Global Tax And Accounting Software Market

Market Size in USD Million

CAGR :

%

USD

25,077.24 Million

USD

46,416.22 Million

2022

2030

USD

25,077.24 Million

USD

46,416.22 Million

2022

2030

| 2023 –2030 | |

| USD 25,077.24 Million | |

| USD 46,416.22 Million | |

|

|

|

|

Tax and Accounting Software Market Analysis and Size

Online websites are ranking the most popular tax and accounting software based on their disadvantages, advantages and pricing. This is assisting business owners to make a well-versed decision. Moreover, the increasing demand for mobile-based tax and accounting software is also enhancing the market growth. It has been witnessed that the web-based segment is expected to be the fastest-growing product segment during the forecast period due to its low cost as compared to another other type of tax and accounting software.

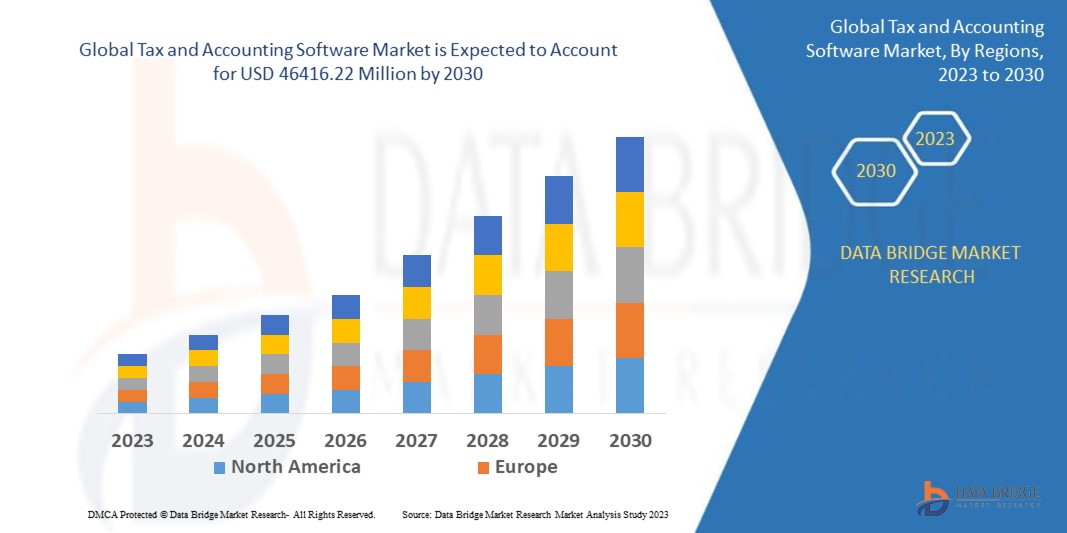

Data Bridge Market Research analyses that the tax and accounting software market is expected to reach USD 46416.22 million by 2030, which is USD 25077.24 million in 2022, at a CAGR of 8.00% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Tax and Accounting Software Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Web-based, Installed, I-Phone Operating System (iOS), Android), Deployment Model (0n-Premises, Cloud), Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), Application (Personal Use, General Company, Listed Company, Government, Others), End User (Healthcare, Manufacturing, Retail and Consumer Goods, IT and Telecommunications, BFSI, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Microsoft (U.S.), Orcale (U.S.), SAP SE (U.S.), Zoho Corporation Pvt. Ltd. (India), Xerox Corporation (U.S.), Chetu Inc. (U.S.), Avalara, Inc. (U.S.), Acumatica, Inc (U.S.), KingstonKnight (Australia), CCH (Australia), Tally Solutions Private Limited (India), Red Wing Software, Inc. (U.S.), Unit4 (Australia), Epicor Software Corporation (U.S.), Intuit Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

Tax and accounting software is a program used to manage finances, comprising tax payments and many other accounting tasks. This type of software can aid to track business expenditures and properly organize financial data. It can also aid with preparing tax returns.

Tax and Accounting Software Market

Drivers

- Increasing popularity of seamless invoicing and billing process

Invoicing and billing are important business processes and the principal source of revenue for companies. If done manually, managing invoices on paper is time-consuming, prone to mistakes and inconvenient. It is impossible to make real invoices for every time a client buys from a user when a user has recurring orders. Reminding consumers of pending payments and tracking bills is challenging without automated tools. Tax and accounting software proficiently addresses these issues and provides properties that simplify invoicing. For regular client orders, users may form recurring profiles and then plan invoices to be sent out immediately every time the order is placed. Consumers can also enhance payment terms and conditions to the invoices to let to know what to customers expect when it comes to payments. Thus, the rising popularity of seamless invoicing and billing process is expected to drive the market growth rate during the forecast period.

Opportunities

- Surging demand for cloud-based software to record real-time adjustments in work papers

Several high-end companies demand real-time global data availability, which will provide them with numerus opportunities, obligations and risks n tax payments. In order to fulfil these demands, companies in the tax and accounting software market are offering platforms that help gather data from unstructured and structured sources. With the goal of capitalizing on revenue opportunities, businesses are offering cloud-enabled platforms, for instance, Microsoft Azure. As such, evolving players and start-ups are posing a competition to established software businesses in the tax and accounting software market. Cloud-based software platforms allow flexibility and scalability for businesses. Now, companies are providing software that compliance to industry standards and facilitates co-sourcing. They are innovating in software that aid users to calculate taxes as per the right service and right geography. Cloud-based software aid to record real-time adjustments in work papers which will create numerous growth opportunities for the market growth.

Restraints

- Multiple issues associated with tax and accounting software Market

Rise in the dependency on digital communication and e-payment methods is leading to data security concerns which is anticipated to act as major restrictions for the growth of the tax and accounting software during the forecasted period, while the increase in concerns related to networking issues can challenge the market growth in the forecast period of 2023 to 2030.

This tax and accounting software market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the tax and accounting software market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Global Tax and Accounting Software Market

The ongoing outbreak of COVID-19 outbreak has compelled people in staying at home. Following the closure of factories, shutting down of businesses, and the trend of work from home, the global economy had decreased. The use of technology is being made at the utmost during such challenging times, As a result of physical distancing requirements, professionals dealing with tax and accounting. The accounting systems allow people to work from home, keep production on track at the facility and manage demand patterns effectively. This is a main advantage at the time of the pandemic. Shifting accounting procedure into cloud will allow people in saving everything easily in online database that can be accessed from anyplace, hence making it easy for teams to collaborate all over the globe. This in turn will have a positive effect on the market size.

Recent Development

- In 2021, Cygnet Infotech, a business software maker, has reorganised its Financial Accounting Comprehensive and Easy (FACE) accounting software platform.

Global Tax and Accounting Software Market Scope

The tax and accounting software market is segmented on the basis of product, deployment model, organization size, application and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Web-based

- Installed

- I-Phone Operating System (iOS)

- Android

Deployment Model

- 0n-Premises

- Cloud

Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

Application

- Personal Use

- General Company

- Listed Company

- Government

- Others

End User

- Healthcare

- Manufacturing

- Retail and Consumer Goods

- IT and Telecommunications

- BFSI

- Others

Tax and Accounting Software Market Regional Analysis/Insights

The tax and accounting software market is analyzed and market size insights and trends are provided by country, product, deployment model, organization size, application and end user as referenced above.

The countries covered in the tax and accounting software market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the tax and accounting software market in terms of revenue and market owing to the growth in IT offices, rapid industrialization, and strong presence of leading accounting software players in this region.

Asia-Pacific will continue to project the highest compound annual growth rate during the forecast period of 2023-2030 owing to growth in the usage of cloud computing solutions and technologies and increase in penetration of business accounting mobile applications in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Tax and Accounting Software Market Share Analysis

The tax and accounting software market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to tax and accounting software market.

Some of the major players operating in the tax and accounting software market are:

- Microsoft (U.S.)

- Orcale (U.S.)

- SAP SE (U.S.)

- Zoho Corporation Pvt. Ltd. (India)

- Xerox Corporation (U.S.)

- Chetu Inc. (U.S.)

- Avalara, Inc. (U.S.)

- Acumatica, Inc (U.S.)

- KingstonKnight (Australia)

- CCH (Australia)

- Tally Solutions Private Limited (India)

- Red Wing Software, Inc. (U.S.)

- Unit4 (Australia)

- Epicor Software Corporation (U.S.)

- Intuit Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.