Global Tank Mix Adjuvants Market

Market Size in USD Billion

CAGR :

%

USD

219.00 Billion

USD

386.00 Billion

2024

2032

USD

219.00 Billion

USD

386.00 Billion

2024

2032

| 2025 –2032 | |

| USD 219.00 Billion | |

| USD 386.00 Billion | |

|

|

|

|

Tank Mix Adjuvants Market Size

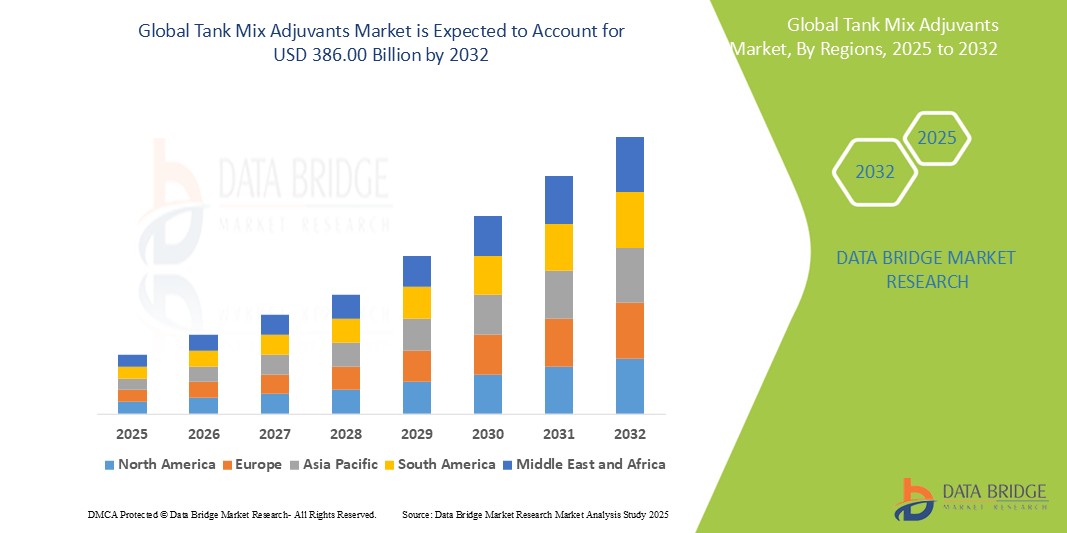

- The global tank mix adjuvants market size was valued at USD 219.00 billion in 2024 and is expected to reach USD 386.00 billion by 2032, at a CAGR of 6.50% during the forecast period

- This growth is driven by increasing global demand for crop protection products in the agricultural sector

Tank Mix Adjuvants Market Analysis

- Tank mix adjuvants are specialized chemical additives used to enhance the effectiveness and efficiency of pesticides, herbicides, and other agricultural chemicals. These adjuvants improve the spreading, sticking, and penetration of active ingredients, enabling better crop protection and management

- The demand for tank mix adjuvants is primarily driven by the increasing need for efficient and environmentally sustainable agricultural practices, coupled with rising crop production, pest management challenges, and a shift toward precision farming solutions

- Asia-Pacific is expected to dominate the tank mix adjuvants market, accounting for the largest market share, supported by its vast agricultural landscape and a growing population driving food demand

- North America is expected to witness the highest growth rate in the tank mix adjuvants market, driven by increasing adoption of precision agriculture and advanced crop protection technologies

- The suspension concentrates segment is expected to dominate the tank mix adjuvants market, as they are free from dust and flammable solvents, minimizing environmental and safety risks

Report Scope and Tank Mix Adjuvants Market Segmentation

|

Attributes |

Tank Mix Adjuvants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tank Mix Adjuvants Market Trends

“Rising Demand for Sustainable and Eco-friendly Adjuvants”

- A prominent trend in the tank mix adjuvants market is the increasing demand for eco-friendly and sustainable adjuvants to reduce the environmental impact of agricultural practices

- Consumers, farmers, and regulatory bodies are becoming more focused on minimizing pesticide residues, improving water retention, and enhancing soil health with the use of biodegradable adjuvants

- Sustainable adjuvants are gaining popularity as they help in reducing the chemical load on ecosystems and increase the overall efficiency of crop protection

- For instance, in 2023, BASF launched a new line of biodegradable Tank Mix Adjuvants that have shown promise in improving herbicide efficacy while reducing environmental impact

- This shift toward sustainable practices is expected to accelerate the adoption of green and innovative tank mix adjuvants solutions across global agricultural markets

Tank Mix Adjuvants Market Dynamics

Driver

“Advancements in Precision Agriculture Technologies”

- The rise of precision agriculture, which involves using technology and data to optimize agricultural practices, is driving the adoption of tank mix adjuvants in crop protection

- Technologies such as GPS, drone surveillance, and soil health sensors enable farmers to precisely apply fertilizers and pesticides, enhancing the effectiveness of adjuvants in specific areas of their fields

- This precision reduces waste, cuts down on costs, and boosts yields, creating a significant demand for specialized adjuvants that can function optimally with modern precision farming tools

- For instance, in 2023, John Deere integrated advanced tank mix adjuvants into its precision agriculture equipment to enhance the efficiency of pesticide application in cotton fields

- The expansion of precision agriculture technologies is expected to drive growth in the tank mix adjuvants market, particularly in regions focusing on high-yield, sustainable farming

Opportunity

“Growth in Emerging Economies”

- The rapid industrialization and growth of the agricultural sector in emerging economies, particularly in Asia-Pacific, Latin America, and Africa, offer significant growth opportunities for tank mix adjuvants manufacturers

- As these regions adopt modern agricultural practices, the demand for efficient and high-performance tank mix adjuvants solutions is expected to rise to meet the needs of farmers looking to increase crop yields and reduce environmental impact

- Improved access to modern farming equipment, including adjuvants, is expected to boost crop protection and pest management solutions in these regions

- For instance, in 2024, a partnership between Syngenta and local distributors in India focused on introducing advanced tank mix adjuvants to help farmers manage pest resistance in rice cultivation

- These expanding markets are likely to present substantial growth opportunities for tank mix adjuvants vendors to offer tailored products suited for different agricultural conditions

Restraint/Challenge

“Regulatory Challenges and Compliance Costs”

- A significant challenge facing the tank mix adjuvants market is navigating the complex and ever-evolving regulatory landscape related to pesticide and chemical use

- With increasing concerns about chemical residue and environmental safety, regulatory authorities worldwide are tightening restrictions on certain ingredients, resulting in additional costs for product development, testing, and certification

- Compliance with these regulations can be burdensome for manufacturers, especially small and medium-sized enterprises (SMEs), which may struggle with the financial and administrative aspects of regulatory adherence

- For instance, in 2023, the European Union imposed stricter limits on the use of certain non-biodegradable adjuvants, causing delays in the approval of several Tank Mix Adjuvants products

- These regulatory hurdles could slow down the market’s growth, especially in regions with stringent pesticide control laws and limited regulatory harmonization.

Tank Mix Adjuvants Market Scope

The market is segmented on the basis of formulation, function, application, and source.

|

Segmentation |

Sub-Segmentation |

|

By Formulation |

|

|

By Function |

|

|

By Application |

|

|

By Source |

|

In 2025, the Suspension Concentrates is projected to dominate the market with a largest share in function segment

The suspension concentrates segment is expected to dominate the tank mix adjuvants market, as they are free from dust and flammable solvents, minimizing environmental and safety risks.

The herbicides is expected to account for the largest share during the forecast period in battery segment

In 2025, the herbicides segment is expected to dominate the market, due to its widespread use of herbicides in agriculture for effective weed control, which is crucial for maximizing crop yields.

Tank Mix Adjuvants Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Tank Mix Adjuvants Market”

- Asia-Pacific is expected to dominate the tank mix adjuvants market, accounting for the largest market share, supported by its vast agricultural landscape and a growing population driving food demand

- Major agricultural economies such as India, China, and Australia are increasingly adopting tank mix adjuvants to improve pesticide efficiency and crop productivity

- Rising awareness of modern farming techniques, government initiatives for sustainable agriculture, and increasing investments in agrochemical innovations are further boosting regional dominance

“North America is Projected to Register the Highest CAGR in the Tank Mix Adjuvants Market”

- North America is expected to witness the highest growth rate in the tank mix adjuvants market, driven by increasing adoption of precision agriculture and advanced crop protection technologies

- The region's agricultural sector is embracing innovative solutions that enhance the effectiveness of herbicides, insecticides, and fungicides, driving the adoption of adjuvants for better pesticide performance and reduced environmental footprint

- Factors such as stringent regulatory standards, emphasis on sustainable farming practices, and the need for efficient pesticide application are propelling the demand for tank mix adjuvants in the region

Tank Mix Adjuvants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Corteva Agriscience (U.S.)

- Evonik Industries AG (Germany)

- Croda International Plc (U.K.)

- Nufarm Limited (Australia)

- Solvay SA (Belgium)

- BASF SE (Germany)

- Huntsman International LLC (U.S.)

- Clariant AG (Switzerland)

- Helena Agri-Enterprises, LLC (U.S.)

- Stepan Company (U.S.)

- Adjuvants Plus Inc. (Canada)

- Wilbur-Ellis Holdings, Inc. (U.S.)

- Brandt Companies (U.S.)

- INNVICTIS (U.S.)

- Precision Laboratories, LLC (U.S.)

- CHS Inc. (U.S.)

- WinField United (U.S.)

- KALO, Inc. (U.S.)

- Ingevity Corporation (U.S.)

- Miller Chemical & Fertilizer, LLC (U.S.)

Latest Developments in Global Tank Mix Adjuvants Market

- In September 2023, Croda unveiled Atlo BS-50, a new delivery system designed for the growing biopesticide market. This innovative product specifically targets the needs of biopesticides, aiming to enhance their effectiveness and optimize their application. This marks Croda’s commitment to advancing sustainable agricultural practices

- In April 2023, Evonik launched BREAK-THRU MSO MAX 522 and TEGO XP 11134, two groundbreaking adjuvants that improve efficacy and minimize drift for drone applications in agriculture. These new products feature advanced blends of polyether-trisiloxanes, reflecting Evonik’s dedication to improving the precision and efficiency of agricultural inputs

- In April 2022, Lamberti SPA acquired Turftech International, a UK-based company specializing in surfactants for horticulture and turf applications. This acquisition strengthens Lamberti’s market position by expanding and diversifying its product portfolio, further solidifying its presence in the regional market

- In June 2021, Evonik partnered with Tropfen to launch the BREAK-THRU MSO MAX adjuvants in Argentina. This successful collaboration aims to cater to the specific needs of South American growers, enhancing agricultural solutions in the region

- In April 2021, Nufarm Group formed a partnership with Attune Agriculture to distribute the Ampersand adjuvant in Mexico. This partnership enhances the availability of effective adjuvant solutions in the region, strengthening both companies' positions in the Mexican market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.