Global Tebufenozide Market

Market Size in USD Billion

CAGR :

%

USD

3.20 Billion

USD

4.91 Billion

2024

2032

USD

3.20 Billion

USD

4.91 Billion

2024

2032

| 2025 –2032 | |

| USD 3.20 Billion | |

| USD 4.91 Billion | |

|

|

|

|

Tebufenozide Market Size

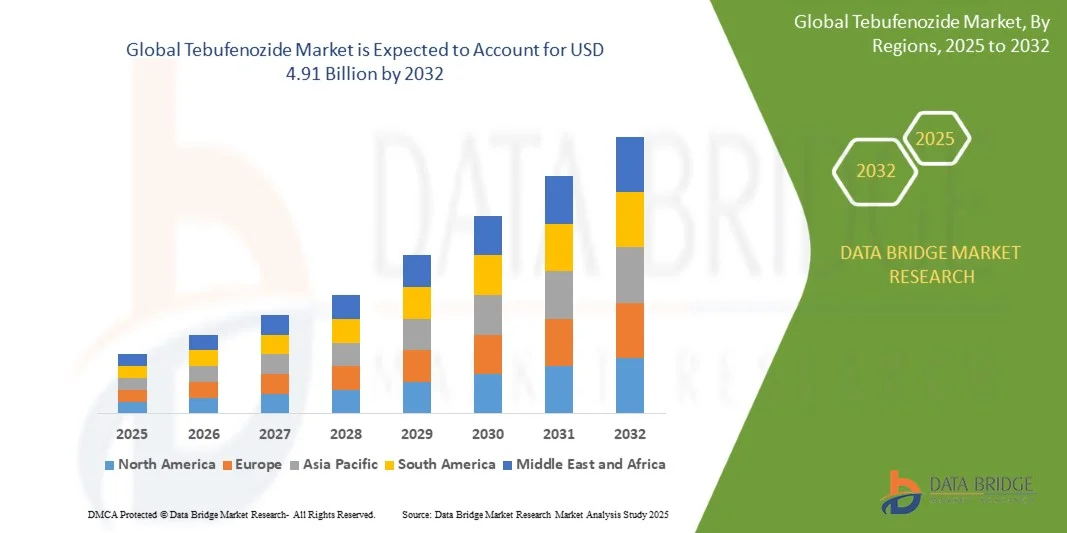

- The global tebufenozide market size was valued at USD 3.2 billion in 2024 and is expected to reach USD 4.91 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by the increasing adoption of eco-friendly and selective insect growth regulators across the agricultural sector, driven by the global shift toward sustainable farming practices and the need to minimize chemical residues in food crops. Tebufenozide’s low toxicity to beneficial insects and targeted mode of action make it a preferred choice for integrated pest management programs aimed at maintaining ecological balance and improving crop quality

- Furthermore, rising awareness among farmers regarding the harmful impacts of conventional pesticides and the growing government support for bio-rational pest control solutions are enhancing the use of Tebufenozide across major crop types such as fruits, vegetables, and cereals. These converging factors are strengthening the demand for environmentally responsible insecticides, thereby propelling the market’s expansion

Tebufenozide Market Analysis

- Tebufenozide, an insect growth regulator specifically targeting lepidopteran pests, has become an essential component of modern pest management systems due to its selectivity, safety profile, and compatibility with organic farming standards. It plays a critical role in improving yield efficiency while reducing the ecological footprint of chemical pest control

- The accelerating demand for Tebufenozide is primarily influenced by stringent regulatory policies favoring low-residue pesticides, the adoption of integrated pest management techniques, and the increasing emphasis on sustainable crop protection solutions across both developed and emerging agricultural economies

- North America dominated the tebufenozide market with a share of over 35% in 2024, due to the widespread adoption of sustainable crop protection practices and stringent environmental regulations limiting the use of toxic pesticides

- Asia-Pacific is expected to be the fastest growing region in the tebufenozide market during the forecast period due to expanding agricultural activities, rising food demand, and growing awareness of sustainable pest control methods

- Agricultural pesticides segment dominated the market with a market share of 59.1% in 2024, due to the rising demand for effective insect growth regulators in crop protection. Tebufenozide’s selective action against lepidopteran pests and minimal toxicity to beneficial insects have made it a preferred choice among farmers for sustainable pest management. Increasing emphasis on residue-free food production and integrated pest management (IPM) practices further supports its extensive use in agricultural applications

Report Scope and Tebufenozide Market Segmentation

|

Attributes |

Tebufenozide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tebufenozide Market Trends

“Growing Adoption of Eco-Friendly Insect Growth Regulators”

- A major trend in the tebufenozide market is the rising preference for eco-friendly insect growth regulators (IGRs) that align with sustainable agricultural practices. Tebufenozide, a molting hormone agonist, targets insects such as Lepidopteran pests while minimizing impact on beneficial organisms, making it suitable for integrated pest management programs focused on environmental stewardship

- For instance, companies such as Nihon Nohyaku Co., Ltd. and Nippon Soda Co., Ltd. have expanded the production and licensing of tebufenozide-based insecticides, reinforcing their presence in environmentally conscious agricultural markets in Asia and Europe. These firms focus on providing farmers with effective, residue-safe pest control options that meet modern sustainability standards

- The growing concern over pesticide residues in food crops has driven the adoption of tebufenozide, which offers high target specificity and low toxicity to non-target species such as bees and aquatic organisms. This has made tebufenozide a preferred alternative to conventional neurotoxic insecticides, supporting food safety initiatives across developed and developing economies

- In addition, regulatory movements promoting reduced chemical load in agriculture have accelerated the shift toward bio-rational and reduced-risk insecticides. Agencies including the U.S. Environmental Protection Agency (EPA) and the European Food Safety Authority (EFSA) have classified tebufenozide-based formulations as lower-risk options under current pesticide regulations

- The increasing inclusion of tebufenozide in organic and integrated pest management product portfolios indicates stronger endorsement from agricultural cooperatives and environmental committees. This adoption trend reflects a notable transition toward safer pest control strategies that balance efficiency with ecological responsibility

- Overall, the growing demand for eco-conscious pest management solutions and compliance with international sustainability standards are expected to further strengthen tebufenozide’s market position as a key eco-friendly insect regulator in global agriculture

Tebufenozide Market Dynamics

Driver

“Rising Demand for Sustainable Crop Protection Solutions”

- The growing global emphasis on sustainable and responsible agriculture is a major driver propelling tebufenozide market expansion. Farmers and agribusinesses increasingly seek crop protection products that ensure effective pest control with minimal ecological disruption, supporting long-term soil and biodiversity health

- For instance, in June 2024, Corteva Agriscience expanded its bio-based crop protection product range by incorporating tebufenozide formulations designed for fruit and vegetable growers, helping them meet eco-certification requirements while maintaining pest resistance management efficiency

- Tebufenozide’s biochemical mode of action, which interferes with insect molting, ensures effective Lepidoptera control without harming beneficial predators or pollinators. This highly selective mechanism allows sustainable pest suppression and supports integrated biological control systems across multiple crop types

- In addition, tebufenozide’s compatibility with a broad range of biological and microbial control agents enhances its value in modern sustainable agriculture. It offers a stable and residue-friendly solution, reducing dependence on high-toxicity insecticides that are being phased out due to regulatory restrictions

- The continued promotion of green agriculture initiatives and the introduction of eco-certification programs globally are reinforcing the market’s shift toward safer agrochemicals such as tebufenozide. The compound’s balance between efficacy and safety makes it instrumental in achieving productivity and environmental harmony in contemporary crop management practices

Restraint/Challenge

“Limited Availability of Raw Materials”

- Limited access to essential intermediates and precursor chemicals required for tebufenozide synthesis presents a key challenge to market stability. Supply chain complexities and regional dependency on specialized chemical producers can lead to production bottlenecks that delay availability in major agricultural regions

- For instance, fluctuations in raw material supply from major chemical manufacturing hubs such as China and Japan have occasionally disrupted formulation schedules for companies including Nihon Nohyaku and BASF, impacting product inventory levels in both domestic and export markets

- The chemical synthesis process for tebufenozide involves multiple stages that require specialized equipment and stringent environmental compliance, making production cost-sensitive and dependent on the steady availability of high-purity intermediates

- In addition, environmental regulations governing the handling and disposal of precursor chemicals have led to limited manufacturing flexibility. Producers often need to invest significantly in pollution control and waste treatment systems, which can further constrain operational capacity during peak demand periods

- Addressing this challenge through supply diversification, advanced synthesis process optimization, and collaborative partnerships with regional chemical suppliers will be essential to ensure stable tebufenozide production and reliable availability in global markets

Tebufenozide Market Scope

The market is segmented on the basis of application, crop type, formulation type, distribution channel, and end-user.

- By Application

On the basis of application, the Tebufenozide market is segmented into agricultural pesticides, forestry, residential pest control, and public health insect control. The agricultural pesticides segment dominated the market with the largest revenue share of 59.1% in 2024, driven by the rising demand for effective insect growth regulators in crop protection. Tebufenozide’s selective action against lepidopteran pests and minimal toxicity to beneficial insects have made it a preferred choice among farmers for sustainable pest management. Increasing emphasis on residue-free food production and integrated pest management (IPM) practices further supports its extensive use in agricultural applications.

The public health insect control segment is anticipated to witness the fastest growth rate from 2025 to 2032 due to the rising global focus on controlling vector-borne diseases. Tebufenozide’s eco-friendly properties and low mammalian toxicity make it suitable for public health pest control programs targeting mosquito larvae and other disease vectors. Growing government initiatives to reduce chemical exposure and adopt biologically selective insecticides are expected to further drive demand within this segment.

- By Crop Type

On the basis of crop type, the Tebufenozide market is segmented into cereal crops, fruits and vegetables, cash crops, and oilseeds. The fruits and vegetables segment dominated the market in 2024 due to the high susceptibility of these crops to caterpillar infestations and the growing demand for premium quality produce. Tebufenozide’s targeted pest control and compatibility with organic farming standards have made it popular among horticultural producers seeking safe and efficient pest management solutions. Moreover, stringent residue regulations on fruits and vegetables have encouraged growers to adopt Tebufenozide as an environmentally responsible alternative.

The cereal crops segment is projected to register the fastest growth from 2025 to 2032 owing to the rising need for pest-resistant grain production. Cereal crops such as rice and maize are heavily affected by lepidopteran pests, and Tebufenozide provides effective control while maintaining grain integrity. Expanding agricultural activities across Asia-Pacific and growing awareness of sustainable crop protection methods are anticipated to support this segment’s rapid expansion.

- By Formulation Type

On the basis of formulation type, the Tebufenozide market is segmented into wettable powder (WP), emulsifiable concentrate (EC), granules (G), and aqueous suspension concentrate (ASC). The emulsifiable concentrate (EC) segment accounted for the largest market share in 2024 due to its superior solubility, ease of application, and uniform distribution on crops. EC formulations provide enhanced pest coverage and are widely used in large-scale agricultural spraying operations, ensuring effective pest control with minimal product wastage. Their compatibility with other agrochemicals further enhances adoption among commercial farmers.

The aqueous suspension concentrate (ASC) segment is expected to record the fastest growth rate during 2025–2032, supported by increasing preference for environmentally safer and user-friendly formulations. ASC formulations minimize solvent use and are suitable for precision agriculture practices. Rising focus on worker safety, reduced chemical exposure, and sustainable pest management are key factors driving this segment’s strong growth potential.

- By Distribution Channel

On the basis of distribution channel, the Tebufenozide market is segmented into direct sales, online retail, wholesale distributors, and specialty stores. The wholesale distributors segment dominated the market in 2024 as they play a crucial role in ensuring consistent supply to agricultural cooperatives and local retailers. Their well-established networks and ability to provide bulk quantities at competitive prices make them the preferred channel for large-scale farming operations. In addition, the technical support and advisory services offered by distributors enhance brand loyalty among end users.

The online retail segment is anticipated to experience the fastest growth from 2025 to 2032, driven by the digital transformation of the agricultural sector and increasing adoption of e-commerce platforms among farmers. Online channels offer price transparency, wider product availability, and doorstep delivery, making it convenient for small and mid-sized farmers. The integration of online retail with agritech platforms and digital advisory services is expected to further accelerate this channel’s expansion.

- By End-User

On the basis of end-user, the Tebufenozide market is segmented into farmers, agricultural cooperatives, pest control companies, and government and regulatory bodies. The farmers segment held the largest share in 2024 due to the widespread use of Tebufenozide in crop protection to prevent yield losses and maintain produce quality. Farmers prefer Tebufenozide for its effectiveness, low toxicity, and compatibility with integrated pest management programs. Increasing adoption of sustainable farming practices and growing awareness of eco-friendly pesticides further drive this segment’s dominance.

The government and regulatory bodies segment is projected to grow at the fastest rate from 2025 to 2032, fueled by rising investment in pest control initiatives and regulatory efforts promoting safer insecticides. Governments are increasingly incorporating Tebufenozide into national pest control programs owing to its favorable environmental profile. The emphasis on minimizing ecological impact and ensuring food security through sustainable pesticide use is expected to bolster the segment’s growth trajectory.

Tebufenozide Market Regional Analysis

- North America dominated the tebufenozide market with the largest revenue share of over 35% in 2024, driven by the widespread adoption of sustainable crop protection practices and stringent environmental regulations limiting the use of toxic pesticides

- Farmers across the region are increasingly adopting Tebufenozide due to its selectivity, low toxicity, and compatibility with integrated pest management programs

- The growing emphasis on eco-friendly insecticides and government initiatives promoting reduced chemical residues in food products have further bolstered market demand

U.S. Tebufenozide Market Insight

The U.S. Tebufenozide market captured the largest share in 2024 within North America, fueled by the rising awareness of organic farming and sustainable agriculture. The market growth is also driven by the need to manage resistant pest species effectively while maintaining productivity. High investments in agricultural biotechnology, along with the presence of major agrochemical companies such as Corteva Agriscience and FMC Corporation, are reinforcing the dominance of the U.S. market.

Europe Tebufenozide Market Insight

The Europe Tebufenozide market is projected to expand at a substantial CAGR during the forecast period, supported by the region’s strict regulatory framework favoring environmentally safe insecticides. Farmers are increasingly transitioning to insect growth regulators such as Tebufenozide to comply with EU pesticide residue limits and promote sustainable farming practices. The rising adoption of organic and integrated pest management systems is contributing to steady market expansion across key agricultural economies such as France, Germany, and Spain.

U.K. Tebufenozide Market Insight

The U.K. Tebufenozide market is anticipated to grow at a notable CAGR throughout the forecast period, driven by the country’s efforts to reduce pesticide dependency and encourage biological alternatives. Increasing pest pressure on high-value crops and strong support from agricultural cooperatives are further driving adoption. In addition, the government’s commitment to sustainable food production and environmental conservation aligns well with the use of Tebufenozide as a targeted, low-toxicity pest control solution.

Germany Tebufenozide Market Insight

The Germany Tebufenozide market is expected to expand at a significant CAGR during the forecast period due to the country’s focus on sustainable agriculture and strict pesticide use policies. Germany’s advanced farming practices, coupled with its technological expertise in precision agriculture, are fostering the application of Tebufenozide in major crops. Its compatibility with organic standards and minimal impact on beneficial insects make it a preferred choice among German farmers pursuing eco-friendly pest management solutions.

Asia-Pacific Tebufenozide Market Insight

The Asia-Pacific Tebufenozide market is projected to grow at the fastest CAGR from 2025 to 2032, attributed to expanding agricultural activities, rising food demand, and growing awareness of sustainable pest control methods. Rapid urbanization and population growth in countries such as China, India, and Japan have heightened the need for efficient crop protection. Governments in the region are promoting eco-friendly pesticides and modern agricultural technologies, fueling Tebufenozide adoption in cereal, fruit, and vegetable cultivation.

China Tebufenozide Market Insight

The China Tebufenozide market accounted for the largest share within Asia-Pacific in 2024, driven by the country’s vast agricultural output and government-led initiatives promoting green pest control solutions. Farmers are increasingly using Tebufenozide for its safety profile, effectiveness against lepidopteran pests, and ability to enhance yield quality. Strong domestic production capabilities and the presence of leading agrochemical manufacturers are further propelling market expansion.

Japan Tebufenozide Market Insight

The Japan Tebufenozide market is experiencing steady growth, supported by the nation’s advanced agricultural infrastructure and commitment to precision farming. The demand for residue-free produce and pest-resistant crops is fostering increased adoption among Japanese farmers. Furthermore, government policies encouraging reduced pesticide residues in exported agricultural products are enhancing the use of Tebufenozide as a reliable, environmentally sustainable insect control solution.

Tebufenozide Market Share

The tebufenozide industry is primarily led by well-established companies, including:

- Gowan Company (U.S.)

- Kumiai Chemical Industry Co., Ltd. (Japan)

- Qingdao Jiner Agrochemical Co., Ltd. (China)

- Shanghai Skyblue Chemical Co., Ltd. (China)

- Jingbo Agrochemicals Technology Co., Ltd. (China)

- Lan-Crystal Biotechnology Co., Ltd. (China)

- Nippon Soda Co., Ltd. (Japan)

- YongNong BioSciences Co., Ltd. (China)

- Shandong Luba Chemical Co., Ltd. (China)

- Hangzhou Tianlong Biotechnology Co., Ltd. (China)

- Qingdao Higrow Chemicals Co., Ltd. (China)

- Jiangsu Baoling Chemical Co., Ltd. (China)

Latest Developments in Global Tebufenozide Market

- In May 2024, Tang Agri (China) introduced a new Tebufenozide 24% SC formulation, designed for enhanced stability, superior pest control efficiency, and export compatibility to markets such as Europe, the U.S., Australia, and India. This launch signifies the company’s focus on catering to international demand for eco-friendly insecticides and expanding its global market footprint. The introduction of improved formulations strengthens Tebufenozide’s competitiveness against conventional insecticides and supports the growing shift toward sustainable crop protection solutions

- In March 2024, Nippon Soda Co., Ltd. (Japan) finalized a strategic distribution partnership with Certis Europe S.A. to market Tebufenozide-based products across major European agricultural regions including France, Italy, Spain, Portugal, the U.K., Belgium, the Netherlands, and Luxembourg. This partnership enhances Nippon Soda’s distribution efficiency and strengthens the availability of Tebufenozide in Europe’s regulated agricultural markets. It also reinforces the company’s strategy to meet the rising demand for selective insect growth regulators aligned with EU environmental standards

- In December 2023, the European Commission renewed regulatory approval for Tebufenozide, ensuring its continued authorization for use across the EU. This decision provides long-term market stability and confidence to manufacturers and farmers adopting Tebufenozide as part of integrated pest management (IPM) programs. The extension also encourages further investment in product development and regional expansion by major agrochemical producers operating under strict European pesticide regulations

- In October 2023, a leading crop-protection company acquired a specialty bio-insecticide manufacturer to strengthen its Tebufenozide portfolio and broaden its sustainable pest control product line. This acquisition reflects the industry’s consolidation trend and growing focus on green chemistry solutions. By integrating Tebufenozide-based formulations with biological pest management systems, the company enhances its R&D capacity and positions itself as a key player in the eco-conscious agrochemical market

- In July 2023, Shandong Jingbo Biotech Co., Ltd. (China) announced a capacity expansion project for a Tebufenozide technical (TC) production line with an annual capacity of approximately 400 tons. This move aims to meet the rising domestic and international demand for Tebufenozide-based insecticides driven by sustainable agriculture initiatives. The expansion reinforces China’s position as a global manufacturing hub for active agrochemical ingredients and strengthens the overall supply chain resilience of the Tebufenozide market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.