Global Telemetry Market

Market Size in USD Billion

CAGR :

%

USD

117.50 Billion

USD

349.31 Billion

2024

2032

USD

117.50 Billion

USD

349.31 Billion

2024

2032

| 2025 –2032 | |

| USD 117.50 Billion | |

| USD 349.31 Billion | |

|

|

|

|

Telemetry Market Size

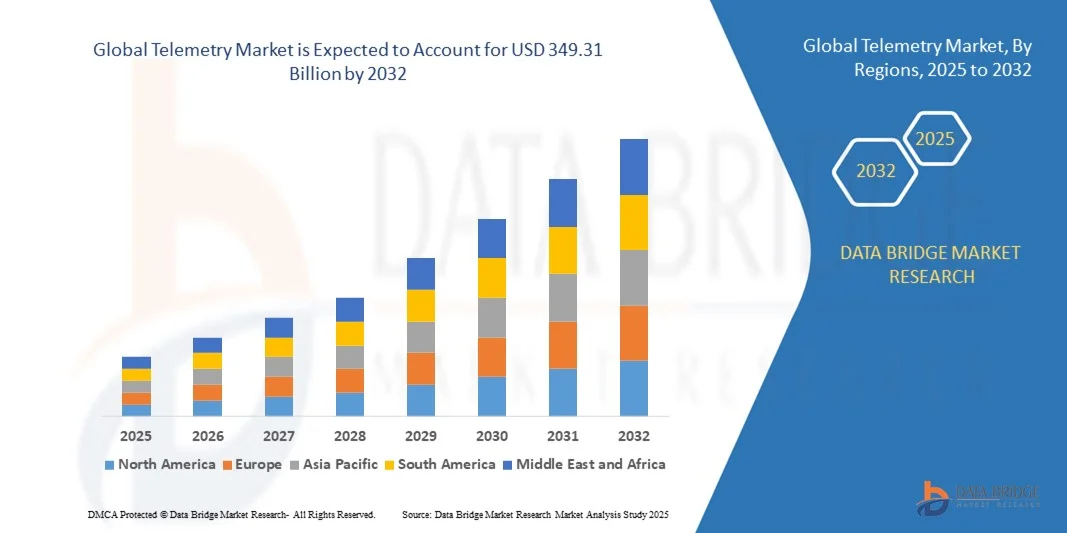

- The global telemetry market size was valued at USD 117.50 billion in 2024 and is expected to reach USD 349.31 billion by 2032, at a CAGR of 14.59% during the forecast period

- The market growth is largely fueled by the increasing deployment of IoT-enabled devices and advancements in wireless communication technologies, enabling real-time data collection and remote monitoring across healthcare, automotive, aerospace, energy, and industrial sectors

- Furthermore, rising demand for accurate, secure, and cost-effective telemetry solutions to support predictive maintenance, patient monitoring, and connected vehicle systems is accelerating adoption, thereby significantly boosting the industry’s expansion

Telemetry Market Analysis

- Telemetry involves the automated collection, transmission, and analysis of data from remote or inaccessible locations to centralized systems for monitoring and control. It utilizes wireless, satellite, and cloud-based networks to provide continuous, real-time insights across applications such as healthcare diagnostics, space exploration, automotive telematics, smart grids, and industrial automation

- The growing need for operational efficiency, early fault detection, and seamless data integration, combined with technological innovations in 5G, AI, and cloud analytics, is driving strong market demand and fostering rapid growth in the global telemetry landscape

- North America dominated the telemetry market with a share of 37.5% in 2024, due to strong demand for remote patient monitoring, industrial automation, and advanced automotive telematics solutions

- Asia-Pacific is expected to be the fastest growing region in the telemetry market during the forecast period due to rapid urbanization, expanding healthcare infrastructure, and increasing adoption of smart transportation systems

- Telemetry transmitter segment dominated the market with a market share of 45.5% in 2024, due to its critical role in capturing and transmitting data across a wide range of applications, from healthcare monitoring devices to automotive systems. Advancements in transmitter technology, such as low-power designs and miniaturization, have enabled seamless integration into portable medical devices, smart vehicles, and industrial automation systems. High demand for reliable and continuous data transfer for diagnostics and operational efficiency continues to strengthen the dominance of telemetry transmitters

Report Scope and Telemetry Market Segmentation

|

Attributes |

Telemetry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Telemetry Market Trends

Growing Use of IoT-Enabled Telemetry Across Healthcare and Industry

- The integration of Internet of Things (IoT) technologies is driving significant advancements in modern telemetry solutions, making it possible to collect, transmit, and analyze real-time data across various industries such as healthcare, manufacturing, and automotive. This enhanced connectivity enables organizations to gain faster insights, improve efficiencies, and enhance decision-making based on live data streams

- For instance, GE Healthcare has implemented IoT-enabled telemetry for remote patient monitoring, allowing hospitals to track patient vitals continuously through connected sensors. Similarly, industrial giants such as Siemens deploy telemetry solutions in predictive maintenance systems for heavy machinery, reducing downtime and enhancing equipment reliability

- Telemetry in healthcare is witnessing notable expansion as connected medical devices such as heart monitors, insulin pumps, and wearable sensors are now increasingly able to communicate patient health data directly to providers. This enables early detection of medical issues, supports remote treatment planning, and reduces reliance on in-person visits. Telemetry-backed healthcare platforms also allow for data-driven insights into patient populations, improving both preventative and long-term care outcomes

- Industrial sectors are also embracing telemetry to optimize production processes, enable predictive analytics, and enhance worker safety. For instance, oil and gas companies deploy advanced telemetry for monitoring drilling operations, ensuring optimal performance while minimizing operational risks. Similarly, in smart manufacturing, telemetry supports IoT-enabled equipment tracking to streamline supply chain and production management

- The convergence of telemetry with advanced analytics and cloud computing is creating end-to-end visibility across industries. Companies are able to centralize massive amounts of data collected through telemetry and leverage AI-driven insights to make more accurate operational forecasts and identify efficiency improvements

- Overall, the rising adoption of IoT-enabled telemetry across healthcare, industrial, automotive, and energy sectors is redefining data-driven decision-making. The expansion into these areas highlights its role as a vital enabler of connected ecosystems, supporting more efficient, predictive, and automated future operations

Telemetry Market Dynamics

Driver

Demand for Real-Time Monitoring and Predictive Analytics

- Organizations across industries are increasingly prioritizing solutions that provide real-time monitoring and timely decision-making capabilities. The rapid rise of connected devices has created an environment where continuous data flow is critical for operational optimization and service delivery, making telemetry essential for enterprises seeking improved responsiveness

- For instance, Phillips Healthcare offers cloud-based telemetry services that provide hospitals with real-time vital sign monitoring and automated alerts for patient health management. Similarly, in transportation, companies such as Caterpillar use telemetry solutions to track vehicle performance continuously, minimizing maintenance costs and ensuring fleet efficiency

- Real-time monitoring provides organizations with the ability to identify anomalies early, reducing costly downtime, improving safety, and enhancing compliance with regulatory requirements. In addition, such systems are being leveraged to strengthen customer satisfaction, as service providers can now identify and resolve faults before clients experience major service interruptions

- Telemetry also contributes to predictive analytics by allowing companies to transform raw data into actionable insights. With tools powered by AI and machine learning, firms can forecast equipment failure or performance degradation, adopt proactive maintenance strategies, and manage resources with greater accuracy

- The growing emphasis on operational continuity, cost-efficiency, and proactive risk management is creating sustained demand for real-time telemetry solutions. As industries continue to expand their digital ecosystems, telemetry’s role in enabling predictive analytics establishes it as a critical driver of long-term sectoral growth

Restraint/Challenge

High Costs and Complex System Integration

- High implementation and integration costs present a major challenge for large-scale adoption of telemetry systems. The need for advanced sensors, reliable connectivity infrastructure, and integration with cloud platforms often requires significant upfront investments, creating barriers for smaller organizations and cost-sensitive industries

- For instance, small and mid-sized healthcare clinics find it difficult to adopt telemetry monitoring platforms due to expensive hardware installation and software licensing fees. Industrial companies such as mining SMEs also encounter high switching costs when upgrading to modern telemetry-enabled operational systems, as integration with legacy equipment proves complex and resource intensive

- System interoperability challenges further complicate deployments, as telemetry solutions must be able to seamlessly connect with diverse platforms, devices, and existing IT systems. Lack of universal standards across industries increases integration delays, raising concerns around efficiency and long-term sustainability of investments

- Cybersecurity adds another layer of complexity, with connected telemetry devices being highly vulnerable to cyberattacks if not supported by strong encryption and network protection measures. Companies hesitant to expose sensitive medical, industrial, or operational data over connected systems may delay adoption for fear of security risks

- Overcoming the dual challenge of high cost and system complexity requires continued vendor efforts toward scalable, interoperable, and cost-efficient solutions. As technology providers simplify integration processes and offer flexible pricing models, wider adoption of telemetry solutions is expected to strengthen industry transformation over the coming years

Telemetry Market Scope

The market is segmented on the basis of technology, component, application, and sensor.

- By Technology

On the basis of technology, the telemetry market is segmented into wire-link, wireless telemetry, digital telemetry, data loggers, and acoustic telemetry. The wireless telemetry segment dominated the largest market revenue share in 2024, primarily due to the rapid adoption of IoT-enabled devices, advanced communication infrastructure, and the need for real-time data transmission across industries. Wireless telemetry eliminates the need for extensive cabling, reducing installation costs and improving flexibility for remote monitoring in healthcare, automotive, and industrial applications. The ability to integrate with cloud platforms and support long-distance communication makes wireless telemetry a preferred choice for organizations seeking scalable, cost-effective, and efficient data collection solutions.

The digital telemetry segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its ability to provide highly accurate, interference-free data transmission in critical applications. Digital systems offer enhanced signal processing, encryption capabilities, and compatibility with advanced analytics platforms, making them suitable for aerospace, defense, and high-precision industrial operations. The growing demand for secure and high-speed communication networks is further accelerating the adoption of digital telemetry for real-time monitoring and predictive maintenance.

- By Component

On the basis of component, the telemetry market is segmented into telemetry transmitter and components of receiver. The telemetry transmitter segment held the largest market revenue share of 45.5% in 2024, supported by its critical role in capturing and transmitting data across a wide range of applications, from healthcare monitoring devices to automotive systems. Advancements in transmitter technology, such as low-power designs and miniaturization, have enabled seamless integration into portable medical devices, smart vehicles, and industrial automation systems. High demand for reliable and continuous data transfer for diagnostics and operational efficiency continues to strengthen the dominance of telemetry transmitters.

The components of receiver segment is projected to register the fastest growth from 2025 to 2032, fueled by increasing innovation in receiver modules that enhance data accuracy and responsiveness. Growing adoption of complex sensor networks and the rising need for precise data interpretation in aerospace, weather monitoring, and defense applications are driving the demand for advanced receiver components. Improved signal sensitivity, low-latency processing, and compatibility with next-generation wireless networks further support the strong growth outlook for this segment.

- By Application

On the basis of application, the telemetry market is segmented into healthcare/medicine, vehicle telemetry, and others. The healthcare/medicine segment dominated the largest market share in 2024, driven by the rising prevalence of chronic diseases, growing demand for remote patient monitoring, and increasing use of wearable health devices. Telemetry systems in healthcare enable real-time tracking of vital signs, reducing hospital visits and improving patient outcomes through early diagnosis and continuous monitoring. The expansion of telehealth services and government initiatives to promote digital healthcare solutions further reinforce the strong growth of this segment.

Vehicle telemetry is projected to experience the fastest growth from 2025 to 2032, propelled by the rapid expansion of connected car technologies, electric vehicles, and fleet management solutions. Automakers are increasingly integrating telemetry systems for real-time diagnostics, predictive maintenance, and driver behavior analysis to enhance safety and operational efficiency. Rising demand for intelligent transportation systems and regulatory mandates for vehicle tracking are accelerating the adoption of vehicle telemetry across both commercial and consumer markets.

- By Sensor

On the basis of sensor, the telemetry market is segmented into optical RPM sensors, vehicle dynamics sensors, position sensors, GPS sensors, magnetic RPM sensors, resistance sensors, temperature sensors, torque sensors, current/voltage sensors, displacement sensors, pressure sensors, vibration sensors, load cell sensors, and phasor sensors. The GPS sensors segment dominated the largest market revenue share in 2024, owing to their extensive use in navigation, tracking, and remote monitoring applications across automotive, logistics, and defense industries. The ability of GPS sensors to provide accurate, real-time location data is critical for fleet management, autonomous vehicle operation, and emergency response systems, making them indispensable in modern telemetry solutions.

The temperature sensors segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increasing demand for environmental monitoring, industrial automation, and healthcare applications. These sensors are essential for maintaining optimal operating conditions in manufacturing plants, medical equipment, and energy systems. Technological advancements enabling higher precision, durability, and energy efficiency are further boosting the adoption of temperature sensors in next-generation telemetry systems.

Telemetry Market Regional Analysis

- North America dominated the telemetry market with the largest revenue share of 37.5% in 2024, driven by strong demand for remote patient monitoring, industrial automation, and advanced automotive telematics solutions

- The region benefits from high R&D investments, widespread 5G deployment, and strong adoption across healthcare, aerospace, and energy sectors, ensuring consistent growth in telemetry applications

- Favorable regulatory support for remote diagnostics and early adoption of IoT-based telemetry platforms further strengthen the market, establishing the region as a global leader in advanced telemetry solutions

U.S. Telemetry Market Insight

The U.S. telemetry market captured the largest revenue share in 2024 within North America, fueled by the growing use of wireless medical telemetry, automotive telematics, and industrial IoT systems. Increasing demand for real-time data monitoring in healthcare, including cardiac telemetry and patient tracking, supports robust growth. Rapid expansion of connected vehicles and smart manufacturing facilities, alongside continuous advancements in satellite and radio telemetry, is further propelling market adoption.

Europe Telemetry Market Insight

The Europe telemetry market is projected to grow at a significant CAGR throughout the forecast period, driven by strong automotive telematics demand, smart energy management initiatives, and regulatory pushes for patient monitoring in healthcare. Countries across the region are adopting telemetry to improve operational efficiency in utilities, transportation, and aerospace. The increasing deployment of 5G networks and growing focus on predictive maintenance in industrial sectors are also key contributors to market growth.

U.K. Telemetry Market Insight

The U.K. telemetry market is expected to expand at a noteworthy CAGR during the forecast period, supported by rapid integration of telemetry in healthcare services and connected vehicle technologies. The country’s commitment to smart grid development and real-time environmental monitoring further boosts demand. Government support for digital healthcare and the presence of leading automotive innovators provide additional momentum for market expansion.

Germany Telemetry Market Insight

The Germany telemetry market is projected to grow at a considerable CAGR, fueled by strong adoption in industrial automation, automotive telematics, and renewable energy monitoring. Germany’s focus on Industry 4.0 and smart manufacturing accelerates the integration of telemetry for predictive maintenance and operational optimization. In healthcare, rising demand for cardiac and remote patient telemetry solutions adds further growth opportunities.

Asia-Pacific Telemetry Market Insight

The Asia-Pacific telemetry market is poised to grow at the fastest CAGR during 2025–2032, driven by rapid urbanization, expanding healthcare infrastructure, and increasing adoption of smart transportation systems. Countries such as China, India, and Japan are leading with large-scale investments in automotive telematics, satellite telemetry, and industrial IoT. The growing manufacturing base and cost-effective deployment of wireless technologies make APAC a key hub for telemetry innovations.

Japan Telemetry Market Insight

The Japan telemetry market is gaining traction with strong demand for advanced automotive telematics, healthcare monitoring, and environmental telemetry systems. The country’s focus on high-tech infrastructure, combined with rising adoption of 5G and IoT-enabled devices, is fueling growth. Increasing use of telemetry in aerospace applications and smart city projects further accelerates market expansion.

China Telemetry Market Insight

The China telemetry market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the country’s aggressive smart city initiatives, rapid industrial digitalization, and widespread use of connected vehicles. Expanding healthcare reforms promoting remote monitoring and the presence of leading domestic telematics providers are further propelling growth. Strong government investments in satellite and space telemetry also position China as a global powerhouse in the sector.

Telemetry Market Share

The telemetry industry is primarily led by well-established companies, including:

- General Electric Company (U.S.)

- Siemens (Germany)

- AstroNova, Inc. (U.S.)

- Rogers Communications (Canada)

- Koninklijke Philips N.V. (Netherlands)

- Bayerische Motoren Werke AG – BMW (Germany)

- KONGSBERG (Norway)

- Honeywell International Inc. (U.S.)

- BioTelemetry (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Cobham Limited (U.K.)

- Lindsay Corporation (U.S.)

- Schneider Electric (France)

- Verizon (U.S.)

- Schlumberger Ltd. (U.S.)

- Sierra Wireless (Canada)

- IBM (U.S.)

Latest Developments in Global Telemetry Market

- In May 2023, Honeywell International entered into a strategic collaboration with the U.S. Department of Defense to advance next-generation telemetry and data acquisition systems for defense and aerospace missions. This initiative focuses on enhancing secure, high-speed data transmission and real-time monitoring, enabling military and space operators to access critical information with greater accuracy and speed. The development strengthens Honeywell’s position as a key technology provider in aerospace telemetry and is expected to drive wider adoption of cutting-edge telemetry solutions in defense communication networks and satellite programs

- In January 2022, Siemens Digital Industries Software partnered with SpaceX to integrate advanced telemetry analytics into satellite operations and launch activities. By embedding predictive maintenance and high-precision data monitoring tools, the collaboration improves the efficiency of satellite communication, enhances mission reliability, and reduces operational risks. This advancement marks a significant step toward commercializing real-time telemetry for private space ventures, setting a benchmark for future satellite missions and expanding telemetry’s role in the rapidly growing commercial space industry

- In August 2021, L3Harris Technologies was selected by NASA’s Jet Propulsion Laboratory (JPL) to deliver the Universal Space Transponder (UST) for the Mars Sample Return program. This technology facilitates seamless transmission of video, data, audio, and telemetry information between Mars spacecraft and Earth, while also enabling inter-satellite communication within Mars’ orbit. The project reinforces L3Harris’ leadership in deep-space telemetry and also paves the way for more complex interplanetary missions by ensuring reliable data relay in extreme space environments

- In March 2021, Cobham Advanced Electronic Solutions received a contract from the U.S. Government to develop state-of-the-art antenna technology for hypersonic applications. These antennas are designed to withstand extreme conditions and deliver uninterrupted telemetry signals at ultra-high speeds, a critical requirement for next-generation hypersonic aircraft and missiles. The project enhances Cobham’s role in high-performance aerospace communication systems and accelerates the development of telemetry solutions capable of supporting advanced defense missions

- In June 2020, Rogers Communications partnered with the City of Calgary to launch the Wireless Infrastructure Development Program aimed at creating a fully connected urban environment. By deploying advanced wireless networks and IoT-based telemetry systems across residential, commercial, and industrial sectors, the initiative promotes smart city development, improves real-time data collection, and supports applications such as environmental monitoring and infrastructure management. This collaboration serves as a model for integrating telemetry into municipal planning and expanding its use in everyday urban operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.