Global Television Services Market

Market Size in USD Billion

CAGR :

%

USD

319.51 Billion

USD

484.80 Billion

2025

2033

USD

319.51 Billion

USD

484.80 Billion

2025

2033

| 2026 –2033 | |

| USD 319.51 Billion | |

| USD 484.80 Billion | |

|

|

|

|

What is the Global Television Services Market Size and Growth Rate?

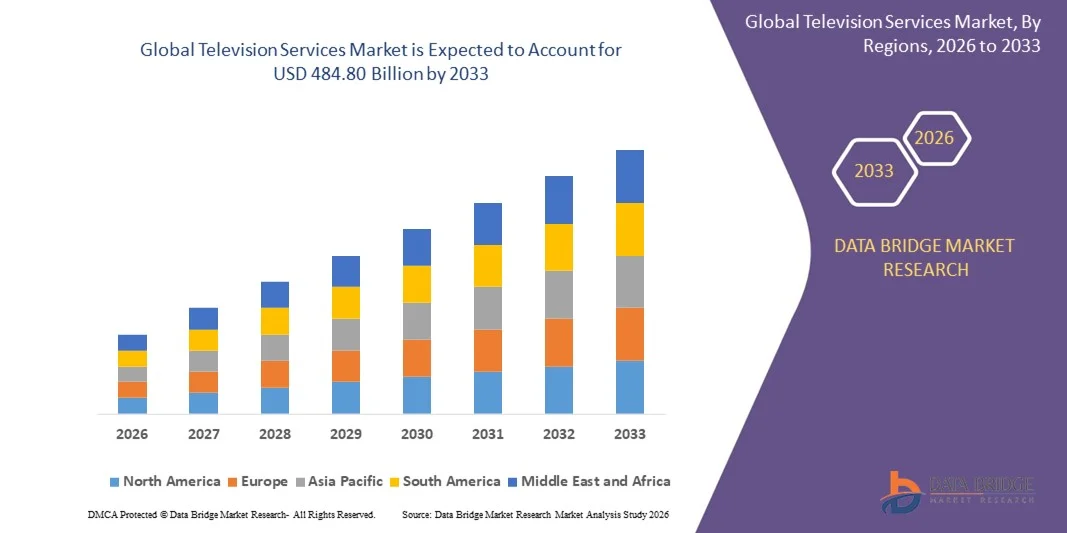

- The global television services market size was valued at USD 319.51 billion in 2025 and is expected to reach USD 484.80 billion by 2033, at a CAGR of5.35% during the forecast period

- Rise in the technological advancements in broadcast industry is a vital factor responsible for the upliftment of the market growth, also increase in the demand for smart TV, rise in the demand for improved distribution infrastructure, rise in the digitalization and increase in the consumption of digital content and the adoption of AR & VR technologies with television are some of the prime factors among others driving the television services market

What are the Major Takeaways of Television Services Market?

- Rise in the technological advancement in the television devices and increase in the digital transformation in media & entertainment industry will further create new opportunities for television services market the in the forecast period mentioned above

- However, digital illiteracy and limited digital infrastructure is the major factor among others which will obstruct the market growth, and will further challenge the growth of television services market

- North America dominated the television services market with a 41.23% revenue share in 2025, driven by a highly developed broadcasting ecosystem, strong penetration of cable and satellite television, and rapid growth of IPTV and OTT-integrated television services across the U.S. and Canada

- Asia-Pacific is expected to register the fastest CAGR of 9.21% from 2026 to 2033, driven by rapid urbanization, expanding broadband networks, growing middle-class populations, and rising demand for affordable television services across China, India, Japan, South Korea, and Southeast Asia

- The Cable Television Broadcasting segment dominated the market with an estimated 38.6% share in 2025, supported by its long-established infrastructure, wide channel availability, and strong penetration across urban and semi-urban households

Report Scope and Television Services Market Segmentation

|

Attributes |

Television Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Television Services Market?

Increasing Shift Toward High-Speed, Compact, and PC-Based Television Services

- The television services market is experiencing a strong transition from traditional linear broadcasting toward OTT, IPTV, and on-demand streaming platforms, driven by changing consumer viewing habits

- Service providers are increasingly investing in cloud-based content delivery, AI-driven recommendations, and personalized viewing experiences to improve user engagement

- Growing penetration of smart TVs, high-speed broadband, and 5G networks is accelerating adoption of internet-based television services across residential and commercial users

- For instance, companies such as Comcast, Warner Bros. Discovery, Canal+, and BBC are expanding digital-first content strategies, hybrid broadcast–OTT models, and multi-device accessibility

- Rising demand for multi-screen viewing, interactive content, and time-shifted services is reshaping content distribution and monetization models

- As digital infrastructure and consumer expectations evolve, Television Services are increasingly centered around flexibility, personalization, and content accessibility, driving long-term market transformation

What are the Key Drivers of Television Services Market?

- Rising demand for on-demand entertainment, live streaming, and personalized content among consumers across all age groups

- For instance, during 2024–2025, major broadcasters and streaming platforms increased investments in original content, regional programming, and sports broadcasting rights to retain subscribers

- Growing adoption of smart TVs, connected devices, and high-speed internet across the U.S., Europe, and Asia-Pacific is expanding the addressable audience

- Advancements in cloud computing, content delivery networks (CDNs), and video compression technologies have improved streaming quality and scalability

- Increasing popularity of subscription-based, ad-supported, and hybrid revenue models is enhancing monetization opportunities for service providers

- Supported by expanding digital ecosystems and rising global media consumption, the Television Services market is expected to witness steady and sustained growth

Which Factor is Challenging the Growth of the Television Services Market?

- Intensifying competition among traditional broadcasters, OTT platforms, and digital content providers is increasing customer acquisition and retention costs

- For instance, during 2024–2025, rising content production expenses, licensing fees, and sports rights costs pressured profit margins for several service providers

- Fragmentation of platforms and subscription fatigue among consumers limits long-term subscriber growth

- Regulatory challenges related to content licensing, data privacy, and cross-border broadcasting increase operational complexity

- Piracy and unauthorized content distribution continue to impact revenue generation in several regions

- To address these challenges, companies are focusing on content differentiation, bundled offerings, strategic partnerships, and technology-driven efficiencies to strengthen their market position

How is the Television Services Market Segmented?

The market is segmented on the basis of delivery platform, revenue model, and broadcaster type.

- By Delivery Platform

On the basis of delivery platform, the television services market is segmented into Digital Terrestrial Broadcast, Satellite Broadcast, Cable Television Broadcasting, Internet Protocol Television (IPTV), and Others. The Cable Television Broadcasting segment dominated the market with an estimated 38.6% share in 2025, supported by its long-established infrastructure, wide channel availability, and strong penetration across urban and semi-urban households. Cable TV remains a preferred option for bundled services, including television, internet, and voice, especially in mature markets.

The IPTV segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising broadband penetration, growing adoption of smart TVs, and increasing preference for on-demand and interactive content. IPTV enables personalized viewing, multi-device access, and flexible subscription models, making it highly attractive for modern consumers.

- By Revenue Model

On the basis of revenue model, the market is segmented into Subscription and Advertisement. The Subscription segment dominated the market with a 56.2% share in 2025, owing to growing consumer willingness to pay for premium content, ad-free viewing, live sports, and exclusive programming. Subscription-based models offer predictable revenue streams and support investments in high-quality original content.

The Advertisement segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by advancements in targeted advertising, addressable TV ads, and data-driven audience analytics. Rising demand for free-to-air and ad-supported streaming services in price-sensitive markets further accelerates growth. Hybrid monetization strategies are also expanding advertiser reach.

- By Broadcaster Type

On the basis of broadcaster type, the television services market is segmented into Public and Commercial broadcasters. The Commercial broadcaster segment dominated the market with an estimated 61.4% share in 2025, driven by strong content investments, diversified revenue models, and aggressive expansion into digital and OTT platforms. Commercial broadcasters benefit from advertising income, subscriptions, and content licensing.

The Public broadcaster segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing government funding, digital transformation initiatives, and expansion of public service content across online platforms. Growing demand for educational, cultural, and regional programming further strengthens long-term growth prospects.

Which Region Holds the Largest Share of the Television Services Market?

- North America dominated the television services market with a 41.23% revenue share in 2025, driven by a highly developed broadcasting ecosystem, strong penetration of cable and satellite television, and rapid growth of IPTV and OTT-integrated television services across the U.S. and Canada. High consumer spending power, widespread availability of high-speed broadband, and early adoption of advanced broadcasting technologies continue to support regional leadership

- Leading television service providers in North America are investing heavily in digital broadcasting infrastructure, cloud-based content delivery, targeted advertising, and hybrid subscription models, strengthening service quality and audience reach

- Strong content production capabilities, presence of major broadcasters and media conglomerates, and continuous innovation in viewer analytics further reinforce North America’s dominant market position

U.S. Television Services Market Insight

The U.S. is the largest contributor in North America, supported by a mature television market, high subscription penetration, and strong demand for premium content, live sports, and on-demand services. Rapid expansion of IPTV, smart TV adoption, and integration of television with streaming platforms drive sustained growth. Presence of global broadcasters, advanced advertising technologies, and strong content monetization models further boost market expansion.

Canada Television Services Market Insight

Canada contributes steadily to regional growth, driven by rising digital television adoption, government support for broadcasting infrastructure, and increasing demand for multilingual and regional content. Expansion of IPTV and hybrid cable services strengthens market penetration across urban and rural areas.

Asia-Pacific Television Services Market

Asia-Pacific is expected to register the fastest CAGR of 9.21% from 2026 to 2033, driven by rapid urbanization, expanding broadband networks, growing middle-class populations, and rising demand for affordable television services across China, India, Japan, South Korea, and Southeast Asia. Increasing adoption of IPTV, digital terrestrial broadcasting, and ad-supported television models accelerates regional growth.

China Television Services Market Insight

China leads the Asia-Pacific market due to its massive subscriber base, strong state-backed broadcasting infrastructure, and rapid expansion of digital and IPTV platforms. Growing demand for high-definition and smart TV services supports long-term growth.

Japan Television Services Market Insight

Japan shows steady growth supported by advanced broadcasting technologies, strong cable and satellite penetration, and high consumer preference for premium and high-quality content.

India Television Services Market Insight

India is emerging as a high-growth market, driven by digitalization initiatives, expansion of DTH and IPTV services, and rising demand for regional and vernacular content across price-sensitive consumers.

South Korea Television Services Market Insight

South Korea benefits from advanced telecom infrastructure, high broadband penetration, and rapid adoption of smart and connected television services, supporting sustained market expansion.

Which are the Top Companies in Television Services Market?

The television services industry is primarily led by well-established companies, including:

- Groupe Canal+ (France)

- Warner Media, LLC (U.S.)

- ViacomCBS Inc. (U.S.)

- Channel Four Television Corporation (U.K.)

- CenturyLink (U.S.)

- Viacom International Inc. (U.S.)

- A&E Television Networks, LLC (U.S.)

- BBC (U.K.)

- 21st Century Fox (U.S.)

- Comcast (U.S.)

What are the Recent Developments in Global Television Services Market?

- In August 2024, Chinese electronics brand Xiaomi introduced its new 4K X Pro QLED smart televisions in 43-inch, 55-inch, and 65-inch variants under the X Pro TV series in India, featuring Google TV, Dolby Vision, and Dolby Atmos to enhance premium viewing experiences. This launch strengthens Xiaomi’s position in the competitively priced smart TV segment

- In June 2024, Netflix rolled out a free, ad-supported subscription tier across select Asian and European markets to broaden its user base and compete directly with regional free-to-air and ad-supported television services. This move supports Netflix’s strategy to drive mass-market adoption and advertising-led revenue growth

- In April 2024, Samsung announced the launch of its latest AI-powered television lineup, including Neo QLED 8K, Neo QLED 4K, and OLED TVs, at the ‘Unbox & Discover’ event held in Bengaluru, highlighting advanced picture processing and smart capabilities. The initiative reinforces Samsung’s leadership in the premium television category

- In March 2024, Tata Play, in collaboration with Disney Star, unveiled the Tata Play 4K service, offering ultra-high-definition content with improved clarity and immersive viewing at an accessible price point for Indian consumers. This development enhances the appeal of next-generation broadcasting services in India

- In January 2024, BLAST launched the beta version of its BLAST tv mobile application for iOS and Android, delivering features such as live statistics, interactive elements, and 4K streaming to elevate the esports viewing experience. The app reflects growing convergence between live television, gaming, and digital engagement

- In October 2023, Indkal Technologies, the licensed distributor of Acer televisions in India, introduced the Acer H Pro TV series, comprising 43-inch, 50-inch, and 55-inch 4K ultra-HD smart LED Google TVs designed for modern connected households. The launch expands Acer’s footprint in India’s mid-to-premium smart TV market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.