Global Terbium Oxide Market

Market Size in USD Million

CAGR :

%

USD

829.30 Million

USD

1,512.38 Million

2024

2032

USD

829.30 Million

USD

1,512.38 Million

2024

2032

| 2025 –2032 | |

| USD 829.30 Million | |

| USD 1,512.38 Million | |

|

|

|

|

Terbium Oxide Market Size

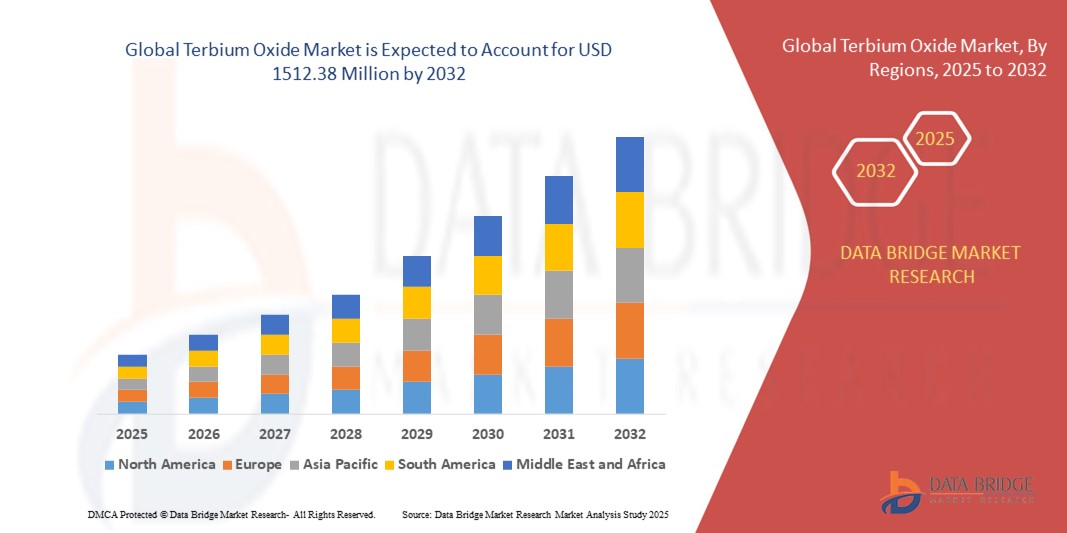

- The global terbium oxide market size was valued at USD 829.3 million in 2024 and is expected to reach USD 1512.38 million by 2032, at a CAGR of 7.8% during the forecast period

- The market growth is largely fueled by the increasing demand for rare earth elements in electronics, renewable energy, and defense sectors, where terbium oxide plays a critical role in enhancing device performance and energy efficiency

- Furthermore, the growing use of terbium oxide in green technologies, including low-energy lighting and electric vehicles, is driving demand across both developed and developing regions. These converging factors are strengthening the global supply chain and accelerating the expansion of the terbium oxide market

Terbium Oxide Market Analysis

- Terbium oxide is a rare earth compound primarily used in phosphors for fluorescent lighting and displays, as well as in permanent magnets for electric motors and defense technologies. Its high luminescent and magnetic properties make it essential for advanced electronic, optical, and energy applications

- The rising demand for terbium oxide is supported by rapid technological advancements, increased production of electric vehicles, and a global push toward energy-efficient systems. Government initiatives to secure rare earth supply chains and growing investment in recycling further bolster market growth

- North America dominated the terbium oxide market with a share of over 30% in 2024, due to the region’s strong foothold in electronics manufacturing and advanced materials research

- Asia-Pacific is expected to be the fastest growing region in the terbium oxide market during the forecast period due to rapid industrialization, electronics manufacturing, and expanding renewable energy projects across China, Japan, India, and South Korea

- High purity terbium oxide (above 99.5%) segment dominated the market with a market share of 42% in 2024, due to its demand in precision electronics, aerospace systems, and optical applications. Applications in lasers, magneto-optic sensors, and scientific instruments require extremely pure materials for consistent performance. Manufacturers prioritize high-purity terbium oxide for its stability, reproducibility, and superior physical properties. Its role in cutting-edge technologies makes it the most valuable grade in terms of price and technical relevance

Report Scope and Terbium Oxide Market Segmentation

|

Attributes |

Terbium Oxide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Terbium Oxide Market Trends

Growing Focus on Rare Earth Recycling Initiatives

- Increasing environmental concerns and supply chain vulnerabilities are driving a strong focus on rare earth recycling initiatives, specifically targeting terbium oxide recovery from electronic waste, magnets, and fluorescent lamps to secure sustainable supplies and reduce reliance on mining

- For instance, companies and consortia in China, Europe, and North America are developing advanced hydrometallurgical and pyrometallurgical recycling technologies and pilot projects that reclaim high-purity terbium oxide from spent permanent magnets and phosphor powders, aligning with circular economy goals

- Government policies and funding programs supporting rare earth recycling are emerging, facilitating research, commercialization, and scaling of eco-friendly processing methods to lower environmental impact and stabilize market supply

- The rise in urban mining and second-life rare earth product markets encourages partnerships between electronics manufacturers, waste management companies, and chemical processors focused on terbium oxide extraction and refining

- Awareness about the carbon footprint of traditional terbium extraction is pushing industry players toward lifecycle assessments and greener sourcing practices, incorporating recycled terbium oxide into product value chains

- Innovation in catalysts and separation chemistry optimizes yield and purity of recycled terbium oxide, making recycled material increasingly competitive with virgin supply

Terbium Oxide Market Dynamics

Driver

Rising Demand for High-Efficiency Electronic Displays

- The ongoing transition to high-efficiency displays, including OLED, QLED, and other advanced screen technologies for smartphones, televisions, and monitors, fuels strong demand for terbium oxide due to its critical role in green phosphors and luminescent materials

- For instance, leading electronics manufacturers such as Samsung, LG Display, and BOE Technology incorporate terbium-doped phosphors to achieve superior brightness, color purity, and energy efficiency in display backlighting and pixels

- Expanding adoption of digital signage, AR/VR devices, and automotive displays further broadens the application scope, requiring high-purity terbium oxide for consistent performance and regulatory compliance around energy use

- Terbium oxide is also essential for emerging laser-based display systems and mini-LED technologies where precise optical properties and material stability are critical. The consumer trend toward eco-friendly and energy-saving electronic products encourages suppliers to improve material quality and reproducibility to meet demanding specifications

- R&D in nanomaterials and composite terbium oxide materials is producing enhanced performance characteristics tailored to next-generation display applications

Restraint/Challenge

Limited Global Supply

- The global supply of terbium oxide is constrained due to terbium’s status as a rare earth element with limited mining sources concentrated mainly in China, and complex extraction and purification processes that restrict production volume

- For instance, geopolitical tensions, export restrictions, and environmental regulations in major rare earth producing countries create periodic supply disruptions and price volatility, impacting downstream industries reliant on steady terbium oxide availability

- Terbium mining involves costly and environmentally sensitive operations due to low ore concentrations and the need for extensive separation from other rare earth elements, limiting new production capacity

- Alternative materials and recycling efforts, though growing, have yet to fully offset the tight supply-demand balance, necessitating cautious inventory management and supplier diversification by end users

- High purity requirements for advanced electronics push for premium grade terbium oxide that is even more challenging to produce in large quantities, reinforcing supply constraints

Terbium Oxide Market Scope

The market is segmented on the basis of application, product form, end-user industry, purity level, and distribution channel.

- By Application

On the basis of application, the market is segmented into electronics, energy storage, nuclear industry, catalysts, glass and ceramics, and imaging and sensors. The electronics segment held the largest market share in 2024 due to the widespread use of terbium oxide in fluorescent lighting and color phosphors for display technologies. It plays a crucial role in television screens, smartphones, and LED lights because of its excellent luminescence and magnetic properties. Increasing global demand for advanced consumer electronics and energy-efficient lighting further supports segment growth. Its integration into miniaturized electronic circuits and optoelectronic devices also makes it vital to modern electronics manufacturing.

The energy storage segment is anticipated to register the fastest growth from 2025 to 2032. Terbium oxide is gaining attention for its potential role in improving battery cathode materials and enhancing magnetic performance in energy storage devices. As the electric vehicle and renewable energy sectors expand, demand for rare earth-enhanced batteries is increasing. Researchers are exploring terbium-based compounds for next-generation solid-state and lithium-ion batteries. The segment is also supported by rising investments in smart grids and decentralized storage technologies.

- By Product Form

On the basis of product form, the terbium oxide market is categorized into powder, nanoparticles, pellets, and coatings. The powder segment accounted for the largest market share in 2024 due to its versatility and compatibility with multiple industrial processes. Powder form is commonly used in glass manufacturing, phosphor applications, and ceramics due to its high purity, ease of blending, and thermal stability. It is the preferred form for bulk purchases in the lighting and electronics industries. The ability to tailor particle size distribution also adds flexibility in formulation and end-use performance.

The nanoparticles segment is projected to grow at the fastest pace over the forecast period. With increasing research in nanomedicine, terbium oxide nanoparticles are being used in bio-imaging, drug delivery systems, and fluorescence-based sensors. Their unique optical and magnetic characteristics at the nanoscale enhance biomedical imaging precision. Growing demand for non-invasive diagnostics, as well as government funding for nanotechnology research, is driving innovation in this area. In addition, these nanoparticles show potential in next-gen memory devices and smart coatings.

- By End-User Industry

On the basis of end-user industry, the market is segmented into electronics manufacturing, renewable energy, automotive, aerospace and defense, and healthcare. The electronics manufacturing segment dominated the market in 2024 due to strong demand for terbium oxide in electronic displays, magneto-optical drives, and semiconductors. Its ability to produce vivid green light makes it essential in RGB phosphors for screens and projectors. Growing consumer demand for high-resolution devices is reinforcing its usage in display components. Furthermore, the material’s use in magnetic data storage enhances its relevance in modern electronics.

The renewable energy segment is expected to witness the fastest growth through 2032. Terbium oxide contributes to the efficiency of permanent magnets used in wind turbine generators, where high magnetic strength and temperature stability are required. As governments globally push for decarbonization and green power generation, demand for rare earth-based components is surging. Its emerging role in advanced battery materials for energy storage solutions adds further traction. Strategic investments in clean energy infrastructure, particularly in Asia and Europe, will likely support sustained growth in this segment.

- By Purity Level

On the basis of purity level, the market is segmented into low purity (below 99%), medium purity (99%, 99.5%), and high purity (above 99.5%) terbium oxide. The high purity segment accounted for the largest share of 42% in 2024, driven by its demand in precision electronics, aerospace systems, and optical applications. Applications in lasers, magneto-optic sensors, and scientific instruments require extremely pure materials for consistent performance. Manufacturers prioritize high-purity terbium oxide for its stability, reproducibility, and superior physical properties. Its role in cutting-edge technologies makes it the most valuable grade in terms of price and technical relevance.

The medium purity segment is expected to expand at the fastest CAGR through 2032, primarily due to its cost-effectiveness and suitability for non-critical applications. Industries such as glass coloring, basic phosphors, and low-cost catalysts use medium-grade materials where ultra-pure composition is not required. This level strikes a balance between performance and affordability, appealing to manufacturers aiming for competitive pricing. Its wider availability and lower production cost support growing usage across developing markets with budget-sensitive demand.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales, online sales, and distributors. The direct sales segment held the highest market share in 2024, as bulk procurement from aerospace, energy, and electronics firms favors manufacturer-to-buyer transactions. Direct sales ensure greater control over quality specifications, pricing contracts, and delivery timelines. Companies dealing with sensitive applications often prefer personalized agreements and long-term relationships with suppliers. It also reduces intermediary costs and ensures a stable supply chain for critical operations.

The online sales segment is projected to record the fastest growth during the forecast period. The rise of digital marketplaces for specialty chemicals and rare earth materials is enabling small and mid-sized buyers to access a broader selection of products. Online platforms provide real-time pricing, global availability, and low-order minimums, making them attractive for research institutions and startups. Improved logistics, secure payment systems, and remote technical support are also contributing to the popularity of this channel. As B2B e-commerce continues to expand, online distribution is expected to play a greater role in material sourcing.

Terbium Oxide Market Regional Analysis

- North America dominated the terbium oxide market with the largest revenue share of over 30% in 2024, driven by the region’s strong foothold in electronics manufacturing and advanced materials research

- Demand is reinforced by the growing use of terbium oxide in display technologies, renewable energy applications, and defense-grade components

- High R&D spending, presence of leading electronics and aerospace companies, and emphasis on technological innovation continue to foster market growth, particularly in applications requiring high-purity rare earth materials

U.S. Terbium Oxide Market Insight

The U.S. terbium oxide market captured the largest revenue share in 2024 within North America, supported by increased adoption in magneto-optical applications and energy-efficient lighting technologies. Terbium oxide is widely used in the production of green phosphors for LED and display screens. The U.S. also invests heavily in clean energy, where terbium-enhanced magnets play a critical role in wind turbines and electric vehicle motors. Favorable government policies encouraging domestic rare earth production and technological independence further support market expansion.

Europe Terbium Oxide Market Insight

The Europe terbium oxide market is projected to grow at a steady CAGR throughout the forecast period, driven by stringent environmental regulations and the rising demand for sustainable technologies. The region is increasingly adopting terbium oxide in energy-efficient applications such as green lighting, electric vehicles, and smart grids. Countries across Europe are also investing in rare earth recycling and circular economy initiatives, boosting demand for high-purity oxides. The integration of terbium oxide in aerospace and defense applications further contributes to regional market expansion.

U.K. Terbium Oxide Market Insight

The U.K. terbium oxide market is anticipated to witness consistent growth, fueled by rising investments in clean energy infrastructure and electric mobility. As the government pushes for carbon neutrality, demand for rare earth materials in green technologies is rising. The U.K.’s expanding electronics R&D landscape also supports the use of terbium oxide in advanced display technologies. Increased collaborations with EU nations for secure supply chains of critical materials are further reinforcing its position in the European market.

Germany Terbium Oxide Market Insight

Germany’s terbium oxide market is expected to grow considerably due to its strong electronics and automotive industries. The country’s focus on energy efficiency and sustainable manufacturing drives the use of terbium oxide in magnet-based applications and LED technologies. Advanced infrastructure, technological innovation, and strong academic-industry partnerships promote the adoption of high-purity rare earth materials. Germany’s leadership in electric vehicle production also contributes to rising consumption of terbium oxide in motor systems.

Asia-Pacific Terbium Oxide Market Insight

The Asia-Pacific terbium oxide market is poised to grow at the fastest CAGR during the forecast period from 2025 to 2032, driven by rapid industrialization, electronics manufacturing, and expanding renewable energy projects across China, Japan, India, and South Korea. Government initiatives supporting domestic rare earth production and rising demand for consumer electronics are major drivers. The region’s dominance in global LED, display, and battery production boosts demand for terbium oxide across multiple sectors.

Japan Terbium Oxide Market Insight

Japan’s terbium oxide market is witnessing strong growth, underpinned by its high-tech manufacturing sector and innovation-driven demand for rare earth materials. The country extensively uses terbium oxide in display phosphors, battery technologies, and magnetic devices. Japan’s strong focus on miniaturization and efficiency in electronic components makes terbium oxide critical to its production ecosystem. Moreover, efforts to diversify rare earth sources and invest in recycling technologies are creating long-term growth opportunities.

China Terbium Oxide Market Insight

China held the largest revenue share in the Asia-Pacific terbium oxide market in 2024, driven by its status as the global leader in rare earth mining and processing. The country is a major supplier and consumer of terbium oxide, used in LEDs, electric vehicles, wind turbines, and advanced electronics. China’s dominance in the production of permanent magnets and phosphors ensures consistent domestic demand. In addition, strong government support for rare earth export controls and industrial upgrading continues to shape the market landscape.

Terbium Oxide Market Share

The terbium oxide industry is primarily led by well-established companies, including:

- Shanghai Ruifeng Chemicals (China)

- Hangzhou Xinfei Non Ferrous Metals (China)

- Nanjing Xuang Chemical (China)

- Nanjing Puxi Chemicals (China)

- Miluo Hengfeng Advanced Materials (China)

- Yixing Xinwei (China)

- Meryer Chemical Technology (China)

- Lynas Rare Earths (Australia)

- China Northern Rare Earth Group (China)

- MP Materials (U.S.)

- Ionic Rare Earths (Australia)

- Shenghe Resources (China)

- Rare Earth Salts (U.S.)

- Neo Performance Materials (Canada)

- Vital Metals (Australia)

- Arafura Rare Earths (Australia)

Latest Developments in Global Terbium Oxide Market

- In June 2025, Lynas Rare Earths, a leading Australian mineral producer, began production of terbium oxide at its Malaysian rare earth plant, marking a significant milestone in expanding the global supply chain for heavy rare earths. Utilizing its newly built 1,500 t/yr heavy rare earth separation circuits, which became operational in Q1 2025, the company’s entry into terbium oxide production enhances supply diversification outside China. This development strengthens Lynas' product portfolio and is expected to ease supply constraints in the global terbium oxide market, particularly for applications in electronics and magnets

- In September 2024, the U.S. Department of Defense awarded $4.22 million to Rare Earth Salts in Nebraska to support the development and scaling of terbium oxide production using recycled fluorescent light bulbs. This initiative reflects a strategic move to bolster domestic rare earth processing capabilities, reduce reliance on imports, and improve sustainability through recycling. By tapping into end-of-life lighting waste, this project enhances the circular economy and adds a resilient domestic supply stream to support critical defense applications that require terbium-based magnets

- In May 2024, Benchmark Mineral Intelligence introduced its Rare Earths Price Assessment service, providing detailed price tracking and market intelligence for key oxides including terbium. The introduction of standardized, transparent pricing for terbium oxide is expected to enhance investor confidence, improve procurement planning, and support long-term contracts. With reliable price data, stakeholders across the supply chain—from miners to manufacturers—can make informed decisions, thereby contributing to market maturity and greater investment activity in the terbium oxide segment

- In April 2024, Ionic Rare Earths Limited announced the commencement of continuous, large-scale production of high-purity recycled magnet rare earth oxides at its Ionic Technologies facility in Belfast, UK. This initiative marks a key advancement in the sustainable sourcing of rare earths, including terbium, from recycled magnets. The operation boosts the availability of high-purity terbium oxide within Europe and also addresses environmental concerns by reducing dependency on primary extraction. It positions the UK as an emerging player in the recycled REO market, enhancing supply chain resilience across the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Terbium Oxide Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Terbium Oxide Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Terbium Oxide Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.