Global Tax Tech Market

Market Size in USD Billion

CAGR :

%

USD

34.40 Billion

USD

85.78 Billion

2024

2032

USD

34.40 Billion

USD

85.78 Billion

2024

2032

| 2025 –2032 | |

| USD 34.40 Billion | |

| USD 85.78 Billion | |

|

|

|

|

Tax Tech Market Size

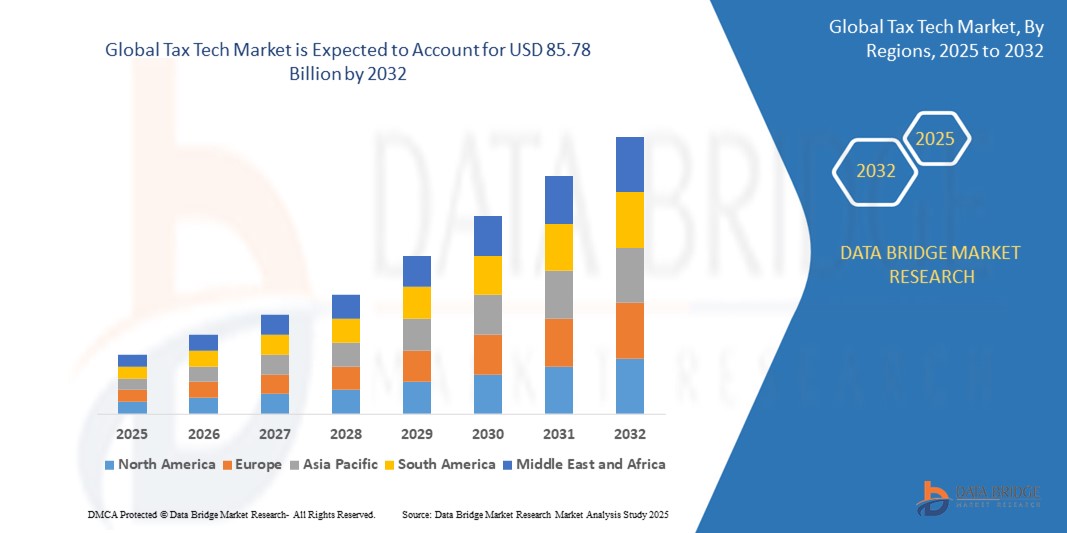

- The global tax tech market size was valued at USD 34.4 billion in 2024 and is expected to reach USD 85.78 billion by 2032, at a CAGR of 12.10% during the forecast period

- The market growth is largely fuelled by the increasing digitalization of tax systems, rising demand for automated tax compliance and reporting solutions, and growing regulatory complexities across jurisdictions

- In addition, the adoption of AI, machine learning, and cloud-based platforms is transforming tax processes, enabling real-time data analysis, enhanced accuracy, and improved decision-making for enterprises and tax authorities

Tax Tech Market Analysis

- The tax technology market is witnessing a steady transformation as organizations increasingly move towards integrated, digital tax solutions that streamline compliance and reporting processes

- Growing demand for real-time tax analytics and end-to-end automation is reshaping how businesses manage their tax obligations across multiple systems and platforms

- North America dominated the global tax tech market in 2024, driven by early adoption of digital tax systems and advanced enterprise software infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global tax tech market, driven by digitalization initiatives, increasing regulatory reforms, and growing demand for automated tax compliance across emerging economies such as India, China, and Indonesia

- The solution segment held the largest market revenue share in 2024, driven by increasing demand for automated tax compliance tools and the integration of artificial intelligence for improved accuracy and speed in processing tax data. Businesses increasingly adopt end-to-end tax management platforms to streamline reporting, calculation, and regulatory compliance

Report Scope and Tax Tech Market Segmentation

|

Attributes |

Tax Tech Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Tax Tech Market Trends

“Increased Adoption of Cloud-Based Tax Solutions”

- Organizations are increasingly adopting cloud-based tax solutions to enhance flexibility, scalability, and real-time access to tax data across multiple jurisdictions

- Cloud platforms allow seamless integration with other financial systems, enabling automated tax calculations, compliance checks, and reporting from a centralized dashboard

- For instance, companies such as Thomson Reuters and Wolters Kluwer offer cloud-native tax solutions that support real-time updates and regulatory changes, helping businesses stay compliant

- These solutions are particularly useful for multinational corporations dealing with diverse tax regimes, as cloud systems simplify data consolidation and reduce manual errors

- For instance, mid-sized enterprises are leveraging cloud tax platforms to lower operational costs while gaining enterprise-grade features such as AI-powered tax forecasting and advanced audit trails

Tax Tech Market Dynamics

Driver

“Rising Complexity in Global Tax Regulations”

- The rising complexity of global tax regulations is a key driver for tax tech adoption, as businesses expanding internationally face diverse rules and frequent updates

- Advanced tax technologies help organizations manage compliance across jurisdictions through real-time updates, automated calculations, and accurate reporting

- These solutions reduce the risk of human error and enhance efficiency in managing intricate tax obligations, particularly in highly regulated industries such as finance

- With the emergence of digital taxation models, such as VAT e-invoicing mandates in countries such as Italy, companies are turning to tax tech for faster adaptation

- Governments moving toward real-time tax enforcement and digital audits are pushing businesses to invest in intelligent, scalable systems to maintain compliance and avoid penalties

Restraint/Challenge

“High Implementation and Integration Costs”

- High implementation and integration costs pose a major challenge to the adoption of tax tech, especially among small and medium-sized enterprises

- Deploying enterprise-grade tax solutions involves licensing, customization, training, and system integration, which require substantial upfront investment

- Integrating new tax technology with legacy ERP or financial systems can be technically complex, often disrupting operations and requiring third-party IT support

- Concerns around data security, compliance risks, and uncertain return on investment lead to hesitancy among organizations to fully adopt tax tech

- Frequent tax regulation updates, such as digital compliance requirements in regions such as the European Union, demand ongoing upgrades and support, increasing long-term operational costs

Tax Tech Market Scope

The market is segmented on the basis of offering, deployment mode, tax type, organization type, and vertical.

- By Offering

On the basis of offering, the tax tech market is segmented into solution and professional services. The solution segment held the largest market revenue share in 2024, driven by increasing demand for automated tax compliance tools and the integration of artificial intelligence for improved accuracy and speed in processing tax data. Businesses increasingly adopt end-to-end tax management platforms to streamline reporting, calculation, and regulatory compliance.

The professional services segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the need for expert guidance in system implementation, data migration, and regulatory consulting. As global tax rules evolve, firms seek advisory and support services to tailor tax tech solutions to specific jurisdictions and business needs, especially across multi-regional operations.

- By Deployment Mode

On the basis of deployment mode, the tax tech market is segmented into cloud and on-premises. The cloud segment held the largest revenue share in 2024, propelled by scalability, remote access, and reduced IT infrastructure costs. Cloud-based tax tech solutions enable real-time updates and facilitate seamless integration with other cloud accounting or ERP platforms.

The on-premises segment is expected to witness the fastest growth rate from 2025 to 2032, supported by demand from highly regulated industries and government entities requiring internal data control. Some large enterprises continue to favor on-premises models due to concerns over data security, customization, and internal compliance mandates.

- By Tax Type

On the basis of tax type, the tax tech market is segmented into direct tax and indirect tax. The indirect tax segment accounted for the largest market share in 2024, fueled by the complexity of value-added tax, goods and services tax, and sales tax regulations across jurisdictions. Businesses increasingly depend on digital solutions to manage real-time filings, calculations, and e-invoicing.

The direct tax segment is expected to witness the fastest growth rate from 2025 to 2032, driven by advancements in digital reporting tools for income and corporate taxes. As more tax authorities adopt e-filing and digital audit practices, demand for accurate and compliant direct tax solutions is on the rise.

- By Organization Type

On the basis of organization type, the tax tech market is segmented into large enterprises and SMEs. Large enterprises held the dominant revenue share in 2024 due to their complex tax structures, multi-country operations, and higher budget allocation for automation and compliance systems. These companies require scalable platforms to streamline cross-border tax functions and audit readiness.

The SME segment is expected to witness the fastest growth rate from 2025 to 2032, supported by growing awareness of compliance risks and the emergence of affordable, user-friendly tax tech solutions. Cloud-based tax platforms are gaining traction among small and medium-sized businesses for their ease of use and cost-effectiveness.

- By Vertical

On the basis of vertical, the tax tech market is segmented into BFSI, IT & telecom, manufacturing, retail & e-commerce, energy & utilities, healthcare & life sciences, government & public sector, and others. The BFSI segment dominated the market in 2024, driven by stringent financial regulations and the need for accurate tax processing across diversified investment portfolios. Financial institutions adopt robust tax engines to ensure transparency and reduce manual errors.

The retail and e-commerce segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing cross-border transactions and dynamic indirect tax requirements. Tax tech helps online retailers stay compliant with digital VAT and sales tax rules in multiple regions, ensuring smooth operations and reduced penalties.

Tax Tech Market Regional Analysis

- North America dominated the global tax tech market in 2024, driven by early adoption of digital tax systems and advanced enterprise software infrastructure

- Organizations in the region prioritize compliance automation and real-time reporting capabilities, leveraging integrated tax platforms to streamline processes across multiple jurisdictions

- Growth is further supported by robust investments in cloud-based technologies, increased regulatory scrutiny, and a tech-savvy enterprise environment across industries such as finance, retail, and healthcare

U.S. Tax Tech Market Insight

The U.S. held the largest revenue share within North America in 2024, propelled by rapid advancements in tax digitalization and the rising demand for transparent, automated reporting systems. Enterprises are increasingly adopting AI-powered tax solutions to reduce manual errors, ensure compliance with IRS and state-level mandates, and handle multi-state sales tax complexities. A growing ecosystem of tax software vendors and regulatory technology innovations continues to support widespread deployment across sectors

Europe Tax Tech Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, driven by evolving tax regimes and stringent reporting requirements such as mandatory e-invoicing and digital VAT compliance. Businesses in the region are increasingly investing in tax platforms to manage cross-border transactions and stay aligned with shifting regulatory frameworks. Tax automation is gaining traction across industries including manufacturing, energy, and retail

U.K. Tax Tech Market Insight

The U.K. tax tech market is expected to witness the fastest growth rate from 2025 to 2032, due to the expansion of the Making Tax Digital (MTD) initiative and the rising adoption of cloud-based tax solutions. As businesses focus on digital recordkeeping and seamless tax submissions to HMRC, demand for intelligent compliance tools is increasing. Accounting firms and SMEs are particularly turning to automated platforms to reduce administrative burdens and improve filing accuracy

Germany Tax Tech Market Insight

The Germany market is set to experience significant growth in the tax tech space as companies seek solutions to address intricate tax codes and comply with local digital reporting mandates. The strong presence of multinational corporations and a regulatory focus on digitization contribute to higher adoption rates. Local businesses are also prioritizing the integration of tax software with ERP systems to support real-time compliance and reduce audit risks

Asia-Pacific Tax Tech Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, supported by ongoing digital transformation initiatives in countries such as India, China, and Japan. Governments across the region are pushing for greater tax transparency and digital infrastructure, accelerating demand for automated filing, GST compliance, and e-invoicing tools. Increased investment in cloud computing and fintech platforms is further driving market expansion

Japan Tax Tech Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032, underpinned by its advanced IT infrastructure and government-backed digital reforms. Enterprises are turning to AI-powered tax solutions to improve accuracy and adapt to evolving consumption tax policies. The demand for seamless integration between accounting systems and tax platforms is rising across both large corporations and small businesses

China Tax Tech Market Insight

The China led the Asia-Pacific region in market revenue share in 2024, driven by its accelerated push for e-invoicing, digital tax audits, and smart city initiatives. Local enterprises are investing in intelligent tax platforms to meet evolving regulatory requirements and streamline VAT processing. The presence of leading domestic software providers and widespread digitization across industries continue to support robust market growth

Tax Tech Market Share

The Tax Tech industry is primarily led by well-established companies, including:

- Wolters Kluwer (Netherlands)

- SOVOS (U.S.)

- Corvee (U.S.)

- H&R Block (U.S.)

- Intuit (U.S.)

- TaxSlayer (U.S.)

- Avalara (U.S.)

- Xero (New Zealand)

- Fonoa (Ireland)

- Vertex (U.S.)

- TaxBit (U.S.)

- Token Tax (U.S.)

- Thomson Reuters (Canada)

- Ryan (U.S.)

- Drake Software (U.S.)

- SAP (Germany)

- TaxAct (U.S.)

- TaxJar (U.S.)

- ADP (U.S.)

- Anrok (U.S.)

- Picnic Tax (U.S.)

Latest Developments in Global Tax Tech Market

- In March 2025, Xero announced a partnership with Parolla to introduce free VAT3 return and SEPA payment solutions for Irish users. This development allows direct VAT3 submissions to Revenue Online Services and facilitates supplier payments via SEPA-compliant files. The tools, available to Xero Business Edition and Cashbook users, enhance tax automation and accuracy. Webinars held in mid-March showcased these features, supporting Xero’s broader “Committed to Ireland” initiative.

- In January 2025, Thomson Reuters completed the acquisition of SafeSend, a U.S.-based cloud-native tax automation provider, for USD 600 million. SafeSend, widely used by leading accounting firms, streamlines the final steps in tax return processing. The acquisition boosts Thomson Reuters’ automation capabilities and strengthens its tax workflow solutions, positioning the company for continued revenue growth and improved customer efficiency

- In January 2025, Wolters Kluwer integrated its AI-powered CCH AnswerConnect with CCH iFirm in Canada, marking a regional first. This integration offers in-workflow AI-driven research and tailored tax answers to professionals, reducing dependence on external sources and improving tax season productivity. Available in both English and French, the solution reflects Wolters Kluwer’s focus on advancing digital transformation in tax services

- In December 2024, Avalara acquired Brazil-based Oobj Tecnologia da Informação Ltda to expand its global e-invoicing capabilities. The deal extends Avalara’s presence across six Latin American countries and strengthens endpoint connectivity in Brazil. Oobj will remain a standalone product but will integrate with Avalara’s E-Invoicing and Live Reporting solution, offering businesses a unified global API for streamlined compliance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.