Global Tantalum Market

Market Size in USD Billion

CAGR :

%

USD

571.64 Billion

USD

825.46 Billion

2025

2033

USD

571.64 Billion

USD

825.46 Billion

2025

2033

| 2026 –2033 | |

| USD 571.64 Billion | |

| USD 825.46 Billion | |

|

|

|

|

What is the Global Tantalum Market Size and Growth Rate?

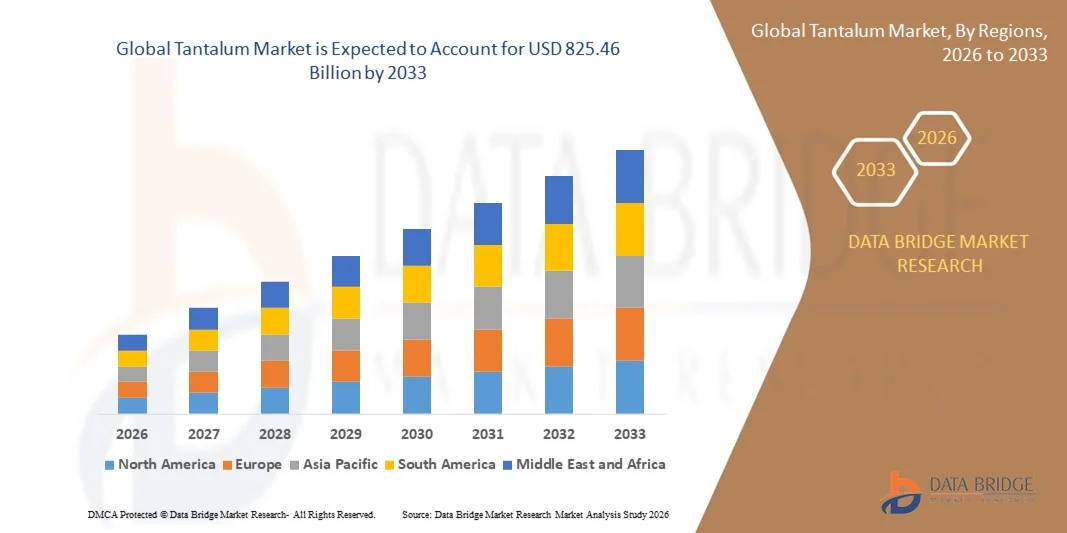

- The global tantalum market size was valued at USD 571.64 billion in 2025 and is expected to reach USD 825.46 billion by 2033, at a CAGR of 4.70% during the forecast period

- The growing usage of tantalum alloys in aviation and gas turbine, increasing demand of the product in the electronics industry for capacitors and high power resistors, rising adoption of innovative technologies, automation and others have led to the increase in demand for electronic devices, high demand for tantalum wire/ powder in super alloys, rising demand for new aircraft for commercial operations are some of the major as well as vital factors which will such asly to augment the growth of the tantalum market

What are the Major Takeaways of Tantalum Market?

- Increasing advancement and replacement of aging power infrastructure, increasing number of applications in medical, space, renewable energy, and others, rise in mining activities along with long term supply agreements which will further contribute by generating massive opportunities that will lead to the growth of the tantalum market

- Detrimental effect of tantalum powder along with volatility in the prices of raw material which will such asly to act as market restraints factor for the growth of the tantalum

- Asia-Pacific dominated the tantalum market with the largest revenue share of 38.5% in 2025, driven by rapid industrialization, growing electronics manufacturing, and strong demand for high-performance materials in emerging economies such as China, Japan, India, and South Korea

- North America is projected to witness the fastest growth rate of 9.7% during 2026–2033, driven by high demand in aerospace, defense, automotive, and electronics applications

- The Ready-to-Drink (RTD) segment dominated the market with the largest revenue share of 44.8% in 2025, driven by the rising consumer demand for convenient, on-the-go beverages that offer both taste and functionality

Report Scope and Tantalum Market Segmentation

|

Attributes |

Tantalum Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Tantalum Market?

Growing Demand for Advanced Electronics and Aerospace Applications

- The tantalum market is witnessing a major shift toward high-performance electronics and aerospace components, fueled by rising adoption of smartphones, electric vehicles, and defense technologies. Manufacturers are focusing on producing tantalum capacitors, powders, and alloys that offer superior thermal stability, reliability, and miniaturization

- For instance, Murata Manufacturing Co., Ltd. and KEMET Corporation expanded their tantalum capacitor portfolios to cater to the increasing demand for compact, high-capacitance components in mobile and automotive applications

- Increasing demand for energy-efficient and high-reliability components in consumer electronics, aerospace, and medical devices is driving the adoption of tantalum-based materials

- Growth in miniaturized electronics, IoT devices, and wearable technologies has accelerated innovation in tantalum powder and capacitors, supporting longer product life cycles and enhanced performance

- Investments in sustainable sourcing, recycling of tantalum from e-waste, and ethical mining practices are reshaping the competitive landscape

- As industries increasingly prioritize performance, durability, and sustainability, the expansion of tantalum applications in electronics and aerospace is expected to remain the dominant trend shaping global market growth

What are the Key Drivers of Tantalum Market?

- Rising demand for high-performance electronic components is driving the adoption of tantalum capacitors, powders, and alloys across consumer electronics, automotive, and industrial applications

- For instance, in 2025, KEMET Corporation expanded its tantalum capacitor production to meet the growing global demand from the smartphone and electric vehicle industries

- Rapid growth in aerospace, defense, and medical device sectors is influencing product innovation, with manufacturers developing lightweight, high-reliability, and corrosion-resistant tantalum-based components

- Increasing electrification in automotive and industrial equipment, particularly in North America and Asia-Pacific, is boosting the consumption of tantalum materials

- Adoption of smart manufacturing, digital supply chain management, and direct-to-client solutions is enhancing market reach and customer engagement, especially in high-tech applications

- As advancements in electronics, EVs, and aerospace technologies accelerate, the Tantalum market is expected to witness steady growth and diversification across global regions

Which Factor is Challenging the Growth of the Tantalum Market?

- Volatility in raw material supply due to geopolitical tensions, ethical mining concerns, and resource scarcity remains a significant challenge, impacting production costs and market stability

- For instance, disruptions in the Democratic Republic of Congo and rising global export tariffs during 2024–2025 affected the supply of critical tantalum ores, influencing prices worldwide

- Intense competition among local and international suppliers increases pricing pressure, making it difficult for manufacturers to maintain profit margins and brand differentiation

- Strict environmental and export regulations in regions such as the U.S., Europe, and Asia-Pacific are compelling companies to adopt sustainable mining, recycling, and production processes

- Rapid technological changes and alternatives such as aluminum and ceramic capacitors pose substitution threats in certain applications

- To overcome these challenges, key players are focusing on supply chain resilience, responsible sourcing, and technological innovation, ensuring long-term market stability and growth

How is the Tantalum Market Segmented?

The market is segmented on the basis of product type, product form, product grade, and application.

- By Product Type

On the basis of product type, the tantalum market is segmented into Tantalum Carbide, Lithium Tantalite, Tantalum Oxide, and Others. The Tantalum Carbide segment dominated the market with the largest revenue share of 38.6% in 2025, driven by its extensive applications in cutting tools, aerospace, and wear-resistant industrial equipment. Its superior hardness, high melting point, and corrosion resistance make it ideal for high-performance and precision applications.

The Tantalum Oxide segment is expected to register the fastest CAGR from 2026 to 2033, supported by rising demand in electronics, capacitors, and semiconductors due to its high dielectric constant and thermal stability. Growing adoption of miniaturized and high-reliability electronic devices globally is further accelerating Tantalum Oxide demand. Manufacturers are focusing on product innovation, quality improvement, and sustainable sourcing to meet evolving industrial and electronic requirements, ensuring market expansion across key regions.

- By Product Form

On the basis of product form, the tantalum market is segmented into Metal, Carbide, Powder, Alloys, and Other Product Forms. The Metal segment dominated the market with the largest revenue share of 42.1% in 2025, owing to its widespread use in capacitors, aerospace, and chemical processing equipment. High thermal and corrosion resistance, coupled with excellent biocompatibility, drives preference for pure tantalum metal in high-value applications.

The Powder segment is anticipated to record the fastest CAGR from 2026 to 2033, driven by increasing utilization in additive manufacturing, chemical catalysts, and high-performance alloys. Technological advancements in powder production, consistent particle size, and enhanced purity are boosting adoption in electronics, aerospace, and automotive sectors. Key players are investing in high-quality powder manufacturing and precision engineering to capture emerging market opportunities.

- By Application

On the basis of application, the tantalum market is segmented into Capacitors, Semiconductors, Engine Turbine Blades, Chemical Processing Equipment, Medical Equipment, and Other Applications. The Capacitors segment dominated the market with the largest revenue share of 45.2% in 2025, owing to the extensive use of tantalum capacitors in mobile devices, automotive electronics, and industrial electronics for their reliability, high capacitance, and long life.

The Medical Equipment segment is expected to register the fastest CAGR from 2026 to 2033, supported by rising demand for biocompatible tantalum implants, surgical instruments, and medical devices. Enhanced biocompatibility, corrosion resistance, and mechanical strength of tantalum in medical applications are driving adoption. Continuous innovations in medical technologies, increasing healthcare expenditure, and aging populations in developed and emerging economies are accelerating the market growth for medical applications globally.

- By Product Grade

On the basis of product grade, the tantalum market is segmented into Medical Grade Tantalum and Commercial Grade Tantalum. The Commercial Grade Tantalum segment dominated the market with the largest revenue share of 53.4% in 2025, driven by its wide applications in electronics, aerospace, chemical equipment, and industrial machinery. Its cost-effectiveness, availability in bulk, and versatile use in non-biomedical applications make it the preferred choice for most industrial requirements.

The Medical Grade Tantalum segment is anticipated to register the fastest CAGR from 2026 to 2033, owing to increasing adoption in implants, prosthetics, and surgical devices. Growing healthcare infrastructure, rising geriatric population, and advancements in biocompatible materials are driving the demand for medical-grade tantalum. Manufacturers are focusing on precision processing, strict quality control, and certification to cater to stringent medical standards and regulatory compliance.

Which Region Holds the Largest Share of the Tantalum Market?

- Asia-Pacific dominated the tantalum market with the largest revenue share of 38.5% in 2025, driven by rapid industrialization, growing electronics manufacturing, and strong demand for high-performance materials in emerging economies such as China, Japan, India, and South Korea. The region’s expanding industrial base, rising investment in aerospace, automotive, and electronics sectors, and increasing adoption of high-purity tantalum products are key growth drivers

- Local and global manufacturers are investing heavily in advanced processing, supply chain expansion, and product innovation to cater to diverse industrial and technological requirements

- Furthermore, government initiatives supporting electronics, renewable energy, and high-tech manufacturing are strengthening Asia-Pacific’s dominance in the global Tantalum market

China Tantalum Market Insight

China is the largest contributor in Asia-Pacific, supported by robust electronics manufacturing sector, growing aerospace and automotive industries, and increasing exports of high-value tantalum components. Domestic manufacturers are focusing on high-purity tantalum, advanced alloys, and sustainable sourcing to meet both local and international demand. Investment in research and development and adherence to quality standards are reinforcing China’s leadership in the regional market.

India Tantalum Market Insight

India is witnessing strong growth in the tantalum market due to increasing electronics assembly, automotive production, and renewable energy projects. Government programs promoting high-tech manufacturing and import-substitution policies are strengthening the supply chain. Expansion of industrial hubs, local processing units, and R&D in high-performance materials are fueling market growth across commercial and industrial applications.

North America Tantalum Market Insight

North America is projected to witness the fastest growth rate of 9.7% during 2026–2033, driven by high demand in aerospace, defense, automotive, and electronics applications. The region’s established manufacturing infrastructure, technological innovation, and rising adoption of high-purity tantalum in capacitors and semiconductors are accelerating growth. Continuous investments in sustainable sourcing and advanced processing techniques further support market expansion.

U.S. Tantalum Market Insight

The U.S. leads the North American tantalum market, driven by a strong aerospace sector, expanding electronics manufacturing, and high demand for medical-grade tantalum. Manufacturers are focusing on product innovation, recycling, and sustainable supply chains to meet evolving industry needs. Major players such as AMG Advanced Metallurgical Group, Cabot Corporation, and AMETEK are investing in high-purity tantalum production to cater to defense, aerospace, and electronics industries.

Canada Tantalum Market Insight

Canada contributes steadily to the regional market, supported by aerospace, electronics, and medical equipment industries. Domestic companies are increasing production of high-purity tantalum, alloy components, and advanced powders. Growing investments in mining, recycling, and sustainable processing methods are enhancing Canada’s market position while meeting the demand from North American manufacturers.

Europe Tantalum Market Insight

Europe is witnessing stable growth, driven by demand from automotive, electronics, and industrial machinery sectors. Countries such as Germany, France, and the U.K. are at the forefront of premium tantalum processing, with rising adoption in capacitors, semiconductors, and high-performance alloys. Stringent environmental regulations and focus on supply chain transparency support sustainable market expansion.

Germany Tantalum Market Insight

Germany leads Europe’s tantalum market, propelled by strong demand from automotive, aerospace, and electronic industries. Industrial manufacturers are adopting high-purity tantalum, advanced alloys, and sustainable sourcing practices. Investments in R&D, quality certifications, and precision engineering are further strengthening Germany’s market position within Europe.

U.K. Tantalum Market Insight

The U.K. market is expanding steadily, driven by aerospace, defense, and electronics sectors. Companies are focusing on sustainable tantalum sourcing, recycling programs, and specialty alloys for high-value applications. Innovation in capacitors, medical devices, and electronic components continues to attract manufacturers, reinforcing the U.K.’s share in the European market.

Which are the Top Companies in Tantalum Market?

The tantalum industry is primarily led by well-established companies, including:

- AMG Advanced Metallurgical Group N.V. (Netherlands)

- Alliance Mineral Assets Limited (Australia)

- China Minmetals Group Co., Ltd. (China)

- Global Advanced Metals Pty Ltd (Australia)

- MINSUR (Peru)

- CNMC Ningxia Orient Group Co. Ltd. (China)

- Pilbara Minerals (Australia)

- Piran Resources Limited (Australia)

- Tantalex Resources Corporation (U.S.)

- Admat Inc. (Canada)

- TeachNuclear (U.S.)

- Inframat Advanced Materials (U.S.)

- Ultra Minor Metals Ltd (Canada)

- By Mokawa Inc. (U.S.)

- U.S. Titanium Industry Inc. (U.S.)

- Ultramet (U.S.)

- High Performance Alloys, Inc. (U.S.)

- Talison Lithium Pty Ltd (Australia)

- Cabot Corporation (U.S.)

- AMETEK, Inc. (U.S.)

What are the Recent Developments in Global Tantalum Market?

- In March 2024, Narryer Metals acquired a 70% stake in two projects located in the Yellowknife Lithium Province in Northwest Territories, Canada, namely the Big Hill and Fran Projects, both containing mapped LCT pegmatites with potential for significant lithium and tantalum mineralization, marking a strategic expansion in North America’s lithium sector

- In January 2024, U.S.-based Tantalex Lithium Resources Corp. announced the successful production of its first batch of tin and tantalum concentrates from the TiTan alluvial plant in Manono, including 10 tons of high-grade, fully traceable tin concentrates (SnO2) and 2.5 tons of tantalum concentrates (Ta2O5), ready for export, demonstrating progress toward commercial-scale operations

- In October 2023, U.S.-based Vishay Intertechnology, Inc. launched a new series of wet capacitors featuring hermetic glass-to-metal seals for avionics and aerospace applications, offering enhanced reliability, improved military H-level shock and vibration resistance, and thermal shock tolerance up to 300 cycles, strengthening the company’s aerospace component portfolio

- In June 2023, Fort Wayne Metals, a manufacturer of precision wire-based materials and components, acquired equipment and assets from Austria’s Plansee SE to support tantalum production, enhancing its operational capabilities in high-performance materials manufacturing and diversifying its global supply chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Tantalum Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tantalum Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tantalum Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.