Global Taxane Based Oncology Drug Class Market

Market Size in USD Billion

CAGR :

%

USD

7.21 Billion

USD

10.25 Billion

2025

2033

USD

7.21 Billion

USD

10.25 Billion

2025

2033

| 2026 –2033 | |

| USD 7.21 Billion | |

| USD 10.25 Billion | |

|

|

|

|

Taxane-Based Oncology Drug Class Market Size

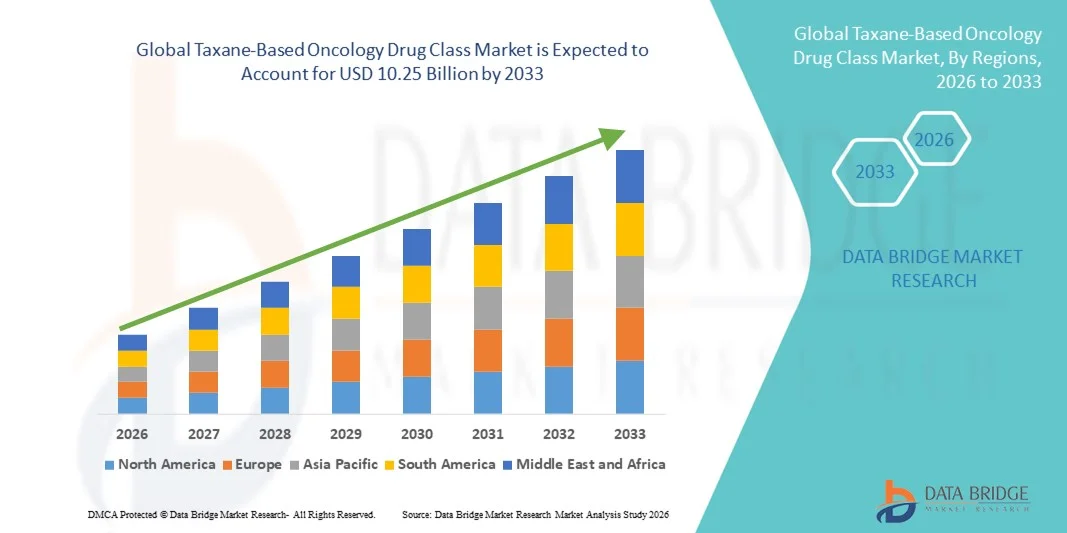

- The global taxane-based oncology drug class market size was valued at USD 7.21 billion in 2025 and is expected to reach USD 10.25 billion by 2033, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by the increasing incidence of cancers technological advancements in drug formulation and delivery and broader clinical adoption in oncology care

- Furthermore, growing healthcare infrastructure investment, expanding generic drug availability, and heightened demand for effective chemotherapeutic regimens are establishing taxane‑based drugs as critical components in modern cancer therapy. These converging factors are accelerating uptake of taxane therapies, thereby significantly boosting the industry’s growth

Taxane-Based Oncology Drug Class Market Analysis

- Taxane‑based oncology drugs, including paclitaxel, docetaxel, and cabazitaxel, are critical chemotherapeutic agents used across multiple cancer indications such as breast, ovarian, prostate, and non-small cell lung cancer, offering targeted anti-mitotic activity and improved patient outcomes, making them essential components of modern oncology treatment protocols

- The escalating demand for taxane therapies is primarily fueled by the rising global incidence of cancer, technological advancements in drug formulation and delivery and increased clinical adoption in standard treatment regimens

- North America dominated the taxane market with the largest revenue share of 38.5% in 2025, characterized by advanced healthcare infrastructure, strong R&D investments, and high adoption of innovative oncology therapies, with the U.S. showing substantial growth in taxane usage across hospitals and specialty cancer centers, driven by established pharmaceutical companies and emerging biotech firms

- Asia-Pacific is expected to be the fastest-growing region in the taxane market during the forecast period due to rising cancer prevalence, improving healthcare access, increasing healthcare expenditure, and expanding adoption of modern chemotherapy protocols in countries such as China and India

- Paclitaxel segment dominated the taxane-based oncology drug class market with the largest market share of 41.9% in 2025, driven by its long-standing clinical efficacy, extensive availability of generic versions, and broad adoption across multiple cancer indications

Report Scope and Taxane-Based Oncology Drug Class Market Segmentation

|

Attributes |

Taxane-Based Oncology Drug Class Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Taxane-Based Oncology Drug Class Market Trends

Advancements in Nanoparticle and Liposomal Formulations

- A significant and accelerating trend in the global taxane market is the development of nanoparticle and liposomal drug delivery systems, which enhance bioavailability, reduce toxicity, and improve treatment outcomes for cancer patients

- For instance, nab-paclitaxel (Abraxane) utilizes albumin-bound nanoparticles to allow higher tumor penetration and lower solvent-related side effects, improving patient tolerability and clinical efficacy

- Advanced formulations enable targeted delivery, minimizing systemic exposure and adverse reactions, and supporting combination therapies with other chemotherapeutic or immunotherapeutic agents

- The integration of these novel formulations with personalized oncology protocols facilitates better adherence and optimized dosing schedules, improving overall patient care and survival rates

- This trend towards more sophisticated, targeted, and safer taxane therapies is reshaping clinical expectations and treatment standards, consequently driving pharmaceutical companies such as Celgene and Teva to innovate with next-generation taxane formulations

- The demand for advanced taxane formulations with improved safety and efficacy profiles is growing rapidly across both developed and emerging markets, as healthcare providers prioritize clinical outcomes and patient quality of life

- Collaboration between biotech firms and oncology hospitals to develop combination therapies of taxanes with immunotherapy is emerging as a key trend, enhancing treatment effectiveness and expanding the addressable patient base

Taxane-Based Oncology Drug Class Market Dynamics

Driver

Rising Global Cancer Prevalence and Expanding Treatment Adoption

- The increasing incidence of cancers worldwide, particularly breast, ovarian, lung, and prostate cancer, is a major driver for the heightened demand for taxane therapies

- For instance, in March 2025, Bristol Myers Squibb reported increased uptake of paclitaxel-based regimens across oncology centers in North America and Europe, reflecting growing treatment adoption

- As healthcare providers prioritize evidence-based chemotherapy protocols, taxane drugs offer clinically proven efficacy across multiple indications, making them a cornerstone in modern cancer therapy

- Furthermore, expanding healthcare infrastructure and oncology centers, especially in emerging regions, is facilitating broader access to taxane treatments, improving patient reach

- The rising preference for combination therapies and personalized oncology protocols further strengthens demand, with taxanes commonly integrated into multi-agent regimens for improved patient outcomes

- Government initiatives, awareness programs, and insurance coverage expansion in cancer treatment are also accelerating taxane adoption globally, driving market growth across regions

- Increasing approvals of biosimilar taxanes in multiple countries are lowering costs and expanding access, further stimulating market adoption

- The rising trend of early cancer detection and screening programs is boosting demand for effective chemotherapy options such as taxanes, ensuring timely intervention and improved survival rates

Restraint/Challenge

Adverse Effects and High Treatment Costs

- The significant toxicity associated with taxane therapies, including neutropenia, neuropathy, and hypersensitivity reactions, poses a challenge to broader market penetration

- For instance, reports of chemotherapy-induced peripheral neuropathy in patients receiving docetaxel have led to dose reductions or therapy discontinuation, limiting treatment flexibility

- Mitigating these side effects requires premedication, specialized monitoring, and supportive care, increasing the complexity of treatment and the burden on healthcare providers

- In addition, the high cost of branded taxane drugs, especially novel formulations or biosimilars in early launch phases, can restrict patient access, particularly in developing markets

- While generic versions are becoming more available, premium formulations with enhanced safety and targeted delivery still carry a price premium, affecting affordability

- Addressing these challenges through improved patient management, biosimilar expansion, and cost-effective treatment strategies will be critical for sustained market growth

- Complex regulatory approval processes in key markets such as the U.S. and EU may delay the launch of new taxane formulations, affecting market expansion

- Limited awareness and expertise in advanced taxane therapy protocols in emerging markets can slow adoption, requiring education and training initiatives for healthcare providers

Taxane-Based Oncology Drug Class Market Scope

The market is segmented on the basis of type, application, formulations, and end user.

- By Type

On the basis of type, the taxane-based oncology drug class market is segmented into Paclitaxel, Docetaxel, and Cabazitaxel. The Paclitaxel segment dominated the market with the largest revenue share of 41.9% in 2025, driven by its long-standing clinical efficacy across multiple cancer indications, including breast, ovarian, and lung cancers. Paclitaxel’s broad adoption is supported by the availability of generic versions, established clinical protocols, and extensive physician familiarity, making it the preferred choice in oncology centers worldwide. Its integration in combination therapies and compatibility with novel formulations such as nanoparticles and albumin-bound delivery systems further strengthens its dominance. The segment also benefits from ongoing research on enhancing its efficacy while minimizing toxicity, boosting its sustained demand in both developed and emerging markets.

The Cabazitaxel segment is expected to witness the fastest growth rate of 12.5% from 2026 to 2033, fueled by its increasing use in castration-resistant prostate cancer where patients show resistance to first-line taxanes such as docetaxel. Cabazitaxel’s role in second-line therapies, improved tolerability profiles in advanced formulations, and expanding approvals in multiple regions contribute to its rapid adoption. Growing awareness among oncologists about its clinical benefits, coupled with ongoing R&D for combination regimens, is expected to drive significant market expansion.

- By Application

On the basis of application, the taxane market is segmented into ovarian cancer, breast cancer, prostate cancer, non‑small cell lung cancer (NSCLC), and other cancers. The Breast Cancer segment dominated the market with the largest revenue share of 35.8% in 2025, attributed to the high prevalence of breast cancer globally and the extensive use of taxanes as a standard adjuvant and neoadjuvant therapy. Taxanes are widely recommended in clinical guidelines, ensuring strong adoption among oncologists. The segment also benefits from the availability of multiple paclitaxel and docetaxel formulations, including generics and nanoparticle-based therapies, which improve patient tolerability and outcomes. Continuous research for combination therapies with targeted agents and immunotherapy further enhances its market position.

The Prostate Cancer segment is expected to witness the fastest CAGR of 10.8% from 2026 to 2033, driven by rising cases of castration-resistant prostate cancer (CRPC) and increasing adoption of docetaxel and cabazitaxel in second-line therapy. The segment is supported by expanding screening programs, improved healthcare access, and growing awareness among patients and healthcare providers. Advances in drug delivery systems and clinical guidelines recommending taxane-based regimens for metastatic prostate cancer also propel growth in this application segment.

- By Formulations

On the basis of formulations, the taxane market is segmented into liposomes, nanoparticles, polymeric micelles, and other formulations. The Nanoparticles segment dominated the market with the largest revenue share of 38.6% in 2025, driven by the success of albumin-bound paclitaxel (nab-paclitaxel) and other nanoparticle-based therapies that enhance drug solubility, tumor penetration, and reduce solvent-related toxicities. These formulations are preferred by oncologists for their improved safety profiles and compatibility with combination therapy regimens. Widespread adoption in developed regions, combined with increasing clinical trials supporting efficacy and safety, further reinforces the dominance of nanoparticle formulations.

The Liposomes segment is expected to witness the fastest growth rate of 11.7% from 2026 to 2033, fueled by research into liposomal docetaxel and paclitaxel formulations that offer targeted delivery and reduced systemic toxicity. Liposomal formulations are particularly appealing in emerging markets, where safety and tolerability are critical for patient compliance. Regulatory approvals, increasing R&D investments, and adoption in advanced cancer centers are expected to drive this rapid growth trend.

- By End User

On the basis of end user, the taxane market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and others. The Hospitals segment dominated the market with the largest revenue share of 52.4% in 2025, due to the high prevalence of inpatient chemotherapy administration, availability of advanced oncology facilities, and comprehensive patient care support. Hospitals are equipped to handle complex regimens, supportive care, and monitoring for adverse effects, making them the primary administration site for taxane-based therapies. Partnerships with pharmaceutical companies, strong distribution networks, and institutional procurement also reinforce hospital dominance.

The Specialty Clinics segment is expected to witness the fastest CAGR of 9.9% from 2026 to 2033, driven by the increasing number of oncology-focused outpatient centers and infusion clinics, which offer convenience and reduced hospital visits. These clinics cater to growing demand for ambulatory chemotherapy, provide personalized care, and often adopt novel formulations such as nanoparticles and liposomes for improved patient outcomes. Expansion in emerging markets and the rising trend of home-based oncology services are expected to further boost growth in this segment.

Taxane-Based Oncology Drug Class Market Regional Analysis

- North America dominated the taxane market with the largest revenue share of 38.5% in 2025, characterized by advanced healthcare infrastructure, strong R&D investments, and high adoption of innovative oncology therapies

- Patients and healthcare providers in the region prioritize clinically proven therapies with established efficacy and safety profiles, making paclitaxel, docetaxel, and cabazitaxel the preferred taxanes for breast, ovarian, lung, and prostate cancer treatments

- This widespread adoption is further supported by high healthcare expenditure, a strong network of oncology hospitals and specialty clinics, and ongoing investments in cancer research and clinical trials, establishing taxane-based drugs as key components in modern oncology treatment regimens

U.S. Taxane-Based Oncology Drug Class Market Insight

The U.S. taxane-based oncology drug class market captured the largest revenue share of 82% in 2025 within North America, fueled by advanced healthcare infrastructure and high adoption of evidence-based chemotherapy protocols. Patients and oncologists prioritize clinically proven therapies such as paclitaxel, docetaxel, and cabazitaxel for breast, ovarian, lung, and prostate cancers. The increasing prevalence of cancer, robust insurance coverage, and the availability of generic and novel formulations further drive market growth. Moreover, ongoing clinical trials and R&D initiatives in targeted and combination therapies are significantly contributing to market expansion. The growing trend of outpatient infusion centers and specialty oncology clinics also supports greater accessibility of taxane therapies.

Europe Taxane-Based Oncology Drug Class Market Insight

The Europe taxane market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising cancer incidence and the need for effective chemotherapy regimens. The region benefits from well-established healthcare systems, regulatory support for oncology drug approvals, and increasing awareness of treatment options. European patients are also drawn to the improved safety and efficacy profiles of novel taxane formulations, such as nanoparticle and liposomal drugs. The market is witnessing strong growth across hospitals, specialty clinics, and ambulatory centers, with taxanes being incorporated into both first-line and combination therapy protocols.

U.K. Taxane-Based Oncology Drug Class Market Insight

The U.K. taxane market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing cancer prevalence and the adoption of modern chemotherapy standards. Rising patient awareness and oncologist preference for paclitaxel and docetaxel-based regimens enhance market demand. In addition, NHS initiatives promoting early cancer detection and coverage of chemotherapy treatments encourage wider access to taxane therapies. The integration of advanced formulations and biosimilars, alongside the country’s robust clinical research infrastructure, is expected to stimulate sustained market growth.

Germany Taxane-Based Oncology Drug Class Market Insight

The Germany taxane market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing incidence of breast, lung, and prostate cancers and rising adoption of nanoparticle and liposomal formulations. Germany’s well-developed healthcare infrastructure, emphasis on advanced oncology care, and strong clinical trial ecosystem promote taxane usage across hospitals and specialty clinics. Growing demand for safer, targeted, and effective chemotherapy regimens, along with government support for innovative cancer therapies, strengthens market penetration. Advanced healthcare reimbursement policies further support patient access to high-cost taxane treatments.

Asia-Pacific Taxane-Based Oncology Drug Class Market Insight

The Asia-Pacific taxane market is poised to grow at the fastest CAGR of 11.8% from 2026 to 2033, driven by rising cancer prevalence, improving healthcare infrastructure, and increasing adoption of modern chemotherapy protocols in countries such as China, Japan, and India. Government initiatives promoting oncology awareness, investment in cancer treatment centers, and the rising availability of generic taxanes are accelerating market growth. The expanding middle class and increasing healthcare spending are boosting accessibility of taxane therapies in both urban and semi-urban regions. Moreover, APAC’s growing participation in clinical trials and drug development enhances the adoption of novel taxane formulations.

Japan Taxane-Based Oncology Drug Class Market Insight

The Japan taxane market is gaining momentum due to rising cancer incidence, advanced healthcare infrastructure, and a focus on patient-centric care. The adoption of nanoparticle-based and liposomal taxanes is increasing, driven by the country’s emphasis on innovative treatment technologies. Hospitals and specialty oncology centers are integrating taxane therapies into combination regimens, improving patient outcomes. Moreover, Japan’s aging population and rising awareness of cancer treatment options are expected to spur demand for safer and more effective taxane-based therapies across residential and commercial healthcare facilities.

India Taxane-Based Oncology Drug Class Market Insight

The India taxane market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising cancer prevalence, increasing healthcare access, and a growing middle class. Taxane therapies, particularly generic paclitaxel and docetaxel, are becoming increasingly popular in hospitals, specialty clinics, and outpatient infusion centers. The push towards cancer awareness programs, government oncology initiatives, and growing private sector healthcare investment are key factors propelling the market in India. In addition, the availability of cost-effective formulations and expanding distribution networks enhances accessibility for patients across urban and semi-urban areas.

Taxane-Based Oncology Drug Class Market Share

The Taxane-Based Oncology Drug Class industry is primarily led by well-established companies, including:

- Bristol Myers Squibb Company (U.S.)

- Pfizer Inc. (U.S.)

- Dr. Reddy’s Laboratories Ltd. (India)

- Sun Pharmaceutical Industries Ltd (India)

- Cipla Ltd (India)

- Fresenius Kabi (Germany)

- Intas Pharmaceuticals Ltd (India)

- Cadila Healthcare Ltd (India)

- Torrent Pharmaceuticals Ltd (India)

- Reliance Life Sciences (India)

- Natco Pharma Ltd (India)

- Zydus Lifesciences Ltd (India)

- Cellon Pharma Ltd (India)

- Hetero Drugs Ltd (India)

- Aurobindo Pharma Ltd (India)

- Teva Pharmaceutical Industries Ltd (Israel)

- Novartis AG (Switzerland)

- Sanofi (France)

- Bayer AG (Germany)

What are the Recent Developments in Global Taxane-Based Oncology Drug Class Market?

- In August 2025, the University of Arizona researchers published findings on a novel nanovesicle formulation of paclitaxel (Paclitaxome) that improved tumor delivery, reduced toxicity, and enhanced efficacy in preclinical models of triple‑negative breast cancer and pancreatic cancer, opening avenues for advanced taxane formulations

- In April 2025, Cipla received final US FDA approval for its protein‑bound paclitaxel, a generic version of Abraxane used to treat metastatic breast cancer, non‑small cell lung cancer (NSCLC), and pancreatic cancer, with commercial launch expected by September 2025, expanding affordable access to this key taxane therapy

- In January 2025, a multicenter real‑world study reported that taxane‑based chemotherapy combined with PD‑1 immune checkpoint inhibitors showed promising efficacy and safety in patients with recurrent or metastatic head and neck squamous cell carcinoma (HNSCC), signaling interest in chemo‑immunotherapy taxane combinations

- In July 2024, the European Medicines Agency (EMA) approved new paclitaxel products (Apexelsin and Naveruclif) for metastatic breast cancer, pancreatic cancer, and NSCLC, representing expanded formulation authorizations in the EU and broadening treatment options in the region

- In October 2023, Starpharma announced positive Phase 2 clinical results for their DEP® cabazitaxel formulation, demonstrating encouraging anti‑tumor activity in multiple advanced solid tumors, underscoring progress in next‑generation taxane therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.