Global Technical Grade Butylated Hydroxytoluene Market

Market Size in USD Million

CAGR :

%

USD

125.53 Million

USD

203.11 Million

2024

2032

USD

125.53 Million

USD

203.11 Million

2024

2032

| 2025 –2032 | |

| USD 125.53 Million | |

| USD 203.11 Million | |

|

|

|

|

Technical Grade Butylated Hydroxytoluene Market Size

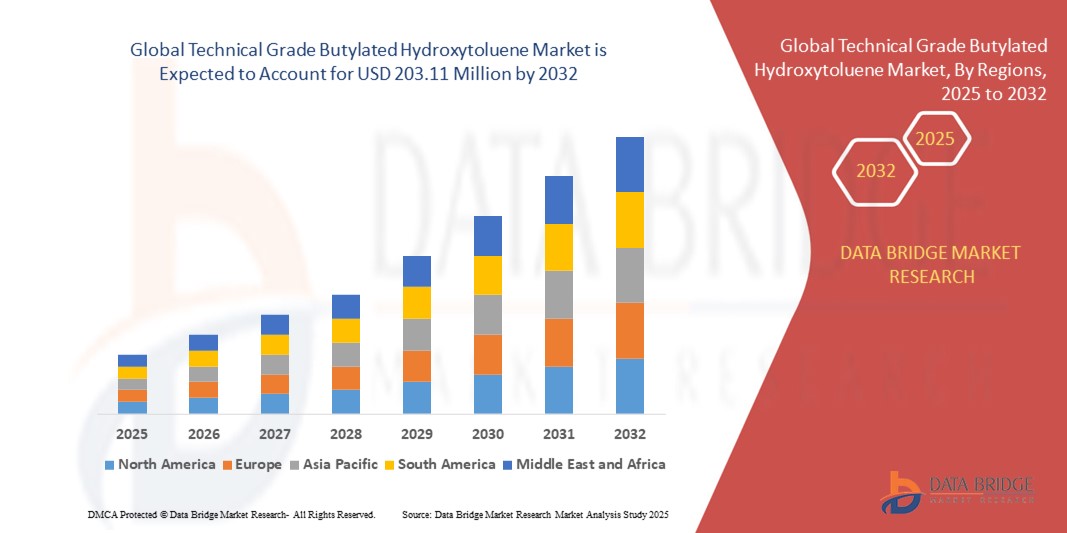

- The global technical grade butylated hydroxytoluene market size was valued at USD 125.53 million in 2024 and is expected to reach USD 203.11 million by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fuelled by the increasing demand for antioxidants in the food, cosmetics, and pharmaceutical industries to enhance product stability and shelf life

- Rising awareness regarding the harmful effects of oxidative degradation in various applications is driving the adoption of technical grade butylated hydroxytoluene as a reliable antioxidant additive

Technical Grade Butylated Hydroxytoluene Market Analysis

- The market is witnessing significant growth due to its widespread use in preventing the oxidation of fats and oils in food processing, ensuring quality and safety

- Industrial sectors such as rubber, plastics, and lubricants are increasingly incorporating technical grade butylated hydroxytoluene to enhance product performance and longevity

- North America dominated the global technical grade butylated hydroxytoluene market with the largest revenue share of 38.5% in 2024, driven by the strong presence of plastics, rubber, and personal care industries that extensively use BHT as an antioxidant and preservative

- Asia-Pacific region is expected to witness the highest growth rate in the global technical grade butylated hydroxytoluene market, driven by rising manufacturing activities, government initiatives promoting food safety and preservation, and growing demand from emerging economies such as China, India, and Japan

- The plastics and rubbers segment dominated the market with the largest revenue share in 2024, driven by the widespread use of BHT as an antioxidant and stabilizer to prevent polymer degradation during processing and extend product lifespan. Manufacturers prioritize technical grade BHT for its effectiveness in maintaining the quality and durability of plastic and rubber products, which is critical across various industrial applications. The segment’s growth is also supported by increased demand for durable and high-performance materials in automotive, construction, and packaging sectors

Report Scope and Technical Grade Butylated Hydroxytoluene Market Segmentation

|

Attributes |

Technical Grade Butylated Hydroxytoluene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand for Antioxidants in Food and Pharmaceutical Industries |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Technical Grade Butylated Hydroxytoluene Market Trends

Increasing Usage of Antioxidants in Food and Pharmaceutical Applications

- The growing preference for antioxidants such as technical grade butylated hydroxytoluene (BHT) in food preservation and pharmaceutical formulations is driving market demand. BHT helps extend shelf life by preventing oxidation, which is critical for maintaining product quality and safety. Its effectiveness and regulatory acceptance make it a favored choice among manufacturers

- Rising consumer awareness about food safety and quality is boosting demand for natural and synthetic antioxidants, including technical grade BHT, in packaged foods and dietary supplements. This trend is supported by stricter food safety regulations and quality standards worldwide

- The expanding pharmaceutical sector is increasing the use of BHT as a stabilizer in various drug formulations, which helps improve product stability and efficacy. This growing application scope further supports market growth

- For instance, in 2023, several food processing companies in Europe enhanced their product formulations with BHT to meet extended shelf life requirements and comply with evolving food safety regulations, resulting in higher product reliability and consumer trust

- While BHT continues to be widely used, ongoing research into its safety profile and regulatory scrutiny are encouraging manufacturers to innovate and develop optimized formulations to balance efficacy and consumer concerns

Technical Grade Butylated Hydroxytoluene Market Dynamics

Driver

Rising Demand for Food Preservation and Stability in Pharmaceutical Products

• The increasing need for food preservation, driven by longer supply chains and growing packaged food consumption, is boosting the demand for antioxidants such as technical grade BHT. This is especially critical for preventing spoilage and maintaining nutritional quality during storage and transport

• In pharmaceuticals, BHT is valued for its role as a stabilizer that prevents oxidation of active ingredients, thereby extending drug shelf life and ensuring consistent therapeutic performance. The expansion of the pharmaceutical industry globally is directly contributing to increased BHT consumption

• Regulatory approvals and inclusion of BHT in food additive lists worldwide provide market legitimacy, encouraging manufacturers to use it widely in food and pharmaceutical sectors. This regulatory support strengthens market confidence and adoption

• For instance, in 2022, key food manufacturers in North America increased procurement of technical grade BHT to meet growing demand for packaged snacks and processed foods, highlighting its critical role in food preservation

• While demand drivers are strong, manufacturers must continue to focus on compliance with evolving safety standards and innovate for improved efficacy to sustain growth

Restraint/Challenge

Safety Concerns and Regulatory Scrutiny Over Synthetic Antioxidants

• Safety concerns related to synthetic antioxidants such as BHT, including debates over potential health risks, are leading to tighter regulations and restrictions in certain regions. This creates uncertainty and challenges for widespread adoption, particularly in markets with stringent food safety laws

• Consumer preference is increasingly shifting toward natural antioxidants, posing competition to synthetic options such as BHT. This shift is pressuring manufacturers to develop cleaner-label products and explore alternative preservatives

• Variations in regulatory frameworks across countries complicate global market strategies, requiring companies to navigate complex compliance requirements and approval processes, which can delay product launches and increase costs

• For instance, in 2023, regulatory agencies in parts of Europe revisited allowable BHT limits in food products, causing some manufacturers to reformulate items and seek alternative antioxidants to maintain market access

• Despite these challenges, ongoing scientific research and formulation innovations are helping the industry address safety concerns and adapt to regulatory changes, paving the way for continued use of technical grade BHT in targeted applications

Technical Grade Butylated Hydroxytoluene Market Scope

The market is segmented on the basis of end-use industry.

- By End-Use Industry

On the basis of end-use industry, the technical grade butylated hydroxytoluene market is segmented into plastics and rubbers, animal feed, personal care, and others. The plastics and rubbers segment dominated the market with the largest revenue share in 2024, driven by the widespread use of BHT as an antioxidant and stabilizer to prevent polymer degradation during processing and extend product lifespan. Manufacturers prioritize technical grade BHT for its effectiveness in maintaining the quality and durability of plastic and rubber products, which is critical across various industrial applications. The segment’s growth is also supported by increased demand for durable and high-performance materials in automotive, construction, and packaging sectors.

The animal feed segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising awareness regarding feed quality and the need to protect feed ingredients from oxidation. BHT helps preserve essential nutrients and extends shelf life, improving animal health and productivity. Growing livestock farming activities and increasing demand for fortified and high-quality feed products globally are driving this segment’s expansion.

Technical Grade Butylated Hydroxytoluene Market Regional Analysis

• North America dominated the global technical grade butylated hydroxytoluene market with the largest revenue share of 38.5% in 2024, driven by the strong presence of plastics, rubber, and personal care industries that extensively use BHT as an antioxidant and preservative

• The region’s stringent regulations on product quality and safety, coupled with increasing demand for extended shelf life in animal feed and packaged goods, fuel the adoption of technical grade BHT

• In addition, technological advancements and growing awareness of synthetic antioxidants’ benefits support the market growth in both industrial and consumer segments, making North America a leading market for technical grade BHT

U.S. Technical Grade Butylated Hydroxytoluene Market Insight

The U.S. market captured the largest share within North America in 2024, driven by the expanding plastics and rubber manufacturing sectors that rely heavily on BHT to enhance product stability and longevity. Increasing demand from the personal care and animal feed industries, which use BHT as a preservative and antioxidant, further propels market growth. Moreover, rising consumer awareness regarding product safety and quality is encouraging manufacturers to adopt high-purity technical grade BHT, reinforcing the market’s upward trajectory.

Europe Technical Grade Butylated Hydroxytoluene Market Insight

The Europe technical grade BHT market is expected to witness the fastest growth rate from 2025 to 2032, supported by regulatory frameworks that promote the use of effective antioxidants in various industries. Growth in the plastics and rubber sectors, especially in Germany, coupled with rising demand from the personal care segment, drives market expansion. Europe’s emphasis on sustainability and quality control encourages the adoption of technical grade BHT in food packaging and animal feed applications, contributing to steady growth.

U.K. Technical Grade Butylated Hydroxytoluene Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing use of BHT in the personal care and animal feed industries. Growing consumer preference for longer shelf-life products and high-quality packaging solutions is boosting demand. In addition, the U.K.’s well-established chemical manufacturing industry is investing in safer and more effective antioxidants, including technical grade BHT, enhancing market potential.

Germany Technical Grade Butylated Hydroxytoluene Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032 due to its advanced manufacturing capabilities in plastics and rubbers, sectors that extensively utilize BHT for its antioxidant properties. The country’s strong focus on quality standards and innovation in personal care formulations further stimulates the technical grade BHT market. Rising awareness about oxidative degradation and increasing demand for durable materials support Germany’s significant market presence.

Asia-Pacific Technical Grade Butylated Hydroxytoluene Market Insight

The Asia-Pacific technical grade BHT market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, expanding plastics and rubber industries, and increasing consumption in personal care and animal feed sectors in countries such as China, India, and Japan. The region benefits from abundant raw material availability and growing manufacturing hubs, making technical grade BHT more accessible and affordable. Government initiatives promoting food safety and product preservation further accelerate market growth.

Japan Technical Grade Butylated Hydroxytoluene Market Insight

Japan’s market growth is expected to witness the fastest growth rate from 2025 to 2032 technological advancements and strong emphasis on quality and safety in personal care and animal feed products. The demand for high-performance antioxidants in plastics and rubbers also contributes to market expansion. Japan’s aging population and stringent regulatory environment encourage the use of effective preservatives such as technical grade BHT to enhance product reliability and shelf life.

China Technical Grade Butylated Hydroxytoluene Market Insight

China held the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s booming plastics and rubber manufacturing sectors, and rapidly growing personal care and animal feed industries. The rise of smart packaging and focus on food safety are boosting the demand for technical grade BHT. Moreover, strong domestic production capabilities and government support for chemical industry development underpin China’s dominant position in the market.

Technical Grade Butylated Hydroxytoluene Market Share

The technical grade butylated hydroxytoluene industry is primarily led by well-established companies, including:

- Sasol Limited (South Africa)

- LANXESS (Germany)

- Eastman Chemical Company (US)

- Oxiris Chemicals S.A. (Spain)

- HELM AG (Germany)

- Finoric LLC (US)

- Honshu Chemical Industry Co., Ltd (Japan)

- Twinkle Chemi Lab Pvt Ltd (India)

- Yasho Industries Ltd (India)

- Milestone Preservatives Pvt Ltd (India)

Latest Developments in Global Technical Grade Butylated Hydroxytoluene Market

- In February 2023, Eastman Chemical Company completed the acquisition of Dalian Ai-Red Technology Co., Ltd., a manufacturer specializing in paint protection and window films. This strategic move aims to broaden Eastman’s product portfolio in the paint protection materials market. The acquisition is expected to strengthen Eastman’s market position by enhancing its offerings and meeting growing demand for advanced protective coatings. As a result, the company is well-positioned to capture new growth opportunities and drive innovation within the paint protection segment. This development is likely to have a positive impact on the overall market by increasing competition and product variety

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Technical Grade Butylated Hydroxytoluene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Technical Grade Butylated Hydroxytoluene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Technical Grade Butylated Hydroxytoluene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.