Global Telecom Cloud Market

Market Size in USD Billion

CAGR :

%

USD

17.59 Billion

USD

96.43 Billion

2024

2032

USD

17.59 Billion

USD

96.43 Billion

2024

2032

| 2025 –2032 | |

| USD 17.59 Billion | |

| USD 96.43 Billion | |

|

|

|

|

Telecom Cloud Market Size

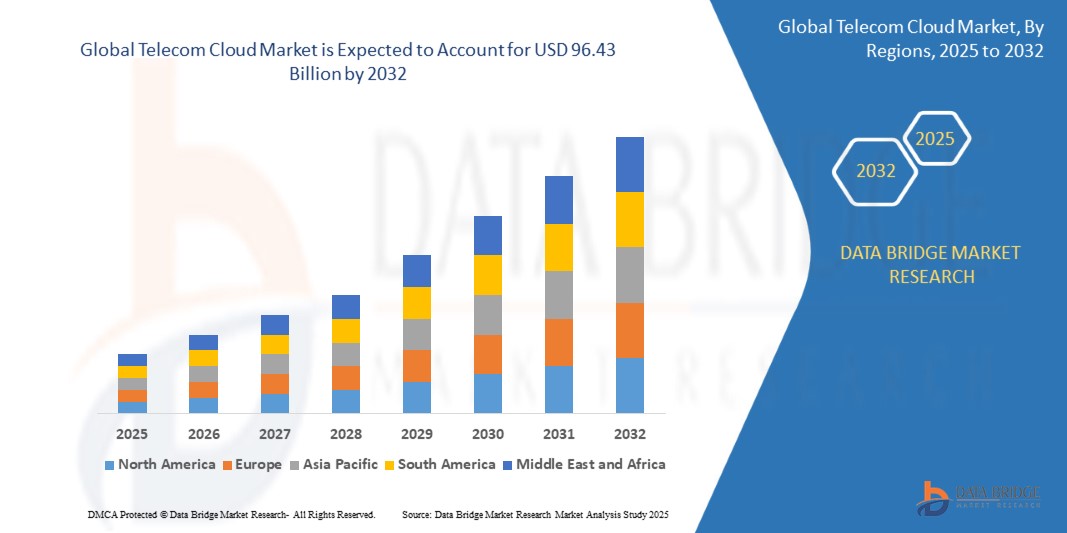

- The global telecom cloud market size was valued at USD 17.59 billion in 2024 and is expected to reach USD 96.43 billion by 2032, at a CAGR of 23.70% during the forecast period

- This growth is driven by factors such as rising demand for cost-effective network management, rapid adoption of cloud-native technologies, increasing need for scalable telecom infrastructure, and integration of 5G and IoT solutions across telecom networks

Telecom Cloud Market Analysis

- Telecom cloud solutions are pivotal in transforming traditional telecom networks by enabling virtualization, automation, and scalability. They support a wide range of services including VoIP, content delivery, and network security, while significantly reducing infrastructure costs

- The demand for telecom cloud is being significantly driven by the increasing adoption of 5G services, growing need for agile and scalable network solutions, and rising deployment of cloud-native architecture by telecom operators

- North America is expected to dominate the telecom cloud market due to early adoption of advanced technologies, presence of leading cloud service providers, and heavy investments in 5G infrastructure

- Asia-Pacific is expected to be the fastest growing region in the telecom cloud market during the forecast period due to rapid digital transformation, expansion of mobile networks, and increasing government initiatives supporting cloud adoption

- The Software as a Service (SaaS) segment is expected to hold the largest market share of 56.2% in the global telecom cloud market due to cost-effectiveness, scalability, and ease of deployment

Report Scope and Telecom Cloud Market Segmentation

|

Attributes |

Telecom Cloud Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Telecom Cloud Market Trends

“Advancements in the Global Telecom Cloud Market”

- One prominent trend in the telecom cloud market is the rapid shift toward cloud-native architectures and disaggregated network infrastructure, enabling telecom operators to improve flexibility, scalability, and innovation

- These changes allow for more dynamic network management and faster deployment of services, especially in tandem with the global rollout of 5G

- For instance, telecom companies are increasingly leveraging 5G-ready cloud infrastructure to deliver ultra-low latency and high-speed connectivity, which is particularly beneficial for emerging applications such as IoT, autonomous vehicles, and smart cities

- These advancements are transforming the telecom industry by enabling more agile network operations, enhancing customer experiences, and driving the demand for next-generation cloud-based solutions and services in the telecom space

Telecom Cloud Market Dynamics

Driver

“Growing Demand Driven by Increasing Need for Scalability and Flexibility in Telecom Operations”

- The growing need for scalability, flexibility, and cost-effective solutions in telecom operations is significantly driving the demand for telecom cloud services

- Telecom companies are increasingly adopting cloud-based infrastructure to improve operational efficiency, reduce costs, and meet the growing demand for advanced services such as 5G, IoT, and high-speed internet

- Cloud-based solutions provide telecom operators with the flexibility to quickly scale services, optimize network performance, and enhance service delivery. As telecom networks become more complex, the need for agile, cloud-powered infrastructure increases

- As a result of the growing demand for scalable, flexible, and efficient telecom solutions, there is a significant rise in the adoption of telecom cloud services, enabling telecom providers to enhance their network capabilities and improve customer experiences

Opportunity

“Telecom Cloud Market with AI and Automation Integration”

- The integration of AI and automation in telecom cloud services offers significant opportunities to enhance operational efficiency, improve network management, and deliver more personalized customer experiences

- AI algorithms can analyze vast amounts of network data in real-time, allowing telecom operators to predict network issues, optimize performance, and proactively address potential service disruptions

- Automation, coupled with AI, can streamline network provisioning, fault detection, and traffic management, reducing operational costs and enhancing service delivery

- The growing adoption of AI and automation in telecom cloud infrastructure opens up opportunities for telecom providers to enhance service reliability, reduce downtime, and deliver innovative solutions that meet the demands of modern, data-driven consumers. By leveraging AI and automation, telecom companies can also improve their competitive edge in a fast-evolving market

Restraint/Challenge

“High Infrastructure and Maintenance Costs Hindering Market Growth”

- The high infrastructure and maintenance costs associated with telecom cloud services present a significant challenge for market growth, especially for smaller telecom operators and businesses with limited budgets

- Setting up and maintaining cloud-based infrastructure requires substantial investment in both hardware and software, as well as continuous upgrades to keep pace with technological advancements. This can make it difficult for smaller telecom companies to compete with larger operators that have the resources to invest in these expensive technologies

- Additionally, the ongoing costs related to cloud service management, network security, and data storage can strain the financial resources of telecom companies, particularly in emerging markets

For instance,

- In January 2025, according to a report by Deloitte, the high capital expenditure required for cloud infrastructure and the complex nature of network management are major barriers for smaller telecom companies looking to transition to cloud services. Many operators in developing regions struggle to allocate the necessary funds for cloud adoption, which could delay the widespread adoption of telecom cloud solutions

- As a result, these financial constraints may slow down the adoption of telecom cloud services in emerging markets, leading to slower market penetration and limiting the ability of smaller companies to take advantage of the scalability, flexibility, and cost benefits that cloud solutions offer. This can ultimately hinder the overall growth and expansion of the telecom cloud market

Telecom Cloud Market Scope

The market is segmented on the basis of type, service model, organization size, deployment mode, application, and end user

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Service Model |

|

|

By Organization Size |

|

|

By Deployment Mode |

|

|

By Application |

|

|

By End User |

|

In 2025, the Software as a Service (SaaS) is projected to dominate the market with a largest share of 56.2% in service model segment

The SaaS segment is expected to dominate the telecom cloud market with the largest share of 56.2% in 2025 due to its widespread adoption and the increasing demand for scalable, on-demand software solutions within the telecommunications industry

The private is expected to account for the largest share of 56.4% during the forecast period in deployment mode segment

In 2025, the private deployment accounted for the largest revenue share of 56.4% in 2021. In this model, the infrastructure is fully operated by an organization and hosted within its own data center either on-premises or off-premises but managed by a third party. This setup offers telecom operators enhanced control, stronger security and data privacy, access to specialized computing resources such as RAN, VNF, and edge applications and services, as well as cost efficiency by leveraging underutilized capacity within existing data centers.

Telecom Cloud Market Regional Analysis

“North America Holds the Largest Share in the Telecom Cloud Market”

- North America leads the telecom cloud market, supported by robust digital infrastructure, early adoption of cloud-based technologies, and strong presence of major telecom and cloud service providers

- The U.S. contributes significantly to market share due to the growing demand for enhanced network capabilities, increasing investments in 5G deployment, and strong emphasis on enterprise digital transformation

- The region benefits from favorable government policies promoting cloud computing and data center expansion, along with the rapid proliferation of IoT, AI, and edge computing technologies

- Additionally, the demand for scalable, cost-efficient telecom services from various industry verticals, coupled with rising cybersecurity concerns driving secure cloud deployments, is fueling market growth across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Telecom Cloud Market”

- The Asia-Pacific region is anticipated to exhibit the highest growth rate in the telecom cloud market, driven by widespread digitalization, increasing mobile and internet penetration, and government-led smart city initiatives

- Countries such as China, India, and South Korea are emerging as high-growth markets due to their large user bases, expanding 5G infrastructure, and rapid cloud adoption by telecom operators

- China, with its aggressive 5G rollout and strong support for indigenous cloud platforms, is significantly advancing the adoption of telecom cloud solutions across the nation

- India’s booming digital economy, increasing demand for OTT and data-intensive services, and support from regulatory bodies for cloud-native telecom architectures are driving momentum in the market

- Japan and South Korea, known for their technological innovation and mature telecom sectors, continue to invest heavily in next-gen cloud services to enhance network flexibility and efficiency

Telecom Cloud Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Amazon Web Services (AWS) (U.S.)

- Microsoft Azure (U.S.)

- Google Cloud (U.S.)

- Huawei Cloud (China)

- IBM Cloud (U.S.)

- Oracle Cloud (U.S.)

- Cisco Systems (U.S.)

- Ericsson (Sweden)

- Nokia (Finland)

- Mavenir (U.S.)

- ZTE Corporation (China)

- AT&T (U.S.)

- Verizon Communications (U.S.)

- BT Group (U.K.)

- Deutsche Telekom (Germany)

- Telstra Corporation (Australia)

- NTT Communications (Japan)

- Lumen Technologies (U.S.)

- Ciena Corporation (U.S.)

- OVHCloud (France)

Latest Developments in Global Telecom Cloud Market

- In May 2021, Vodafone and Google Cloud entered a long-term strategic partnership to co-develop Nucleus, an advanced integrated data platform designed to transform Vodafone’s data operations across its global footprint. The partnership underscores a growing trend within the global Telecom Cloud Market, where telecom operators are increasingly leveraging cloud technologies to modernize infrastructure, unlock data-driven insights, and foster agility in a highly competitive digital landscape

- In May 2021, Amazon Web Services (AWS) extended its strategic partnership with Ericsson to validate and certify Ericsson’s mission-critical Business Support Systems (BSS) portfolio on the AWS cloud infrastructure. This development is highly relevant to the global Telecom Cloud Market, as it reflects a broader industry shift toward cloud-based telecom operations, where service providers are transitioning from legacy systems to agile, cloud-native solutions

- In January 2021, IBM and Telefónica announced a strategic collaboration to enhance hybrid cloud adoption by launching Cloud Garden 2.0, an advanced platform designed to support enterprises in modernizing and managing their applications across diverse IT environments. The partnership holds significant relevance to the global Telecom Cloud Market, showcasing how telecom operators like Telefónica are evolving into full-scale digital service providers by offering advanced cloud-native solutions to enterprise clients

- In July 2022, Nokia and AST SpaceMobile, Inc. entered into a five-year strategic agreement to jointly enhance global connectivity, with a focus on providing 5G coverage to underserved and remote communities around the world. This agreement holds significant relevance to the global Telecom Cloud Market, highlighting the increasing role of satellite and cloud-based solutions in expanding telecom network capabilities

- In May 2022, Nokia introduced its cloud-native IMS Voice Core product, designed to help Communication Service Providers (CSPs) optimize their network operations, improve agility, and reduce overall network management costs. The product's release is highly relevant to the global Telecom Cloud Market, reflecting the industry's ongoing shift toward cloud-native technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.