Global Terrestrial Photogrammetry Software Market

Market Size in USD Billion

CAGR :

%

USD

2.06 Billion

USD

6.47 Billion

2025

2033

USD

2.06 Billion

USD

6.47 Billion

2025

2033

| 2026 –2033 | |

| USD 2.06 Billion | |

| USD 6.47 Billion | |

|

|

|

|

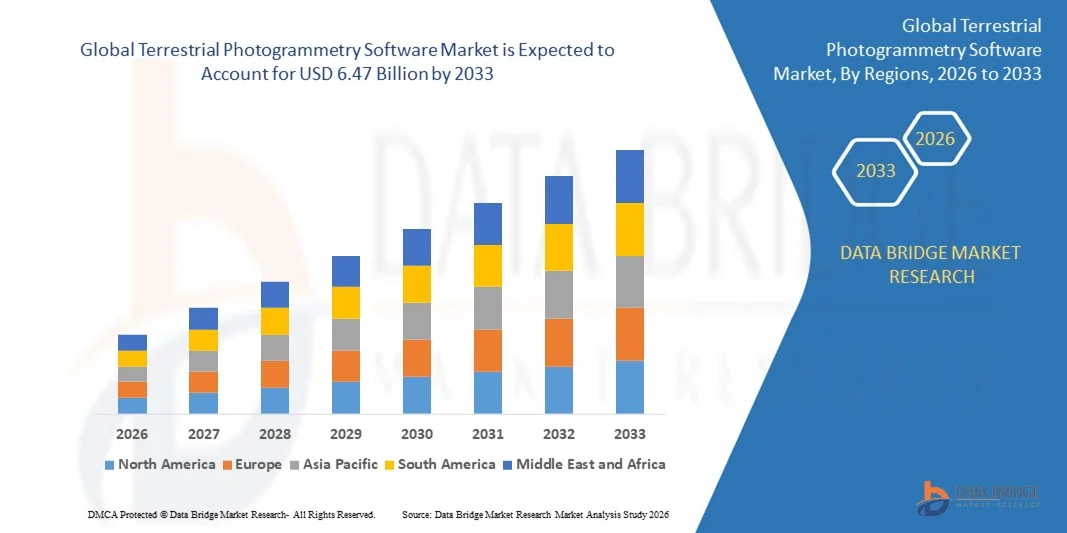

What is the Global Terrestrial Photogrammetry Software Market Size and Growth Rate?

- The global terrestrial photogrammetry software market size was valued at USD 2.06 billion in 2025 and is expected to reach USD 6.47 billion by 2033, at a CAGR of15.40% during the forecast period

- The increase in demand for terrestrial photogrammetry from engineers, architects and surveyors and the availability of various forms of photogrammetry style are the main factors driving the terrestrial photogrammetry software market

- The extensive use of photogrammetry software for processing films and games, traffic management systems, topographic maps and 3D printing and surge in number of applications of photogrammetry across verticals accelerates the terrestrial photogrammetry software market growth

- The rise in the rate of construction and infrastructure developments across the globe, the high utilization of automation is integrated into construction activities and the expansion of construction industry influence the terrestrial photogrammetry software market

What are the Major Takeaways of Terrestrial Photogrammetry Software Market?

- The high usage of photogrammetry software in the building and construction sector and the increase in need for enhancing disaster management also boosts the terrestrial photogrammetry software market

- In addition, rapid urbanization and industrialization, improving infrastructure, increase in investment for infrastructural development and surge in income status positively affect the terrestrial photogrammetry software market. Furthermore, technological advancement, innovations and economic growth in developing countries extend profitable opportunities to the terrestrial photogrammetry software market

- North America dominated the terrestrial photogrammetry software market with a 41.98% revenue share in 2025, supported by strong adoption of 3D mapping, infrastructure documentation, cultural preservation workflows, and advanced imaging techniques across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.85% from 2026 to 2033, driven by rapid infrastructure development, large-scale construction projects, expanding mining activities, and accelerated urbanization across China, Japan, India, South Korea, and Southeast Asia

- The Point-and-Shoot Photogrammetry segment dominated the market in 2025 with a 44.7% share, driven by its simplicity, low-cost imaging setup, and widespread adoption across surveying, construction documentation, cultural heritage recording, and academic research

Report Scope and Terrestrial Photogrammetry Software Market Segmentation

|

Attributes |

Terrestrial Photogrammetry Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Terrestrial Photogrammetry Software Market?

Increasing Shift Toward High-Speed, Compact, and PC-Integrated Terrestrial Photogrammetry Software

- The market is witnessing a rising shift toward compact, high-speed, and PC-integrated photogrammetry solutions designed for faster processing of terrestrial imaging datasets

- Manufacturers are enhancing software capabilities with automated image alignment, dense point-cloud generation, and AI-based error correction to support high-accuracy 3D modeling

- Growing demand for lightweight, field-deployable, and workflow-optimized software solutions is driving adoption across surveying, construction, mining, and infrastructure monitoring sectors

- For instance, companies such as Pix4D, Agisoft, Trimble, Hexagon, and DroneDeploy introduced upgraded terrestrial photogrammetry modules with improved point-cloud accuracy, faster mesh generation, and enhanced compatibility with LiDAR and GNSS devices

- As demand for rapid 3D reconstruction, digital twin creation, and terrain mapping accelerates, compact and AI-driven terrestrial photogrammetry software will remain critical for real-time visualization and high-precision geospatial analysis

What are the Key Drivers of Terrestrial Photogrammetry Software Market?

- Rising need for accurate, cost-efficient, and high-resolution 3D mapping across surveying, construction, urban planning, archaeology, and mining industries

- Growing adoption of digital twins, BIM workflows, and automated site-monitoring systems is driving advanced terrestrial photogrammetry software deployment globally

- Advancements in computer vision, image-processing algorithms, cloud rendering, and GPU-accelerated computation are significantly improving output accuracy and processing speeds

- Increasing use of LiDAR-camera hybrid systems, high-resolution DSLR sensors, and GNSS-enabled terrestrial setups is boosting software demand

- Rapid investments in infrastructure modernization, smart-city development, and geospatial analytics are supporting long-term market expansion

- For instance, in 2025, major players such as Esri, Trimble, Hexagon, and Agisoft upgraded their terrestrial photogrammetry engines with deeper cloud integration, faster point-cloud densification, and automated accuracy-grading tools

Which Factor is Challenging the Growth of the Terrestrial Photogrammetry Software Market?

- High costs of premium photogrammetry software, GPU requirements, and licensing models limit adoption among small surveying firms and academic institutions

- For instance, during 2024–2025, price fluctuations in high-performance computing components, increasing GPU demand, and rising operational costs affected software vendors’ pricing strategies

- Challenges in processing large-scale datasets, high-density point clouds, and complex terrain features increase the need for skilled geospatial professionals and training

- Limited awareness of advanced photogrammetric workflows in emerging markets slows the adoption of modern terrestrial 3D mapping solutions

- Competition from LiDAR-only platforms, drone-based photogrammetry, and hybrid 3D scanning systems creates pricing pressure and reduces differentiation

- To overcome these challenges, companies are increasingly focusing on low-cost subscriptions, AI-assisted automation, cloud rendering, and stronger software–device interoperability to boost global adoption of terrestrial photogrammetry software

How is the Terrestrial Photogrammetry Software Market Segmented?

The market is segmented on the basis of photogrammetry style, application, and end user.

- By Photogrammetry Style

The terrestrial photogrammetry software market is segmented into Point-and-Shoot Photogrammetry, Multi-Camera Photogrammetry, and Video-to-Photogrammetry. The Point-and-Shoot Photogrammetry segment dominated the market in 2025 with a 44.7% share, driven by its simplicity, low-cost imaging setup, and widespread adoption across surveying, construction documentation, cultural heritage recording, and academic research. Its compatibility with standard digital cameras, ease of data capture in the field, and support for quick 3D reconstruction make it the preferred choice for SMEs, archaeologists, and engineering consultants.

The Video-to-Photogrammetry segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing use of high-frame-rate cameras, drones, and action cameras capable of capturing continuous video streams. This method allows seamless mapping of large structures, moving objects, roads, and complex terrains with minimal setup time. Growing demand for real-time visualization, automated frame extraction, and efficient 3D modeling is further accelerating adoption of video-based photogrammetry solutions.

- By Application

Based on application, the market is segmented into Culture Heritage and Museum, Films and Games, Topographic Maps, Traffic Management System, 3D Printing, Drones and Robots, and Others. The Topographic Maps segment dominated the market in 2025 with a 38.6% share, driven by the expanding need for high-resolution terrain models, land-surveying workflows, environmental monitoring, and infrastructure planning. Terrestrial photogrammetry software is extensively used to generate accurate contours, elevation models, and point-cloud datasets, enabling precise land development and engineering design. Its ability to provide cost-efficient, scalable, and repeatable mapping makes it a standard tool for governmental agencies, GIS professionals, and survey engineering firms.

The Drones and Robots segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rapid automation in inspection, mining operations, industrial monitoring, and autonomous navigation. Increasing deployment of ground robots and drone-based scanning solutions is accelerating demand for software capable of processing high-density imagery with real-time 3D reconstruction capabilities.

- By End User

The terrestrial photogrammetry software market is segmented into Building and Construction, Automotive, Energy, Oil and Gas, Ship Building, and Others. The Building and Construction segment held the largest share in 2025 at 41.2%, supported by strong adoption for infrastructure documentation, construction progress monitoring, digital twin development, façade mapping, and renovation planning. Photogrammetry software enables contractors, engineers, and architects to generate precise 3D models, assess structural conditions, and streamline survey workflows without complex instrumentation. Its cost-efficiency, accuracy, and compatibility with BIM systems are driving widespread use across commercial, residential, and industrial projects.

The Automotive segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing application in vehicle design, crash simulation support, component modeling, and autonomous vehicle environment mapping. As vehicle systems become more advanced, manufacturers are adopting high-precision 3D capture tools to optimize prototyping, enhance quality inspection, and support digital engineering workflows.

Which Region Holds the Largest Share of the Terrestrial Photogrammetry Software Market?

- North America dominated the terrestrial photogrammetry software market with a 41.98% revenue share in 2025, supported by strong adoption of 3D mapping, infrastructure documentation, cultural preservation workflows, and advanced imaging techniques across the U.S. and Canada. High utilization of terrestrial photogrammetry for construction monitoring, land surveying, mining operations, and urban planning continues to strengthen regional market leadership. Rapid uptake of AI-enabled reconstruction tools, LiDAR–photogrammetry hybrid workflows, and high-resolution cameras further accelerates demand across engineering firms, government agencies, and architectural design studios

- Leading companies in North America are introducing software innovations such as automated mesh generation, cloud-based 3D processing, large-area mapping support, and faster dense point-cloud reconstruction, enhancing technological competitiveness. Consistent investment in digital twin development, infrastructure modernization, and 3D geospatial analytics drives long-term market expansion

- A strong ecosystem of GIS professionals, photogrammetry experts, and surveying organizations across the region reinforces North America’s leadership position

U.S. Terrestrial Photogrammetry Software Market Insight

The U.S. remains the largest contributor to the regional market due to extensive adoption of terrestrial photogrammetry across construction engineering, environmental monitoring, disaster assessment, autonomous vehicle mapping, and heritage conservation. The country benefits from strong technological maturity, early adoption of AI-based reconstruction tools, and widespread use of high-resolution imaging systems. Increasing demand for digital twins, 3D site documentation, and structural health monitoring fuels adoption across DOTs, urban development authorities, and architectural firms. Presence of leading geospatial companies, advanced survey technology providers, and strong investment in infrastructure digitization further drives market growth.

Canada Terrestrial Photogrammetry Software Market Insight

Canada contributes significantly to regional expansion, driven by growing use of 3D mapping technologies in mining, forestry, energy sector inspections, and environmental management. Engineering consultancies and universities increasingly deploy terrestrial photogrammetry for terrain modeling, volumetric estimation, and construction progress tracking. Government support for digital transformation projects, combined with expanding demand for GIS-driven planning and resource management, is boosting adoption. Strong emphasis on sustainable land use, ecological monitoring, and infrastructure safety further strengthens the country’s photogrammetry software demand.

Asia-Pacific Terrestrial Photogrammetry Software Market

Asia-Pacific is projected to register the fastest CAGR of 8.85% from 2026 to 2033, driven by rapid infrastructure development, large-scale construction projects, expanding mining activities, and accelerated urbanization across China, Japan, India, South Korea, and Southeast Asia. High adoption of 3D geospatial tools for smart city development, transportation planning, and utility mapping significantly increases software demand. Advancements in digital imaging systems, drone integration, and real-time 3D visualization further support strong market growth. Increasing government investments in digital surveying, land management, and heritage preservation also accelerate adoption.

China Terrestrial Photogrammetry Software Market Insight

China leads the Asia-Pacific region due to significant growth in infrastructure megaprojects, construction management technologies, and digital mapping of urban and rural landscapes. Strong government support for digital geospatial platforms, smart city initiatives, and high-density reconstruction systems fuels widespread usage. Extensive manufacturing capabilities, competitive pricing of imaging hardware, and rapid deployment of 3D digital systems boost domestic and international market penetration.

Japan Terrestrial Photogrammetry Software Market Insight

Japan exhibits steady growth driven by modernization of transportation networks, precision engineering, and adoption of advanced simulation and mapping tools. Strong demand for high-accuracy 3D reconstruction in robotics, industrial inspection, disaster management, and cultural preservation supports increasing adoption. Japan’s focus on quality, precision, and reliability ensures stable demand for premium photogrammetry software.

India Terrestrial Photogrammetry Software Market Insight

India is emerging as a high-growth market, supported by government-backed smart city projects, expanding construction activity, digital land management initiatives, and infrastructure modernization. Rising use of terrestrial photogrammetry in railways, highways, mining zones, and urban planning fuels adoption. Increasing availability of skilled GIS professionals and growing investments in 3D mapping technologies accelerate market penetration across both public and private sectors.

South Korea Terrestrial Photogrammetry Software Market Insight

South Korea contributes significantly to regional growth due to strong adoption of 3D mapping for autonomous vehicle development, urban infrastructure monitoring, and smart manufacturing environments. High technological readiness, strong digital ecosystems, and emphasis on innovation in imaging systems drive increasing deployment. Rising focus on digital twins, construction automation, and real-time spatial analytics reinforces long-term market expansion.

Which are the Top Companies in Terrestrial Photogrammetry Software Market?

The terrestrial photogrammetry software industry is primarily led by well-established companies, including:

- Autodesk, Inc. (U.S.)

- Esri International LLC (U.S.)

- Trimble Inc. (U.S.)

- Hexagon AB (Sweden)

- DroneDeploy (U.S.)

- Pix4D SA (Switzerland)

- 3Dflow SR (Italy)

- Agisoft (Russia)

- Capturing Reality s.r.o. (Slovakia)

- Vexcel Imaging GmbH (Austria)

- nFrames (Germany)

- REDcatch GmbH (Germany)

- NUBIGON Inc. (Bulgaria)

- Linearis3D GmbH & Co. KG (Germany)

- Menci Software SRL (Italy)

- Photometrix Photogrammetry Software (U.K.)

- Skyline Software Systems Inc. (Canada)

- Racurs (Russia)

- SimActive Inc. (Canada)

- ICAROS (Austria)

- Magnasoft (U.S.)

- PhotoModeler Technologies (Canada)

What are the Recent Developments in Global Terrestrial Photogrammetry Software Market?

- In March 2023, the release of Skycatch EdgePlus V2.4.0 introduced key updates that enhance the software’s capabilities for high-precision 3D drone photogrammetry, processing, and analysis. This version brings improvements to the platform, focusing on better integration and enhanced performance for industries such as mining and construction, allowing users to generate more accurate 3D models and geospatial data, making it an essential tool for advanced drone mapping applications

- In January 2023, Photometrix launched iWitnessPRO version 4.2, offering significant upgrades to its photogrammetry software. This version introduces automatic generation of fully textured high-resolution 3D models, digital surface models, and 3D object reconstructions. Leveraging advanced photogrammetry and dense image matching techniques, the software is now better suited for applications requiring precise 3D visualizations in industries such as surveying, engineering, and architecture, enhancing workflow efficiency and accuracy

- In December 2022, Pix4D rolled out new features and tools for its cloud platform, adding significant upgrades to improve the user experience. The update enables enhanced processing capabilities, including better handling of large datasets and faster model generation. These improvements cater to industries such as agriculture, construction, and mining, providing users with more robust and efficient photogrammetry solutions, streamlining data processing and analysis for better decision-making

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.