Global Tea Packaging Market

Market Size in USD Billion

CAGR :

%

USD

10.03 Billion

USD

15.39 Billion

2024

2032

USD

10.03 Billion

USD

15.39 Billion

2024

2032

| 2025 –2032 | |

| USD 10.03 Billion | |

| USD 15.39 Billion | |

|

|

|

|

Tea Packaging Market Size

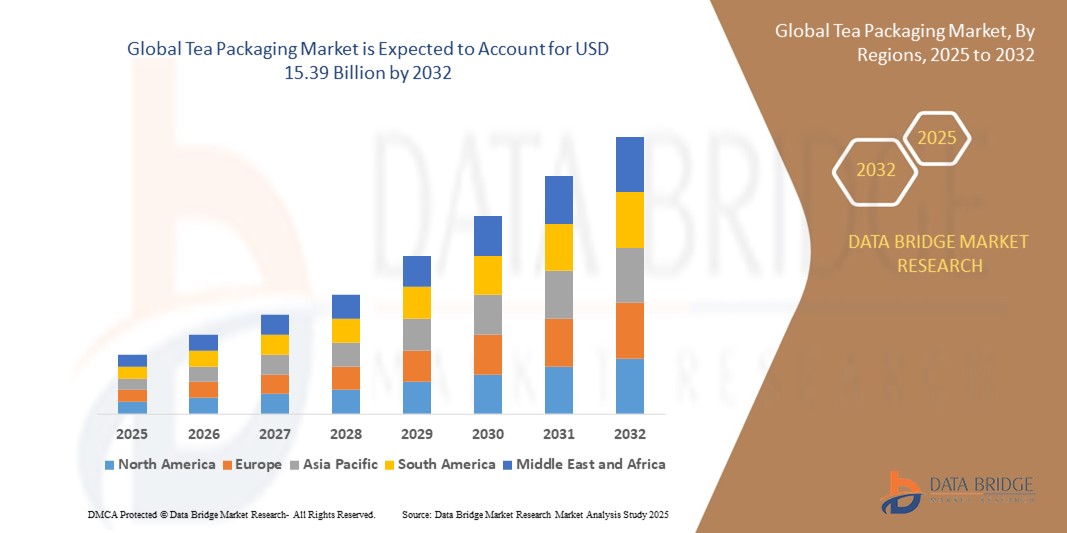

- The global tea packaging market size was valued at USD 10.03 billion in 2024 and is expected to reach USD 15.39 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by the rising global consumption of tea, combined with increasing demand for safe, hygienic, and visually appealing packaging that preserves freshness and flavor across retail and export markets

- Furthermore, the shift toward sustainable and biodegradable materials, along with growing consumer awareness of environmental impact, is driving innovation in eco-friendly tea packaging formats. These converging factors are accelerating the adoption of flexible and premium packaging solutions, thereby significantly boosting the industry's growth

Tea Packaging Market Analysis

- Tea packaging refers to a variety of materials and formats used to protect, preserve, and present tea products for commercial distribution. These include pouches, sachets, bags, tins, and boxes made from paper, plastic, metal, and biodegradable alternatives, serving both loose-leaf and bagged teas across retail, foodservice, and e-commerce channels

- The increasing demand for tea packaging is primarily driven by the growth of specialty and organic tea segments, rising health-consciousness among consumers, and the expansion of online and premium retail channels that require high-quality, sustainable, and functional packaging solutions

- Asia-Pacific dominated the tea packaging market with a share of 41.23% in 2024, due to the region’s deep-rooted tea culture, large consumer base, and strong tea production

- Europe is expected to be the fastest growing region in the tea packaging market during the forecast period due to increasing consumer preference for organic, herbal, and specialty teas

- Flexible tea packaging segment dominated the market with a market share of 63% in 2024, due to its lightweight nature, reduced transportation cost, and lower material consumption. This format allows for easy customization, quick production, and integration of user-friendly features such as resealable zippers and spouts

Report Scope and Tea Packaging Market Segmentation

|

Attributes |

Tea Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tea Packaging Market Trends

“Sustainable Packaging Boosts Tea Packaging Market Growth”

- The tea packaging market is expanding quickly as brands and manufacturers respond to rising consumer demand for sustainable, environmentally friendly packaging solutions—driven by eco-consciousness, health trends, and global regulations pressure

- For instance, companies such as DAVIDsTEA, Tazo, Celestial Seasonings, Bigelow, and Lipton (Unilever) have invested in launching compostable tea bags, recyclable paperboard cartons, and plastic-free pouches to differentiate in the premium and organic segments, improve shelf presence, and reduce landfill waste

- Flexible packaging formats—such as pouches, zipper bags, and resealable sachets—dominate the market thanks to their efficiency in storage, lightweight design, and adaptability for single-serve, specialty, and e-commerce-focused tea lines

- Growth in functional and wellness teas (herbal, detox, green, organic) accelerates demand for packaging with aroma barrier technology, heat-sealable paper, and superior shelf-life protection—pushing innovation in high-barrier and minimalistic packaging designs

- Digital technologies such as scannable QR codes and smart labeling are being integrated on tea packages to enhance traceability, share origin stories, and promote brand engagement, especially for premium and specialty teas

- Regulatory bans on single-use plastics—especially in Europe and North America—are accelerating the shift towards FSC-certified pulp, PLA-coated substrates, and renewable fiber-based packaging, with leading companies rolling out automation-ready, recyclable, and mono-material solutions

Tea Packaging Market Dynamics

Driver

“Growing Tea Consumption”

- The global increase in tea consumption for wellness, taste variety, and cultural reasons is driving consistent demand for innovative, efficient, and visually distinctive packaging in retail and e-commerce channels

- For instance, leading tea brands such as Lipton, Bigelow, and DAVIDsTEA are expanding their product ranges and investing in advanced packaging to meet the rising popularity of specialty, organic, and ready-to-drink teas in North America, Asia, and Europe

- Health, convenience, and premiumization trends give rise to single-serve packaging, pyramid tea bags, and sachets with improved infusibility and eco-credentials

- Rapid growth of organized retail and digital grocery platforms enables more diverse packaging experimentation and wider shelf presence for differentiated, value-added tea products

- The strong market position of loose-leaf, herbal, and green teas is pushing the adoption of packaging solutions that guarantee freshness, aroma retention, and visibility, supporting continuous market innovation

Restraint/Challenge

“High Packaging Costs”

- The cost of switching to biodegradable, compostable, or recyclable packaging remains significantly higher than traditional plastic and foil-based solutions, especially for small- to medium-sized tea producers

- For instance, premium manufacturers working with advanced materials such as PLA films, FSC-certified pulp, and custom barrier technologies face elevated raw material and production costs, impacting margins and price competitiveness compared to traditional packaging

- Sourcing high-quality sustainable materials in volume can be challenging due to supply constraints and lack of regional recycling infrastructure, slowing broader adoption of eco-friendly formats

- Regulations requiring robust food safety testing, shelf-life validation, and recyclability certification increase R&D, compliance, and operational expenses for new packaging launches

- The entrenched use of legacy plastic packaging in the industry creates resistance to widespread shifts, particularly in price-sensitive markets such as bulk or commodity tea segments

Tea Packaging Market Scope

The market is segmented on the basis of material type, product type, packaging type, and application.

- By Material Type

On the basis of material type, the tea packaging market is segmented into polymer and plastic, paper and paperboard, glass, and metal. The paper and paperboard segment dominated the largest market revenue share in 2024 due to increasing environmental concerns and consumer preference for sustainable packaging solutions. This material type is widely favored for its biodegradability and recyclability, aligning with global trends in eco-conscious consumption. Furthermore, paper-based tea packaging offers excellent printability, allowing brands to create visually appealing designs that enhance shelf appeal and reinforce brand identity.

The polymer and plastic segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its superior barrier properties that preserve aroma, freshness, and flavor of tea. Lightweight, cost-effective, and versatile in form, plastic-based materials are heavily adopted in both mass-market and specialty tea packaging. Advancements in recyclable and compostable plastics are also supporting segment growth by mitigating environmental impact concerns.

- By Product Type

On the basis of product type, the tea packaging market is segmented into pouches, sachet, bags, rigid box, bottles, tin packaging, and others. The pouches segment held the largest revenue share in 2024, primarily due to its affordability, minimal material usage, and strong sealing capabilities that extend shelf life. Pouches offer flexibility in design, support single-serve and bulk formats, and are compatible with a wide variety of printing technologies, making them the go-to format for both traditional and herbal teas.

The rigid box segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand in the premium and gift tea market. Rigid boxes offer a luxurious and durable packaging format, ideal for enhancing perceived product value. Their ability to protect delicate tea leaves and support high-end branding strategies makes them especially popular among specialty tea producers and for e-commerce-ready packaging.

- By Packaging Type

On the basis of packaging type, the tea packaging market is segmented into flexible tea packaging and rigid tea packaging. The flexible tea packaging segment dominated the market revenue share of 63% in 2024 owing to its lightweight nature, reduced transportation cost, and lower material consumption. This format allows for easy customization, quick production, and integration of user-friendly features such as resealable zippers and spouts.

The rigid tea packaging segment is projected to grow at the fastest rate from 2025 to 2032, fueled by increasing consumer demand for reusable and recyclable packaging. Rigid formats such as metal tins and glass jars offer strong protection against moisture and light and also reinforce brand premiumization and sustainability goals.

- By Application

On the basis of application, the tea packaging market is segmented into commercial and industrial. The commercial segment held the largest revenue share in 2024, driven by increasing consumption of packaged tea through supermarkets, specialty stores, and online platforms. Branded tea products rely heavily on packaging to differentiate themselves and communicate quality, origin, and health attributes to end consumers.

The industrial segment is anticipated to register the highest growth from 2025 to 2032, as tea exporters and contract manufacturers increase investments in bulk and transit packaging solutions. Growth in tea-producing regions and rising global demand for private label products are prompting industrial users to adopt efficient, durable, and cost-optimized packaging formats to meet scaling distribution needs.

Tea Packaging Market Regional Analysis

- Asia-Pacific dominated the tea packaging market with the largest revenue share of 41.23% in 2024, driven by the region’s deep-rooted tea culture, large consumer base, and strong tea production

- The demand for diverse tea packaging formats, including eco-friendly and premium solutions, is surging due to evolving consumer preferences and growing export activities.

- The expansion of organized retail, increasing disposable incomes, and rising health awareness are further contributing to the strong uptake of packaged tea products across both urban and rural areas, positioning the region as a global leader in tea packaging innovation and consumption

China Tea Packaging Market Insight

The China tea packaging market accounted for the largest revenue share within Asia-Pacific in 2024, driven by its vast domestic tea consumption and global export leadership. The demand for modern, eco-conscious, and high-end packaging is accelerating as consumers seek authenticity, freshness, and quality in tea products. Both traditional and new-age tea brands are heavily investing in innovative packaging formats such as vacuum-sealed pouches, decorative tins, and recyclable boxes to enhance visual appeal and extend shelf life. In addition, China’s emphasis on smart and traceable packaging, especially for export-quality teas, is fostering strong growth in the segment.

India Tea Packaging Market Insight

India's tea packaging market is expanding rapidly due to its strong domestic consumption base and a growing focus on packaged, branded tea products. Rising health awareness, urbanization, and disposable income levels are prompting consumers to seek hygienic and convenient packaging. Small and mid-tier brands are embracing modern packaging styles that balance visual appeal with functionality, while export-focused firms are adopting global standards in tea preservation and presentation. In addition, the growth of online retail channels and value-added tea offerings is stimulating further demand for durable, lightweight, and sustainable packaging solutions.

Europe Tea Packaging Market Insight

Europe is projected to witness the fastest growth in the tea packaging market during the forecast period, driven by increasing consumer preference for organic, herbal, and specialty teas. The region’s stringent sustainability regulations and heightened environmental awareness are prompting a shift toward recyclable, compostable, and minimalist packaging designs. Tea brands are focusing on packaging that preserves freshness and aroma and also communicates brand values such as ethical sourcing and ecological responsibility. The growing trend of premiumization and personalization in tea products is further supporting demand for high-quality, functional, and aesthetically pleasing packaging across the region.

U.K. Tea Packaging Market Insight

The U.K. tea packaging market is expected to grow steadily, fueled by a combination of traditional tea consumption habits and rising interest in wellness-oriented and artisanal blends. Consumers are increasingly drawn to packaging that is both visually sophisticated and environmentally sustainable. Brands in the U.K. are leveraging biodegradable pouches, plastic-free sachets, and reusable tin formats to align with eco-conscious consumer preferences. In addition, clear labeling, resealability, and smart design elements are being used to enhance the user experience, especially in e-commerce and retail shelf formats.

Germany Tea Packaging Market Insight

Germany's tea packaging market is experiencing notable growth, particularly driven by increasing demand for herbal and functional teas among health-conscious consumers. Sustainability is a key purchasing factor, encouraging brands to utilize recyclable paperboard, plant-based plastics, and minimalist packaging designs. The market also benefits from Germany’s well-developed logistics and retail infrastructure, which supports the efficient distribution of packaged tea across a wide consumer base. Innovative features such as aroma-lock sealing and tamper-evident closures are gaining popularity as German consumers place high value on product integrity and convenience.

North America Tea Packaging Market Insight

North America holds a significant share of the global tea packaging market, underpinned by the growing popularity of wellness and specialty teas such as green tea, kombucha, and ready-to-drink herbal blends. Consumers are seeking convenient, on-the-go formats with sustainable and eye-catching packaging. Flexible pouches, resealable bags, and recyclable canisters are among the most widely adopted formats in the region. In addition, the rise of health-focused lifestyles and organic product preferences is prompting tea brands to invest in clean-label packaging designs that highlight ingredient transparency and eco-friendliness.

U.S. Tea Packaging Market Insight

The U.S. tea packaging market dominated the North American region in 2024, driven by increasing demand for functional beverages and strong growth in premium and specialty tea segments. Brands are placing greater emphasis on sustainable materials and consumer-centric packaging features, including portion control, resealability, and ergonomic design. The fast-evolving retail landscape—particularly the rise of direct-to-consumer and online tea brands—is encouraging the development of shelf-ready and e-commerce-optimized packaging formats that are lightweight, durable, and aligned with sustainability standards.

Tea Packaging Market Share

The tea packaging industry is primarily led by well-established companies, including:

- Pacific Bag, LLC (U.S.)

- Custom-Pak, Inc. (U.S.)

- Swiss Pack (Switzerland)

- Blue Ridge Tea & Herb Company Ltd. (U.K.)

- Salazar Packaging, Inc. (U.S.)

- Solaris Tea (U.S.)

- Roaster (U.S.)

- Clipper Teas (U.K.)

- FPC Flexible Packaging (U.S.)

- Cascades Inc. (Canada)

- Hankuk Package (South Korea)

- Aero-pack Industries, Inc. (U.S.)

- Detmold Group (Australia)

- Oji Foodservice Packaging Solutions (AUS) Pty Ltd (Australia)

- BERICAP (Germany)

- CANPACK (Poland)

- HANIL CAN COMPANY LTD. (South Korea)

- Mondi (U.K.)

- Amcor plc (Australia)

- ProAmpac (U.S.)

- Crown (U.S.)

- Ardagh Group S.A. (Luxembourg)

Latest Developments in Global Tea Packaging Market

- In September 2024, Koehler Paper, a division of the Koehler Group, launched a high-quality flexible packaging paper range specifically tailored for the tea industry, marking a strategic response to the growing demand for sustainable and functional packaging solutions. Designed to meet a wide spectrum of requirements—from superior knurling and heat-sealing capabilities to high aroma protection and compatibility with teabag wrapping and flow pack systems—this product line empowers tea brands to enhance both product integrity and environmental responsibility. By unveiling this range at the Fachpack trade fair in Nuremberg, Koehler strengthens its position in the premium sustainable packaging market and also supports the tea industry's transition toward eco-friendly materials without compromising on performance or aesthetics

- In July 2024, Esah Tea, a direct-to-consumer tea brand based in Assam, made a groundbreaking move by launching the world’s first microplastic-free cotton tea bags. These handmade, 100% biodegradable, and chemical-free tea bags directly address consumer concerns over health and environmental safety, especially in light of alarming studies—such as the one from McGill University—highlighting the presence of billions of microplastic particles in conventional tea bags. By offering a sustainable alternative priced at just ₹5 per bag, Esah Tea has democratized access to clean and eco-conscious tea consumption. This launch differentiates the brand in a crowded marketplace and also sets a new benchmark for affordability, health-conscious innovation, and environmental stewardship in the global tea packaging sector

- In January 2023, Dorset Tea expanded its sustainable product offerings by introducing tea bags made from polylactic acid (PLA), a compostable material derived from renewable resources such as vegetable starch and wood pulp. This development aligns with the brand’s long-term sustainability goals and caters to the rising consumer preference for plastic-free and biodegradable solutions. The use of PLA ensures that the tea bags break down naturally, reducing their environmental footprint compared to conventional synthetic alternatives. This move enhances Dorset Tea’s brand credibility among eco-aware consumers and also positions it competitively in the premium tea segment where sustainability and packaging innovation are increasingly key purchase drivers

- In March 2021, Dorset Tea demonstrated early leadership in sustainable packaging by announcing the release of fully compostable tea bags made from PLA. At a time when environmental concerns surrounding single-use plastics were intensifying, this launch represented a forward-thinking approach to responsible consumption. By replacing petroleum-based tea bag materials with a plant-based, biodegradable alternative, Dorset Tea addressed both regulatory and consumer pressures for greener packaging. This initiative contributed to building customer trust and brand loyalty while aligning the company with broader industry trends focused on reducing plastic pollution and supporting circular economy practices

- In September 2023, Mitsubishi Chemical Group unveiled BioPBS, a new bio-based compostable polymer used in EN TEA teabag packaging pouches. These innovative pouches feature a complex structure including a sealant layer, a zipper closure with adhesives, and a barrier layer. BioPBS aims to enhance sustainability by offering a fully compostable option for tea packaging, reducing environmental impact

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Tea Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tea Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tea Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.