Global Technical Ceramic Market

Market Size in USD Billion

CAGR :

%

USD

12.48 Billion

USD

22.49 Billion

2024

2032

USD

12.48 Billion

USD

22.49 Billion

2024

2032

| 2025 –2032 | |

| USD 12.48 Billion | |

| USD 22.49 Billion | |

|

|

|

|

Technical Ceramic Market Size

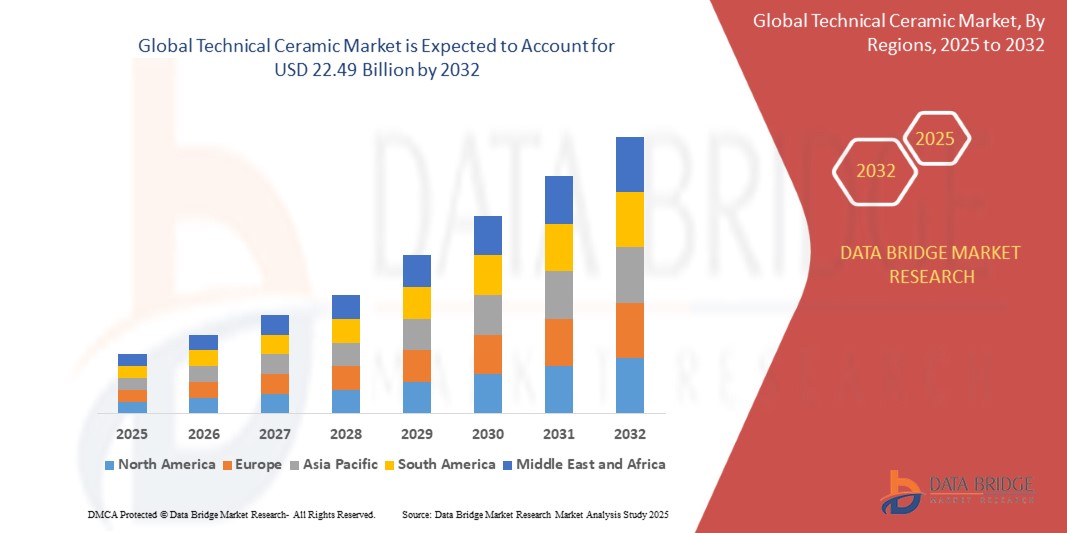

- The global technical ceramic market was valued at USD 12.48 billion in 2024 and is expected to reach USD 22.49 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.64%, primarily driven by the increasing demand across electronics, automotive, and medical sectors

- This growth is driven by factors such as the rising adoption of ceramic components in electric vehicles (EVs), growing use in semiconductor manufacturing, and enhanced performance advantages over traditional materials like metals and plastics

Technical Ceramic Market Analysis

- Technical ceramics are advanced materials engineered for exceptional mechanical, thermal, and chemical properties, making them indispensable in applications ranging from electronics and automotive to medical and industrial equipment. They are used in components such as substrates, insulators, seals, bearings, and biomedical implants

- The demand for technical ceramics is significantly driven by their superior durability, resistance to heat and corrosion, and electrical insulation properties. In particular, the electronics and semiconductor industries contribute to a major share of global demand, followed closely by applications in automotive electrification and medical implants

- The Asia-Pacific region stands out as one of the dominant markets for technical ceramics, driven by rapid industrialization, the expansion of electronics manufacturing in countries like China, Japan, and South Korea, and growing investments in healthcare infrastructure

- For instance, Kyocera Corporation expanded its technical ceramics production capacity in Japan in 2023 to meet rising demand from EV and semiconductor sectors. Similarly, Murata Manufacturing continues to invest in ceramic components for 5G and IoT technologies, further driving market momentum in the region

- Globally, technical ceramics are considered key enabling materials for high-performance systems, especially in environments requiring extreme wear resistance, electrical insulation, and biocompatibility, and they play a pivotal role in advancing emerging technologies such as electric vehicles, renewable energy systems, and next-generation electronics

Report Scope and Technical Ceramic Market Segmentation

|

Attributes |

Technical Ceramic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Technical Ceramic Market Trends

“Increased Use of Advanced Ceramics in High-Performance Applications”

- One prominent trend in the global technical ceramic market is the growing use of advanced ceramics in high-performance applications across industries such as electronics, automotive, aerospace, and healthcare. These materials are increasingly being adopted for their superior thermal, mechanical, and electrical properties

- In the electronics sector, the demand for ceramic substrates and components continues to grow, particularly for 5G telecommunications and semiconductor packaging. Ceramic capacitors and resistors offer superior performance in miniaturized, high-frequency devices, driving their widespread use in next-gen electronics

- For instance, the automotive industry is incorporating advanced ceramics in components like electric vehicle batteries, brake systems, and thermal management parts, due to their ability to withstand high temperatures, reduce weight, and improve performance in electric drivetrains

- Bioceramics are gaining significant traction in the medical and dental industries, where they are used for implants, prosthetics, and bone replacements. These materials are highly biocompatible, making them ideal for use in joint replacements, dental crowns, and bone grafting, contributing to improved patient recovery and longer-lasting implants

- This trend is revolutionizing various industries by enabling the development of lighter, stronger, and more efficient components, which are vital for advancing technologies in electric mobility, telecommunications, and healthcare

Technical Ceramic Market Dynamics

Driver

“Growing Demand for Advanced Materials in High-Performance Applications”

- The growing demand for advanced materials in high-performance applications is significantly contributing to the increased demand for technical ceramics across multiple industries, including electronics, automotive, aerospace, and medical devices

- As global industries transition toward more energy-efficient and high-performing technologies, the need for materials that can withstand extreme conditions, such as high temperatures, pressures, and corrosive environments, is rising. Technical ceramics, such as silicon carbide and alumina, offer unmatched durability and reliability, making them crucial in these high-performance sectors

- In particular, the automotive and electric vehicle (EV) industries are driving substantial growth in the demand for technical ceramics. Ceramic components are increasingly being used in brake systems, batteries, and heat management systems for EVs, as they offer lightweight, heat-resistant, and electrically insulating properties. The growing shift to EVs is directly increasing the need for these advanced ceramics

- The electronics sector is also a key driver, with semiconductor manufacturers using advanced ceramics for substrates, insulators, and packaging components in 5G networks, mobile devices, and semiconductor fabrication, as these materials provide superior performance in high-frequency and high-temperature applications

- In addition, the demand for bioceramics is rising in the healthcare industry. Implants made from zirconia and alumina ceramics are increasingly used for joint replacements and dental implants, offering biocompatibility and longer-lasting performance

For instance,

- In April 2023, CeramTec announced the launch of a new ceramic-based brake system for electric vehicles, which features superior performance in high temperatures, a direct response to the increasing demand for efficient EV technology. This highlights the growing demand for technical ceramics in the automotive sector

- In November 2022, Kyocera Corporation expanded its production of ceramic substrates for 5G semiconductor applications, recognizing the growing demand in high-tech electronics markets. The increasing adoption of 5G networks and electronic devices requires durable, high-performance ceramic components, further driving market growth

- As industries continue to demand lighter, stronger, and more efficient materials, the use of technical ceramics is expected to increase, making them a crucial component in the ongoing evolution of modern technologies

Opportunity

“Integration of Advanced Ceramics in Emerging Technologies”

- The integration of advanced ceramics into emerging technologies offers a significant opportunity for market growth, particularly in the electric vehicle (EV), renewable energy, and semiconductor industries. These industries require materials with high durability, heat resistance, and electrical insulation, all of which advanced ceramics provide

- In the electric vehicle (EV) sector, advanced ceramics are increasingly being used for battery components, power electronics, and thermal management systems. Ceramic materials like silicon carbide are helping EVs achieve higher power efficiency, better heat dissipation, and longer battery life, creating substantial opportunities for ceramic manufacturers

- Renewable energy technologies, such as solar panels and wind turbines, are another area where advanced ceramics are showing great promise. Ceramics are used in high-temperature coatings, insulating materials, and durable components for renewable energy systems, providing superior performance in harsh environmental conditions

- Semiconductor manufacturing continues to drive demand for ceramics, especially in the production of advanced substrates and insulating materials for 5G technologies and microelectronics. The trend toward miniaturization and the increasing use of high-performance ceramics in electronics will contribute significantly to market expansion

For instance,

- In September 2023, CeramTec launched a new line of high-performance ceramics for power electronics used in electric vehicles, offering improved thermal conductivity and reduced energy losses. This marks an important step toward the widespread adoption of ceramics in the growing EV market

- In June 2022, Kyocera introduced ceramic components for 5G infrastructure, allowing for smaller, more efficient antennas that are vital for the advancement of high-speed telecommunications. The use of ceramics in 5G network devices presents a significant opportunity for technical ceramics in the telecommunications sector

- The continued push for higher efficiency, sustainability, and miniaturization in various industries presents expanding opportunities for technical ceramics, particularly in sectors where performance under extreme conditions is critical

Restraint/Challenge

“High Material and Manufacturing Costs Limiting Market Growth”

- The high material and manufacturing costs associated with advanced technical ceramics pose a significant challenge to the market, particularly in industries like automotive, aerospace, and electronics, where cost-effective production is crucial

- Technical ceramics, such as silicon carbide, zirconia, and alumina, are often expensive due to the complexity of their manufacturing processes and the high-quality materials required. These materials are sourced from specialized suppliers and involve advanced processing techniques like sintering and hot isostatic pressing, which increase production costs

- For industries with tight budgets, particularly in developing regions, the high costs of advanced ceramics can limit their ability to adopt these materials for mass production or innovation. Small and medium-sized enterprises (SMEs) may struggle to justify the investment in ceramics due to the significant capital outlay required, often resulting in a reliance on traditional, less expensive materials

For instance,

- In January 2024, CeramTec reported that the high cost of raw materials and manufacturing processes for advanced ceramics remains a key challenge in expanding their use in the automotive sector, where companies are seeking more cost-effective alternatives to keep vehicle prices competitive

- In October 2022, Kyocera Corporation highlighted the financial burden of ceramic materials for high-end electronics in a report, acknowledging that the high cost of ceramic substrates in semiconductors limits their widespread adoption in mass-market consumer electronics, despite the performance advantages

- These cost-related barriers can prevent the widespread adoption of advanced ceramics, slowing down market penetration in critical industries that would benefit from the high-performance characteristics these materials offer

Technical Ceramic Market Scope

The market is segmented on the basis material, products, application and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Material |

|

|

By Product |

|

|

By Application |

|

|

By End-User |

|

Technical Ceramic Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Technical Ceramic Market”

- Asia-Pacific dominates the global technical ceramic market, driven by rapid industrialization, high demand for advanced manufacturing technologies, and strong presence of key market players in countries like China, Japan, and South Korea

- China holds a significant share in the market due to the growing demand for high-performance materials in industries such as electronics, automotive, and energy. The country’s expanding automotive sector, coupled with rising investments in electric vehicles (EVs) and renewable energy technologies, is significantly boosting the demand for advanced ceramics

- The region’s electronics industry is another major driver. Japan and South Korea, home to leading semiconductor and electronics companies, are seeing significant growth in the demand for ceramic substrates, insulators, and high-frequency components used in next-generation electronics and telecommunications

- The availability of government incentives, cost-efficient production capabilities, and growing emphasis on technological advancements in ceramic manufacturing further strengthen the market in the Asia-Pacific region

- In addition, the increasing adoption of ceramic materials in EVs, power electronics, and high-temperature applications across industries such as aerospace and healthcare is fueling market expansion in the region

“North America is Projected to Register the Highest Growth Rate”

- The North America region is expected to witness the highest growth rate in the global technical ceramic market, fueled by the rapid adoption of advanced materials in aerospace, defense, medical devices, and electronics sectors, along with strong investments in domestic semiconductor and clean energy manufacturing

- The U.S. and Canada are emerging as key markets due to increased R&D activities, reshoring of semiconductor and electronics production, and growing demand for high-performance ceramic materials in industrial and healthcare applications

- The U.S. , with its substantial investments in domestic semiconductor manufacturing, is driving demand for technical ceramics used in wafer processing, insulators, and chip packaging. In February 2024, CoorsTek Inc., a leading US-based ceramics manufacturer, announced the expansion of its Grand Junction, Colorado facility to increase production capacity for alumina and zirconia-based ceramics used in chip fabrication and medical implants

- Canada is witnessing growth in the use of technical ceramics in clean energy and mining sectors. In September 2023, Nano One Materials Corp., based in British Columbia, partnered with a European automotive supplier to explore the use of technical ceramics in lithium-ion battery components, targeting durability and thermal stability

- The region's robust aerospace and defense sector is also a major driver. In June 2023, Ceramic Matrix Composites Inc. secured a contract with a US defense supplier to develop lightweight ceramic armor systems, underscoring the growing role of technical ceramics in advanced defense technologie

Technical Ceramic Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- CoorsTek, Inc. (U.S.)

- CeramTec GmbH (Germany)

- Kyocera Corporation (Japan)

- Morgan Advanced Materials (U.K.)

- Saint-Gobain (France)

- NGK SPARK PLUG CO., LTD (Japan)

- 3M (U.S.)

- McDanel Advanced Ceramic Technologies (U.S.)

- Rauschert GmbH (Germany)

- STC Superior Technical Ceramics (U.S.)

- Elan Technology (U.S.)

- OC Oerlikon Management AG (Switzerland)

- Mingrui Ceramic (China)

- DuPont (U.S.)

- HOPE Microelectronics CO Ltd. (Japan)

- HONEYWELL INTERNATIONAL INC (U.S.)

- Shin-Etsu Chemical Co., Ltd. (China)

- Albemarle Corporation (U.S.)

- Advanced Ceramics Association (U.S.)

- Applied Ceramics (U.S.)

- Materion Corporation (U.S.)

Latest Developments in Global Technical Ceramic Market

- In July 2022, Bosch Advanced Ceramics, in partnership with Karlsruhe Institute of Technology (KIT) and BASF SE, achieved a ground breaking milestone by developing the world's first microreactor crafted from technical ceramic materials using 3D printing technology. This innovative microreactor is designed to withstand extreme conditions, such as high temperatures and corrosive environments, making it ideal for facilitating chemical reactions. The collaboration highlights Bosch's expertise in ceramics and additive manufacturing, KIT's advanced chemical process knowledge, and BASF's research capabilities

- In October 2022, Artemis Capital Partners, a Boston-based private equity firm, announced the acquisition of McDanel Advanced Ceramic Technologies. McDanel is renowned for its expertise in advanced technical ceramics, particularly in manufacturing high-quality tubular ceramics for demanding applications. This acquisition aligns with Artemis's focus on partnering with innovative industrial technology companies to drive growth and innovation

- In February 2021, STC Raw Material Solutions revealed its acquisition of IJ Research, Inc., a California-based company specializing in sapphire-to-metal assemblies. This strategic move aims to broaden STC's services portfolio, particularly in consulting on material selection and advanced engineering solutions. The acquisition underscores STC's commitment to innovation and expanding its capabilities to meet diverse industry needs

- In May 2021, 3DCeram, a French company specializing in 3D ceramic materials and processes, partnered with Shree Rapid Technologies, an Indian firm, to strengthen its presence in the Indian market. This collaboration aimed to leverage the combined expertise of both companies in 3D printed ceramics, enhancing innovation and accessibility in the field. The partnership reflects 3DCeram's commitment to expanding its global reach and advancing additive manufacturing technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TECHNICAL CERAMICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL TECHNICAL CERAMICS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL TECHNICAL CERAMICS MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRODUCTION CONSUMPTION ANALYSIS

5.2 IMPORT EXPORT SCENARIO

5.3 PRICE TREND ANALYSIS

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 GLOBAL TECHNICAL CERAMICS MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 OXIDE CERAMICS

7.2.1 ALUMINUM

7.2.1.1. ALUMINUM OXIDE

7.2.1.2. ALUMINUM SILICATE

7.2.2 ZIRCONIUM OXIDE

7.2.3 ALUMINUM TITANATE

7.2.4 MIXED/DISPERSION CERAMICS

7.2.5 PIEZO-CERAMICS

7.2.6 SILICATE CERAMICS

7.3 NON-OXIDE CERAMICS

7.3.1 ALUMINUM NITRIDE (ALN)

7.3.2 SILICON CARBIDE

7.3.3 SILICON NITRIDE (SI3N4)

7.3.4 SIALONS

7.3.5 BORON CARBIDE

7.3.6 BORON NITRIDE

7.3.7 FUNCTIONAL CERAMICS/ PIEZO-CERAMICS

8 GLOBAL TECHNICAL CERAMICS MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 MONOLITHIC CERAMICS

8.3 CERAMIC MATRIX COMPOSITES

8.4 CERAMIC COATINGS

8.5 OTHERS

9 GLOBAL TECHNICAL CERAMICS MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 ELECTRONIC

9.3 WEAR-RESISTANT

9.4 HIGH TEMPERATURE

9.5 OTHER

10 GLOBAL TECHNICAL CERAMICS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ELECTRICAL EQUIPMENT

10.3 CATALYST SUPPORTS

10.4 ELECTRONIC DEVICES

10.5 WEAR PARTS

10.6 ENGINE PARTS

10.7 FILTERS

10.8 BIOCERAMICS

10.9 PUMP

10.9.1 PUMP, BY INDUSTRY

10.9.1.1. AGRICULTURE

10.9.1.2. CONSTRUCTION & BUILDING SERVICES

10.9.1.3. WATER & WASTEWATER

10.9.1.4. POWER GENERATION

10.9.1.5. OIL & GAS

10.9.1.6. OTHERS

10.1 OTHERS

11 GLOBAL TECHNICAL CERAMICS MARKET, BY END-USE

11.1 OVERVIEW

11.2 ELECTRICAL & ELECTRONICS

11.2.1 ELECTRICAL & ELECTRONICS, BY PRODUCT TYPE

11.2.1.1. MONOLITHIC CERAMICS

11.2.1.2. CERAMIC MATRIX COMPOSITES

11.2.1.3. CERAMIC COATINGS

11.2.1.4. OTHERS

11.3 AUTOMOTIVE

11.3.1 AUTOMOTIVE, BY PRODUCT TYPE

11.3.1.1. MONOLITHIC CERAMICS

11.3.1.2. CERAMIC MATRIX COMPOSITES

11.3.1.3. CERAMIC COATINGS

11.3.1.4. OTHERS

11.4 MACHINERY

11.4.1 MACHINERY, BY PRODUCT TYPE

11.4.1.1. MONOLITHIC CERAMICS

11.4.1.2. CERAMIC MATRIX COMPOSITES

11.4.1.3. CERAMIC COATINGS

11.4.1.4. OTHERS

11.5 ENVIRONMENTAL

11.5.1 ENVIRONMENTAL, BY PRODUCT TYPE

11.5.1.1. MONOLITHIC CERAMICS

11.5.1.2. CERAMIC MATRIX COMPOSITES

11.5.1.3. CERAMIC COATINGS

11.5.1.4. OTHERS

11.6 TRANSPORTATION

11.6.1 TRANSPORTATION, BY PRODUCT TYPE

11.6.1.1. MONOLITHIC CERAMICS

11.6.1.2. CERAMIC MATRIX COMPOSITES

11.6.1.3. CERAMIC COATINGS

11.6.1.4. OTHERS

11.7 MEDICAL

11.7.1 MEDICAL, BY PRODUCT TYPE

11.7.1.1. MONOLITHIC CERAMICS

11.7.1.2. CERAMIC MATRIX COMPOSITES

11.7.1.3. CERAMIC COATINGS

11.7.1.4. OTHERS

11.8 DEFENCE & SECURITY

11.8.1 DEFENCE & SECURITY, BY PRODUCT TYPE

11.8.1.1. MONOLITHIC CERAMICS

11.8.1.2. CERAMIC MATRIX COMPOSITES

11.8.1.3. CERAMIC COATINGS

11.8.1.4. OTHERS

11.9 CHEMICAL

11.9.1 CHEMICAL, BY PRODUCT TYPE

11.9.1.1. MONOLITHIC CERAMICS

11.9.1.2. CERAMIC MATRIX COMPOSITES

11.9.1.3. CERAMIC COATINGS

11.9.1.4. OTHERS

11.1 OTHERS

11.10.1 OTHERS, BY PRODUCT TYPE

11.10.1.1. MONOLITHIC CERAMICS

11.10.1.2. CERAMIC MATRIX COMPOSITES

11.10.1.3. CERAMIC COATINGS

11.10.1.4. OTHERS

12 GLOBAL TECHNICAL CERAMICS MARKET, BY GEOGRAPHY

Global Technical Ceramics Market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 U.K.

12.2.3 ITALY

12.2.4 FRANCE

12.2.5 SPAIN

12.2.6 SWITZERLAND

12.2.7 RUSSIA

12.2.8 TURKEY

12.2.9 BELGIUM

12.2.10 NETHERLANDS

12.2.11 LUXEMBURG

12.2.12 REST OF EUROPE

12.3 ASIA-PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 SINGAPORE

12.3.6 THAILAND

12.3.7 INDONESIA

12.3.8 MALAYSIA

12.3.9 PHILIPPINES

12.3.10 AUSTRALIA AND NEW ZEALAND

12.3.11 REST OF ASIA-PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 UNITED ARAB EMIRATES

12.5.5 ISRAEL

12.5.6 REST OF MIDDLE EAST AND AMERICA

13 GLOBAL TECHNICAL CERAMICS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS AND ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

15 GLOBAL TECHNICAL CERAMICS MARKET – COMPANY PROFILE

15.1 MARUWA CO., LTD.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 CTS CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 COORSTEK INC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 CERAMTEC GMBH

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 KYOCERA CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATESA

15.6 MORGAN ADVANCED MATERIALS

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 SAINT-GOBAIN

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 NGK SPARK PLUG CO.,LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 3M

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 MCDANEL ADVANCED CERAMIC TECHNOLOGIES

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 RAUSCHERT GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

15.12 STC SUPERIOR TECHNICAL CERAMICSS

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATES

15.13 ELAN TECHNOLOGY

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATES

15.14 TECHNICAL CERAMICS

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 ORTECH ADVANCED CERAMICS

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

15.16 DUPONT

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 MURATA MANUFACTURING CO., LTD

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT UPDATES

15.18 GENERAL ELECTRIC

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT UPDATES

15.19 MOMENTIVE

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 PALL CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT UPDATES

15.21 ALBEMARLE CORPORATION

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Global Technical Ceramic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Technical Ceramic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Technical Ceramic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.