Global Tapping Sleeves Market

Market Size in USD Billion

CAGR :

%

USD

2.69 Billion

USD

4.00 Billion

2024

2032

USD

2.69 Billion

USD

4.00 Billion

2024

2032

| 2025 –2032 | |

| USD 2.69 Billion | |

| USD 4.00 Billion | |

|

|

|

|

Tapping Sleeves Market Size

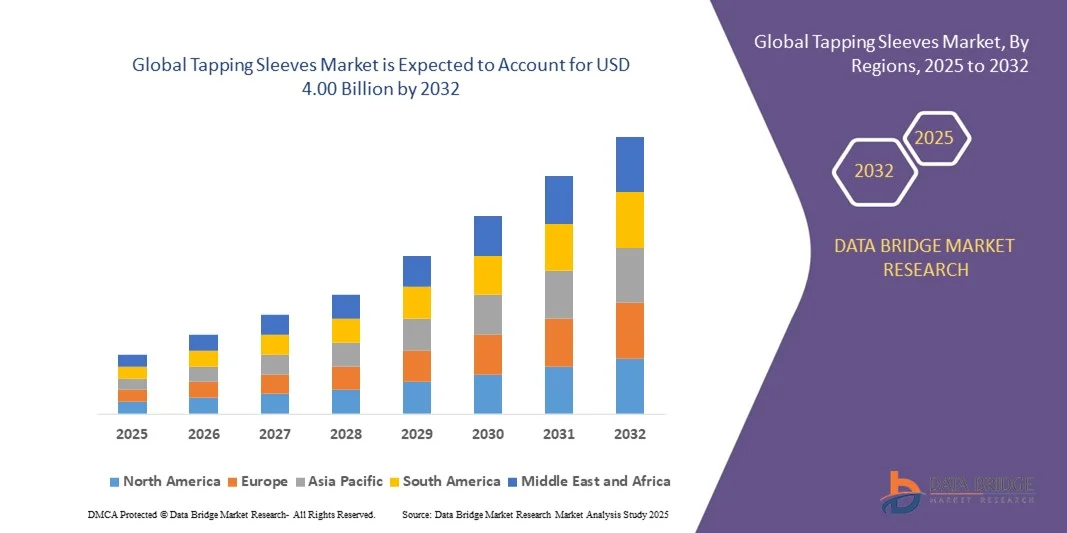

- The global tapping sleeves market size was valued at USD 2.69 billion in 2024 and is expected to reach USD 4.00 billion by 2032, at a CAGR of 3.85% during the forecast period

- The market growth is largely fuelled by the rising demand for water and wastewater infrastructure development across urban and rural regions

- Increasing investments in pipeline maintenance, expansion projects, and replacement of aging water distribution systems are also propelling market growth

Tapping Sleeves Market Analysis

- The tapping sleeves market is witnessing steady growth due to the increasing need for efficient pipeline connections in water, gas, and oil distribution networks

- Technological advancements in sleeve design, including lightweight materials and easy installation mechanisms, are improving operational efficiency and reducing downtime

- North America dominated the tapping sleeves market with the largest revenue share in 2024, driven by ongoing water infrastructure modernization, pipeline expansion projects, and rising investments in municipal and industrial water systems

- Asia-Pacific region is expected to witness the highest growth rate in the global tapping sleeves market, driven by rising industrialization, growing demand for durable and corrosion-resistant pipeline components, and the adoption of smart and automated tapping sleeve systems in emerging economies

- The steel segment held the largest market revenue share in 2024, driven by its superior corrosion resistance, high pressure-handling capacity, and suitability for a wide range of pipeline applications. Steel tapping sleeves are widely used in municipal and industrial water systems due to their durability and long service life under harsh conditions

Report Scope and Tapping Sleeves Market Segmentation

|

Attributes |

Tapping Sleeves Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tapping Sleeves Market Trends

Growing Integration of Smart Monitoring and Advanced Materials in Tapping Sleeves

- The increasing adoption of smart monitoring systems in water distribution networks is transforming the tapping sleeves market by improving leak detection, flow monitoring, and maintenance efficiency. Integrating IoT-enabled sensors within tapping sleeves enables utilities to collect real-time data, optimize operations, and reduce water loss due to pipeline leakage

- The demand for corrosion-resistant and high-performance materials such as stainless steel, epoxy-coated ductile iron, and composite alloys is rising. These advanced materials enhance durability, reduce maintenance costs, and ensure longevity, especially in harsh environmental conditions and high-pressure water systems

- Growing emphasis on sustainable infrastructure and efficient resource utilization is driving the development of eco-friendly tapping sleeve solutions. Manufacturers are increasingly focusing on recyclable materials and energy-efficient production processes to meet global environmental regulations

- For instance, in 2023, several municipal water authorities in Europe adopted stainless steel tapping sleeves equipped with leak detection sensors to enhance operational reliability and extend service life. This innovation significantly reduced downtime and improved the overall efficiency of pipeline maintenance

- While technological advancements are enhancing product performance, their market impact relies on affordability, compatibility with existing networks, and ease of installation. Manufacturers must prioritize modular, smart, and cost-effective designs to cater to the diverse needs of urban and rural water systems

Tapping Sleeves Market Dynamics

Driver

Rising Investments in Water Infrastructure and Pipeline Expansion Projects

- Increasing global investment in water and wastewater infrastructure modernization is a major driver for the tapping sleeves market. Governments and utilities are upgrading aging pipelines to meet growing urban water demands and improve distribution efficiency. As cities expand, the focus on minimizing water loss and ensuring uninterrupted supply continues to strengthen demand for robust tapping solutions

- The need for reliable and non-disruptive connection methods during maintenance and expansion projects has made tapping sleeves an essential component in water, oil, and gas pipelines. These solutions offer faster installation, lower operational downtime, and enhanced safety during live-tap procedures. This ensures efficient network expansion without interrupting critical services in densely populated areas

- Growing industrialization and urbanization in developing economies are further fueling demand for tapping sleeves that ensure safe and efficient pipeline branching, especially in large-scale infrastructure projects. Rapid industrial growth in Asia-Pacific and the Middle East is generating continuous replacement needs for older infrastructure, expanding opportunities for product adoption

- For instance, in 2022, the U.S. and Canada launched multiple pipeline rehabilitation projects under water infrastructure funding programs, significantly boosting the demand for advanced tapping sleeves across municipal and industrial sectors. Similar initiatives in Latin America and Europe are also focusing on reducing leakage rates and improving service life, propelling long-term market growth

- Although infrastructure expansion remains a strong growth catalyst, long-term adoption depends on consistent product innovation, cost optimization, and adherence to regional compliance standards. Manufacturers that emphasize standardized installation methods and sustainable designs are more likely to benefit from government-led modernization efforts

Restraint/Challenge

High Installation and Maintenance Costs Associated with Advanced Tapping Sleeves

- The high initial cost of premium-grade tapping sleeves, particularly those made from stainless steel or designed for high-pressure applications, remains a key challenge for small utilities and developing regions. Budget limitations often push organizations toward low-cost, less durable alternatives, which can compromise long-term reliability and performance

- Installation of large-diameter or specialty tapping sleeves requires skilled technicians and precision tools, which can increase labor costs and project timelines. In many regions, especially developing economies, the lack of standardized training programs further complicates deployment, increasing dependency on imported expertise and specialized contractors

- Supply chain disruptions, especially in sourcing specialized alloys and components, further add to the production and installation cost burden, affecting market penetration. Raw material volatility and transportation delays have led to fluctuating project budgets, forcing utilities to defer modernization plans

- For instance, in 2023, several water utilities in Southeast Asia reported project delays due to elevated material costs and a shortage of trained personnel, leading to slower deployment of modern tapping sleeve systems. Similar challenges have been observed in Africa and parts of Latin America, where supply constraints and currency fluctuations hinder consistent equipment availability

- While manufacturers continue to introduce cost-effective and modular solutions, addressing affordability, installation efficiency, and skill development will be essential to ensure widespread adoption of tapping sleeves globally. Strategic partnerships with training institutions and local distributors could bridge capability gaps and reduce long-term operational challenges

Tapping Sleeves Market Scope

The market is segmented on the basis of material, inches, fluid motion, and application.

- By Material

On the basis of material, the tapping sleeves market is segmented into steel, ductile iron, and cast iron. The steel segment held the largest market revenue share in 2024, driven by its superior corrosion resistance, high pressure-handling capacity, and suitability for a wide range of pipeline applications. Steel tapping sleeves are widely used in municipal and industrial water systems due to their durability and long service life under harsh conditions.

The ductile iron segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its strength, flexibility, and cost-effectiveness compared to other materials. Ductile iron tapping sleeves are increasingly preferred for medium-pressure pipelines and expansion projects, offering a balance between performance and affordability.

- By Inches

On the basis of inches, the tapping sleeves market is segmented into 1–10, 11–20, 21–30, 31–40, and above 40. The 1–10 inches segment held the largest market revenue share in 2024, primarily due to its extensive use in small-diameter pipelines for municipal and residential applications. Compact tapping sleeves in this range are ideal for service connections and maintenance activities in urban distribution networks.

The 11–20 inches segment is expected to register the fastest growth rate from 2025 to 2032, supported by the increasing adoption of mid-range tapping sleeves in industrial and commercial water infrastructure projects. These products offer flexibility in connecting to moderate-sized mains, ensuring safe and efficient branching without system shutdowns.

- By Fluid Motion

On the basis of fluid motion, the tapping sleeves market is segmented into liquid, gas, and oil. The liquid segment dominated the market in 2024, driven by its extensive use in water distribution and wastewater systems worldwide. Growing investments in urban water supply networks and the need for non-disruptive pipeline tapping solutions are boosting demand in this category.

The gas segment is expected to register the fastest growth rate from 2025 to 2032, owing to expanding natural gas distribution networks and rising demand for safe and leak-proof pipeline connections. Tapping sleeves designed for gas applications are gaining traction due to their precision sealing, corrosion resistance, and compatibility with pressurized systems.

- By Application

On the basis of application, the tapping sleeves market is segmented into drinking water distribution, wastewater systems, gas solution, and petroleum solution. The drinking water distribution segment held the largest market share in 2024, driven by the growing need for reliable water supply infrastructure and rehabilitation of aging pipeline systems across urban and rural areas.

The gas solution segment is expected to register the fastest growth rate from 2025 to 2032, fueled by rising energy infrastructure investments and the expansion of gas transmission lines. Tapping sleeves in this segment provide secure, maintenance-friendly connections for high-pressure gas pipelines, supporting efficiency and operational safety.

Tapping Sleeves Market Regional Analysis

- North America dominated the tapping sleeves market with the largest revenue share in 2024, driven by ongoing water infrastructure modernization, pipeline expansion projects, and rising investments in municipal and industrial water systems

- Utilities and industrial operators in the region highly value the reliability, corrosion resistance, and operational efficiency offered by advanced tapping sleeves, including smart monitoring-enabled solutions

- This widespread adoption is further supported by regulatory standards, high technical expertise, and the growing focus on sustainable and leak-free water distribution networks, establishing tapping sleeves as essential components in both urban and industrial applications

U.S. Tapping Sleeves Market Insight

The U.S. tapping sleeves market captured the largest revenue share in North America in 2024, fueled by extensive investments in water infrastructure and pipeline rehabilitation projects. Utilities are increasingly prioritizing smart and corrosion-resistant tapping sleeve solutions to ensure operational efficiency and reduce downtime. The adoption of automated, high-durability materials, and IoT-enabled monitoring systems is significantly enhancing network reliability. Furthermore, government funding programs and industrial modernization initiatives are driving faster deployment of advanced tapping sleeves across municipal, gas, and petroleum networks.

Europe Tapping Sleeves Market Insight

The Europe tapping sleeves market is expected to register the fastest growth rate from 2025 to 2032, primarily driven by stringent infrastructure regulations and the growing emphasis on sustainable water and industrial networks. Urbanization, coupled with the need for high-performance pipeline connections, is fostering adoption. European utilities and industrial operators are drawn to corrosion-resistant materials and smart monitoring systems, which improve operational efficiency and extend service life. The region is witnessing significant growth across drinking water, wastewater, and petroleum pipeline applications.

U.K. Tapping Sleeves Market Insight

The U.K. tapping sleeves market is expected to register the fastest growth rate from 2025 to 2032, driven by government initiatives to upgrade aging water networks and industrial pipeline systems. Rising awareness of water conservation and leak prevention is encouraging utilities to adopt smart and durable tapping sleeve solutions. The availability of skilled technicians and strong e-commerce and procurement channels further supports market growth, particularly for high-performance and modular tapping sleeves.

Germany Tapping Sleeves Market Insight

The Germany tapping sleeves market is expected to register the fastest growth rate from 2025 to 2032, fueled by growing urbanization, industrialization, and infrastructure modernization. German utilities emphasize corrosion-resistant, high-quality materials and integration with smart monitoring systems for water and industrial networks. The adoption of advanced, modular, and durable tapping sleeves ensures efficient operations, reduces downtime, and aligns with sustainability goals, driving consistent market growth.

Asia-Pacific Tapping Sleeves Market Insight

The Asia-Pacific tapping sleeves market is expected to register the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising industrial and construction activities, and significant investments in water and gas infrastructure. Countries such as China, Japan, and India are increasingly adopting smart monitoring-enabled and high-performance tapping sleeves to improve pipeline reliability and operational efficiency. Growing government initiatives for digitalization and leak prevention, along with the availability of cost-effective local manufacturing, are expanding the market’s reach across municipal, gas, and petroleum sectors.

Japan Tapping Sleeves Market Insight

The Japan tapping sleeves market is expected to register the fastest growth rate from 2025 to 2032 due to the country’s technologically advanced infrastructure, rapid urbanization, and increasing demand for precision and reliability in pipeline systems. Utilities and industrial operators prioritize smart, corrosion-resistant, and modular tapping sleeve solutions to reduce downtime and improve maintenance efficiency. Japan’s focus on sustainable water management and integration of IoT-enabled monitoring systems is further propelling market adoption.

China Tapping Sleeves Market Insight

The China tapping sleeves market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, rising industrial and construction activities, and substantial government investments in water, gas, and petroleum infrastructure. Chinese utilities and industrial sectors are increasingly adopting corrosion-resistant, high-durability tapping sleeves with smart monitoring capabilities. The push towards smart cities, large-scale infrastructure projects, and domestic manufacturing of advanced tapping sleeves are key factors driving market growth.

Tapping Sleeves Market Share

The Tapping Sleeves industry is primarily led by well-established companies, including:

- Mueller Water Products, Inc. (U.S.)

- American Cast Iron Pipe Company (U.S.)

- Ford Meter Box Company, Inc. (U.S.)

- PowerSeal Corporation (U.S.)

- JCM Industries Inc. (U.S.)

- Romac Industries, Inc. (U.S.)

- Robar Industries Ltd. (U.S.)

- Petersen Products Co. (U.S.)

- UTS Engineering (U.S.)

- Everett J. Prescott, Inc. (U.S.)

- Total Piping Solutions (U.S.)

- Kennedy Valve Company (U.S.)

- PipeMan Products, Inc. (U.S.)

- Cascade Waterworks Mfg. (U.S.)

- Smith-Blair, Inc. (U.S.)

- LB Water (U.S.)

- GF Piping Systems (Switzerland)

- APAC International Corporation (U.S.)

- Tracon International BV (Netherlands)

- Guhring, Inc. (Germany)

- La Buvette (France)

- U.S. Pipe (U.S.)

Latest Developments in Global Tapping Sleeves Market

- In January 2025, American Cast Iron Pipe Company executed a strategic acquisition of C&B Piping, Inc., a leading manufacturer in the piping industry. This move aims to expand the company’s product portfolio, enhance its manufacturing capabilities, and strengthen its market presence across North America. The acquisition is expected to improve operational efficiency, provide a broader range of solutions to customers, and drive competitive advantage in the tapping sleeves and pipeline fittings market. By integrating C&B Piping’s expertise, the company is positioned to meet growing infrastructure demands and capitalize on emerging opportunities in water distribution and industrial applications

- In April 2024, Everett J. Prescott, Inc. (Team EJP) announced an expansion of its exclusive distribution partnership with Kamstrup to cover 13 U.S. states. This development establishes Team EJP as Kamstrup’s largest distributor in these regions, aiming to enhance product accessibility and service coverage. The expanded collaboration enables faster deployment of advanced metering and pipeline solutions, improves customer support, and strengthens the company’s market influence in water infrastructure and smart utility management sectors. This strategic alignment is expected to drive sales growth and increase market penetration across the U.S

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.