Global Tankless Water Heater Market

Market Size in USD Billion

CAGR :

%

USD

4.52 Billion

USD

7.00 Billion

2024

2032

USD

4.52 Billion

USD

7.00 Billion

2024

2032

| 2025 –2032 | |

| USD 4.52 Billion | |

| USD 7.00 Billion | |

|

|

|

|

Tankless Water Heater Market Size

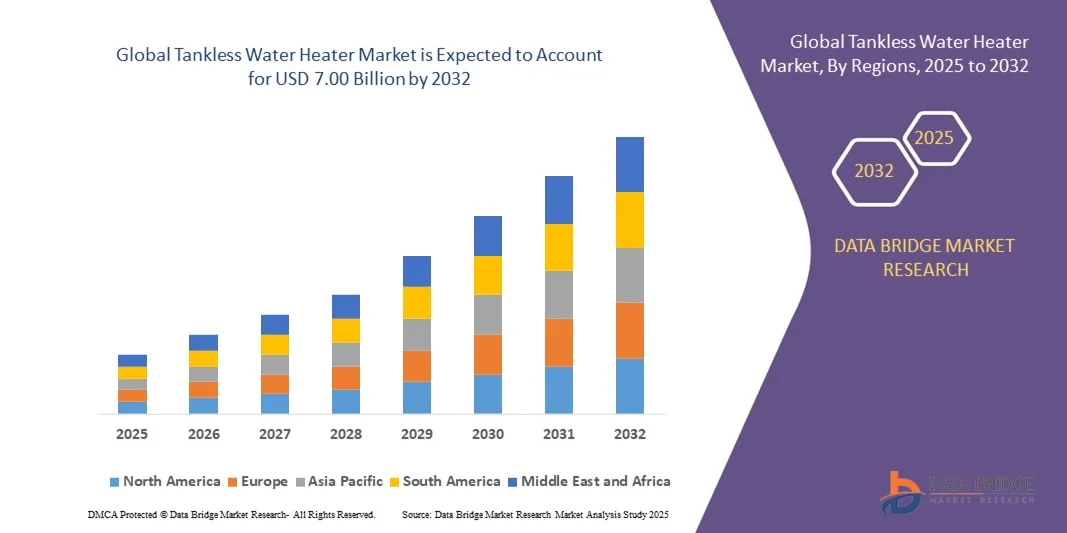

- The global tankless water heater market size was valued at USD 4.52 billion in 2024 and is expected to reach USD 7.00 billion by 2032, at a CAGR of 5.62% during the forecast period

- The market growth is largely fuelled by the rising adoption of energy-efficient appliances and the growing emphasis on reducing household energy consumption

- Increasing urbanization, coupled with the expansion of residential and commercial infrastructure, is boosting the demand for compact and continuous hot water solutions

Tankless Water Heater Market Analysis

- The global tankless water heater market is witnessing robust expansion driven by the shift toward sustainable living and eco-friendly energy systems

- Consumers are increasingly preferring tankless systems over traditional storage heaters due to their long lifespan, reduced standby energy losses, and compact design

- North America dominated the tankless water heater market with the largest revenue share of 38.42% in 2024, driven by the growing demand for energy-efficient home appliances and increasing awareness of sustainable living solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global tankless water heater market, driven by expanding middle-class populations, technological innovation, and government initiatives promoting energy-efficient home appliances

- The gas segment held the largest market revenue share in 2024, driven by its higher heating capacity, faster flow rate, and suitability for large households and commercial spaces requiring continuous hot water supply. Gas-powered models are preferred for their efficiency and ability to handle multiple outlets simultaneously, making them ideal for regions with established gas infrastructure

Report Scope and Tankless Water Heater Market Segmentation

|

Attributes |

Tankless Water Heater Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tankless Water Heater Market Trends

Rising Adoption of Energy-Efficient and Eco-Friendly Water Heating Solutions

- The growing emphasis on energy conservation and sustainable living is driving the rapid adoption of tankless water heaters worldwide. Unlike traditional storage systems, tankless models heat water on demand, significantly reducing energy waste and operating costs. This aligns with global efforts to minimize carbon footprints and improve household energy efficiency, making them a preferred choice among environmentally conscious consumers who seek both performance and sustainability in home appliances

- Governments across several regions are promoting the use of energy-efficient appliances through rebates, tax incentives, and labeling programs. Such initiatives are encouraging consumers and businesses to replace conventional storage heaters with modern tankless systems. These policies not only reduce energy consumption but also promote innovation in heating technologies to meet stricter environmental standards, supporting national decarbonization goals and reducing dependence on fossil fuels

- Advancements in design and performance, such as condensing technology and modulating gas burners, are enhancing the efficiency and lifespan of tankless units. Manufacturers are increasingly focusing on integrating IoT and smart features for temperature control, predictive maintenance, and energy usage monitoring. These innovations allow users to optimize performance, lower utility bills, and achieve a more personalized heating experience in both residential and commercial environments

- For instance, in 2023, several leading manufacturers in Japan and South Korea introduced next-generation tankless models equipped with AI-based controls to optimize energy usage and ensure consistent water temperature under varying pressure conditions. These smart systems analyze usage patterns and automatically adjust heating cycles to improve comfort and efficiency, reflecting the growing role of artificial intelligence in modern home energy management

- While tankless water heaters continue to gain popularity due to their efficiency and performance benefits, their higher upfront cost remains a concern in developing regions. However, increasing awareness about long-term savings, combined with regulatory support, is expected to sustain steady market growth globally. As consumers become more educated about lifecycle cost advantages, adoption rates are likely to rise across both residential and commercial sectors

Tankless Water Heater Market Dynamics

Driver

Increasing Demand for Energy-Efficient and Compact Home Appliances

- The growing focus on sustainable living and energy optimization is a major factor driving the demand for tankless water heaters. These systems provide continuous hot water while reducing energy consumption by up to 30% compared to traditional tank-based models, appealing to both residential and commercial users seeking cost-effective and eco-friendly solutions. The trend aligns with broader shifts toward low-carbon technologies in household energy systems

- Rapid urbanization and the trend toward smaller living spaces are also fueling demand for compact and wall-mounted heating systems. Tankless water heaters require minimal installation space and offer greater design flexibility, making them ideal for modern apartments and multi-unit buildings. Their efficiency and aesthetic appeal further enhance their adoption across developed and developing regions, especially in high-density urban environments where space utilization is a priority

- The increasing integration of smart technologies and IoT-enabled features allows users to remotely control water temperature, monitor usage, and receive maintenance alerts, improving convenience and operational safety. These capabilities align with the rising consumer preference for connected home appliances and digital comfort solutions. Integration with home automation systems is also allowing better energy management and user personalization

- For instance, in 2023, several North American manufacturers launched Wi-Fi-enabled tankless systems that allow real-time energy tracking and performance monitoring via mobile applications, empowering consumers to optimize usage and reduce utility bills. Such connected systems also enable predictive maintenance alerts, minimizing downtime and extending product lifespan, which adds long-term value for homeowners

- The growing awareness of environmental conservation and government mandates for energy-efficient appliances continue to support the widespread adoption of tankless water heaters, making them a key component of the modern sustainable home ecosystem. This momentum is expected to accelerate further as manufacturers innovate with hybrid models and renewable energy-compatible designs

Restraint/Challenge

High Initial Installation Costs and Technical Complexities

- Despite their long-term cost benefits, tankless water heaters often involve higher upfront expenses compared to conventional systems. The installation process requires advanced plumbing and venting configurations, increasing labor and material costs. This initial investment can deter budget-conscious consumers, particularly in emerging economies where cost sensitivity is high and credit options for home upgrades are limited

- Retrofitting existing homes with tankless systems can be technically challenging due to the need for upgraded gas lines, electrical capacity, and water flow adjustments. These requirements can lead to increased installation times and expenses, creating barriers to adoption in older housing infrastructures. As a result, the market’s penetration in mature residential segments remains slower than expected despite growing environmental awareness

- In addition, consumers may face operational issues such as fluctuating water temperatures during simultaneous use in large households or commercial settings. While manufacturers are addressing these challenges with improved flow rate management and digital modulation, awareness and proper sizing remain crucial to ensuring performance efficiency. Misconfigured installations can lead to dissatisfaction and reduced trust in technology among end users

- For instance, in 2023, surveys across European residential markets revealed that many homeowners were hesitant to transition from traditional heaters due to installation complexity and the need for specialized technicians, despite understanding the long-term benefits of tankless systems. This highlights the importance of installer training and after-sales support in overcoming consumer hesitation

- Addressing these cost and technical barriers through product standardization, skilled installation training, and affordable financing options will be essential to unlocking the full potential of the global tankless water heater market and ensuring broader adoption across all consumer segments. Strategic partnerships between manufacturers, utilities, and governments can further drive accessibility and adoption in both new and existing infrastructures

Tankless Water Heater Market Scope

The market is segmented on the basis of product type, installation, technology, features, and application.

- By Product Type

On the basis of product type, the tankless water heater market is segmented into electric and gas. The gas segment held the largest market revenue share in 2024, driven by its higher heating capacity, faster flow rate, and suitability for large households and commercial spaces requiring continuous hot water supply. Gas-powered models are preferred for their efficiency and ability to handle multiple outlets simultaneously, making them ideal for regions with established gas infrastructure.

The electric segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing adoption in residential apartments, improved electricity accessibility, and growing environmental concerns. Electric tankless water heaters are easy to install, compact, and compatible with renewable power sources, making them an attractive choice for sustainable and energy-conscious consumers.

- By Installation

On the basis of installation, the tankless water heater market is segmented into indoor tankless water heater and outdoor tankless water heater. The indoor segment held the largest market share in 2024 due to its higher adoption in urban households, apartments, and commercial buildings where protection from external weather conditions is essential. Indoor systems are preferred for their reliability, controlled installation environments, and integration with interior plumbing networks.

The outdoor segment is expected to witness the fastest growth rate from 2025 to 2032 owing to its suitability in regions with mild climates and limited indoor space. Outdoor tankless water heaters eliminate the need for complex venting systems and are easier to maintain, making them ideal for residential properties and small businesses seeking flexible installation solutions.

- By Technology

On the basis of technology, the tankless water heater market is segmented into condensing technology and non-condensing technology. The condensing segment accounted for the largest share in 2024 due to its superior energy efficiency and reduced heat loss through exhaust gases. These systems utilize advanced heat exchangers to capture additional energy, lowering operational costs and emissions.

The non-condensing segment is expected to witness the fastest growth rate from 2025 to 2032, especially in cost-sensitive regions. It is preferred for its lower initial investment, simpler design, and ease of maintenance, making it suitable for applications where installation costs and space constraints are key considerations.

- By Features

On the basis of features, the market is segmented into manual and remote control. The remote control segment dominated the market in 2024 owing to the rising integration of smart technologies such as Wi-Fi, IoT, and mobile applications that allow users to adjust water temperature, monitor energy consumption, and schedule heating operations remotely. These features align with the growing trend of connected home ecosystems and digital convenience.

The manual segment is expected to witness the fastest growth rate from 2025 to 2032, remains relevant in developing regions due to its affordability and reliability. These models require minimal maintenance and are preferred in areas with inconsistent internet connectivity or limited access to smart home infrastructure.

- By Application

On the basis of application, the tankless water heater market is segmented into residential and commercial. The residential segment held the largest share in 2024, driven by increasing household awareness of energy-efficient appliances, urban housing growth, and government incentives promoting sustainable technologies. Tankless systems in this segment cater to modern living preferences for compact, high-performance, and eco-friendly home solutions.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032 due to rising installation in hotels, hospitals, restaurants, and educational institutions. These facilities demand consistent hot water supply with minimal downtime, making tankless systems a cost-effective and durable choice for long-term operational efficiency.

Tankless Water Heater Market Regional Analysis

- North America dominated the tankless water heater market with the largest revenue share of 38.42% in 2024, driven by the growing demand for energy-efficient home appliances and increasing awareness of sustainable living solutions

- Consumers in the region highly value the convenience, efficiency, and long-term cost savings offered by tankless systems compared to traditional water heaters

- This widespread adoption is further supported by favorable government policies promoting energy conservation, advanced technological integration, and the increasing popularity of smart home ecosystems across residential and commercial applications

U.S. Tankless Water Heater Market Insight

The U.S. tankless water heater market captured the largest revenue share in 2024 within North America, propelled by the rising adoption of energy-efficient appliances and the modernization of home infrastructure. The market is experiencing strong growth due to increasing consumer preference for on-demand water heating systems that lower utility bills and reduce carbon emissions. In addition, the integration of IoT-enabled features, such as mobile control and real-time performance monitoring, is enhancing user experience and boosting product adoption. The presence of major manufacturers and the availability of diverse product offerings further support market expansion in the U.S.

Europe Tankless Water Heater Market Insight

The Europe tankless water heater market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent energy efficiency regulations and the growing focus on carbon neutrality. European consumers are increasingly transitioning from conventional storage systems to tankless models to reduce energy consumption and improve sustainability. Furthermore, the modernization of aging residential infrastructure and government-backed initiatives promoting energy-efficient technologies are accelerating adoption. The increasing renovation of multi-family housing units with eco-friendly solutions also supports steady growth across the region.

U.K. Tankless Water Heater Market Insight

The U.K. tankless water heater market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the country’s commitment to achieving net-zero emissions and its strong emphasis on energy efficiency. Growing awareness among homeowners regarding energy savings and compact installation benefits is driving the shift toward tankless systems. In addition, the rising popularity of smart homes and government rebates for high-efficiency appliances are stimulating consumer demand. The trend of replacing outdated boilers with tankless systems is also gaining traction, particularly in urban housing developments.

Germany Tankless Water Heater Market Insight

The Germany tankless water heater market is expected to witness the fastest growth rate from 2025 to 2032, driven by the nation’s emphasis on sustainability, precision engineering, and innovation in heating technologies. German consumers are increasingly favoring compact, efficient, and eco-friendly systems to align with the country’s strong energy transition goals. The widespread adoption of condensing and smart-controlled tankless systems in both residential and commercial sectors underscores the growing focus on digitalization and efficiency. Manufacturers are also investing in R&D to deliver systems with superior heat recovery and minimal emissions.

Asia-Pacific Tankless Water Heater Market Insight

The Asia-Pacific tankless water heater market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising urbanization, improving living standards, and expanding construction activities in countries such as China, Japan, and India. The region’s large population base and growing middle class are accelerating the adoption of energy-efficient water heating solutions. Governments are promoting eco-friendly technologies through policy incentives and awareness programs. In addition, increasing product affordability and the availability of compact electric and gas models are enhancing adoption across both residential and commercial sectors.

Japan Tankless Water Heater Market Insight

The Japan tankless water heater market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s focus on space-saving technologies and sustainability. Japanese consumers are drawn to the efficiency, convenience, and reliability of tankless systems, especially in urban areas with limited space. The integration of AI-based heating controls and smart monitoring features is also propelling adoption. Moreover, Japan’s aging population and growing preference for automated, user-friendly systems are contributing to increased demand across both new constructions and retrofit installations.

China Tankless Water Heater Market Insight

The China tankless water heater market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, rising disposable incomes, and strong domestic manufacturing capabilities. Consumers are increasingly adopting tankless systems as part of the country’s smart home trend, driven by efficiency, convenience, and energy savings. Government initiatives promoting green building standards and energy-efficient technologies further support market growth. The expansion of residential and commercial construction projects, combined with the availability of affordable local products, positions China as a major growth driver in the regional market.

Tankless Water Heater Market Share

The Tankless Water Heater industry is primarily led by well-established companies, including:

• A. O. Smith India Water Products Pvt. Ltd. (India)

• Rheem Manufacturing Company (U.S.)

• Eemax, Inc. (U.S.)

• Rinnai Corporation (Japan)

• GE Appliances (U.S.)

• Bajaj Electricals Ltd. (India)

• Bradford White Corporation (U.S.)

• STIEBEL ELTRON GmbH & Co. KG (Germany)

• Robert Bosch LLC (U.S.)

• Haier Inc. (China)

• Ariston Thermo India Private Limited (India)

• NORITZ Corporation (Japan)

• EcoSmart Green Energy Products, Inc. (U.S.)

• V-GUARD INDUSTRIES LTD. (India)

• Havells India Ltd. (India)

• Alpha Electric Co. (Malaysia)

• Takagi (Japan)

• Westinghouse Electric Corporation (U.S.)

• Noritz America (U.S.)

• Navien Inc. (South Korea)

Latest Developments in Global Tankless Water Heater Market

- In September 2024, A. O. Smith India Water Products Pvt. Ltd. introduced a new Point-Of-Use (POU) Electric Tankless Water Heater aimed at quick installation in both light commercial and residential environments. The innovative unit eliminates the need for venting and integrates advanced features such as dry fire protection, leak detection with audible alerts, and scale detection to improve longevity and safety. This launch enhances the company’s product portfolio in the energy-efficient water heating segment and strengthens its competitive position in the global tankless water heater market

- In January 2023, Robert Bosch LLC expanded its product line with the introduction of the Tronic 4000 C and Tronic 6100 C electric tankless water heaters, tailored for point-of-use and whole-house applications, respectively. These models feature compact designs, superior energy efficiency, and reliable on-demand hot water performance. The development supports Bosch’s commitment to sustainability and innovation, contributing to the growing adoption of eco-friendly and space-saving water heating solutions worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.