Global Teak Wood Packaging Market

Market Size in USD Billion

CAGR :

%

USD

4.47 Billion

USD

8.53 Billion

2024

2032

USD

4.47 Billion

USD

8.53 Billion

2024

2032

| 2025 –2032 | |

| USD 4.47 Billion | |

| USD 8.53 Billion | |

|

|

|

|

Teak Wood Packaging Market Size

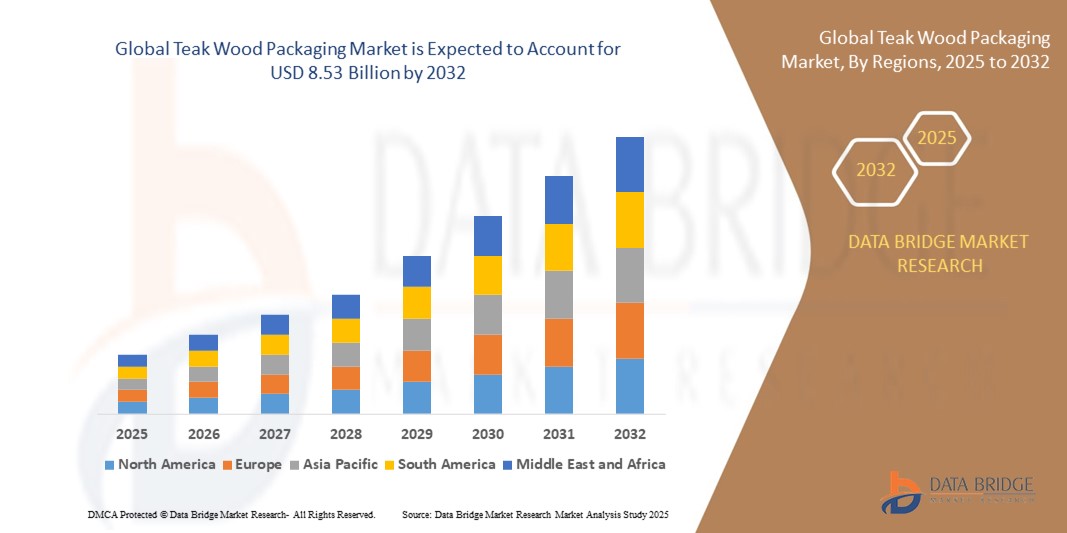

- The global teak wood packaging market size was valued at USD 4.47 billion in 2024 and is expected to reach USD 8.53 billion by 2032, at a CAGR of 8.4% during the forecast period

- The market growth is largely fueled by the rising demand for sustainable, durable, and compliant packaging solutions across industries such as logistics, food and beverages, and industrial exports, where teak wood’s natural strength, resistance to moisture, and long service life offer significant advantages over conventional materials

- Furthermore, increasing global regulations promoting eco-friendly packaging and growing preference for reusable and pest-resistant wooden alternatives are accelerating the adoption of teak wood packaging, thereby significantly boosting the industry's growth

Teak Wood Packaging Market Analysis

- Teak wood packaging consists of pallets, crates, and boxes made from high-quality teak, valued for its exceptional durability, resistance to weathering, and ability to withstand heavy loads during long-distance transportation and storage

- The increasing demand for teak wood packaging is primarily driven by export-heavy industries requiring high-performance, regulation-compliant packaging solutions, coupled with rising emphasis on sustainability, reusability, and long-term cost efficiency in both developed and emerging markets

- North America dominated the teak wood packaging market with a share of 39.9% in 2024, due to rising demand for premium, durable, and sustainable packaging solutions in logistics, food, and beverage industries

- Asia-Pacific is expected to be the fastest growing region in the teak wood packaging market during the forecast period due to rapid industrialization, urbanization, and rising export activities across key economies such as China, India, and Southeast Asian countries

- Pallets segment dominated the market with a market share of 55.1% in 2024, due to their critical role in modern logistics and warehousing operations. Teak wood pallets are highly valued for their durability, resistance to moisture, and ability to withstand heavy loads during transit and storage. Their strong structural integrity and long lifespan make them a preferred choice across global supply chains, especially in industries requiring repeated handling and export-grade packaging. The rising emphasis on sustainable and reusable packaging solutions has further boosted demand for teak wood pallets in recent years

Report Scope and Teak Wood Packaging Market Segmentation

|

Attributes |

Teak Wood Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Teak Wood Packaging Market Trends

“Rising Demand for Premium Packaging”

- The teak wood packaging market is growing rapidly driven by increasing demand for premium, durable, and sustainable packaging solutions across luxury goods, electronics, pharmaceuticals, and high-value food products

- For instance, companies such as UFP Industries and Shur-way Group are innovating with teak wood packaging that combines high strength and aesthetic appeal, catering to premium brands emphasizing product protection and upscale presentation

- Teak wood’s natural resistance to moisture, decay, and insect attack makes it a favored packaging material for products requiring extended shelf life and secure transportation

- Increasing global trade of luxury items such as high-end wines, spirits, and watches fuels the need for sophisticated packaging that enhances brand value and product integrity

- Sustainable packaging trends and regulatory pressure on reducing plastic usage promote teak wood as an eco-friendly alternative that aligns with green supply chain initiatives

- Advances in processing techniques such as precision kiln drying and digital customization improve the consistency, durability, and design flexibility of teak wood packaging

Teak Wood Packaging Market Dynamics

Driver

“Resistance to Environmental Factors”

- Teak wood’s inherent resistance to environmental stressors including moisture, fungal decay, and pests enhances product protection during shipping and storage, making it a top choice for sensitive and high-value products

- For instance, luxury watch manufacturers prefer teak wood packaging for humidity and pest resistance, ensuring watches arrive undamaged and maintain their pristine quality throughout distribution

- The wood’s durability reduces packaging damage and product loss, contributing to lower total supply chain costs and improved customer satisfaction

- Growing emphasis on sustainable packaging drives industries to select teak wood for its longevity and minimal environmental impact, fulfilling both performance and ecological requirements

- This natural protection capability enables wider adoption across industries such as pharmaceuticals, electronics, and fine foods where packaging integrity is critical

Restraint/Challenge

“High Cost of Teak Wood”

- Teak wood commands a premium price compared to other wood types and alternative packaging materials, which can limit its adoption primarily to high-value, luxury segments

- For instance, manufacturers note that the cost of sustainable, certified teak raw material and advanced processing increases packaging prices, making it less competitive for price-sensitive industries or bulk commodity packaging

- Supply constraints due to restricted harvesting, responsible forestry regulations, and geopolitical factors drive teak wood prices upward and create sourcing challenges

- The high upfront investment in teak wood packaging also affects smaller producers and emerging markets where cost efficiency is paramount, slowing wider penetration

- Competition from less expensive sustainable materials such as bamboo, recycled paperboard, and engineered woods adds pricing pressure and narrows market share potential outside premium categories

Teak Wood Packaging Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the teak wood packaging market is segmented into pallets, cases, and boxes. The pallets segment dominated the largest market revenue share of 55.1% in 2024, owing to their critical role in modern logistics and warehousing operations. Teak wood pallets are highly valued for their durability, resistance to moisture, and ability to withstand heavy loads during transit and storage. Their strong structural integrity and long lifespan make them a preferred choice across global supply chains, especially in industries requiring repeated handling and export-grade packaging. The rising emphasis on sustainable and reusable packaging solutions has further boosted demand for teak wood pallets in recent years.

The cases and boxes segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the growing need for customized and protective packaging in the food, beverage, and industrial sectors. Teak wood cases and boxes offer superior protection for delicate or high-value goods during shipping and storage. Their aesthetic appeal and premium quality also make them suitable for branding and presentation purposes, especially in premium exports. The increasing adoption of eco-friendly packaging materials in regulated industries is further accelerating the uptake of teak wood-based cases and boxes.

- By Application

On the basis of application, the teak wood packaging market is segmented into food and beverages, shipping, transportation, construction industry, and others. The shipping and transportation segment held the largest market revenue share in 2024 due to the extensive use of sturdy wood packaging in protecting goods across long-distance trade routes. Teak wood’s natural resistance to pests, humidity, and physical damage makes it ideal for export packaging, particularly in maritime shipping where exposure to varying climates is common. The segment’s growth is further supported by international regulations favoring heat-treated and pest-resistant wooden packaging materials, which teak naturally satisfies.

The food and beverages segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing demand for hygienic, non-reactive, and sustainable packaging solutions. Teak wood packaging is increasingly being adopted for premium and organic food products, as well as for wine and beverage exports that require both structural strength and visual appeal. As sustainability becomes a key purchasing criterion for consumers and manufacturers alike, the segment is experiencing rising interest in teak-based packaging as an alternative to plastic and synthetic materials.

Teak Wood Packaging Market Regional Analysis

- North America dominated the teak wood packaging market with the largest revenue share of 39.9% in 2024, driven by rising demand for premium, durable, and sustainable packaging solutions in logistics, food, and beverage industries

- The region’s reliance on high-quality wood packaging for export and interstate transport, combined with growing environmental concerns, has made teak wood an attractive material for long-term packaging solutions

- Increased adoption of reusable packaging and the presence of established logistics and manufacturing sectors further support regional dominance, especially in sectors prioritizing structural integrity and eco-conscious sourcing

U.S. Teak Wood Packaging Market Insight

The U.S. captured the largest revenue share within the North American teak wood packaging market in 2024, propelled by strong trade volumes, well-developed logistics infrastructure, and increasing emphasis on sustainable and regulation-compliant packaging. U.S. companies across sectors such as food, beverages, industrial goods, and electronics are increasingly favoring teak wood for pallets and crates due to its durability and compliance with international shipping standards. The growing preference for reusable packaging in domestic and international trade further accelerates the adoption of teak wood solutions across the country.

Europe Teak Wood Packaging Market Insight

The Europe teak wood packaging market is projected to grow at a steady CAGR throughout the forecast period, supported by the region’s stringent environmental regulations and a clear shift toward eco-friendly packaging alternatives. As sustainability becomes a key priority, industries such as automotive, electronics, and food exports are adopting teak wood packaging for its resilience, recyclability, and ability to meet European timber compliance standards. The region is also witnessing increased investment in premium packaging for high-value goods, further encouraging the use of long-lasting teak-based solutions in both industrial and consumer sectors.

Germany Teak Wood Packaging Market Insight

Germany is expected to experience consistent growth in the teak wood packaging market, driven by the country’s large-scale manufacturing and export-oriented economy. German manufacturers are increasingly seeking robust packaging materials that provide enhanced protection during international transport, especially for machinery and industrial components. The integration of sustainability into corporate practices and compliance with EU timber packaging directives are further encouraging the adoption of teak wood packaging in the German market.

U.K. Teak Wood Packaging Market Insight

The U.K. teak wood packaging market is anticipated to expand at a significant CAGR during the forecast period, fueled by increasing demand for reusable and weather-resistant packaging across food, pharmaceutical, and retail export sectors. Businesses in the U.K. are focusing on long-term cost efficiency and environmental compliance, leading to a higher uptake of teak wood pallets and crates. The country’s support for sustainable supply chain practices, along with rising consumer and regulatory expectations, is reinforcing the growth of teak wood packaging solutions.

Asia-Pacific Teak Wood Packaging Market Insight

Asia-Pacific is poised to witness the fastest growth in the teak wood packaging market, with a projected CAGR from 2025 to 2032. This growth is fueled by rapid industrialization, urbanization, and rising export activities across key economies such as China, India, and Southeast Asian countries. The increasing need for high-strength, durable, and cost-effective packaging materials in the region’s booming manufacturing and logistics sectors is boosting demand for teak wood. Moreover, the availability of domestic teak plantations in several countries and favorable government policies toward sustainable practices are contributing to market expansion across both industrial and agricultural segments.

China Teak Wood Packaging Market Insight

China accounted for the largest revenue share in the Asia-Pacific teak wood packaging market in 2024, supported by the country’s vast manufacturing base, large-scale exports, and growing preference for durable and reusable packaging. Chinese exporters in sectors such as electronics, automotive components, and chemicals are increasingly relying on teak wood pallets and crates for international shipments. Domestic production capabilities, combined with regulatory efforts to phase out non-compliant packaging materials, are helping expand the teak wood packaging footprint across the country.

India Teak Wood Packaging Market Insight

India is expected to emerge as one of the fastest-growing markets for teak wood packaging, driven by rising exports in agriculture, pharmaceuticals, and e-commerce. The availability of teak resources domestically and the growing demand for protective, natural packaging alternatives are fostering adoption among manufacturers and logistics providers. As India strengthens its position in global trade and sustainability takes center stage, teak wood packaging is gaining momentum as a preferred choice for cost-effective, long-lasting solutions that align with global quality standards.

Teak Wood Packaging Market Share

The teak wood packaging industry is primarily led by well-established companies, including:

- UFP Industries, Inc. (U.S.)

- Shur-way Group Inc. (Canada)

- PACKXPERT INDIA PVT LTD (India)

- CHEP (Australia)

- Rowlinson Group Ltd. (U.K.)

- C&K Box Company, Inc. (U.S.)

- Inter Agra (Poland)

- Greif (U.S.)

- Mondi (U.K.)

- NEFAB GROUP (Sweden)

- Hemant Wooden Packaging (India)

- Spruce Pax Private Limited (India)

- SHREE SAIRAM INDUSTRIAL CORPORATION (India)

- Rajat Packers (India)

- Totre Industries (India)

- PalletOne (U.S.)

- ARRINGTON LUMBER & PALLET CO (U.S.)

Latest Developments in Global Teak Wood Packaging Market

- In May 2023, Packxpert India Pvt. Ltd. announced the expansion of its teak wood packaging line in response to rising demand from pharmaceutical and agricultural exporters. The company introduced lightweight, high-load-bearing boxes and crates optimized for both sea and air freight. This strategic expansion reinforces Packxpert’s role in the Indian packaging ecosystem and its commitment to delivering premium, export-ready packaging solutions backed by sustainable sourcing practices

- In April 2023, GreenWood Packaging Solutions Ltd., a sustainable packaging provider, launched an advanced line of teak wood pallets and crates designed to meet the EU's new Deforestation Regulation (EUDR) compliance requirements. The product line features full traceability via blockchain integration and geolocation tracking, reinforcing the company’s commitment to ethical sourcing and environmentally responsible manufacturing. This move positioned GreenWood as a leader in compliant teak wood packaging for the European market

- In August 2022, Premium Teak Logistics Co. introduced a new treatment facility for teak wood packaging materials in Indonesia to align with phytosanitary standards required by North American and European regulators. The facility incorporates heat treatment and eco-safe fumigation processes to ensure compliance with ISPM-15 regulations. This development reflects the company’s dedication to supporting global trade with packaging solutions that are both durable and regulation-compliant

- In October 2022, NEFAB Group, a global industrial packaging company, acquired Cargopack Group, a Switzerland-based specialist in industrial and export packaging. This acquisition enabled NEFAB to expand its footprint in Europe and enhance its sustainable wood packaging capabilities. Through this strategic move, the company aimed to strengthen its position in the global market by offering environmentally conscious and durable wood-based packaging solutions, including teak-based applications for high-value exports

- In June 2022, The Central Vista Project, which focuses on redeveloping and expanding India's Parliament, will feature interiors made of teakwood sourced from the Gadchiroli district of Maharashtra. This choice highlights the 'Make in India' initiative by promoting domestic products and craftsmanship

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Teak Wood Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Teak Wood Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Teak Wood Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.