Global Telecom Network Infrastructure Market

Market Size in USD Billion

CAGR :

%

USD

82.47 Billion

USD

142.97 Billion

2025

2033

USD

82.47 Billion

USD

142.97 Billion

2025

2033

| 2026 –2033 | |

| USD 82.47 Billion | |

| USD 142.97 Billion | |

|

|

|

|

What is the Global Telecom Network Infrastructure Market Size and Growth Rate?

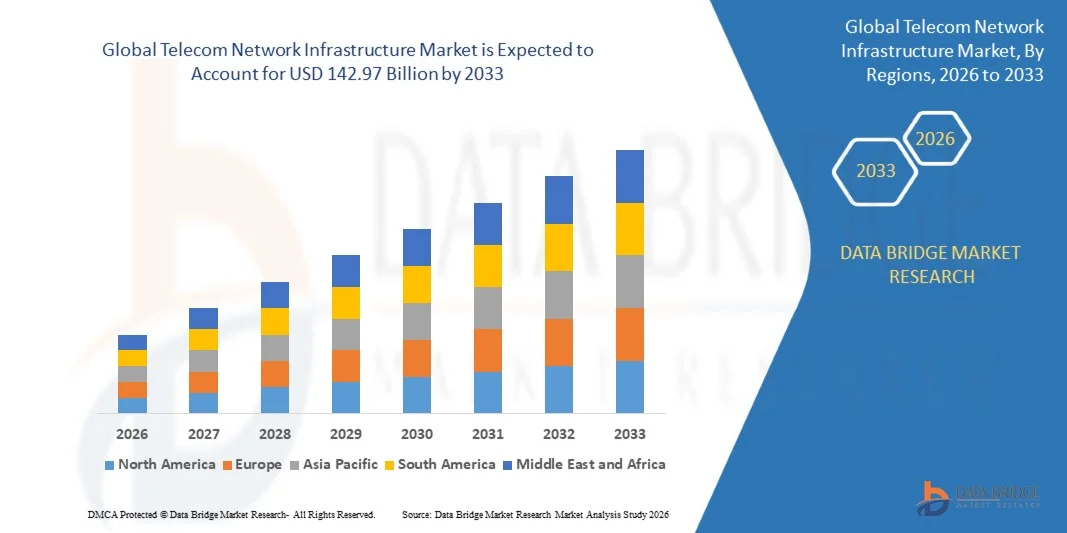

- The global telecom network infrastructure market size was valued at USD 82.47 billion in 2025 and is expected to reach USD 142.97 billion by 2033, at a CAGR of 12.30% during the forecast period

- Increasing deployment of 5G networks, rising investments in fiber broadband expansion, growing demand for high-speed data connectivity, rapid adoption of cloud computing and edge data centers, and continuous modernization of legacy telecom systems are some of the major as well as vital factors which are expected to drive the growth of the Telecom Network Infrastructure market

What are the Major Takeaways of Telecom Network Infrastructure Market?

- Rising demand for high-bandwidth applications such as video streaming, IoT connectivity, AI-enabled services, and enterprise digital transformation across developing economies is expected to generate significant growth opportunities for the Telecom Network Infrastructure market

- High capital expenditure requirements, spectrum allocation challenges, regulatory complexities, and supply chain disruptions are such asly to act as market restraint factors that may limit the growth of the Telecom Network Infrastructure market during the forecast period

- North America dominated the Telecom Network Infrastructure market with a 37.43% revenue share in 2025, driven by early 5G deployment, large-scale fiber broadband expansion, and continuous modernization of legacy telecom networks across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.89% from 2026 to 2033, driven by large-scale 5G deployments, expanding fiber networks, and rapid digital transformation across China, Japan, India, South Korea, and Southeast Asia

- The Wireless Network Infrastructure segment dominated the market with a 41.6% share in 2025, driven by rapid 5G rollouts, increasing mobile data traffic, and expanding small cell deployments

Report Scope and Telecom Network Infrastructure Market Segmentation

|

Attributes |

Telecom Network Infrastructure Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Telecom Network Infrastructure Market?

“Accelerating Deployment of 5G, Fiberization, and AI-Driven Network Modernization”

- The telecom network infrastructure market is witnessing rapid deployment of 5G standalone networks, Open RAN architectures, and fiber-to-the-home (FTTH) solutions to support ultra-high-speed connectivity and low-latency applications

- Network equipment manufacturers are introducing AI-powered network management platforms, cloud-native core networks, and software-defined networking (SDN) solutions to enhance scalability, automation, and operational efficiency

- Growing demand for edge computing, private 5G networks, and hyperscale data center connectivity is driving large-scale investments in transport networks and optical backhaul systems

- For instance, in 2025, companies such as Nokia Corporation, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., and Cisco Systems, Inc. expanded their 5G-Advanced, cloud core, and AI-integrated RAN portfolios to support next-generation telecom transformation

- Increasing focus on energy-efficient network equipment, virtualization, and automation is accelerating the shift toward intelligent and sustainable telecom infrastructures

- As global data traffic continues to surge, Telecom Network Infrastructure will remain critical for delivering seamless connectivity, supporting digital economies, and enabling future 6G evolution

What are the Key Drivers of Telecom Network Infrastructure Market?

- Rising demand for high-speed mobile broadband, IoT connectivity, and enterprise digital transformation is significantly boosting investments in wireless and fixed network infrastructure

- For instance, in 2025, leading operators across the U.S., Europe, and Asia-Pacific accelerated 5G rollouts and fiber expansion projects in collaboration with vendors such as ZTE Corporation and Samsung Electronics Co., Ltd. to enhance network capacity and coverage

- Growing adoption of cloud services, video streaming, AI applications, and smart city initiatives is increasing the need for robust core and transport network solutions

- Advancements in massive MIMO, network slicing, virtualization, and optical transport technologies have strengthened network performance, reliability, and spectrum efficiency

- Rising investments in private 5G networks, data center interconnect (DCI), and edge infrastructure are creating strong demand for scalable telecom systems

- Supported by continuous spectrum auctions, government digitalization programs, and telecom modernization initiatives, the Telecom Network Infrastructure market is expected to witness sustained long-term growth

Which Factor is Challenging the Growth of the Telecom Network Infrastructure Market?

- High capital expenditure requirements for 5G spectrum acquisition, fiber deployment, and network densification restrict investment capabilities, especially among smaller telecom operators

- For instance, during 2024–2025, supply chain disruptions, semiconductor shortages, and rising raw material costs increased equipment pricing and extended deployment timelines for several global vendors

- Complexity in integrating legacy 2G/3G/4G networks with new cloud-native and virtualized architectures increases operational challenges and technical risks

- Regulatory uncertainties, geopolitical restrictions, and security concerns regarding telecom equipment sourcing slow down cross-border deployments

- Competition among vendors, pricing pressure, and rapid technological evolution reduce profit margins and increase R&D expenditure

- To address these challenges, companies are focusing on Open RAN adoption, cost-optimized hardware designs, network sharing models, and AI-based automation, which are expected to gradually improve efficiency and global adoption of Telecom Network Infrastructure solutions

How is the Telecom Network Infrastructure Market Segmented?

The market is segmented on the basis of infrastructure type, component, network technology, and end user.

• By Infrastructure Type

On the basis of infrastructure type, the telecom network infrastructure market is segmented into Wireless Network Infrastructure, Fixed Network Infrastructure, Core Network Infrastructure, and Transport Network Infrastructure. The Wireless Network Infrastructure segment dominated the market with a 41.6% share in 2025, driven by rapid 5G rollouts, increasing mobile data traffic, and expanding small cell deployments. Rising smartphone penetration, IoT connectivity, and demand for low-latency communication continue to strengthen investments in radio access networks (RAN), macro towers, and distributed antenna systems.

The Core Network Infrastructure segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by the transition toward cloud-native cores, network virtualization, and standalone 5G architectures. Increasing adoption of AI-enabled traffic management and network slicing is accelerating modernization of core networks globally.

• By Component

On the basis of component, the market is segmented into Hardware, Software, and Services. The Hardware segment dominated the market with a 52.3% share in 2025, owing to large-scale deployment of base stations, routers, switches, optical transport equipment, and fiber infrastructure. Continuous upgrades in 5G radios, massive MIMO systems, and broadband expansion projects significantly contribute to hardware demand.

The Software segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of software-defined networking (SDN), network function virtualization (NFV), and AI-based network automation tools. Telecom operators are prioritizing cloud-based orchestration, analytics platforms, and cybersecurity solutions to enhance efficiency and scalability.

• By Network Technology

On the basis of network technology, the telecom network infrastructure market is segmented into 2G/3G, 4G/LTE, 5G, Fiber Broadband, and Satellite. The 4G/LTE segment dominated the market with a 34.8% share in 2025, as it remains the backbone of global mobile connectivity, particularly in developing economies where LTE expansion and capacity upgrades are ongoing.

The 5G segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for ultra-low latency applications, smart cities, industrial IoT, autonomous vehicles, and private 5G networks. Accelerated spectrum allocation and standalone 5G deployments are further strengthening growth prospects.

• By End User

On the basis of end user, the market is segmented into Telecom Operators, Internet Service Providers, Data Centers, Enterprises, and Government & Public Sector. The Telecom Operators segment dominated the market with a 46.1% share in 2025, supported by continuous investments in wireless, fiber, and core network modernization to handle rising data consumption and subscriber growth.

The Data Centers segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by hyperscale cloud expansion, edge computing deployment, and increasing demand for high-speed data center interconnect (DCI) solutions. Growing digital transformation initiatives across industries are expected to further accelerate infrastructure investments in this segment.

Which Region Holds the Largest Share of the Telecom Network Infrastructure Market?

- North America dominated the Telecom Network Infrastructure market with a 37.43% revenue share in 2025, driven by early 5G deployment, large-scale fiber broadband expansion, and continuous modernization of legacy telecom networks across the U.S. and Canada. Strong investments in cloud infrastructure, hyperscale data centers, and private 5G networks are accelerating demand for advanced wireless, core, and transport network solutions

- Leading telecom operators and infrastructure vendors in the region are deploying AI-driven network management, Open RAN architectures, and edge computing platforms, strengthening technological leadership. Continuous spectrum auctions and federal broadband initiatives further support long-term infrastructure expansion

- High digital adoption rates, strong capital investment capacity, and the presence of major telecom equipment manufacturers reinforce North America’s dominant position in the global market

U.S. Telecom Network Infrastructure Market Insight

The U.S. is the largest contributor in North America, supported by aggressive 5G standalone rollouts, fiber-to-the-home (FTTH) expansion, and rapid adoption of cloud-native core networks. Increasing investments in private 5G for enterprises, defense communication systems, and smart city projects are driving demand for advanced telecom infrastructure. Expansion of hyperscale data centers and edge computing facilities further strengthens the need for high-capacity transport and optical networking solutions.

Canada Telecom Network Infrastructure Market Insight

Canada contributes significantly to regional growth, driven by rural broadband expansion programs, 5G coverage enhancement, and modernization of fixed and mobile networks. Government-backed connectivity initiatives and investments in remote area fiber deployment are accelerating infrastructure upgrades. Rising enterprise demand for secure and high-speed connectivity further supports market expansion across the country.

Asia-Pacific Telecom Network Infrastructure Market

Asia-Pacific is projected to register the fastest CAGR of 7.89% from 2026 to 2033, driven by large-scale 5G deployments, expanding fiber networks, and rapid digital transformation across China, Japan, India, South Korea, and Southeast Asia. Strong government support for smart cities, industrial automation, and digital economies is fueling telecom infrastructure investments. Growing mobile subscriber bases and rising data consumption further accelerate market growth.

China Telecom Network Infrastructure Market Insight

China is the largest contributor in Asia-Pacific due to extensive 5G base station deployment, strong domestic equipment manufacturing, and large-scale fiber broadband penetration. Continuous investments in AI-enabled network optimization and next-generation telecom technologies drive sustained infrastructure demand.

Japan Telecom Network Infrastructure Market Insight

Japan demonstrates steady growth supported by advanced telecom infrastructure, early adoption of 5G-Advanced technologies, and high demand for reliable, low-latency networks. Continuous modernization of transport and core networks strengthens long-term market prospects.

India Telecom Network Infrastructure Market Insight

India is emerging as a high-growth market, driven by nationwide 5G rollout, rapid fiberization, and expanding digital connectivity initiatives. Government programs promoting rural broadband and domestic telecom manufacturing are accelerating infrastructure development.

South Korea Telecom Network Infrastructure Market Insight

South Korea contributes significantly due to its advanced 5G ecosystem, high mobile penetration, and strong focus on next-generation communication technologies. Continuous upgrades toward AI-driven and 6G-ready networks support sustained telecom infrastructure expansion.

Which are the Top Companies in Telecom Network Infrastructure Market?

The telecom network infrastructure industry is primarily led by well-established companies, including:

- Huawei Technologies Co., Ltd. (China)

- Nokia Corporation (Finland)

- Telefonaktiebolaget LM Ericsson (publ) (Sweden)

- ZTE Corporation (China)

- Cisco Systems, Inc. (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- NEC Corporation (Japan)

- Ciena Corporation (U.S.)

- Fujitsu Limited (Japan)

- Juniper Networks, Inc. (U.S.)

What are the Recent Developments in Telecom Network Infrastructure Market?

- In October 2025, NVIDIA collaborated with Nokia to develop an AI-RAN platform and committed an investment of USD 1 billion to accelerate the advancement of AI-native 5G-Advanced and emerging 6G networks. The partnership focuses on integrating NVIDIA’s AI computing capabilities into Nokia’s radio access network portfolio to enable large-scale edge AI inferencing and intelligent network automation, thereby reinforcing the evolution toward next-generation, AI-driven telecom infrastructure

- In October 2025, Nokia partnered with Corporación Nacional de Telecomunicaciones to deploy Ecuador’s first commercial 5G network, establishing 188 sites across Guayaquil and surrounding regions using Nokia’s AirScale RAN, IP routing, and optical transport technologies. This milestone rollout strengthens Latin America’s digital transformation efforts and highlights the accelerating expansion of advanced telecom infrastructure across emerging markets

- In May 2025, Vodafone Idea collaborated with Ericsson to deploy high-capacity Massive MIMO radios, including AIR 3268 and AIR 3255, to support its 5G rollout in Delhi NCR while upgrading existing 4G infrastructure with energy-efficient radio systems. This initiative enhances spectrum efficiency, network performance, and service reliability, underscoring the ongoing modernization of telecom infrastructure to support rising data demand and next-generation connectivity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.