Global Tennis Equipment Market

Market Size in USD Billion

CAGR :

%

USD

4.09 Billion

USD

4.83 Billion

2025

2033

USD

4.09 Billion

USD

4.83 Billion

2025

2033

| 2026 –2033 | |

| USD 4.09 Billion | |

| USD 4.83 Billion | |

|

|

|

|

Tennis Equipment Market Size

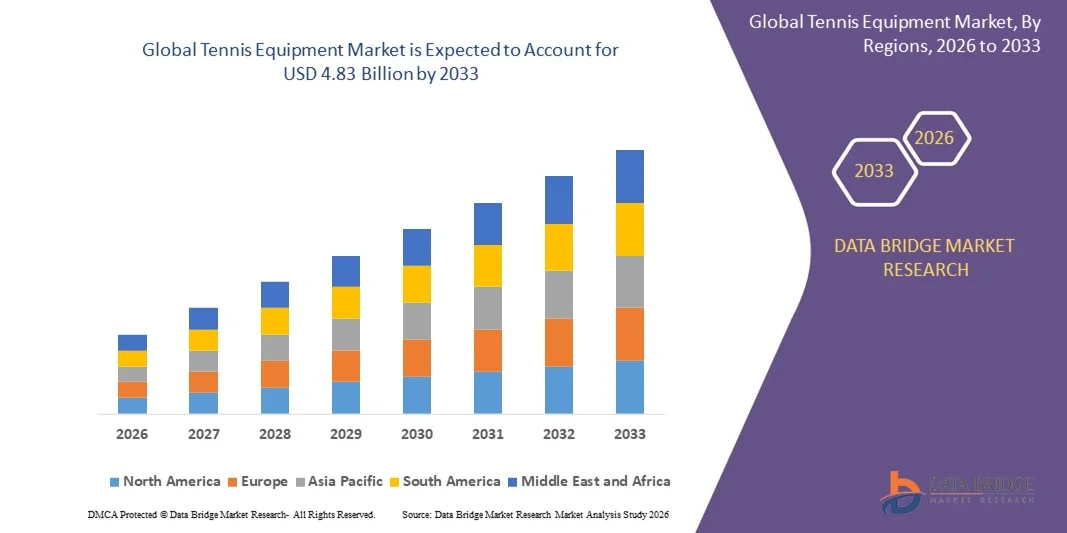

- The global tennis equipment market size was valued at USD 4.09 billion in 2025 and is expected to reach USD 4.83 billion by 2033, at a CAGR of 2.10% during the forecast period

- The market growth is largely fuelled by the rising popularity of tennis as a recreational and professional sport, increased participation in international tournaments, and the growing demand for advanced equipment such as rackets, balls, and wearable technology

- Expansion of tennis academies and training centers worldwide is boosting the demand for high-quality equipment and accessories, particularly in emerging markets

Tennis Equipment Market Analysis

- The market is witnessing a steady growth trend due to increasing awareness about health and fitness, as well as rising disposable incomes in key regions

- In addition, technological advancements in racket and ball manufacturing, coupled with the adoption of smart sports devices for performance tracking, are reshaping the competitive landscape

- North America dominated the global tennis equipment market with the largest revenue share of 38.50% in 2025, driven by the rising popularity of tennis, increasing participation in recreational and professional sports, and growing adoption of advanced and smart equipment

- Asia-Pacific region is expected to witness the highest growth rate in the global tennis equipment market, driven by growing youth population, rising interest in tennis as a professional sport, and increasing adoption of high-performance and technologically advanced equipment. Supportive government initiatives and expanding retail and e-commerce channels are also contributing to market expansion

- The Racquet segment held the largest market revenue share in 2025, driven by the rising adoption of advanced and smart rackets that enhance player performance and reduce injury risks. Smart rackets with sensors and vibration-dampening technology are increasingly preferred by both professional and amateur players, offering real-time feedback and data-driven training insights

Report Scope and Tennis Equipment Market Segmentation

|

Attributes |

Tennis Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tennis Equipment Market Trends

Rise of Advanced and Smart Tennis Equipment

- The growing adoption of technologically advanced tennis equipment is transforming the tennis landscape by enabling improved player performance, injury prevention, and data-driven training. Smart rackets, connected wearables, and sensor-equipped balls allow athletes to monitor swing speed, shot accuracy, and movement patterns, resulting in enhanced skills and competitive advantage. In addition, these tools enable long-term performance tracking and customized training plans tailored to individual players’ strengths and weaknesses, increasing engagement and skill development

- The high demand for performance-enhancing equipment in professional tournaments and training academies is accelerating the adoption of smart rackets, vibration-reducing strings, and impact-resistant balls. These tools are particularly effective for competitive players aiming to refine technique and reduce injury risk. Moreover, the use of these products supports data analytics for coaches, allowing them to evaluate players’ strengths, correct weaknesses, and plan targeted training strategies

- The affordability, ergonomic design, and durability of modern tennis equipment are making them attractive for amateur and semi-professional players as well. Players benefit from enhanced comfort, precision, and overall playing experience without incurring prohibitive costs. In addition, the integration of lightweight materials and shock-absorbent components increases usability and minimizes physical strain during extended play, expanding the user base

- For instance, in 2024, several tennis academies in the U.S. reported improved player training outcomes after integrating sensor-based rackets and wearable devices, allowing coaches to provide real-time feedback and performance optimization. This resulted in measurable improvements in swing consistency, serve accuracy, and overall match readiness, highlighting the practical benefits of advanced equipment in both practice and competitive settings

- While smart and advanced equipment are driving growth through enhanced training and gameplay, their impact depends on ongoing innovation, user awareness, and adoption across both amateur and professional segments. Manufacturers must focus on design innovation, durability, and connectivity features to fully capitalize on market demand. Continuous updates, integration with mobile apps, and advanced analytics capabilities are essential to maintain engagement and ensure long-term market expansion

Tennis Equipment Market Dynamics

Driver

Rising Popularity of Tennis and Increasing Participation in Competitive Sports

- The surge in global interest in tennis, driven by professional tournaments, recreational leagues, and school programs, is encouraging increased investment in high-quality equipment. This trend is accelerating sales of rackets, balls, apparel, and accessories worldwide. In addition, the expansion of international competitions and televised events is boosting visibility, inspiring new players, and expanding the overall market size

- Players and coaches are increasingly aware of the benefits of advanced equipment, such as smart rackets and vibration-dampening technology, which improve performance and reduce injury risks. This awareness is driving adoption across different skill levels. Coupled with growing interest in data analytics and performance tracking, this trend is also encouraging investment in smart accessories, wearable monitors, and connected training systems

- Expansion of tennis academies, clubs, and training centers is supporting wider access to premium and technologically advanced equipment, enabling players in emerging markets to access professional-grade tools. These facilities often provide demo equipment, training workshops, and trial programs, which encourage players to adopt advanced products and integrate technology into their regular practice routines

- For instance, in 2023, European tennis clubs reported significant sales growth in smart rackets and performance-monitoring wearables, highlighting the increasing demand for high-tech equipment in training and competitions. The integration of such devices into coaching programs has been observed to improve match preparation, tactical understanding, and player confidence during tournaments

- While growing interest and institutional support are fueling market growth, widespread adoption requires affordability, education, and continued product innovation to ensure long-term engagement. Partnerships between brands and academies, coupled with awareness campaigns, are critical to encouraging adoption in both amateur and semi-professional segments

Restraint/Challenge

High Cost of Advanced Equipment and Limited Awareness Among Amateur Players

- The premium pricing of smart rackets, sensor-equipped balls, and performance-tracking wearables limits adoption among amateur players and budget-conscious consumers. High cost remains a key barrier for widespread usage in recreational segments. In addition, fluctuating currency rates and import tariffs in certain regions can further inflate prices, restricting access to advanced equipment

- In many regions, limited awareness about the benefits of technologically advanced equipment reduces market penetration. Players often prefer traditional rackets and balls due to familiarity and perceived ease of use. Marketing efforts, demonstrations, and educational campaigns are often needed to showcase the benefits of smart technologies and overcome skepticism among amateur players

- Supply chain and manufacturing constraints, particularly for smart and sensor-based equipment, can impact product availability and timely distribution, affecting market growth. Delays in component sourcing, logistics issues, and regional distribution challenges may hinder product launches, affecting overall market performance and consumer confidence

- For instance, in 2023, several small-scale sports retailers in Southeast Asia reported lower sales of high-tech tennis equipment due to limited consumer awareness and accessibility challenges. Players in these regions were less likely to invest in expensive or unfamiliar products, highlighting the need for localized awareness and distribution strategies

- While technological innovations continue to enhance the market, addressing cost, awareness, and distribution barriers is essential for broader adoption and sustained growth in the global tennis equipment industry. Stakeholders must focus on affordable alternatives, localized marketing, and after-sales support to ensure continued market expansion

Tennis Equipment Market Scope

The market is segmented on the basis of product type, application, distribution channel, material, buyer, and sales channel

- By Product Type

On the basis of product type, the global tennis equipment market is segmented into Apparel, Racquet, Ball, Tennis Bag, and Others. The Racquet segment held the largest market revenue share in 2025, driven by the rising adoption of advanced and smart rackets that enhance player performance and reduce injury risks. Smart rackets with sensors and vibration-dampening technology are increasingly preferred by both professional and amateur players, offering real-time feedback and data-driven training insights.

The Ball segment is expected to witness the fastest growth rate from 2026 to 2033, driven by innovations in high-performance, durable, and sensor-equipped tennis balls. These balls allow players and coaches to track spin, speed, and impact metrics, supporting skill improvement and competitive play. Enhanced ball technology is particularly popular in training academies and professional tournaments, increasing overall market adoption.

- By Application

On the basis of application, the global tennis equipment market is segmented into Domestic and Commercial. The Commercial segment held the largest market revenue share in 2025, driven by increasing demand from tennis clubs, professional training centers, and academies that require high-quality equipment for coaching, competitions, and organized events. Commercial buyers prefer durable, performance-enhancing products that support intensive usage.

The Domestic segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising participation in recreational tennis, home practice setups, and growing awareness of fitness and sports activities. Consumers are increasingly adopting advanced rackets, balls, and apparel for personal use, contributing to the expansion of the domestic segment globally.

- By Distribution Channel

On the basis of distribution channel, the global tennis equipment market is segmented into Sports Stores and E-Commerce. The Sports Stores segment held the largest market revenue share in 2025, driven by established retail networks, in-store product trials, and expert guidance for buyers. Physical stores enable players to evaluate products personally, which supports higher-value purchases.

The E-Commerce segment is expected to witness the fastest growth rate from 2026 to 2033, driven by convenience, wide product variety, home delivery, attractive discounts, and increasing digital adoption. Online platforms are increasingly used by both amateur and professional players to access specialized equipment not available locally, boosting market penetration.

- By Material

On the basis of material, the global tennis equipment market is segmented into Composites, Metallic, and Other Materials. The Composites segment held the largest market revenue share in 2025, fueled by the use of lightweight, high-strength, and durable materials in rackets, balls, and other equipment. Composites enhance performance, reduce fatigue, and are preferred by professional players.

The Metallic and Other Materials segment is expected to witness the fastest growth rate from 2026 to 2033, driven by affordability, ease of manufacturing, and suitability for beginners or recreational players. These materials are increasingly used in emerging markets due to cost-effectiveness and accessibility, expanding the market base.

- By Buyer

On the basis of buyer, the global tennis equipment market is segmented into Individual and Institutional. The Individual segment held the largest market revenue share in 2025, driven by recreational players, professional athletes, and coaching enthusiasts purchasing personal equipment. Individual buyers prefer high-performance products for training, competitions, and personal fitness goals.

The Institutional segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by demand from tennis clubs, sports academies, schools, and professional organizations. Institutions procure bulk equipment for training programs, coaching sessions, and organized events, supporting large-scale adoption of advanced tennis products.

- By Sales Channel

On the basis of sales channel, the global tennis equipment market is segmented into Independent Sports Outlet, Sports Retail Chain, Franchised Sports Outlet, Direct to Customer Online Channel, Direct-to-Customer Institutional Channel, Modern Trade Channels, and Third-Party Online Channel. The Independent Sports Outlet segment held the largest market revenue share in 2025, driven by personalized customer service, in-store trials, and regional presence that builds trust and ensures repeat purchases.

The Direct to Customer Online Channel is expected to witness the fastest growth rate from 2026 to 2033, fueled by convenience, wider product selection, home delivery, digital promotions, and the increasing preference for e-commerce. Online channels allow consumers to access specialty products, enhancing market reach and adoption across regions.

Tennis Equipment Market Regional Analysis

- North America dominated the global tennis equipment market with the largest revenue share of 38.50% in 2025, driven by the rising popularity of tennis, increasing participation in recreational and professional sports, and growing adoption of advanced and smart equipment

- Players in the region highly value performance-enhancing gear, including smart rackets, sensor-equipped balls, and vibration-reducing accessories, which improve training outcomes and reduce injury risks

- The widespread adoption is further supported by the presence of professional tennis academies, extensive club networks, and higher disposable incomes, establishing advanced tennis equipment as a preferred choice for both amateur and professional players

U.S. Tennis Equipment Market Insight

The U.S. tennis equipment market captured the largest revenue share in 2025 within North America, fueled by increasing interest in competitive tennis, recreational leagues, and school sports programs. The growing demand for technologically advanced rackets, balls, and wearable devices is boosting market growth. Players and coaches are prioritizing smart equipment to monitor swing, shot accuracy, and performance metrics. Furthermore, the integration of connected wearables and performance-monitoring systems in training programs is significantly contributing to market expansion.

Europe Tennis Equipment Market Insight

The Europe tennis equipment market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing awareness of injury prevention, adoption of advanced rackets and balls, and expansion of tennis clubs and training academies. Urbanization and disposable income growth are fostering demand for premium equipment. European players are also drawn to data-driven training tools that improve precision and technique. The region is witnessing growth across domestic and commercial applications, with tennis academies actively incorporating smart training devices.

U.K. Tennis Equipment Market Insight

The U.K. tennis equipment market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising participation in professional and amateur tournaments, increased awareness of performance-enhancing gear, and interest in injury-preventive technology. Players and academies are adopting smart rackets, sensor balls, and wearable devices to track performance metrics. The country’s strong retail and e-commerce infrastructure further supports market growth. The trend toward technologically advanced tennis training solutions is expected to continue stimulating demand.

Germany Tennis Equipment Market Insight

The Germany tennis equipment market is expected to witness the fastest growth rate from 2026 to 2033, fueled by growing investment in professional sports training, awareness of sports science, and adoption of innovative tennis gear. Germany’s emphasis on high-quality, durable, and technologically advanced equipment encourages players to invest in premium products. The integration of smart balls, vibration-dampening rackets, and wearable analytics into training programs is increasingly prevalent. The focus on performance optimization and safety drives adoption in both domestic and commercial segments.

Asia-Pacific Tennis Equipment Market Insight

The Asia-Pacific tennis equipment market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising disposable incomes, growing interest in tennis, and expansion of training academies in countries such as India, China, and Japan. The region’s increasing exposure to international tournaments and professional coaching is promoting demand for advanced rackets, sensor balls, and apparel. In addition, the growing e-commerce penetration and retail network expansion improve accessibility to smart and high-performance equipment, boosting market adoption across amateur and professional players.

Japan Tennis Equipment Market Insight

The Japan tennis equipment market is expected to witness the fastest growth rate from 2026 to 2033 due to increasing sports participation, technological adoption, and focus on precision training. Japanese players emphasize injury prevention and performance optimization, driving demand for smart rackets, connected wearables, and sensor-equipped balls. Integration of data-driven analytics in training programs enhances skill development. Furthermore, the country’s aging population encourages the use of ergonomic and easy-to-use tennis gear for all age groups, supporting market growth.

China Tennis Equipment Market Insight

The China tennis equipment market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to increasing interest in professional and recreational tennis, rapid urbanization, and rising disposable incomes. The demand for smart rackets, sensor balls, and performance-monitoring wearables is growing among players and academies. China’s expanding tennis club network, coupled with e-commerce and retail availability of premium and advanced gear, is driving market adoption. Initiatives promoting sports education and youth training programs further propel growth in the region.

Tennis Equipment Market Share

The Tennis Equipment industry is primarily led by well-established companies, including:

- Wilson Sporting Goods (U.S.)

- YONEX Co., Ltd (Japan)

- Dunlop Sports (U.K.)

- Babolat (France)

- HEAD (Austria)

- Tecnifibre (France)

- GAMMA Sports (U.S.)

- Prokennex (Taiwan)

- SportsDirect (U.K.)

- Solinco (U.S.)

- PowerAngle LLC (U.S.)

- Rishi Sports (India)

- Get Set Sports Company (India)

- M/s Mittal Rubber Industries (India)

- Metco Sports Private Limited (India)

- Sports Line (India)

- Thermo Blow Engineers (India)

- Kumaram Sports (India)

- Vinex Enterprises Private Limited (India)

- S.M. Enterprise (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.