Global Terahertz Technology Market

Market Size in USD Million

CAGR :

%

USD

492.41 Million

USD

1,678.91 Million

2025

2033

USD

492.41 Million

USD

1,678.91 Million

2025

2033

| 2026 –2033 | |

| USD 492.41 Million | |

| USD 1,678.91 Million | |

|

|

|

|

What is the Global Terahertz Technology Market Size and Growth Rate?

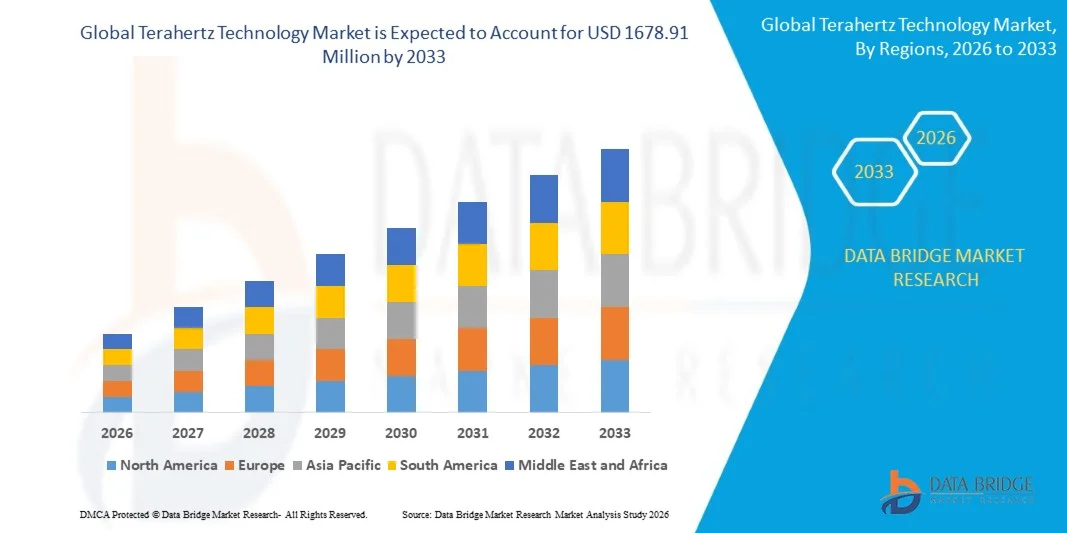

- The global terahertz technology market size was valued at USD 492.41 million in 2025 and is expected to reach USD 1678.91 million by 2033, at a CAGR of16.57% during the forecast period

- Market growth is driven by rising demand for high-speed and power-efficient electronic systems, increasing adoption of terahertz solutions in imaging, spectroscopy, and communication applications, growing need for non-destructive testing and high-resolution sensing, expanding use of terahertz waves in medical diagnostics and security screening, and continuous advancements in terahertz sources, detectors, and signal processing technologies

What are the Major Takeaways of Terahertz Technology Market?

- Rapid growth in research and development activities, increasing deployment in healthcare imaging, semiconductor inspection, and defense applications, and rising adoption across emerging economies are creating significant growth opportunities for the terahertz technology market

- However, high system costs, technical complexity, limited availability of skilled professionals, and challenges related to system integration and standardization are expected to restrain market expansion to some extent during the forecast period

- North America dominated the terahertz technology market with a 42.32% revenue share in 2025, driven by strong growth in semiconductor research, advanced electronics manufacturing, defense technologies, and expanding terahertz-focused R&D activities across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 6.89% from 2026 to 2033, driven by rapid semiconductor expansion, large-scale electronics manufacturing, increasing 5G-to-6G transition efforts, and rising adoption of terahertz imaging across China, Japan, India, South Korea, and Southeast Asia

- The Imaging segment dominated the market with an estimated 44.6% share in 2025, driven by extensive adoption in security screening, non-destructive testing, medical diagnostics, and industrial inspection

Report Scope and Terahertz Technology Market Segmentation

|

Attributes |

Terahertz Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Terahertz Technology Market?

“Increasing Shift Toward High-Speed, Compact, and PC-Integrated Terahertz Systems”

- The terahertz technology market is witnessing growing adoption of compact, portable, and PC-connected terahertz systems used for imaging, spectroscopy, communications testing, and non-destructive evaluation

- Manufacturers are introducing high-frequency, broadband, and software-defined terahertz sources and detectors offering improved resolution, faster data acquisition, and seamless integration with advanced analytics platforms

- Rising demand for lightweight, cost-efficient, and field-deployable terahertz solutions is driving usage across semiconductor fabs, security screening, medical diagnostics, and academic research environments

- For instance, companies such as Keysight, Luna Innovations, Gentec Electro-Optics, and TeraView have enhanced their terahertz platforms with higher bandwidth, improved signal stability, and PC-based data visualization

- Increasing need for real-time material characterization, high-speed signal analysis, and contactless inspection is accelerating the shift toward compact, digitally controlled terahertz systems

- As devices and materials become more complex, terahertz technologies will remain critical for high-precision testing, imaging, and advanced analytical applications

What are the Key Drivers of Terahertz Technology Market?

- Rising demand for non-destructive testing, high-resolution imaging, and accurate material characterization across semiconductor, aerospace, healthcare, and defense sectors

- For instance, during 2024–2025, leading players such as Keysight, Nokia Bell Labs partners, and Luna Innovations expanded terahertz solutions to support 6G research, EV battery inspection, and advanced sensing

- Growing adoption of terahertz systems in semiconductor inspection, EV manufacturing, security screening, and biomedical imaging is boosting global market demand

- Advancements in terahertz sources, detectors, signal processing, and PC-based control software have significantly improved system performance and usability

- Rising focus on 6G communications, AI hardware testing, and high-frequency electronics is creating strong demand for broadband terahertz measurement solutions

- Backed by increasing investments in R&D, advanced manufacturing, and next-generation communication technologies, the Terahertz Technology market is poised for sustained long-term growth

Which Factor is Challenging the Growth of the Terahertz Technology Market?

- High costs associated with terahertz sources, detectors, and precision components limit adoption among small research labs and cost-sensitive end users

- For instance, during 2024–2025, supply chain constraints, specialized component shortages, and high fabrication costs increased overall system pricing for several vendors

- Technical complexity in system integration, calibration, and interpretation of terahertz data raises the need for skilled professionals and specialized training

- Limited awareness and standardization in emerging markets regarding terahertz applications and performance benefits slow broader adoption

- Competition from alternative imaging and testing technologies such as X-ray, infrared, and ultrasonic systems creates pricing pressure and adoption challenges

- To overcome these barriers, companies are focusing on modular designs, cost optimization, user-friendly software, and expanded training initiatives to accelerate global adoption of Terahertz Technologies

How is the Terahertz Technology Market Segmented?

The market is segmented on the basis of application, product type, and end-use.

• By Application

On the basis of application, the terahertz technology market is segmented into Imaging, Communications, and Spectroscopy. The Imaging segment dominated the market with an estimated 44.6% share in 2025, driven by extensive adoption in security screening, non-destructive testing, medical diagnostics, and industrial inspection. Terahertz imaging enables high-resolution, non-ionizing, and contactless analysis, making it highly suitable for detecting defects, concealed objects, and material inconsistencies. Its growing use in semiconductor inspection and biomedical research further strengthens market leadership.

The Communications segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising investments in 6G research, ultra-high-speed wireless transmission, and next-generation networking technologies. Increasing demand for high-frequency spectrum utilization and low-latency data transmission is accelerating terahertz adoption in advanced communication systems.

• By Product Type

On the basis of product type, the market is segmented into Imaging Scanner, Imaging Cameras, Antennas, Spectrometer, and Body Scanner. The Imaging Scanner segment held the largest market share of around 38.9% in 2025, owing to widespread use in industrial quality control, airport security, and semiconductor wafer inspection. Imaging scanners offer high penetration capability, precision, and rapid scanning, making them indispensable across multiple industries.

The Spectrometer segment is projected to register the fastest growth during 2026–2033, driven by increasing demand in material characterization, pharmaceutical analysis, chemical sensing, and academic research. Continuous advancements in compact spectrometer design and PC-integrated platforms are further enhancing adoption.

• By End-Use

On the basis of end-use, the terahertz technology market is segmented into IT & Telecom, Medical & Healthcare, Laboratory Research, Defense & Security, Semiconductor Testing, and Others. The Semiconductor Testing segment dominated the market with a 41.2% share in 2025, supported by rising chip complexity, demand for non-destructive inspection, and increasing terahertz usage in fault detection and process monitoring.

The Medical & Healthcare segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by expanding applications in cancer detection, skin imaging, dental diagnostics, and biomedical research. Growing preference for safe, non-ionizing diagnostic technologies continues to accelerate adoption in healthcare settings.

Which Region Holds the Largest Share of the Terahertz Technology Market?

- North America dominated the terahertz technology market with a 42.32% revenue share in 2025, driven by strong growth in semiconductor research, advanced electronics manufacturing, defense technologies, and expanding terahertz-focused R&D activities across the U.S. and Canada. High adoption of terahertz systems for non-destructive testing, security screening, medical imaging, and high-frequency communication research continues to fuel demand across research laboratories, aerospace programs, defense facilities, and leading universities

- Leading companies and research institutions in North America are advancing terahertz imaging systems, spectrometers, and communication platforms with higher frequency ranges, improved resolution, and compact PC-integrated designs, reinforcing the region’s technological leadership. Continuous investment in 6G research, AI-enabled sensing, and next-generation semiconductor inspection supports long-term market expansion

- Strong availability of skilled researchers, mature innovation ecosystems, and sustained government and private funding further strengthen North America’s dominance in the global terahertz technology landscape

U.S. Terahertz Technology Market Insight

The U.S. represents the largest contributor in North America, supported by extensive terahertz research in defense, aerospace, healthcare imaging, and semiconductor testing. Rising development of 6G communication prototypes, advanced medical diagnostics, and non-contact inspection technologies is accelerating demand for high-performance terahertz systems. Presence of major research labs, startups, and technology vendors continues to drive market growth.

Canada Terahertz Technology Market Insight

Canada contributes steadily through growing investments in photonics research, medical imaging, and academic terahertz laboratories. Universities and research centers increasingly deploy terahertz spectrometers and imaging systems for material science, biomedical research, and industrial testing, supported by government-backed innovation programs.

Asia-Pacific Terahertz Technology Market

Asia-Pacific is projected to register the fastest CAGR of 6.89% from 2026 to 2033, driven by rapid semiconductor expansion, large-scale electronics manufacturing, increasing 5G-to-6G transition efforts, and rising adoption of terahertz imaging across China, Japan, India, South Korea, and Southeast Asia. Growth in consumer electronics, EVs, industrial automation, and digital healthcare is accelerating terahertz deployment across manufacturing and research environments.

China Terahertz Technology Market Insight

China leads Asia-Pacific due to massive investments in semiconductor fabrication, national 6G research programs, and expanding industrial inspection capabilities. Strong domestic manufacturing and competitive system pricing continue to boost adoption of terahertz imaging and spectroscopy solutions.

Japan Terahertz Technology Market Insight

Japan shows consistent growth supported by precision electronics manufacturing, advanced medical research, and automotive innovation. Strong emphasis on reliability and high-resolution sensing drives adoption of premium terahertz systems in industrial and healthcare applications.

India Terahertz Technology Market Insight

India is emerging as a high-growth market, supported by expanding research institutes, government-backed semiconductor initiatives, and increasing use of terahertz technology in medical research, defense applications, and academic laboratories.

South Korea Terahertz Technology Market Insight

South Korea contributes significantly due to strong demand from semiconductor testing, display technologies, and next-generation communication research. Rapid innovation in AI hardware, memory devices, and high-frequency electronics supports sustained terahertz market growth across the country.

Which are the Top Companies in Terahertz Technology Market?

The terahertz technology industry is primarily led by well-established companies, including:

- Advantest Corporation (Japan)

- Luna Innovations (U.S.)

- HUBNER GmbH & Co. KG (Germany)

- TeraView Limited (U.K.)

- Toptica Photonics AG (Germany)

- Gentec Electro-optics Inc. (Canada)

- Bakman Technologies LLC (U.S.)

- Menlo Systems (Germany)

- QMC Instruments Ltd. (U.K.)

- TeraSense Group (U.S.)

What are the Recent Developments in Global Terahertz Technology Market?

- In January 2024, Gentec Electro-Optics, a specialist in laser beam and terahertz technologies, introduced the PRONTO-250-FLEX laser power meter with flexible calibration options that allow customers to pay only for required services, strengthening cost efficiency and user customization in precision measurement solutions

- In December 2023, Luna Innovations acquired U.K.-based Silixa to enhance its fiber optic sensing portfolio by integrating Distributed Temperature Sensing (DTS) and Distributed Acoustic Sensing (DAS) technologies for mining, energy, and defense applications, reinforcing its competitive position in advanced sensing markets

- In August 2023, Luna Innovations secured a large-scale order for its terahertz sensing solution for electric vehicle battery production, utilizing its Atlanta, Georgia facility to deliver four times higher capacity, highlighting the growing role of terahertz technology in EV manufacturing

- In November 2022, Nokia Bell Labs selected Keysight’s Sub-Terahertz Testbed to evaluate the performance of its 6G transceiver modules, leveraging combined expertise in advanced semiconductor technologies to accelerate the development and validation of next-generation 6G communications

- In October 2022, the Center for Nondestructive Evaluation (CNDE) acquired a new terahertz continuous-wave spectrometer from Bakman Technologies, featuring fiber-coupled semiconductor lasers and digital control systems, enhancing terahertz spectroscopic research and non-destructive testing capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Terahertz Technology Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Terahertz Technology Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Terahertz Technology Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.