Global Tampons Market

Market Size in USD Billion

CAGR :

%

USD

6.80 Billion

USD

11.85 Billion

2025

2033

USD

6.80 Billion

USD

11.85 Billion

2025

2033

| 2026 –2033 | |

| USD 6.80 Billion | |

| USD 11.85 Billion | |

|

|

|

|

Tampons Market Size

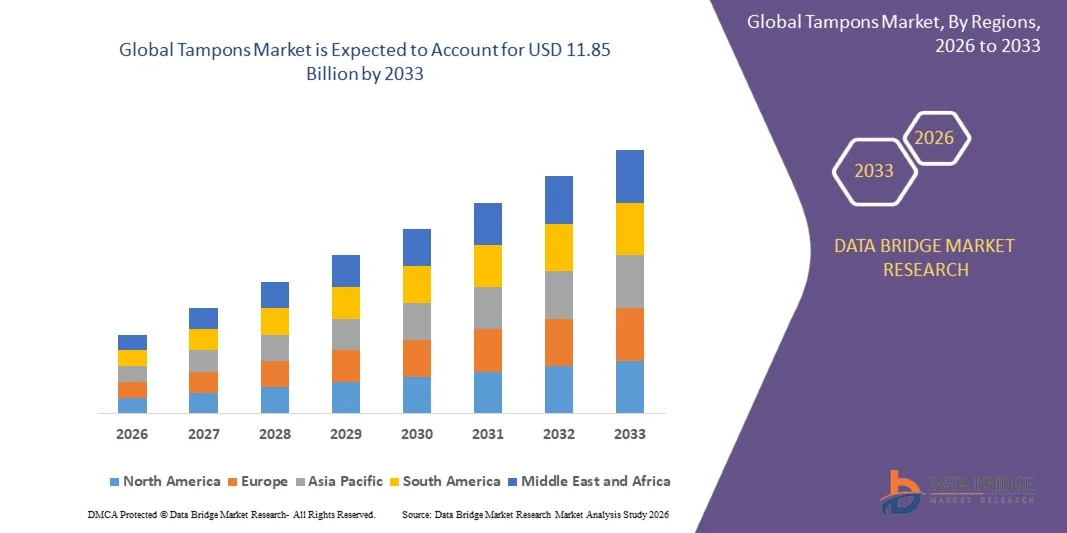

- The global tampons market size was valued at USD 6.80 billion in 2025 and is expected to reach USD 11.85 billion by 2033, at a CAGR of 7.20% during the forecast period

- The market growth is largely fuelled by the increasing awareness of feminine hygiene, rising adoption of tampons among working women, and the growing availability of organic and eco-friendly tampon products

- The expansion of e-commerce platforms and rising disposable incomes in emerging economies are further driving the market demand

Tampons Market Analysis

- The market is witnessing a shift towards biodegradable and chemical-free tampons due to consumer preference for sustainable and health-conscious products

- Product innovation, including applicator-free and compact tampons, along with aggressive marketing campaigns by key players, is contributing to the overall market growth

- North America dominated the tampons market with the largest revenue share of 35.80% in 2025, driven by increasing awareness of menstrual hygiene, rising adoption of tampons among working women, and growing availability of organic and biodegradable options

- Asia-Pacific region is expected to witness the highest growth rate in the global tampons market, driven by rapid urbanization, rising awareness of menstrual hygiene, expansion of e-commerce channels, and increasing availability of organic and sustainable tampon options

- The Applicator Tampons segment held the largest market revenue share in 2025, driven by convenience, ease of use, and hygienic application. Applicator tampons are particularly preferred by consumers for comfort and discreet handling, making them the dominant choice in both developed and emerging markets

Report Scope and Tampons Market Segmentation

|

Attributes |

Tampons Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tampons Market Trends

“Rising Demand for Convenient and Sustainable Feminine Hygiene Products”

- The growing focus on comfort, convenience, and eco-friendly alternatives is significantly shaping the global tampons market, as consumers increasingly prefer products that are safe, hygienic, and biodegradable. Tampons are gaining traction due to their ease of use, discreet design, and ability to provide reliable protection, strengthening their adoption across women of different age groups and lifestyles

- Increasing awareness around menstrual health, hygiene, and sustainable consumption has accelerated the demand for organic, applicator-free, and biodegradable tampons. Health-conscious consumers and environmentally aware populations are actively seeking products that reduce chemical exposure and environmental impact, prompting brands to innovate with sustainable materials and certifications

- Sustainability and health trends are influencing purchasing decisions, with manufacturers emphasizing eco-friendly production, natural cotton sourcing, and certification labels. These factors help brands differentiate products in a competitive market and build consumer trust, while also driving the adoption of organic and biodegradable labeling. Companies are increasingly using marketing campaigns to highlight these benefits to reinforce brand positioning and appeal to conscious consumers

- For instance, in 2024, Tampax in the U.S. and Organyc in Europe expanded their product portfolios by introducing biodegradable and organic tampons with applicator-free options. These launches responded to rising consumer preference for sustainable and health-conscious products, with distribution across retail, e-commerce, and specialty stores. The products were also marketed as environmentally responsible choices, enhancing brand loyalty and repeat purchases among target audiences

- While demand for tampons is growing, sustained market expansion depends on continuous R&D, cost-effective production, and ensuring product comfort, absorbency, and safety. Manufacturers are also focusing on improving supply chain reliability, expanding product accessibility, and developing innovative solutions that balance cost, quality, and sustainability for broader adoption

Tampons Market Dynamics

Driver

“Growing Preference for Comfortable, Safe, and Sustainable Products”

- Rising consumer demand for convenient, eco-friendly, and skin-safe feminine hygiene products is a major driver for the tampons market. Manufacturers are increasingly offering organic, biodegradable, and applicator-free options to meet consumer expectations, improve product appeal, and comply with safety standards. This trend is also pushing research into novel materials and design innovations for tampons

- Expanding awareness of menstrual hygiene and growing adoption among working women and urban populations are influencing market growth. Tampons offer discreet, reliable protection and ease of use, meeting consumer expectations for comfort and convenience during menstruation. Increasing digital campaigns and educational initiatives further reinforce this trend

- Feminine care brands are actively promoting tampon-based formulations through product innovation, marketing campaigns, and eco-certifications. These efforts, supported by health-conscious and environmentally aware consumer preferences, also encourage collaborations between suppliers and brands to improve sustainability, performance, and user experience

- For instance, in 2023, Kotex in the U.S. and Natracare in the U.K. reported increased incorporation of organic cotton and biodegradable materials in their tampon products. This expansion followed higher consumer demand for chemical-free, sustainable, and convenient options, driving repeat purchases and product differentiation. Both companies also emphasized eco-certification and health benefits in marketing campaigns to strengthen consumer trust and brand loyalty

- Although rising demand for sustainable and convenient products supports growth, wider adoption depends on cost optimization, raw material availability, and scalable production processes. Investment in supply chain efficiency, sustainable sourcing, and advanced manufacturing technology will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

“Higher Cost And Limited Awareness Compared To Conventional Products”

- The relatively higher cost of organic and biodegradable tampons compared to conventional products remains a key challenge, limiting adoption among price-sensitive consumers. Higher raw material costs and complex production processes contribute to elevated pricing, affecting market penetration

- Consumer awareness remains uneven, particularly in developing regions where menstrual hygiene education is still emerging. Limited understanding of the benefits of organic and eco-friendly tampons restricts adoption across certain demographics. This also leads to slower innovation uptake in emerging economies where educational initiatives are minimal

- Supply chain and distribution challenges impact market growth, as organic and biodegradable tampons require sourcing from certified suppliers and adherence to quality standards. Logistical complexities and shorter shelf life of natural materials increase operational costs, prompting manufacturers to invest in efficient storage and transport networks

- For instance, in 2024, distributors in India and Southeast Asia reported slower uptake of biodegradable tampons due to higher prices and limited awareness of health and environmental benefits. Retailers often allocated limited shelf space for premium tampon products, affecting visibility and sales

- Overcoming these challenges will require cost-efficient production, expanded distribution networks, and targeted educational initiatives for consumers. Collaboration with retailers, e-commerce platforms, and certification bodies can help unlock the long-term growth potential of the global tampons market. Developing cost-competitive formulations and strengthening marketing strategies around comfort, safety, and sustainability will be essential for widespread adoption

Tampons Market Scope

The market is segmented on the basis of type, material, and distribution channel.

• By Type

On the basis of type, the global tampons market is segmented into Applicator Tampons and Non-applicator Tampons. The Applicator Tampons segment held the largest market revenue share in 2025, driven by convenience, ease of use, and hygienic application. Applicator tampons are particularly preferred by consumers for comfort and discreet handling, making them the dominant choice in both developed and emerging markets.

The Non-applicator Tampons segment is expected to witness the fastest growth rate from 2026 to 2033, driven by lower cost, compact design, and growing consumer preference for eco-friendly and biodegradable products. Non-applicator tampons are increasingly popular among environmentally conscious consumers and those seeking minimal packaging options.

• By Material

On the basis of material, the tampons market is segmented into Cotton, Rayon, and Blended. The Cotton segment held the largest market revenue share in 2025, owing to rising awareness of skin-friendly, chemical-free products and the increasing demand for organic cotton tampons that offer comfort and safety during menstruation.

The Blended segment is expected to witness the fastest growth from 2026 to 2033, due to product innovation, improved absorbency, and the ability to balance cost and performance. Manufacturers are focusing on blended materials to offer tampons with enhanced protection, comfort, and sustainability.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Retail Stores, Pharmacy Stores, and Online Stores. The Retail Stores segment held the largest market revenue share in 2025, driven by wide availability, convenience, and strong presence of leading feminine hygiene brands across supermarkets and convenience stores.

The Online Stores segment is expected to witness the fastest growth rate from 2026 to 2033, owing to increasing e-commerce adoption, subscription-based delivery models, and consumer preference for privacy and doorstep convenience. Online platforms are also helping brands reach untapped markets and promote organic and premium tampons to a broader audience.

Tampons Market Regional Analysis

- North America dominated the tampons market with the largest revenue share of 35.80% in 2025, driven by increasing awareness of menstrual hygiene, rising adoption of tampons among working women, and growing availability of organic and biodegradable options

- Consumers in the region highly value comfort, convenience, and health-conscious features offered by tampons, with preferences for applicator, organic cotton, and eco-friendly products

- This widespread adoption is further supported by high disposable incomes, strong retail and e-commerce presence, and educational initiatives around menstrual health, establishing tampons as a preferred feminine hygiene solution across various age groups

U.S. Tampons Market Insight

The U.S. tampons market captured the largest revenue share in 2025 within North America, fueled by increasing awareness of menstrual hygiene and the expanding preference for convenient and safe feminine care products. Consumers are increasingly prioritizing comfort, absorbency, and eco-friendly options. The growing adoption of organic and biodegradable tampons, combined with online subscription services and widespread retail availability, further propels the market. Moreover, digital campaigns and educational initiatives around menstrual health are significantly contributing to market expansion.

Europe Tampons Market Insight

The Europe tampons market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising awareness of menstrual hygiene, stringent quality standards, and the demand for organic and biodegradable products. Increasing urbanization and rising disposable incomes are fostering adoption. European consumers are also drawn to products offering comfort, safety, and eco-friendly benefits. The region is experiencing significant growth across retail and e-commerce channels, with tampons being increasingly adopted in both developed and emerging markets.

U.K. Tampons Market Insight

The U.K. tampons market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising awareness of menstrual health, demand for sustainable products, and the growing preference for convenient and discreet feminine hygiene solutions. Concerns regarding chemical exposure and comfort are encouraging both younger and working women to choose organic and applicator-free tampons. The U.K.’s strong retail, pharmacy, and e-commerce infrastructure is expected to continue stimulating market growth.

Germany Tampons Market Insight

The Germany tampons market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing consumer awareness of organic and biodegradable options, as well as the demand for high-quality, skin-friendly products. Germany’s focus on health, sustainability, and innovation promotes the adoption of premium tampon products. Retailers and online platforms are increasingly promoting certified organic and eco-friendly tampons, with strong emphasis on safety, comfort, and environmental responsibility.

Asia-Pacific Tampons Market Insight

The Asia-Pacific tampons market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising urbanization, increasing disposable incomes, and growing awareness of menstrual hygiene in countries such as China, Japan, and India. Government initiatives promoting women’s health and education are supporting adoption. Furthermore, the region’s expanding e-commerce ecosystem and increasing availability of affordable organic and applicator-free tampons are enabling greater accessibility to a wider consumer base.

Japan Tampons Market Insight

The Japan tampons market is expected to witness the fastest growth rate from 2026 to 2033 due to high awareness of menstrual health, technological advancement in feminine hygiene products, and growing demand for convenience and comfort. Japanese consumers are increasingly choosing tampons integrated with safety, absorbency, and eco-friendly features. Moreover, the aging population is expected to drive demand for easy-to-use and hygienic products in both residential and institutional settings.

China Tampons Market Insight

The China tampons market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urbanization, expanding middle-class population, and increasing awareness of feminine hygiene. China stands as one of the largest markets for tampons, with growing popularity across residential, commercial, and institutional segments. The push towards women’s health initiatives, availability of affordable options, and strong domestic brands are key factors propelling the market in China.

Tampons Market Share

The Tampons industry is primarily led by well-established companies, including:

- Procter & Gamble (U.S.)

- Playtex (U.S.)

- Johnson & Johnson (U.S.)

- Edgewell Personal Care Company (U.S.)

- Unicharm (Japan)

- Natracare (U.K.)

- MOXIE (U.S.)

- Rossmann (Germany)

- Lil-lets (South Africa)

- Cotton High Tech S.L. (Spain)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.