Global Tea Pods And Capsules Market

Market Size in USD Billion

CAGR :

%

USD

6.29 Billion

USD

11.47 Billion

2025

2033

USD

6.29 Billion

USD

11.47 Billion

2025

2033

| 2026 –2033 | |

| USD 6.29 Billion | |

| USD 11.47 Billion | |

|

|

|

|

What is the Global Tea Pods and Capsules Market Size and Growth Rate?

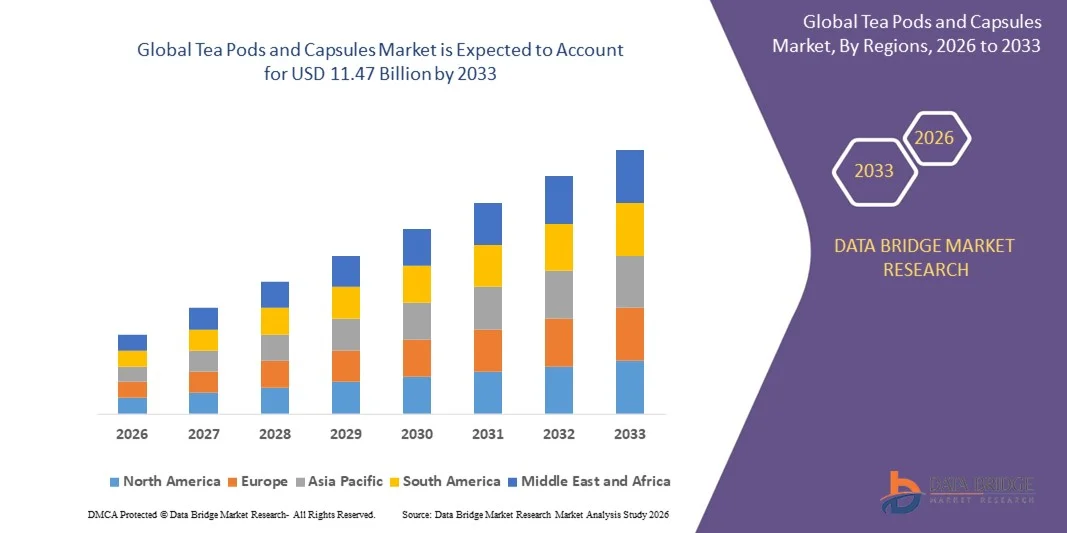

- The global tea pods and capsules market size was valued at USD 6.29 billion in 2025 and is expected to reach USD 11.47 billion by 2033, at a CAGR of12.30% during the forecast period

- The increase in demand for single-serve tea pods for both out-of-home and at-home purposes, acts as one of the major factors driving the growth of tea pods and capsules market

- The continuous developments to meet with the changing consumer preferences encouraging vendors to introduce novel packaging and product innovations and easier accessibility through online retailing accelerate the market growth

What are the Major Takeaways of Tea Pods and Capsules Market?

- The increase in the preferences towards non-alcoholic beverages along with rise in consumption of tea and coffee among the youth population and growing popularity of the tea pods and capsules owning to their comfort and convenience further influence the market

- Additionally, urbanization, growth of e-commerce sector, rise in the online sales, increase in awareness regarding tea benefits and surge in disposable income of people positively affect the tea pods and capsules market. Furthermore, the rise in demand for biodegradable and compostable products among consumers extends profitable opportunities to the market players in the forecast period

- Asia-Pacific dominated the tea pods and capsules market with a 42.8% revenue share in 2025, driven by robust growth in tea consumption, expanding residential and commercial setups, and rising adoption of single-serve tea machines across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 10.7% from 2026 to 2033, driven by rising awareness of single-serve tea products, e-commerce growth, and increasing penetration of automated tea machines in homes and offices across the U.S. and Canada

- The Capsules segment dominated the market with a 55.2% share in 2025, driven by convenience, single-serve portioning, consistent brewing quality, and broad compatibility with automated tea machines

Report Scope and Tea Pods and Capsules Market Segmentation

|

Attributes |

Tea Pods and Capsules Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Tea Pods and Capsules Market?

Increasing Shift Toward Premium, Convenient, and Single-Serve Tea Solutions

- The tea pods and capsules market is witnessing strong adoption of compact, single-serve, and easy-to-use brewing systems designed for home, office, and hospitality settings

- Manufacturers are introducing multi-flavor, recyclable, and biodegradable capsules with enhanced aroma retention, optimized brewing profiles, and compatibility with modern tea machines

- Growing demand for convenience, portion control, and consistent quality is driving usage across households, cafes, and commercial establishments

- For instance, companies such as Nestlé, Twinings, Dilmah, Unilever, and Tata Consumer Products have upgraded their tea capsule portfolios with eco-friendly designs, diverse flavor options, and machine compatibility

- Increasing need for fast preparation, customizable strength, and premium tea experiences is accelerating the shift toward capsule-based systems

- As consumers seek healthier and more convenient tea options, tea pods and capsules will remain essential for daily brewing, premium consumption, and gifting purposes

What are the Key Drivers of Tea Pods and Capsules Market?

- Rising demand for convenient, single-serve, and consistent tea brewing solutions in homes, offices, and commercial settings

- For instance, in 2025, leading companies such as Nestlé, Twinings, and Dilmah expanded their capsule portfolios with premium blends, eco-friendly pods, and machine-compatible designs

- Growing adoption of specialty teas, flavored blends, and wellness-focused teas is boosting demand across North America, Europe, and Asia-Pacific

- Advancements in pod sealing technology, shelf-life extension, and brewing optimization have strengthened flavor retention, aroma, and consumer satisfaction

- Rising consumer preference for sustainable packaging, recyclable pods, and premium convenience products is creating demand for high-quality, single-serve tea solutions

- Supported by steady investment in R&D, brand innovation, and distribution expansion, the tea pods and capsules market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Tea Pods and Capsules Market?

- Higher costs associated with premium tea pods, machine compatibility, and sustainable packaging restrict adoption among price-sensitive consumers

- For instance, during 2024–2025, fluctuations in raw tea prices, pod material costs, and supply chain disruptions increased manufacturing expenses for several global vendors

- Limited awareness in emerging markets regarding capsule brewing systems and brand offerings slows adoption

- Competition from traditional loose-leaf tea, tea bags, and other ready-to-drink tea products creates pricing pressure and reduces differentiation

- Complexity in recycling pods and machine maintenance increases perceived inconvenience among some consumers

- To address these issues, companies are focusing on cost-optimized capsule ranges, educational campaigns, and eco-friendly designs to increase global adoption of tea pods and capsules

How is the Tea Pods and Capsules Market Segmented?

The market is segmented on the basis of product, types, tea capsules type, material, application, and distribution channel.

- By Product

On the basis of product, the tea pods and capsules market is segmented into Pods and Capsules. The Capsules segment dominated the market with a 55.2% share in 2025, driven by convenience, single-serve portioning, consistent brewing quality, and broad compatibility with automated tea machines. Capsules are widely adopted across households, offices, and commercial establishments for fast, mess-free tea preparation and uniform flavor extraction.

The Pods segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising consumer interest in eco-friendly soft and hard tea pods, customizable blends, and compatibility with new-generation brewing devices. Increasing awareness of sustainability, ease of use, and innovative flavor offerings is further driving market adoption in both residential and commercial settings, creating a strong long-term growth opportunity.

- By Types

On the basis of types, the market is segmented into Soft Tea Pods, Tea Capsules, and Hard Tea Pods. The Tea Capsules segment dominated with a 51.8% share in 2025, supported by high demand for machine-compatible, premium tea blends that ensure consistent brewing and taste quality.

Soft Tea Pods are projected to grow at the fastest CAGR from 2026 to 2033, driven by biodegradable composition, flavor preservation, and rising adoption in eco-conscious households and cafés. These pods provide convenient single-serve brewing, attractive packaging, and compatibility with compact machines, catering to the increasing demand for sustainable and convenient tea solutions globally.

- By Tea Capsules Type

On the basis of tea capsule type, the market is segmented into Red Tea Capsules, Green Tea Capsules, Oolong Tea Capsules, Black Tea Capsules, and Yellow Tea Capsules. Black Tea Capsules dominated with a 40.3% share in 2025, owing to global consumer preference, high residential and commercial consumption, and widespread brand availability.

Green Tea Capsules are expected to grow at the fastest CAGR from 2026 to 2033, driven by rising health-conscious trends, wellness-focused consumption, and adoption of functional teas for energy, detoxification, and relaxation. The demand for antioxidant-rich formulations, innovative blends, and ready-to-brew solutions is boosting growth across premium and mass-market segments.

- By Material

On the basis of material, the market is segmented into Conventional Plastic, Bio Plastics, Fabric, and Others. Conventional Plastic dominated the market with a 47.5% share in 2025, due to affordability, durability, and broad compatibility with tea machines.

Bio Plastics are expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing sustainability awareness, government regulations, and adoption of biodegradable and compostable pods. Rising demand for environmentally friendly solutions in residential and commercial setups is supporting long-term adoption, while innovation in renewable materials is further enhancing product appeal.

- By Application

On the basis of application, the market is segmented into Residential and Commercial. Residential dominated with a 58.7% share in 2025, driven by growing at-home consumption, adoption of single-serve machines, and demand for convenience among busy households.

The Commercial segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by expansion of cafés, restaurants, offices, and hospitality chains adopting automated tea machines for consistent brewing and premium quality. Increasing interest in specialty teas and flavored blends in commercial settings is further supporting adoption globally.

- By Distribution Channels

On the basis of distribution channels, the market is segmented into Supermarket/Hypermarket, Convenience Store, Online Retailing, and Others. Supermarkets/Hypermarkets dominated with a 49.2% share in 2025, benefiting from wide consumer reach, extensive product assortment, and accessibility.

Online Retailing is projected to grow at the fastest CAGR from 2026 to 2033, driven by e-commerce growth, subscription-based tea capsule deliveries, and rising consumer preference for doorstep convenience. Digital platforms, promotional campaigns, and easy availability of premium tea pods and capsules are supporting long-term adoption across regions.

Which Region Holds the Largest Share of the Tea Pods and Capsules Market?

- Asia-Pacific dominated the tea pods and capsules market with a 42.8% revenue share in 2025, driven by robust growth in tea consumption, expanding residential and commercial setups, and rising adoption of single-serve tea machines across China, Japan, India, South Korea, and Southeast Asia. Increasing health awareness, rising demand for convenience products, and growing middle-class population contribute to strong market penetration in both urban and semi-urban areas

- Leading companies in Asia-Pacific are introducing innovative tea pod and capsule varieties, eco-friendly packaging, and premium blends, strengthening the region’s product diversity and appeal. Expansion of distribution networks, promotional campaigns, and strategic partnerships further enhance adoption and regional leadership

- Rapid urbanization, increasing disposable income, and evolving consumer lifestyles reinforce Asia-Pacific’s dominance, establishing the region as a global hub for tea pods and capsules

China Tea Pods and Capsules Market Insight

China is the largest contributor in Asia-Pacific due to strong consumer demand, high tea culture prevalence, and extensive e-commerce adoption. Rising preference for ready-to-brew tea, premium blends, and sustainable pods drives market growth. Presence of local manufacturers and competitive pricing further supports domestic consumption and export opportunities, making China a key market driver.

Japan Tea Pods and Capsules Market Insight

Japan shows steady growth supported by advanced retail infrastructure, premium tea culture, and widespread adoption of capsule machines in homes and offices. Increasing focus on functional teas, green tea varieties, and innovative flavors accelerates market expansion. Rising interest in sustainability and biodegradable pods further reinforces long-term adoption.

India Tea Pods and Capsules Market Insight

India is emerging as a major growth hub, driven by expanding urban households, rising café and restaurant chains, and government initiatives promoting domestic manufacturing. Growing awareness of single-serve tea solutions, along with adoption of green and herbal teas, supports strong market penetration. Rising disposable income and digital retail adoption accelerate sales in residential and commercial segments.

South Korea Tea Pods and Capsules Market Insight

South Korea contributes significantly due to growing consumption of convenience beverages, increasing adoption of premium tea pods, and rapid growth of online retail channels. Rising health-conscious consumer trends, innovative flavors, and eco-friendly packaging fuel adoption in households, cafés, and office environments.

North America Tea Pods and Capsules Market

North America is projected to register the fastest CAGR of 10.7% from 2026 to 2033, driven by rising awareness of single-serve tea products, e-commerce growth, and increasing penetration of automated tea machines in homes and offices across the U.S. and Canada. Health-focused consumption, premium tea blends, and convenience-driven lifestyles support rapid adoption. Strategic collaborations, product launches, and marketing initiatives by key players further accelerate growth in residential and commercial segments.

U.S. Tea Pods and Capsules Market Insight

The U.S. leads North America’s growth with increasing adoption of tea capsules in homes, cafés, and workplaces. Rising demand for herbal, green, and functional tea variants along with subscription-based delivery models supports market expansion.

Canada Tea Pods and Capsules Market Insight

Canada contributes to regional growth through expanding e-commerce platforms, rising café culture, and growing preference for sustainable tea pods. Increasing interest in wellness teas and eco-conscious packaging encourages adoption across households and commercial outlets.

Which are the Top Companies in Tea Pods and Capsules Market?

The tea pods and capsules industry is primarily led by well-established companies, including:

- Unilever (U.K.)

- Gourmesso (Germany)

- International Coffee & Tea, LLC (U.S.)

- Harney & Sons Fine Teas (U.S.)

- Dualit (U.K.)

- Nestlé (Switzerland)

- Dilmah Ceylon Tea Company PLC. (Sri Lanka)

- Kusmi E-Commerce LLC (France)

- Caffè Vergnano (Italy)

- Tata Consumer Products (India)

- Twinings North America (U.K.)

- red espresso USA (U.S.)

- Bonini Srl (Italy)

What are the Recent Developments in Global Tea Pods and Capsules Market?

- In November 2025, Wagh Bakri revamped the food menu at its tea lounges, combining traditional Indian flavors with modern culinary trends to appeal to younger customers while maintaining heritage tastes, enhancing the overall tea lounge experience and customer satisfaction

- In May 2025, Bebida Hospitality introduced Copenhagen Sparkling Tea to India, offering a premium Nordic-inspired, organic sparkling tea that delivers a non-alcoholic luxury beverage experience, catering to the growing demand for wellness-oriented and gourmet drinks in upscale hospitality and retail segments, strengthening the brand’s presence in the Indian market

- In June 2024, Lipton launched its new Green Tea Portfolio, presenting a range of refreshing, health-focused tea options designed to promote wellness and enrich the consumer tea-drinking experience, reinforcing Lipton’s commitment to innovation and healthy lifestyle choices

- In January 2024, Chai Sutta Bar unveiled its new tea brand, Maatea, aimed at tea enthusiasts seeking unique and flavorful tea experiences, expanding its product lineup and reinforcing its position in the specialty tea segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Tea Pods And Capsules Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tea Pods And Capsules Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tea Pods And Capsules Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.