Global Technical Fluids Market

Market Size in USD Billion

CAGR :

%

USD

69.30 Billion

USD

127.32 Billion

2024

2032

USD

69.30 Billion

USD

127.32 Billion

2024

2032

| 2025 –2032 | |

| USD 69.30 Billion | |

| USD 127.32 Billion | |

|

|

|

|

Technical Fluids Market Size

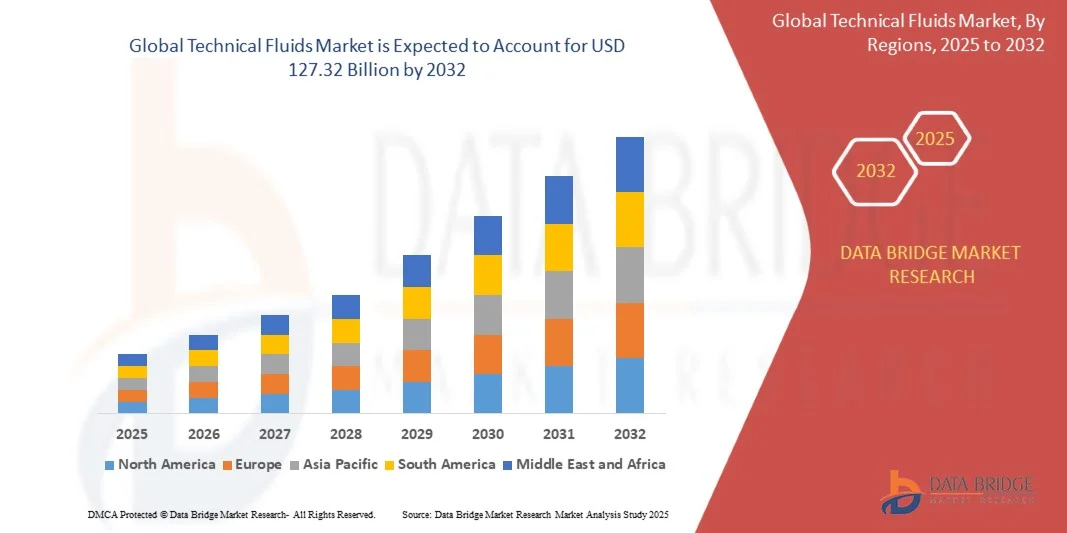

- The global technical fluids market size was valued at USD 69.30 billion in 2024 and is expected to reach USD 127.32 billion by 2032, at a CAGR of 7.90% during the forecast period

- The market growth is largely fueled by increasing industrialization, expansion of the automotive and manufacturing sectors, and rising demand for high-performance and specialty fluids that enhance machinery efficiency, reduce wear, and improve operational safety

- Furthermore, growing awareness of environmentally friendly and sustainable fluids, combined with stricter government regulations on emissions and hazardous chemicals, is driving the adoption of biodegradable, low-VOC, and fire-resistant technical fluids across industries. These converging factors are accelerating the uptake of advanced fluid solutions, thereby significantly boosting the market's growth

Technical Fluids Market Analysis

- Technical fluids, including lubricants, heat transfer fluids, brake fluids, and metalworking fluids, are essential for maintaining operational efficiency, reducing maintenance costs, and ensuring safety across automotive, energy, and industrial applications. Their performance directly impacts equipment longevity and productivity in both industrial and commercial settings

- The escalating demand for technical fluids is primarily fueled by rapid industrialization, increasing vehicle production, and the need for specialized fluids in energy, power generation, and chemical processing industries. In addition, the shift toward sustainable and high-performance fluids is further driving market adoption and innovation

- North America dominated the technical fluids market in 2024, due to high industrialization, advanced manufacturing capabilities, and the widespread adoption of automotive and energy-related fluids

- Asia-Pacific is expected to be the fastest growing region in the technical fluids market during the forecast period due to rapid industrialization, increasing automotive production, and expanding energy and manufacturing sectors in countries such as China, India, and Japan

- Lubricants segment dominated the market with a market share of 39% in 2024, due to their essential role in reducing friction, wear, and energy loss across industrial and automotive applications. Industries increasingly rely on high-performance lubricants to ensure machinery longevity and optimize operational efficiency. The growth is further supported by the rising demand for synthetic and environmentally friendly lubricants that provide enhanced stability under extreme temperatures.

Report Scope and Technical Fluids Market Segmentation

|

Attributes |

Technical Fluids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Technical Fluids Market Trends

“Rising Adoption of High-Performance and Sustainable Technical Fluids”

- The technical fluids market is experiencing accelerated advancements as industries prioritize high-performance and environmentally sustainable formulations. Manufacturers are developing specialty fluids with optimized viscosity, thermal stability, corrosion resistance, and extended lifecycle to meet demanding applications in sectors such as automotive, electronics, aerospace, and energy

- For instance, global players such as BASF and Shell have launched bio-based hydraulic fluids and nanotechnology-enhanced lubricants that deliver superior performance while supporting environmental goals. These innovations offer improved biodegradability, reduced toxicity, and lower emissions compared to traditional petroleum-based fluids, gaining traction in metalworking and precision manufacturing markets

- Continuous R&D in technical fluid chemistry is unlocking transformative properties such as enhanced lubrication and higher heat transmission. The adoption of nanofluids incorporating engineered nanoparticles provides significant improvements in wear resistance, efficiency, and can enable new applications in high-performance engines and critical electronic components

- Technological upgrades and real-time monitoring requirements are driving the adoption of smart fluids in automated manufacturing. Specialty coolants, dielectric fluids, and heat transfer agents are now tailored for integration with Industry 4.0 solutions and predictive maintenance systems, helping industries boost uptime and reduce operational costs

- Growing concerns about energy efficiency and compatibility with renewable technologies are stimulating demand for fluids sourced from vegetable oils and plant extracts. These bio-based formulations have become preferred choices in regions facing increasingly strict sustainability regulations and corporate ESG targets

- This shift toward innovation-infused, sustainable technical fluids is setting new market standards. As industries evolve, continuous investment in advanced fluid engineering, green chemistry, and regulatory compliance is becoming central to competitive positioning and long-term growth

Technical Fluids Market Dynamics

Driver

“Growing Industrialization and Demand for Specialty Fluids”

- Rapid global industrialization and increasing technical complexity across manufacturing sectors are driving robust demand for specialty technical fluids capable of meeting stringent performance requirements. Key industries such as automotive, heavy machinery, chemicals, and electronics depend on these fluids for power transmission, heat management, lubricity, and process control under diverse operating conditions

- For instance, ExxonMobil and Fuchs Petrolub are expanding their product portfolios with high-purity process fluids, advanced coolants, and custom lubricants tailored for growing markets in Asia and Eastern Europe. These offerings support high-throughput automated processes and industrial scale operations, ensuring optimal equipment efficiency and longevity

- The expansion of e-mobility, renewable energy, and aerospace projects is elevating requirements for technical fluids that maximize energy conversion and minimize wear in critical systems. High-performance dielectric fluids, hydraulic compounds, and heat transfer agents are increasingly incorporated to support safer, more productive operations

- Demand for specialty fluids is also propelled by sectoral trends in clean manufacturing, microelectronics, and precision engineering. Customization and innovation in formulation are critical as manufacturers seek enhanced product quality, reduced downtime, and streamlined compliance with international safety and performance standards

- As industries modernize and scale up, technical fluids will remain foundational to efficient production and process reliability on a global level. This continuing drive for specialty solutions highlights the sector’s pivotal role in supporting industrial evolution and technological advancement

Restraint/Challenge

“Strict Environmental and Safety Regulations”

- Strict environmental and safety regulations are imposing significant challenges for technical fluid manufacturers and users worldwide. Regulatory bodies are mandating reduced VOC emissions, lower toxicity levels, and rigorous standards concerning chemical composition, workplace safety, and waste management in fluid manufacturing and deployment

- For instance, compliance with EU REACH and U.S. EPA regulations requires manufacturers such as Chevron Phillips Chemical and TotalEnergies to reformulate products, restrict hazardous ingredients, and invest in safer handling procedures and emission controls. These demands increase operational complexity and elevate development costs for sector participants

- The deployment of technical fluids in hazardous environments and sensitive applications such as food, pharmaceuticals, and microelectronics raises the stakes for traceability, contamination prevention, and ecological impact. Regular audits, certification processes, and reporting procedures burden supply chains, increasing administrative overhead for both manufacturers and end-users

- Meeting evolving regulations, particularly in biobased fluids and nanomaterials, requires continuous innovation and costly technical validation. Balancing high-performance requirements with eco-design and safe workplace practices can impact margins and market agility, especially for medium-scale entrants

- Overcoming these challenges will depend on proactive investment in regulatory intelligence, sustainable formulation science, and advanced risk management. As statutory scrutiny intensifies, compliance will remain central to market participation and sector durability worldwide

Technical Fluids Market Scope

The market is segmented on the basis of fluid type and end-user.

• By Fluid Type

On the basis of fluid type, the technical fluids market is segmented into dielectric fluids, heat transfer fluids, antifreeze/coolants, brake fluids, transmission fluids, drilling fluids, washer fluids, metalworking fluids, lubricants, and other industrial fluids. The lubricants segment dominated the market with the largest market revenue share of 39% in 2024, driven by their essential role in reducing friction, wear, and energy loss across industrial and automotive applications. Industries increasingly rely on high-performance lubricants to ensure machinery longevity and optimize operational efficiency. The growth is further supported by the rising demand for synthetic and environmentally friendly lubricants that provide enhanced stability under extreme temperatures.

The heat transfer fluids segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by expanding industrial processes and the growing adoption of renewable energy systems that require efficient thermal management. For instance, companies such as Dow and Eastman are innovating advanced heat transfer fluids for solar thermal and concentrated solar power applications, driving sector expansion. The increasing need for fluids capable of operating under high thermal loads in chemical, power generation, and automotive sectors also contributes to the accelerated growth of this segment.

• By End Users

On the basis of end users, the technical fluids market is segmented into oil and gas, chemicals and petrochemicals, plastics and polymers, automotive and transportation, energy and power, pharmaceuticals, and others. The automotive and transportation segment dominated the market in 2024, owing to the high consumption of lubricants, coolants, brake fluids, and transmission fluids in vehicles. Rising vehicle production, electrification trends, and maintenance requirements in both passenger and commercial vehicles significantly support this dominance. The segment also benefits from growing aftermarket demand and government regulations promoting high-performance, eco-friendly automotive fluids.

The energy and power segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rapid deployment of power generation infrastructure and the need for specialized technical fluids in turbines, transformers, and thermal systems. For instance, companies such as Shell and ExxonMobil are supplying advanced dielectric and heat transfer fluids for renewable and conventional energy plants, boosting adoption. Increased investments in sustainable and high-efficiency energy systems across emerging economies further reinforce the rapid expansion of this end-user segment.

Technical Fluids Market Regional Analysis

- North America dominated the technical fluids market with the largest revenue share in 2024, driven by high industrialization, advanced manufacturing capabilities, and the widespread adoption of automotive and energy-related fluids

- Consumers and industries in the region highly value high-performance, reliable, and eco-friendly technical fluids that enhance operational efficiency, reduce maintenance costs, and comply with stringent environmental regulations

- This widespread adoption is further supported by strong industrial infrastructure, high investment in oil and gas, automotive, and chemical sectors, and the growing emphasis on sustainability, establishing technical fluids as a critical component across multiple industries

U.S. Technical Fluids Market Insight

The U.S. technical fluids market captured the largest revenue share in North America in 2024, fueled by robust industrial and automotive demand. The country’s emphasis on advanced manufacturing and energy efficiency drives the adoption of lubricants, heat transfer fluids, and specialty industrial fluids. Rising investments in automotive production, renewable energy projects, and chemical processing plants further support market growth. Moreover, innovations in environmentally friendly and high-performance fluid solutions are significantly contributing to market expansion.

Europe Technical Fluids Market Insight

The Europe technical fluids market is projected to grow steadily throughout the forecast period, primarily driven by stringent environmental and safety regulations and the adoption of high-performance industrial fluids. The increasing industrial modernization, coupled with the demand for reliable and sustainable fluids in automotive, energy, and chemical sectors, is fostering adoption. European consumers and industries also prioritize fluids that enhance equipment longevity and energy efficiency. Growth is notable across automotive manufacturing, chemicals, and power generation sectors, with technical fluids integrated into both new setups and retrofitting applications.

U.K. Technical Fluids Market Insight

The U.K. technical fluids market is expected to expand at a considerable CAGR during the forecast period, driven by rising industrial output, adoption of high-performance automotive and energy fluids, and government regulations on emissions and energy efficiency. Concerns regarding operational efficiency and equipment maintenance encourage industries to opt for advanced fluids. The U.K.’s focus on green manufacturing and sustainability, alongside its strong automotive and chemical sectors, is expected to continue driving market growth.

Germany Technical Fluids Market Insight

The Germany technical fluids market is anticipated to witness strong growth, fueled by technological advancements, industrial innovation, and high awareness of eco-friendly and energy-efficient fluid solutions. Germany’s well-developed automotive, manufacturing, and chemical industries promote consistent demand for technical fluids. The adoption of fluids integrated with machinery monitoring and performance-enhancing technologies is becoming increasingly prevalent, with strong preference for high-quality, environmentally compliant products aligning with consumer and industrial expectations.

Asia-Pacific Technical Fluids Market Insight

The Asia-Pacific technical fluids market is poised to grow at the fastest CAGR during 2025–2032, driven by rapid industrialization, increasing automotive production, and expanding energy and manufacturing sectors in countries such as China, India, and Japan. The region’s growing industrial base and government initiatives promoting sustainable and high-efficiency fluids are driving adoption. Furthermore, APAC’s emergence as a production hub for industrial and automotive fluids enhances affordability and accessibility, expanding the market to a wider industrial and automotive customer base.

Japan Technical Fluids Market Insight

The Japan technical fluids market is gaining momentum due to advanced manufacturing, high automotive production, and technological innovation. Japanese industries emphasize energy efficiency, machinery longevity, and sustainability, driving demand for lubricants, heat transfer fluids, and specialty industrial fluids. The integration of fluids with automated manufacturing and performance-monitoring systems further fuels growth. In addition, Japan’s aging industrial workforce encourages the adoption of fluids that reduce maintenance complexity and enhance operational safety in both automotive and industrial sectors.

China Technical Fluids Market Insight

The China technical fluids market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid industrial expansion, urbanization, and a growing automotive sector. China is one of the largest consumers of industrial and automotive fluids, with increasing demand from energy, power generation, and chemical processing sectors. Government initiatives supporting smart manufacturing and sustainable operations, alongside strong domestic production capabilities, are key factors propelling the market. Moreover, the availability of cost-effective high-performance fluids is driving adoption across a broad industrial base.

Technical Fluids Market Share

The technical fluids industry is primarily led by well-established companies, including:

- Arkema (France)

- VOLTRONIC (U.S.)

- NISOTEC (Japan)

- BIZOL (Germany)

- Nefteproduct JSC (Russia)

- TotalEnergies SE (France)

- CIMCOOL Fluid Technology, LLC (U.S.)

- Thermic Fluids Pvt. Ltd. (India)

- Eastman Chemical Company (U.S.)

- Witmans Advanced Fluids (U.S.)

- Exxon Mobil Corporation (U.S.)

- BASF SE (Germany)

- Gumpro Drilling Fluids Pvt. Ltd. (India)

- Quaker Chemical Corporation (U.S.)

- Dynalene, Inc. (U.S.)

- Solvay (Belgium)

- Dalian Richfortune Chemicals Co., Ltd. (China)

- KRATON CORPORATION (U.S.)

- Schultz (U.S.)

- MULTITHERM LLC (U.S.)

Latest Developments in Global Technical Fluids Market

- In September 2025, PETRONAS Lubricants International (PLI) partnered with Bosch Rexroth AG to jointly develop bio‑based hydraulic and UTTO (Universal Tractor Transmission Oil) fluids. This strategic collaboration strengthens both companies’ focus on sustainability and energy efficiency in off‑highway and agricultural vehicles. By introducing environmentally friendly and high-performance alternatives, this partnership is expected to accelerate market adoption of bio-based fluids, reduce reliance on traditional mineral-oil products, and set new standards for eco-conscious solutions in the technical fluids industry

- In May 2025, Lubrication Engineers (LE) acquired RSC Bio Solutions, a company specializing in biodegradable, high-performance lubricants for marine and industrial applications. This acquisition significantly enhances LE’s portfolio of sustainable fluids and positions the company as a key player in the environmentally conscious segment of the market. The move reflects the growing importance of eco-friendly solutions, with industries increasingly demanding fluids that comply with environmental regulations while maintaining performance and operational efficiency

- In April 2025, PETRONAS Lubricants International (PLI) and Quaker Houghton formed a strategic partnership to distribute industrial metalworking fluids in India and Malaysia. Through this collaboration, PLI gains access to Quaker Houghton’s product portfolio in Malaysia, while Quaker Houghton can offer PLI’s industrial fluids to steel-mill customers in India. This partnership strengthens both companies’ regional presence, expands product offerings, and enhances competitiveness in the industrial fluids market, particularly in Asia-Pacific, by enabling broader adoption of advanced fluid solutions across multiple sectors

- In February 2025, Lubrication Engineers acquired the industrial brands and products of Royal Purple, known for premium synthetic lubricants and greases. This acquisition allows LE to offer ultra-premium synthetic fluids to a wider industrial customer base, including gear oils, hydraulic fluids, and compressor oils. The move reflects market consolidation and signals a shift toward high-performance, premium-grade industrial fluids, meeting the growing demand for solutions that improve equipment longevity, efficiency, and reliability in industrial and manufacturing operations

- In January 2025, TotalEnergies Lubrifiants acquired low‑VOC, mineral-oil-free fire-resistant hydraulic fluid product lines from Fluid Competence GmbH. These products are designed for high-temperature, high-pressure applications in steel, mining, and tunneling sectors. This acquisition expands TotalEnergies’ specialty fluid portfolio, addresses growing regulatory and environmental requirements, and enhances its market position in safety-critical and high-performance industrial fluids. The move also highlights the increasing emphasis on sustainable, non-toxic fluids in heavy industries globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Technical Fluids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Technical Fluids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Technical Fluids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.