Global Textile Colorant Market

Market Size in USD Billion

CAGR :

%

USD

3.16 Billion

USD

5.00 Billion

2025

2033

USD

3.16 Billion

USD

5.00 Billion

2025

2033

| 2026 –2033 | |

| USD 3.16 Billion | |

| USD 5.00 Billion | |

|

|

|

|

What is the Global Textile Colorant Market Size and Growth Rate?

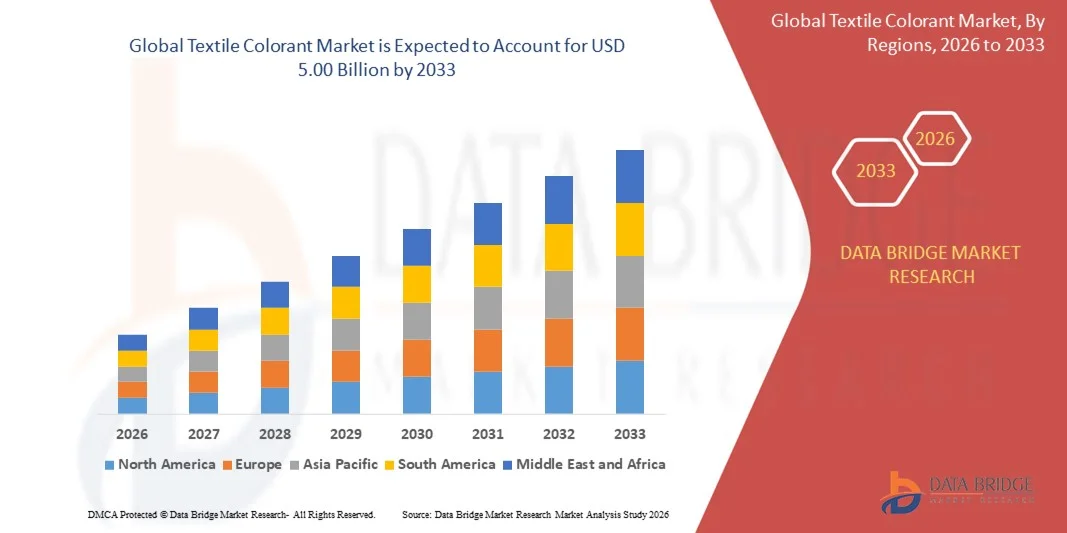

- The global textile colorant market size was valued at USD 3.16 billion in 2025 and is expected to reach USD 5.00 billion by 2033, at a CAGR of5.87% during the forecast period

- Increasing demand for high-performance dyes and pigments, rising preference for eco-friendly and sustainable textile processing, expanding use of functional and specialty colorants, and strong growth in apparel, home textiles, and technical textiles are key factors driving market expansion

- Rapid adoption of digital textile printing, increasing penetration of fast-fashion brands, and innovation in bio-based and low-impact colorant formulations further support long-term market growth

What are the Major Takeaways of Textsile Colorant Market?

- Growing demand for sustainable fashion, expansion of textile manufacturing in emerging economies, and rising R&D investments in non-toxic and low-energy dyeing techniques are creating substantial growth opportunities for the textile colorant market

- However, challenges such as stringent environmental regulations, high wastewater treatment costs, and technical limitations in natural and bio-based colorants are likely to restrain market growth in the coming years

- Asia-Pacific dominated the textile colorant market with a 42.05% revenue share in 2025, driven by the massive expansion of textile manufacturing, strong demand from apparel & home furnishing industries, and rapid growth in technical textiles across China, India, Bangladesh, Vietnam, and Indonesia

- North America is projected to register the fastest CAGR of 10.7% from 2026 to 2033, led by the U.S. and Canada. Rapid expansion of semiconductor R&D, embedded electronics, AI hardware, and IoT systems drives demand for textile colorants in automotive, aerospace, defence, and industrial automation sectors

- The Synthetic segment dominated the market with a 68.4% share in 2025, driven by its strong suitability for large-scale textile manufacturing, superior wash fastness, wider color range, and high compatibility with polyester and blended fabrics

Report Scope and Textile Colorant Market Segmentation

|

Attributes |

Textile Colorant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Textile Colorant Market?

Increasing Shift Toward High-Performance, Eco-Friendly, and Digital-Printing-Compatible Textile Colorants

- The textile colorant market is experiencing strong growth driven by rising adoption of sustainable, low-water, and low-energy dyeing technologies aligned with global environmental regulations and cleaner production initiatives

- Manufacturers are shifting toward high-performance reactive, disperse, and pigment colorants compatible with digital textile printing, enabling superior color fastness, sharpness, and design flexibility

- Growing demand for bio-based, non-toxic, and heavy-metal-free dyes is accelerating investment across apparel, home textiles, and technical textile sectors

- For instance, leading players such as Archroma, Huntsman, DyStar, Kiri Industries, and BASF SE have introduced advanced eco-friendly dye ranges, including low-salt reactive dyes, waterless dyeing solutions, and high-speed digital printing pigments in 2024–2025

- Increasing adoption of sustainable coloration technologies is reshaping manufacturing practices across Asia-Pacific and Europe

- As textile producers move toward environment-friendly, digitally compatible, and cost-efficient colorants, the Textile Colorant market will continue to evolve toward high-tech, performance-driven solutions

What are the Key Drivers of Textile Colorant Market?

- Rising demand for vibrant, durable, and cost-effective dyes across apparel, automotive textiles, home furnishings, and technical fabrics is strengthening market growth globally

- For instance, in 2025, companies such as BASF SE, Archroma, LANXESS, and DyStar expanded their portfolios to offer high-strength colorants with improved fixation rates and reduced wastewater generation

- Growing penetration of digital textile printing, driven by fashion customization, fast fashion, and short-run production, continues to boost demand for advanced pigment-based colorants

- Advancements in reactive, disperse, and vat dye technologies, along with automated dye dispersion and color-matching systems, are improving consistency and efficiency

- Rising production of synthetic fibers such as polyester, nylon, and acrylic is fueling the need for specialized colorants with enhanced thermal and chemical stability

- Supported by investments in sustainable dyes, smart coloration systems, and R&D, the global textile colorant market is expected to witness solid long-term expansion

Which Factor is Challenging the Growth of the Textile Colorant Market?

- High costs associated with premium, eco-friendly, and digitally compatible dyes limit adoption among small textile mills and low-margin manufacturers

- For instance, during 2024–2025, fluctuations in raw material prices, tighter environmental norms, and wastewater treatment requirements increased operational costs for global textile dye manufacturers

- Complexity in adopting waterless dyeing, digital printing pigments, and high-performance synthetic dyes increases the need for skilled technicians and upgraded machinery

- Limited awareness in emerging markets regarding sustainable dyes, regulatory compliance, and digital printing processes slows market penetration

- Competition from low-cost local dye manufacturers and availability of counterfeit colorants create pricing pressure and quality inconsistencies

- To address these challenges, companies are focusing on cost-optimized eco-friendly dyes, digital printing formulations, training, and automation, enabling broader global adoption of advanced textile colorant

How is the Textile Colorant Market Segmented?

The market is segmented on the basis of source, dye type, product form, fibre type, application, and end use.

- By Source

The textile colorant market is segmented into Natural and Synthetic colorants. The Synthetic segment dominated the market with a 68.4% share in 2025, driven by its strong suitability for large-scale textile manufacturing, superior wash fastness, wider color range, and high compatibility with polyester and blended fabrics. Synthetic dyes are widely used across apparel, home textiles, and technical textiles due to their cost-efficiency, stability, and repeatability in industrial dyeing processes.

The Natural segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for eco-friendly, plant-based, and biodegradable colorants among sustainable fashion brands. Increasing consumer preference for toxin-free fabrics, combined with regulatory restrictions on harmful chemicals, is further propelling adoption. Expanding R&D investments in bio-extraction processes, fermentation-derived colorants, and low-impact dyeing technologies are expected to strengthen long-term growth of natural textile colorants globally.

- By Dye Type

The textile colorant market is categorized into Azoic Dyes, Direct Dyes, Basic Dyes, Disperse Dyes, Reactive Dyes, Sulfur Dyes, Vat Dyes, and Others. The Reactive Dyes segment dominated the market with a 34.7% share in 2025, supported by its widespread use in cotton and cellulosic fiber dyeing, excellent wash fastness, bright shades, and strong fixation properties. Its compatibility with eco-friendly, low-salt dyeing processes further boosts market dominance.

The Disperse Dyes segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing global production of polyester, microfiber, and blended synthetic fabrics. Growth in sportswear, athleisure, fast fashion, and automotive textiles continues to drive demand for high-performance disperse dyes. Advancements in high-temperature dyeing, digital printing pigments, and reduced-energy dyeing technologies support expanding adoption across Asia-Pacific and Europe.

- By Product Form

The market is segmented into Powder, Granules, Paste, and Liquid forms of textile colorants. The Powder segment dominated the market with a 41.2% share in 2025, as powders offer long shelf life, easy storage, strong color strength, and suitability for large-scale dyeing operations. They are preferred in textile mills for batch dyeing, exhaust dyeing, and pad dyeing across cotton, polyester, and blended fabrics.

The Liquid segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of digital textile printing, automated dispensing systems, and continuous dyeing applications. Liquid formulations offer superior dispersion, reduced dust, and consistent color output, making them ideal for high-speed printing machines and precision coloration processes. Increasing use in pigment printing, reactive digital inks, and water-based formulations further enhances their market growth.

- By Fibre Type

The market is segmented into Wool, Nylon, Cotton, Polyester, Acrylic, Acetate, and Rayon. The Cotton segment dominated the market with a 38.5% share in 2025, supported by its high consumption in apparel, home textiles, and fashion applications. Reactive dyes remain the preferred choice due to their durability, brightness, and compatibility with sustainable dyeing methods.

The Polyester segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing global production of synthetic fibers, rising demand for sportswear, durability-focused textiles, and cost-efficient manufacturing. Disperse dyes are widely used for polyester due to their excellent thermal stability and dyeing uniformity. Expanding use of polyester in automotive textiles, industrial fabrics, and technical applications further accelerates segment growth.

- By Application

On the basis of application, the market is segmented into Clothing, Technical Textiles, Apparel, Household, Home Textiles & Carpets, Automotive Textiles, and Accessories. The Clothing segment dominated the market with a 32.6% share in 2025, driven by fast fashion, rising consumption of colored fabrics, and increasing demand for vibrant, durable, and eco-friendly dyeing solutions across global garment production hubs.

The Technical Textiles segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising use of functional fabrics in healthcare, filtration, industrial workwear, geotextiles, and protective textiles. These applications require advanced high-fastness colorants capable of withstanding heat, abrasion, chemical exposure, and UV radiation. Increasing investments in performance textiles and engineered fabrics across the U.S., Europe, China, and India further fuel segment expansion.

- By End Use

The Textile Colorant market is segmented into Oil & Gas, Aerospace and Defense, Automotive, Electronics, and Others. The Automotive segment dominated the market with a 29.8% share in 2025, owing to increased production of dyed seat fabrics, headliners, carpets, interior trim textiles, and performance materials requiring high fastness and flame-retardant dyeing technologies.

The Aerospace and Defense segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for high-strength technical fabrics, UV-stable coatings, and camouflage dyes used in military gear, aircraft interiors, and protective equipment. Strict durability, safety, and environmental standards are pushing manufacturers toward premium high-performance colorants with superior thermal and chemical resistance.

Which Region Holds the Largest Share of the Textile Colorant Market?

- Asia-Pacific dominated the textile colorant market with a 42.05% revenue share in 2025, driven by the massive expansion of textile manufacturing, strong demand from apparel & home furnishing industries, and rapid growth in technical textiles across China, India, Bangladesh, Vietnam, and Indonesia. High consumption of dyes and pigments in large-scale textile production, supportive government policies, and rising exports make the region the leading hub for global textile colorant usage

- Leading manufacturers in Asia-Pacific are increasingly focusing on eco-friendly dyes, waterless dyeing techniques, digital printing inks, and high-performance synthetic colorants, strengthening technological competitiveness. Rising investment in sustainable textile ecosystems, coupled with the rapid shift toward low-impact and recyclable colorants, is expanding long-term market opportunities

- Strong textile export infrastructure, availability of raw materials, and cost-effective manufacturing capacity further reinforce Asia-Pacific’s dominant position in the textile colorant market

China Textile Colorant Market Insight

China leads regional demand due to its large textile manufacturing base, high dye consumption, and ongoing innovation in eco-friendly dyeing solutions. Rising production of synthetic fibers, expansion of export-driven factories, and adoption of digital printing colorants further strengthen its dominant market position. Local manufacturers offer competitive pricing and large-volume supply capabilities.

Japan Textile Colorant Market Insight

Japan exhibits stable growth driven by its strong demand for high-quality, durable, and functional textiles. Advanced R&D, precision dyeing technologies, and increasing demand for specialty colorants across automotive textiles, sportswear, and home furnishings support market expansion. Focus on low-carbon manufacturing continues to boost adoption of sustainable colorants.

India Textile Colorant Market Insight

India is evolving into a major textile colorant consumer, supported by expanding textile parks, strong cotton production, and rising demand from apparel exports. Increased investment in digital printing, technical textiles, and sustainable dyeing technologies enhances long-term growth potential. Government-backed initiatives such as PM MITRA parks further accelerate market adoption.

South Korea Textile Colorant Market Insight

South Korea’s growth is driven by rising demand for functional fabrics, premium apparel, and advanced dyeing technologies. Strong presence of high-performance textile manufacturers, increased investment in smart fabrics, and expanding exports of synthetic fibers contribute to growing demand for specialized textile colorants.

North America Textile Colorant Market

North America is projected to register the fastest CAGR of 10.7% from 2026 to 2033, led by the U.S. and Canada. Rapid expansion of semiconductor R&D, embedded electronics, AI hardware, and IoT systems drives demand for Textile Colorants in automotive, aerospace, defence, and industrial automation sectors.

U.S. Textile Colorant Market Insight

The U.S. is the largest contributor in North America, supported by rising demand for sustainable fashion, growing adoption of digital textile printing, and strong consumption from the sportswear, home textiles, and technical textiles sectors. Increasing R&D in bio-based dyes, strong presence of premium apparel brands, and stringent environmental regulations are accelerating the shift toward low-toxicity and high-performance colorants. Expansion of e-commerce-driven fashion and high per-capita textile spending continue to propel market growth.

Canada Textile Colorant Market Insight

Canada contributes meaningfully to regional expansion due to increasing emphasis on eco-friendly textile production, adoption of innovative dyeing technologies, and rising imports of high-quality pigments and reactive dyes. Growth in technical textiles, government-supported sustainability programs, and higher demand for premium fabrics support the market’s upward trajectory. Universities, textile labs, and emerging manufacturers are increasingly adopting advanced colorants to enhance fabric performance and durability.

Which are the Top Companies in Textile Colorant Market?

The textile colorant industry is primarily led by well-established companies, including:

- Archroma (Switzerland)

- Huntsman Corporation (U.S.)

- BASF SE (Germany)

- LANXESS AG (Germany)

- DuPont de Nemours, Inc. (U.S.)

- Kiri Industries Ltd. (India)

- Sumitomo Chemical Co., Ltd. (Japan)

- DyStar Group (Singapore)

- Allied Industrial Corp., Ltd. (Taiwan)

- Colorant Limited (India)

- Jay Chemical Industries Limited (India)

- Zhejiang Longsheng Group Co., Ltd. (China)

- Jiangsu Yabang Dyestuff Co., Ltd. (China)

- Vipul Organics Ltd. (India)

- Akik Dye Chem (India)

- Blendwell SA (South Africa)

- DEV COLOURS (India)

- KeyColour (U.S.)

- Mahickra Chemicals Limited (India)

- Organic Dyes and Pigments (U.S.)

What are the Recent Developments in Global Textile Colorant Market?

- In August 2021, Owens Corning launched its PINK Next Gen Fiberglas Insulation, marking a significant advancement in building insulation technology and reinforcing the company’s leadership in high-performance insulation solutions

- In January 2021, Armacell entered into a cooperation agreement with smartMELAMINE, a joint venture of the German TITK Group and the Slovenian listed company Melamine d.d., to specify and commercialize smartMELAMINE's non-wovens made from melamine resins, providing excellent thermal and acoustic insulation for the transportation industry and expanding Armacell’s presence in automotive applications

- In March 2020, Rockwool International introduced a dual-density insulation board featuring a bonded fleece facing to mask the insulation layer and create a crisp, dark aesthetic for open-joint facades, enhancing both design and functional performance in modern construction

- In August 2020, Armacell launched ArmaGel DT, delivering high-quality thermal and acoustic solutions globally with an excellent cost-to-performance ratio, strengthening the company’s position in premium insulation materials

- In January 2020, Saint-Gobain acquired Sonex in Brazil, a manufacturer and supplier of acoustic ceiling systems marketed under the Sonex, Nexacustic, and Fiberwood brands, bolstering the group’s market presence and capabilities in the Brazilian acoustic solutions sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Textile Colorant Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Textile Colorant Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Textile Colorant Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.