Global Temperature Controlled Packaging Solutions For Pharmaceutical Market

Market Size in USD Billion

CAGR :

%

USD

5.94 Billion

USD

10.92 Billion

2025

2033

USD

5.94 Billion

USD

10.92 Billion

2025

2033

| 2026 –2033 | |

| USD 5.94 Billion | |

| USD 10.92 Billion | |

|

|

|

|

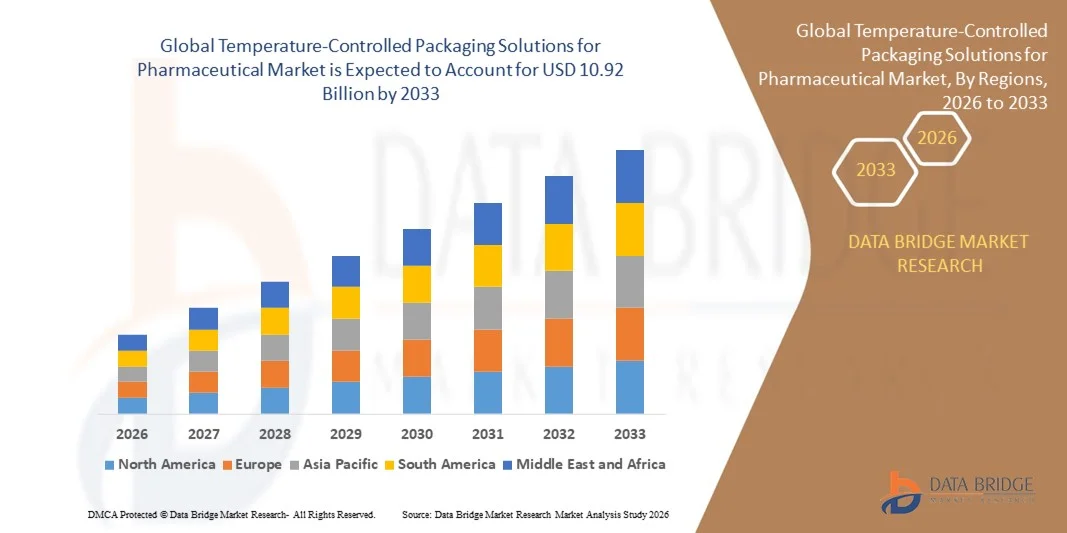

What is the Global Temperature-Controlled Packaging Solutions for Pharmaceutical Market Size and Growth Rate?

- The global temperature-controlled packaging solutions for pharmaceutical market size was valued at USD 5.94 billion in 2025 and is expected to reach USD 10.92 billion by 2033, at a CAGR of7.90% during the forecast period

- The temperature-controlled packaging solutions for pharmaceutical market is experiencing significant growth, driven by the rising demand for efficient cold chain logistics to ensure drug efficacy and safety

- These solutions are critical for maintaining the required temperature range during storage and transportation of temperature-sensitive pharmaceuticals, including vaccines, biologics, and specialty drugs

What are the Major Takeaways of Temperature-Controlled Packaging Solutions for Pharmaceutical Market?

- The market offers a range of solutions, such as active and passive packaging systems, insulated containers, and phase change materials, catering to diverse pharmaceutical need

- Recent developments highlight advancements in sustainable materials, reusable packaging, and digital monitoring technologies for real-time temperature tracking. Key players such as Pelican BioThermal, va-Q-tec, and Sonoco Products Company are actively innovating to meet regulatory standards and environmental goals

- North America dominated the temperature-controlled packaging solutions for pharmaceutical market with a 41.89% revenue share in 2025, driven by the strong presence of pharmaceutical manufacturers, biologics producers, and advanced cold chain logistics infrastructure across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.9% from 2026 to 2033, driven by rapid expansion of pharmaceutical manufacturing, rising biologics production, and increasing healthcare investments across China, Japan, India, South Korea, and Southeast Asia

- The Passive Systems segment dominated the market with an estimated 62.4% share in 2025, owing to their cost-effectiveness, ease of handling, and widespread use in short- to medium-duration pharmaceutical shipments

Report Scope and Temperature-Controlled Packaging Solutions for Pharmaceutical Market Segmentation

|

Attributes |

Temperature-Controlled Packaging Solutions for Pharmaceutical Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Temperature-Controlled Packaging Solutions for Pharmaceutical Market?

Advancements in Smart Packaging Technologies

- The temperature-controlled packaging solutions for pharmaceutical market is expanding rapidly, driven by the growing need to preserve the integrity of temperature-sensitive drugs

- These solutions are essential for biologics, vaccines, and specialty medicines, ensuring they remain within strict temperature ranges during transportation and storage. Innovation is a key driver, with advancements in smart packaging technologies such as IoT-enabled sensors for real-time temperature monitoring and eco-friendly packaging materials addressing sustainability concerns

- One notable trend is the increasing adoption of reusable packaging systems, which reduce waste and lower logistics costs while meeting regulatory standards

- With rising global pharmaceutical production and stringent cold chain requirements, the market is set to witness significant growth, underpinned by technological advancements and evolving industry needs.

What are the Key Drivers of Temperature-Controlled Packaging Solutions for Pharmaceutical Market?

- The increasing production and distribution of biologics, vaccines, and other temperature-sensitive drugs are key drivers of the temperature-controlled packaging solutions market

- As the demand for these products rises, particularly with the expansion of personalized medicine, gene therapies, and vaccines, the need for secure and reliable cold chain logistics has grown

- Biologics and vaccines often require stringent temperature controls to maintain their efficacy and stability, making specialized packaging essential

- This growing demand for temperature-sensitive pharmaceuticals is pushing the adoption of advanced temperature-controlled solutions, such as insulated containers, active systems, and real-time monitoring technologies, thus driving the market’s growth

Which Factor is Challenging the Growth of the Temperature-Controlled Packaging Solutions for Pharmaceutical Market?

- Despite significant advancements in temperature-controlled packaging, temperature fluctuations during transit continue to pose a major challenge in the pharmaceutical industry

- Variations in external temperatures, extended transit times, or inadequate handling can cause temperature-sensitive products, such as biologics and vaccines, to experience deviations that compromise their potency and efficacy

- Even with sophisticated packaging solutions, such as insulated containers and active systems, unforeseen delays or environmental factors may lead to product degradation

- This persistent risk presents a major hurdle for companies in ensuring the safe delivery of temperature-sensitive medications, emphasizing the need for more reliable and robust cold chain logistics to overcome this challenge

How is the Temperature-Controlled Packaging Solutions for Pharmaceutical Market Segmented?

The market is segmented on the basis of channel count, application, and vertical.

- By Type

On the basis of type, the temperature-controlled packaging solutions for pharmaceutical market is segmented into Active Systems and Passive Systems. The Passive Systems segment dominated the market with an estimated 62.4% share in 2025, owing to their cost-effectiveness, ease of handling, and widespread use in short- to medium-duration pharmaceutical shipments. Passive systems rely on insulated materials and refrigerants such as gel packs and phase change materials, making them suitable for vaccines, biologics, and clinical trial materials where external power is not required. Their simplicity, regulatory acceptance, and lower operational costs drive high adoption across global pharmaceutical supply chains.

The Active Systems segment is expected to register the fastest CAGR from 2026 to 2033, driven by rising demand for precise temperature control over long-distance and high-value drug shipments. Increasing transportation of cell & gene therapies, biologics, and specialty pharmaceuticals is accelerating adoption of battery-powered and compressor-based active solutions.

- By Product

Based on product, the market is segmented into Insulated Shippers, Insulated Containers, Refrigerants, and Others. The Insulated Shippers segment held the largest market share of approximately 38.7% in 2025, supported by extensive use in last-mile and mid-range pharmaceutical distribution. These shippers provide reliable thermal protection, lightweight handling, and compatibility with air and ground transport, making them ideal for vaccines, injectables, and temperature-sensitive medicines. High adoption in clinical trials and commercial drug distribution further strengthens segment dominance.

The Refrigerants segment is projected to grow at the fastest CAGR during the forecast period, driven by continuous innovation in phase change materials (PCMs) and eco-friendly cooling solutions. Increasing focus on maintaining strict temperature ranges, improving shipment duration, and meeting sustainability targets is accelerating demand for advanced refrigerant technologies across pharmaceutical logistics networks.

- By Application

On the basis of application, the market is segmented into Frozen, Chilled, and Ambient categories. The Chilled segment dominated the market with an estimated 44.9% share in 2025, as most pharmaceutical products, including vaccines, insulin, monoclonal antibodies, and biologics, require storage between 2°C and 8°C. Strong global immunization programs, expanding biologics pipelines, and increasing chronic disease prevalence continue to drive high demand for chilled packaging solutions.

The Frozen segment is anticipated to witness the fastest growth from 2026 to 2033, driven by rising transportation of cell & gene therapies, plasma-derived products, and mRNA-based drugs requiring ultra-low temperatures. Advancements in cryogenic packaging, dry ice handling, and temperature monitoring technologies are further supporting rapid expansion of frozen pharmaceutical logistics globally.

- By End User

By end user, the Temperature-Controlled Packaging Solutions for Pharmaceutical market is segmented into Food & Beverages, Healthcare, and Others. The Healthcare segment dominated the market with a commanding 57.6% share in 2025, driven by the pharmaceutical industry’s strict temperature compliance requirements, increasing global drug trade, and growing reliance on cold chain logistics. Hospitals, pharmaceutical manufacturers, biotech firms, and clinical research organizations extensively utilize temperature-controlled packaging to ensure drug efficacy, safety, and regulatory compliance.

The Healthcare segment is also expected to grow at the fastest CAGR during the forecast period, supported by expanding biologics production, personalized medicine, vaccine distribution programs, and rising clinical trial activities. Continuous innovation in pharmaceutical packaging, coupled with stringent regulatory frameworks, will sustain long-term demand across global healthcare supply chains.

Which Region Holds the Largest Share of the Temperature-Controlled Packaging Solutions for Pharmaceutical Market?

- North America dominated the temperature-controlled packaging solutions for pharmaceutical market with a 41.89% revenue share in 2025, driven by the strong presence of pharmaceutical manufacturers, biologics producers, and advanced cold chain logistics infrastructure across the U.S. and Canada. High demand for vaccines, specialty drugs, biologics, and clinical trial materials continues to fuel adoption of temperature-controlled packaging solutions across pharmaceutical manufacturing, distribution, and healthcare supply chains

- Leading companies in North America are introducing advanced insulated packaging, active temperature-controlled containers, real-time monitoring systems, and compliance-driven cold chain solutions, strengthening regional leadership. Continuous investment in pharmaceutical R&D, biologics production, and vaccine development supports sustained market expansion

- Strong regulatory frameworks, advanced logistics networks, and high healthcare spending further reinforce North America’s dominant market position

U.S. Temperature-Controlled Packaging Solutions for Pharmaceutical Market Insight

The U.S. is the largest contributor in North America, supported by a well-established pharmaceutical industry, extensive biologics manufacturing, and high-volume vaccine distribution programs. Increasing production of temperature-sensitive drugs, cell & gene therapies, and injectable medicines drives strong demand for reliable temperature-controlled packaging solutions. Presence of major pharmaceutical companies, contract research organizations, and clinical trial hubs accelerates adoption of compliant cold chain packaging. Advanced logistics infrastructure, strict regulatory requirements, and continuous innovation in packaging technologies further strengthen long-term market growth across domestic and international pharmaceutical shipments.

Canada Temperature-Controlled Packaging Solutions for Pharmaceutical Market Insight

Canada contributes significantly to regional growth, driven by expanding pharmaceutical manufacturing, rising clinical research activities, and growing demand for biologics and vaccines. Pharmaceutical distributors and healthcare providers increasingly rely on temperature-controlled packaging to ensure drug integrity during transportation and storage. Government-supported healthcare programs, investments in cold chain infrastructure, and strong regulatory oversight support market adoption. Increasing cross-border pharmaceutical trade with the U.S. and rising focus on specialty drugs further enhance demand for advanced temperature-controlled packaging solutions across the country.

Asia-Pacific Temperature-Controlled Packaging Solutions for Pharmaceutical Market

Asia-Pacific is projected to register the fastest CAGR of 8.9% from 2026 to 2033, driven by rapid expansion of pharmaceutical manufacturing, rising biologics production, and increasing healthcare investments across China, Japan, India, South Korea, and Southeast Asia. Growing vaccine manufacturing, expanding clinical trials, and rising demand for temperature-sensitive medicines significantly increase the need for reliable cold chain packaging. Improvements in healthcare infrastructure, pharmaceutical exports, and regulatory compliance further accelerate adoption of temperature-controlled packaging solutions across the region.

China Temperature-Controlled Packaging Solutions for Pharmaceutical Market Insight

China is the largest contributor to Asia-Pacific growth due to its massive pharmaceutical manufacturing capacity and expanding biologics and vaccine production. Rising exports of temperature-sensitive drugs and increasing domestic healthcare demand drive adoption of temperature-controlled packaging solutions. Government support for pharmaceutical innovation, cold chain logistics development, and healthcare modernization strengthens market expansion. Local manufacturing capabilities and cost-effective packaging solutions further enhance domestic and international market penetration.

Japan Temperature-Controlled Packaging Solutions for Pharmaceutical Market Insight

Japan shows steady growth supported by advanced pharmaceutical manufacturing, strong regulatory standards, and high demand for precision drug delivery. Increasing production of biologics, injectable therapies, and specialty medicines drives adoption of high-quality temperature-controlled packaging solutions. Strong focus on product safety, reliability, and compliance encourages use of premium cold chain packaging technologies. Continuous innovation and aging population healthcare needs support long-term market growth.

India Temperature-Controlled Packaging Solutions for Pharmaceutical Market Insight

India is emerging as a key growth hub, driven by expanding pharmaceutical manufacturing, vaccine production, and global drug exports. Increasing clinical trials, biologics development, and cold chain infrastructure investments boost demand for temperature-controlled packaging solutions. Government initiatives supporting pharmaceutical manufacturing and healthcare access further accelerate market growth across domestic and export-oriented supply chains.

South Korea Temperature-Controlled Packaging Solutions for Pharmaceutical Market Insight

South Korea contributes significantly due to strong growth in biopharmaceutical manufacturing and advanced healthcare infrastructure. Rising production of biologics, biosimilars, and specialty drugs increases reliance on temperature-controlled packaging solutions. Technological innovation, regulatory compliance, and expanding pharmaceutical exports support sustained market expansion across the country.

Which are the Top Companies in Temperature-Controlled Packaging Solutions for Pharmaceutical Market?

The temperature-controlled packaging solutions for pharmaceutical industry is primarily led by well-established companies, including:

- Peli BioThermal LLC (U.S.)

- Sofrigam (France)

- Deutsche Post AG (Germany)

- United Parcel Service of America, Inc (U.S.)

- TEMPACK (Spain)

- AmerisourceBergen Corporation (U.S.)

- va-Q-tec Thermal Solutions GmbH (Germany)

- DS Smith (U.K.)

- Biotempak (Mexico)

- Inmark - Life Sciences (U.S.)

- APEX Packaging Corporation (U.S.)

- Blue Dart Express Limited (India)

- Cryopak (U.S.)

- Intelsius (U.K.)

- Envirotainer (Sweden)

- Cold Chain Technologies (U.S.)

- Sonoco Products Company (U.S.)

What are the Recent Developments in Global Temperature-Controlled Packaging Solutions for Pharmaceutical Market?

- In January 2025, DS Smith announced the launch of a temperature-supported packaging solution designed specifically for the pharmaceutical industry, enabling safe cross-border transportation and storage of temperature-sensitive drugs while supporting sustainability goals for pharma and biotech companies, strengthening its position as a sustainable cold-chain packaging provider

- In January 2024, Envirotainer, a global leader in pharmaceutical air-cargo cold chain solutions, was recognized as the Best Temperature Control Packaging Provider – Active at the 2024 Biopharma Excellence Awards for the second consecutive year, reinforcing its leadership in high-performance active temperature-controlled packaging

- In September 2023, phase-change material specialist Pluss Advanced Technologies (PLUSS) launched two new pharmaceutical temperature-controlled packaging solutions, the Celsure XL Pallet Shipper series and the Celsure VIP Multi-Use Parcel Shipper series, expanding its cold-chain offerings for large-scale and repeat-use pharma logistics

- In January 31, 2023, Cold Chain Technologies expanded its healthcare packaging portfolio with the launch of CCT Therashield, a reusable thermal packaging solution for temperature-sensitive pharmaceutical products, enhancing sustainability and reliability in healthcare cold-chain transportation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Temperature Controlled Packaging Solutions For Pharmaceutical Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Temperature Controlled Packaging Solutions For Pharmaceutical Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Temperature Controlled Packaging Solutions For Pharmaceutical Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.