Global Teleradiology Market

Market Size in USD Billion

CAGR :

%

USD

2.52 Billion

USD

9.81 Billion

2024

2032

USD

2.52 Billion

USD

9.81 Billion

2024

2032

| 2025 –2032 | |

| USD 2.52 Billion | |

| USD 9.81 Billion | |

|

|

|

|

Teleradiology Market Size

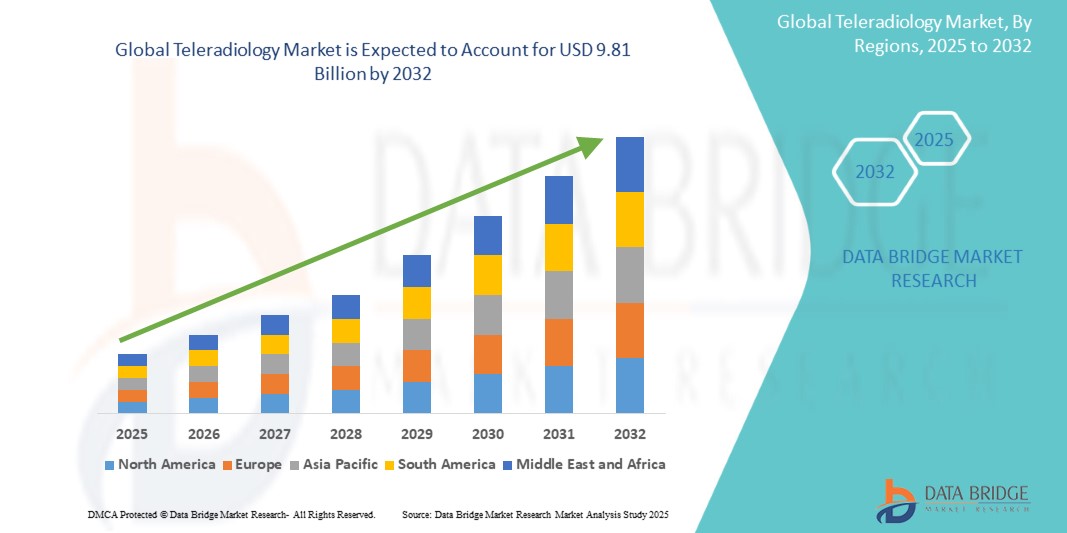

- The global teleradiology market size was valued at USD 2.52 billion in 2024 and is expected to reach USD 9.81 billion by 2032, at a CAGR of 18.50% during the forecast period

- This growth is driven by factors such as the rising demand for remote radiology services due to a global shortage of radiologists, advancements in imaging technology, and increased adoption of telehealth solutions

Teleradiology Market Analysis

- Teleradiology involves the transmission of radiological images from one location to another for interpretation by a radiologist, enabling remote diagnostics and consultations, especially in underserved regions

- The market is primarily driven by the growing need for timely diagnostics, the global shortage of radiologists, and the increasing adoption of telehealth solutions and advanced imaging technologies

- North America is expected to dominate the teleradiology market with a market share of 44.8%, due to advanced healthcare infrastructure, widespread adoption of digital imaging technologies, and the strong presence of established healthcare IT companies

- Asia-Pacific is expected to be the fastest growing region in the teleradiology market with a market share of 24.5%, during the forecast period due to rising healthcare expenditure, increasing digitalization of medical services, and growing awareness of telehealth solutions

- Cloud based delivery mode segment is expected to dominate the market with a market share of 65.8% due to its scalability, cost-efficiency, and ease of access to imaging data across remote locations

Report Scope and Teleradiology Market Segmentation

|

Attributes |

Teleradiology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Teleradiology Market Trends

“AI Integration and Cloud-Based Platforms Reshaping Diagnostic Imaging”

- One prominent trend in the teleradiology market is the integration of artificial intelligence (AI) and machine learning algorithms to assist radiologists in image interpretation, anomaly detection, and workflow automation

- These technologies enhance diagnostic speed and accuracy, particularly in high-volume settings, by prioritizing critical cases and reducing reporting times

- For instance, AI-powered platforms are being used to flag urgent abnormalities in chest X-rays and CT scans, supporting radiologists with faster triaging in emergency and remote settings

- The shift toward cloud-based teleradiology platforms is also gaining momentum, offering scalability, remote accessibility, and secure data sharing, which are crucial for multi-location healthcare systems and global collaboration in diagnostics

Teleradiology Market Dynamics

Driver

“Rising Demand for Remote Diagnostics and Shortage of Radiologists”

- The growing global shortage of radiologists, particularly in rural and underserved regions, is a major factor driving the demand for teleradiology services

- With the increasing volume of diagnostic imaging procedures, healthcare systems are turning to teleradiology to ensure timely and accurate interpretations without geographical limitations

- Teleradiology enables 24/7 access to radiological expertise, improving patient care and operational efficiency in hospitals and imaging centers

For instance,

- In a 2021 report by the Royal College of Radiologists, it was highlighted that nearly two-thirds of UK radiology departments lacked sufficient staff to meet imaging demand, emphasizing the critical role of teleradiology in filling this gap

- As healthcare systems strive to deliver faster diagnoses and reduce turnaround times, the adoption of teleradiology continues to rise, supported by advancements in digital imaging and communication technologies

Opportunity

“Enhancing Diagnostic Accuracy with Artificial Intelligence Integration”

- The integration of artificial intelligence (AI) in teleradiology offers significant opportunities to enhance diagnostic accuracy, streamline workflows, and address the growing demand for radiological services

- AI-powered tools can analyze vast volumes of medical images, prioritize critical findings, and assist radiologists by highlighting abnormalities such as tumors, fractures, or pulmonary nodules with high precision

- In addition, AI can reduce reporting times by automating repetitive tasks such as image segmentation and preliminary reads, allowing radiologists to focus on complex cases and improve overall efficiency

For instance,

- According to a March 2024 report published in Radiology: Artificial Intelligence, AI algorithms have demonstrated high accuracy in detecting abnormalities in chest X-rays, with sensitivity rates exceeding 90%. These tools are increasingly being deployed in emergency departments to expedite triage and diagnosis, especially in resource-limited settings

- The adoption of AI in teleradiology not only reduces diagnostic delays but also supports global collaboration among radiologists, enabling better access to expert consultations and improved patient outcomes worldwide

Restraint/Challenge

“Data Privacy Concerns and Regulatory Compliance Issues”

- Data security and patient privacy concerns pose significant challenges to the widespread adoption of teleradiology, especially in cross-border data transmission scenarios

- Teleradiology platforms handle sensitive patient information and must comply with stringent data protection regulations such as HIPAA in the U.S. and GDPR in the EU, which can complicate implementation and operations

- Ensuring encrypted data transmission, secure cloud storage, and robust cybersecurity measures requires substantial investment and ongoing management, which may be a hurdle for smaller providers or facilities in low-resource settings

For instance,

- According to a February 2024 report by the European Society of Radiology, data breaches in healthcare have increased substantially, with radiology departments among the most targeted due to the volume and sensitivity of the images processed. These risks have prompted regulators to enforce stricter compliance protocols, raising barriers for new market entrants

- Consequently, regulatory complexities and data security concerns can slow the adoption of teleradiology solutions, particularly in regions with evolving legal frameworks or limited IT infrastructure

Teleradiology Market Scope

The market is segmented on the basis of type, delivery mode, imaging technique, technology, procedure, application, site, age, mode of purchase, and end user

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Delivery mode |

|

|

By Imaging Technique |

|

|

By Technology |

|

|

By Procedure |

|

|

By Application |

|

|

By Site |

|

|

By Age |

|

|

By Mode of purchase |

|

|

By End user |

|

In 2025, the cloud-based delivery mode is projected to dominate the market with a largest share in delivery mode segment

The cloud-based delivery mode segment is expected to dominate the teleradiology market with the largest share of 65.8% in 2025 due to its scalability, cost-efficiency, and ease of access to imaging data across remote locations. It enables real-time collaboration among radiologists and healthcare providers, improving diagnostic speed and accuracy. The growing adoption of cloud technology in healthcare further supports its widespread implementation.

The onshore is expected to account for the largest share during the forecast period in site market

In 2025, the onshore segment is expected to dominate the market with the largest market share of 49.1% due to its advantages in regulatory compliance, faster turnaround times, and improved coordination with local healthcare providers. Onshore services also offer better data security and align more easily with country-specific healthcare standards. This fosters greater trust and adoption among hospitals and clinics.

Teleradiology Market Regional Analysis

“North America Holds the Largest Share in the Teleradiology Market”

- North America dominates the teleradiology market with a market share of estimated 44.8%, driven, by advanced healthcare infrastructure, widespread adoption of digital imaging technologies, and the strong presence of established healthcare IT companies

- U.S. holds a market share of 38.5%, due to the high volume of diagnostic imaging procedures, rising demand for remote radiology services, and favorable government initiatives supporting telemedicine

- Well-defined reimbursement frameworks, extensive use of PACS (Picture Archiving and Communication Systems), and integration of AI tools further boost the adoption of teleradiology services across U.S. healthcare systems

- In addition, the increasing pressure on radiology departments to deliver faster results has fueled partnerships with teleradiology providers, ensuring 24/7 radiological interpretation and improved patient care

“Asia-Pacific is Projected to Register the Highest CAGR in the Teleradiology Market”

- Asia-Pacific is expected to witness the highest growth rate in the teleradiology market with a market share of 24.5%, driven by rising healthcare expenditure, increasing digitalization of medical services, and growing awareness of telehealth solutions

- Countries such as India, China, and Japan are key contributors to regional growth, due to their large patient populations, improving diagnostic infrastructure, and rising adoption of cloud-based radiology systems

- Japan continues to be a leading market with its mature healthcare system and early adoption of advanced imaging and teleradiology technologies

- India is projected to register the highest CAGR of 26.9% in the region, supported by government-led telemedicine initiatives, increased public and private investment in healthcare, and an acute shortage of radiologists in rural areas, which boosts demand for remote diagnostic services

Teleradiology Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Telemedicine Clinic (Spain)

- VRad (U.S.)

- RamSoft, Inc. (Canada)

- Koninklijke Philips N.V. (Netherlands)

- Teleradiology Solutions (India)

- All-American Teleradiology (U.S.)

- Medica Reporting Ltd. (U.K.)

- Vital Radiology Services (India)

- GE Healthcare (U.S.)

- RadNet Inc. (U.S.)

- FUJIFILM Corporation (Japan)

- Agfa-Gevaert Group (Belgium)

- USARAD.COM (U.S.)

- TeleDiagnosys Services Pvt Ltd. (India)

- ONRAD, Inc. (U.S.)

- 4ways Healthcare Limited (U.K.)

- Veradigm LLC (U.S.)

- Redox, Inc. (U.S.)

- NightHawk Radiology (U.S.)

- NightShift Radiology (U.S.)

- Nucleus Medical Media (U.S.)

Latest Developments in Global Teleradiology Market

- In January 2025, ONRAD Inc., a Phoenix-based teleradiology company, acquired Direct Radiology from Royal Philips, establishing itself as the largest independent teleradiology provider in the United States. ONRAD partners with over 120 hospitals, major health systems, outpatient clinics, imaging centers, and government entities. The company offers a comprehensive range of services, including conventional teleradiology, tailored full-service onsite radiology solutions, and subspecialty interpretations across all imaging modalities

- In March 2024, RamSoft, a provider of cloud-based RIS/PACS radiology solutions for imaging centers and teleradiology providers, announced a five-year agreement with Premier Radiology Services to implement RamSoft’s OmegaAI and cloud-based PowerServer PACS platform across its network of more than 1,000 teleradiology locations

- In October 2023, IMAGE Information Systems, in partnership with Aycan Medical Systems, introduced an updated version of the iQ-ROUTER. This medical imaging router is designed to facilitate the transfer of medical images across various healthcare systems

- In June 2023, Grovecourt Capital Partners, a private equity firm, revealed its acquisition of Premier Radiology Services, a nationwide teleradiology company based in Miami, FL

- In April 2023, Aster DM Healthcare launched its Telecommand Center and Digital Health facility in India, utilizing state-of-the-art technology to deliver a comprehensive range of telehealth services, including teleradiology, all under one roof

- In April 2022, Teleradiology Solutions (TRS) entered into a partnership with Andhra Med Tech Zone (AMTZ) to establish a dedicated hub in the zone aimed at offering remote radiology image interpretations for both government and public sector clients, with expert radiologists supported by advanced artificial intelligence solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.