and clean-label ingredients. The country’s focus on sustainable sourcing, high-quality formulations, and innovation in functional foods and cosmetics supports continued growth. Demand is particularly strong from bakery, beverage, and skincare product manufacturers.

U.K. Tamarind Gum Market Insight

The U.K. market is supported by increasing adoption of natural ingredients in food, beverages, and cosmetic formulations, alongside rising awareness of functional and clean-label products. Strong R&D infrastructure, collaborations between ingredient suppliers and manufacturers, and investments in nutraceutical and personal care product innovation are boosting demand. The U.K. continues to play a significant role in high-value natural ingredient markets.

North America Tamarind Gum Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by growing demand for natural and functional ingredients in food, beverages, pharmaceuticals, and personal care. Rising consumer preference for plant-based, clean-label products, increasing product launches incorporating natural gums, and expanding nutraceutical and cosmetic industries are boosting market growth. In addition, awareness of preventive health and sustainable sourcing supports rapid adoption.

U.S. Tamarind Gum Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its strong food processing, nutraceutical, and personal care industries. The country’s focus on innovation, regulatory compliance, and high-quality natural ingredient sourcing is encouraging widespread use of tamarind gum. Presence of key suppliers, mature distribution channels, and growing consumer demand for functional and plant-based products further solidify the U.S.'s leading position in the region.

Tamarind Gum Market Share

The tamarind gum industry is primarily led by well-established companies, including:

- Sumitomo Pharma Food & Chemical (Japan)

- Polygal AG (Switzerland)

- Qingdao Libangda Marine Technology (China)

- Premcem Gums (India)

- Dabur India Ltd (India)

- Mysore Starch Manufacturing Company (India)

- Chhaya Industries (India)

- Mahesh Agro Food Industries (India)

- Altrafine Gums (India)

- Shivam Exim (India)

- ADEKA (Japan)

- Indian Hydrocolloids (India)

- Sarda Bio Polymers (India)

- Agri Group (India)

- Adachi Group (Japan)

Latest Developments in Global Tamarind Gum Market

- In July 2025, CP Kelco expanded its tamarind polysaccharide gum production capacity to meet growing demand from food, pharmaceutical, and cosmetic sectors. This expansion reflects the rising importance of natural hydrocolloids as sustainable ingredients and enables CP Kelco to supply larger volumes to international clients. The move supports innovation in functional foods, nutraceuticals, and personal care products while strengthening the company’s market leadership and encouraging broader adoption of tamarind gum in clean-label formulations

- In June 2025, Tamarindus Indica Ltd. launched a new line of tamarind seed–derived gum powder targeted at sauces, beverages, and confectionery formulations. This product launch expands the application scope of tamarind gum, enabling food and beverage manufacturers to incorporate natural thickeners and stabilizers into more complex recipes. The initiative encourages innovation in product formulations, increases market adoption, and positions Tamarindus Indica Ltd. as a leading provider of value-added tamarind gum derivatives

- In March 2025, Nahar Exports acquired a production facility from Tamarind Products to strengthen its supply chain and increase global tamarind-powder output capability. This strategic acquisition enhances Nahar Exports’ operational control and production flexibility, allowing the company to respond rapidly to rising global demand. The increased output capacity supports bulk supply to food, pharmaceutical, and cosmetic manufacturers, boosting Nahar Exports’ competitiveness and market reach in key international markets

- In February 2025, Altrafine Gums expanded its production facility in Gujarat to increase tamarind gum output by roughly 30%. This expansion addresses rising global demand from food and pharmaceutical manufacturers in the U.S. and Europe, ensuring better supply availability and shorter lead times. By boosting production capacity, Altrafine Gums strengthens its ability to meet bulk orders for clean-label and natural-ingredient products, stabilizes market pricing, and reinforces its position as a key supplier in the international tamarind gum market

- In 2024, Ingredion Incorporated increased focus on clean-label and plant-based formulations, driving a surge in adoption of organic and natural tamarind gum products. By aligning its offerings with consumer demand for natural and sustainable ingredients, Ingredion expanded its market share across food, beverage, and cosmetic industries. The initiative promotes greater use of tamarind gum over synthetic alternatives, encourages R&D in new applications, and enhances the company’s reputation as a provider of high-quality natural functional ingredients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Tamarind Gum Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tamarind Gum Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tamarind Gum Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.