Global Tennis Shoes Market

Market Size in USD Billion

CAGR :

%

USD

2.78 Billion

USD

3.55 Billion

2025

2033

USD

2.78 Billion

USD

3.55 Billion

2025

2033

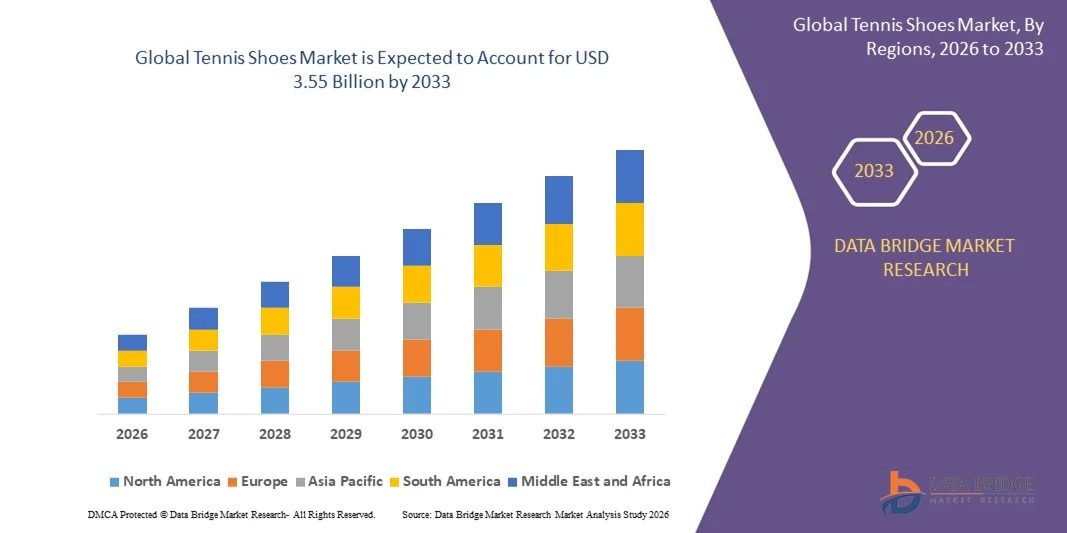

| 2026 –2033 | |

| USD 2.78 Billion | |

| USD 3.55 Billion | |

|

|

|

|

Tennis Shoes Market Size

- The global tennis shoes market size was valued at USD 2.78 billion in 2025 and is expected to reach USD 3.55 billion by 2033, at a CAGR of 3.1% during the forecast period

- The market growth is largely fueled by increasing participation in tennis and other racquet sports globally, combined with rising awareness of health, fitness, and sports activities among consumers, which is driving higher demand for specialized and performance-oriented tennis shoes

- Furthermore, technological advancements in shoe design, such as improved cushioning systems, lightweight materials, and court-specific traction, are enhancing player performance and comfort. These converging factors are accelerating the adoption of advanced tennis shoes, thereby significantly boosting the industry's growth

Tennis Shoes Market Analysis

- Tennis shoes, designed for optimal performance on various court surfaces including hard, clay, and grass courts, are increasingly considered essential equipment for both professional and recreational players due to their impact on agility, stability, and injury prevention

- The escalating demand for tennis shoes is primarily fueled by growing consumer preference for branded and technologically advanced footwear, increased participation in tennis academies and leagues, and the rising popularity of sports-inspired fashion and athleisure trends

- North America dominated tennis shoes market with a share of over 30% in 2025, due to the high participation rate in recreational and professional tennis, as well as growing awareness of sports and fitness activities

- Asia-Pacific is expected to be the fastest growing region in the tennis shoes market during the forecast period due to increasing urbanization, rising disposable incomes, and growing interest in tennis across countries such as China, Japan, and India

- Hard court tennis shoes segment dominated the market with a market share of 48% in 2025, due to the widespread prevalence of hard court surfaces in tennis clubs, schools, and professional tournaments. Hard court shoes are favored for their durability, superior traction, and cushioning that reduces the risk of injuries during high-impact movements

Report Scope and Tennis Shoes Market Segmentation

|

Attributes |

Tennis Shoes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tennis Shoes Market Trends

Rising Demand for Performance-Enhancing and Court-Specific Tennis Shoes

- A significant trend in the tennis shoes market is the growing preference for performance-enhancing footwear designed for specific court surfaces, driven by increasing professional and recreational tennis participation and the need for injury prevention and optimal performance. These shoes are being engineered to offer tailored traction, cushioning, and support to meet the demands of competitive play

- For instance, Nike and Adidas have launched court-specific models such as the NikeCourt Air Zoom Vapor Pro and Adidas Adizero Ubersonic, which incorporate advanced cushioning and lightweight materials for improved agility and endurance. Such designs are influencing consumer expectations and pushing the market toward innovation in performance-oriented footwear

- Integration of advanced materials, including breathable mesh, adaptive midsoles, and carbon fiber shanks, is becoming more common in tennis shoes to enhance stability, reduce fatigue, and optimize energy transfer during play. This is enabling athletes to maintain peak performance during extended matches and training sessions

- The rising awareness of injury prevention and ergonomic design among amateur players is boosting demand for specialized shoes with enhanced ankle support, shock absorption, and lateral stability. This trend is expanding the market beyond professional athletes to fitness enthusiasts and club players

- E-commerce and online retail platforms are facilitating greater accessibility to diverse tennis shoe models, allowing consumers to compare features and select products suited to their playing style and court preference. This digital shift is accelerating market growth and enabling global brand outreach

- Collaborations between tennis stars and footwear brands are driving consumer interest through signature editions that blend performance technology with style. These partnerships are reinforcing brand loyalty and contributing to the premiumization of the tennis shoes segment

Tennis Shoes Market Dynamics

Driver

Growing Participation in Tennis and Fitness Activities Globally

- Increasing global participation in tennis and fitness activities is driving demand for specialized tennis footwear that enhances performance, comfort, and safety. Rising memberships in tennis clubs, school programs, and recreational leagues are expanding the consumer base for court-specific shoes

- For instance, Wilson Sporting Goods and Asics have actively promoted tennis participation through sponsorships and product launches targeting youth and adult programs. These initiatives are increasing brand visibility and stimulating sales of high-performance tennis shoes

- The rising focus on health, wellness, and active lifestyles is contributing to higher adoption of tennis as a fitness activity, encouraging consumers to invest in premium shoes designed to support intensive training and match play. This is pushing brands to innovate in cushioning, durability, and traction technologies

- Professional tournaments and televised tennis events are inspiring amateurs to emulate athletes’ gear choices, thereby increasing market penetration for branded, performance-oriented tennis shoes. This influence enhances consumer willingness to purchase advanced footwear

- The growing trend of multi-sport and recreational training is creating demand for versatile tennis shoes suitable for both on-court and off-court activities. This versatility requirement is prompting manufacturers to develop hybrid designs that cater to broader fitness needs

Restraint/Challenge

High Cost of Advanced and Branded Tennis Footwear

- The high price point of advanced and branded tennis shoes is limiting adoption among casual players and price-sensitive consumers, especially in emerging markets. Premium materials, cutting-edge technologies, and brand positioning contribute to elevated costs

- For instance, models such as the NikeCourt Air Zoom Vapor Pro and Adidas Adizero Ubersonic are priced at a premium, which may deter first-time buyers or recreational players seeking affordable options. This restricts broader market penetration and creates demand for mid-tier alternatives

- Advanced shoes often involve sophisticated design, specialized cushioning systems, and high-grade materials that increase production expenses and retail pricing. These factors limit accessibility for budget-conscious consumers and slow growth in certain regions

- Competition from lower-cost brands offering basic tennis shoes creates a challenge for premium players in balancing innovation with affordability. This competitive dynamic pressures established brands to justify pricing through performance differentiation and marketing

- Consumer sensitivity to price-performance ratios continues to influence purchase decisions, requiring companies to carefully position their product lines to appeal to both professional athletes and recreational users. Managing this balance is critical to sustaining market growth

Tennis Shoes Market Scope

The market is segmented on the basis of playing surface, user, and distribution channel.

- By Playing Surface

On the basis of playing surface, the tennis shoes market is segmented into hard court tennis shoes, clay court tennis shoes, and grass court tennis shoes. The hard court tennis shoes segment dominated the market with the largest revenue share of 48% in 2025, driven by the widespread prevalence of hard court surfaces in tennis clubs, schools, and professional tournaments. Hard court shoes are favored for their durability, superior traction, and cushioning that reduces the risk of injuries during high-impact movements. The versatility of hard court shoes also makes them suitable for multiple surfaces, attracting recreational and professional players alike. The market sees strong demand as leading brands continue to innovate in cushioning technology, sole patterns, and lightweight designs to enhance player performance.

The clay court tennis shoes segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing interest in clay court tournaments and the growing popularity of clay courts in Europe and South America. For instance, Adidas has introduced specialized clay court models with advanced outsole patterns that prevent clay build-up while ensuring lateral stability. These shoes are particularly preferred by competitive players who require enhanced grip and slide control on clay surfaces. In addition, rising investments in tennis academies and training centers with clay courts contribute to the accelerating adoption of clay-specific tennis shoes. The lightweight design, breathable materials, and targeted traction technology of clay court shoes further boost their appeal among professional and amateur players.

- By User

On the basis of user, the tennis shoes market is segmented into men, women, and kids. The men’s segment dominated the market in 2025 with the largest revenue share, driven by higher participation rates in professional and recreational tennis among male players. Men’s tennis shoes are often engineered with reinforced durability, advanced cushioning, and stability technologies to accommodate intense gameplay and lateral movements. The strong presence of male athletes in global tournaments and endorsement campaigns by leading brands further stimulates demand for high-performance men’s tennis shoes. In addition, the expansion of fitness culture and tennis clubs targeting male members continues to support market dominance in this segment.

The women’s segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing female participation in competitive and recreational tennis activities. For instance, Nike has launched women-specific tennis shoes incorporating ergonomic designs and tailored cushioning to meet the biomechanical needs of female players. Growing awareness of fitness, wellness, and sports among women, along with targeted marketing campaigns and sponsorships in women’s tennis, accelerates market adoption. The demand is further enhanced by aesthetic appeal, lightweight materials, and color variations designed to attract female consumers. Expanding access to tennis coaching and leagues for women also contributes to the rapid growth of this segment.

- By Distribution Channel

On the basis of distribution channel, the tennis shoes market is segmented into supermarket/hypermarket, specialty stores, e-commerce, and others. The specialty stores segment dominated the market with the largest revenue share in 2025, driven by the availability of expert guidance, extensive product selection, and opportunities for customers to try shoes for fit and performance. Specialty stores often provide personalized recommendations, exclusive brand launches, and professional insights, which attract serious players and tennis enthusiasts. The segment benefits from strong brand collaborations and promotional activities, reinforcing customer trust and repeat purchases. Consumers also prefer specialty stores for high-end or performance-oriented tennis shoes that may not be available in mass retail outlets.

The e-commerce segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the convenience of online shopping, broader product variety, and competitive pricing offered through digital platforms. For instance, Amazon and Decathlon’s online portals have expanded their tennis shoe offerings with detailed specifications, customer reviews, and fast delivery options. Increasing smartphone penetration, easy return policies, and targeted online marketing campaigns further boost adoption among younger consumers and remote buyers. E-commerce also enables brands to introduce limited editions, exclusive collaborations, and region-specific models directly to consumers, driving rapid growth in this channel. The growing trust in digital payment methods and logistics infrastructure enhances the segment’s attractiveness and projected CAGR.

Tennis Shoes Market Regional Analysis

- North America dominated the tennis shoes market with the largest revenue share of over 30% in 2025, driven by the high participation rate in recreational and professional tennis, as well as growing awareness of sports and fitness activities

- Consumers in the region highly value comfort, performance-enhancing features, and durability offered by technologically advanced tennis shoes

- This widespread adoption is further supported by high disposable incomes, a strong culture of sports engagement, and the popularity of branded athletic footwear, establishing tennis shoes as a preferred choice for men, women, and kids across the region

U.S. Tennis Shoes Market Insight

The U.S. tennis shoes market captured the largest revenue share in 2025 within North America, fueled by increasing interest in tennis leagues, school programs, and recreational play. Consumers are prioritizing lightweight designs, superior cushioning, and high-traction outsoles for better performance on different court surfaces. The growing trend of athleisure and sports-inspired fashion, combined with robust demand for premium and branded tennis shoes, further propels market growth. Moreover, collaborations between footwear brands and professional athletes are significantly influencing consumer choices, boosting sales in both physical and e-commerce channels.

Europe Tennis Shoes Market Insight

The Europe tennis shoes market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing popularity of tennis as a competitive sport and leisure activity. Rising urbanization and disposable incomes are fostering adoption across both professional players and recreational users. European consumers are drawn to the comfort, design, and technologically advanced features offered by modern tennis shoes. The market is experiencing growth across various segments, including hard court, clay court, and grass court shoes, with premium and specialized products being integrated into tennis academies, clubs, and retail outlets.

U.K. Tennis Shoes Market Insight

The U.K. tennis shoes market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of active lifestyles, school-level tennis programs, and leisure sports participation. In addition, concerns regarding proper footwear to prevent injuries encourage consumers to invest in specialized tennis shoes. The U.K.’s well-established retail infrastructure, e-commerce platforms, and preference for branded athletic footwear are expected to continue stimulating market growth.

Germany Tennis Shoes Market Insight

The Germany tennis shoes market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of sports-related health benefits and the demand for technologically enhanced footwear. Germany’s emphasis on quality, sustainability, and ergonomic designs promotes the adoption of premium and performance-oriented tennis shoes, particularly in professional and recreational segments. Integration of advanced cushioning, grip, and stability features is driving consumer preference for brands that offer reliable, durable, and eco-conscious options.

Asia-Pacific Tennis Shoes Market Insight

The Asia-Pacific tennis shoes market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and growing interest in tennis across countries such as China, Japan, and India. The region’s rising inclination toward fitness, sports academies, and professional training programs is driving the adoption of specialized tennis shoes. Furthermore, APAC is emerging as a manufacturing hub for athletic footwear, making high-quality tennis shoes more affordable and accessible to a broader consumer base.

Japan Tennis Shoes Market Insight

The Japan tennis shoes market is gaining momentum due to high participation in recreational tennis, increasing enrollment in tennis clubs, and a strong focus on performance-enhancing sports footwear. Consumers prefer shoes with advanced cushioning, lightweight materials, and designs optimized for various court surfaces. In addition, the aging population and interest in safe, easy-to-wear sports shoes are likely to spur demand across both residential and commercial sports facilities.

China Tennis Shoes Market Insight

The China tennis shoes market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a growing middle class, and increasing participation in sports and fitness activities. China represents one of the largest markets for athletic footwear, with tennis shoes gaining popularity in recreational, professional, and school-level sports. Government initiatives promoting physical activity, rising awareness of health benefits, and the availability of affordable yet high-quality domestic and international brands are key factors driving market growth.

Tennis Shoes Market Share

The tennis shoes industry is primarily led by well-established companies, including:

- Nike Inc. (U.S.)

- adidas (Germany)

- ASICS Asia Pte. Ltd (Singapore)

- K-Swiss (U.S.)

- Wilson Sporting Goods (U.S.)

- PUMA SE (Germany)

- Mizuno USA (U.S.)

- New Balance (U.S.)

- DUNLOP PROTECTIVE FOOTWEAR (U.K.)

- Li-Ning (China)

- SKECHERS (U.S.)

- Peak Sport (China)

- YONEX Co. Ltd (Japan)

- Babolat (France)

- Lotto Spa (Italy)

- Nivia Sports (India)

- Fila Inc. (Italy)

- Diadora S.p.A. (Italy)

- Joma Sport (Spain)

- HEAD (Austria)

Latest Developments in Global Tennis Shoes Market

- In February 2025, Nike debuted its latest tennis shoe, emphasizing lightweight stability to support aggressive playstyles. The model features Zoom Air forefoot cushioning for responsive energy return, a flexible TPU design for adaptability, and a secure midfoot band ensuring a snug fit. Its enhanced durability and performance-oriented design cater to both professional and club-level players, boosting Nike’s presence in the high-performance segment and reinforcing consumer preference for technologically advanced tennis footwear

- In February 2025, Wilson Rush introduced a new line of tennis shoes with a revamped mesh for improved airflow, helping maintain foot comfort during prolonged play. The shoes incorporate a speed lacing system for quick adjustments, a split chassis enhancing stability and propulsion, and a Duralast outsole for superior traction across multiple surfaces. This launch strengthens Wilson’s market position by addressing comfort, agility, and multi-surface performance needs, attracting competitive and recreational players alike

- In February 2025, Adidas unveiled its latest tennis shoe featuring the LightStrike midsole for enhanced agility, a lightweight mono-mesh upper for breathability, and a TPU heel clip for stability during intense movements. Its durable construction and high-performance design make it suitable for all player levels. The product reinforces Adidas’ reputation in the market for innovation and positions the brand strongly in the agility-focused tennis shoe segment

- In January 2025, ASICS launched the 10th-anniversary edition of its iconic tennis shoe line, featuring reengineered foam for superior comfort, enhanced lateral support for better control, bio-based cushioning, and the DYNALACING™ system for a custom fit. This model appeals to both professional athletes and recreational players, highlighting ASICS’ commitment to combining legacy with innovation and strengthening its competitive edge in stability and eco-conscious performance segments

- In January 2025, Puma introduced its latest tennis shoe designed for explosive court movements, incorporating a ProFoam midsole for lightweight cushioning, a durable rubber outsole for improved traction, and a supportive upper for lateral stability. This launch enhances Puma’s market share by targeting players seeking agility and responsiveness, while emphasizing design innovation and performance optimization for professional and amateur users

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.