Global Textile Recycling Market

Market Size in USD Billion

CAGR :

%

USD

7.92 Billion

USD

14.76 Billion

2024

2032

USD

7.92 Billion

USD

14.76 Billion

2024

2032

| 2025 –2032 | |

| USD 7.92 Billion | |

| USD 14.76 Billion | |

|

|

|

|

Textile Recycling Market Size

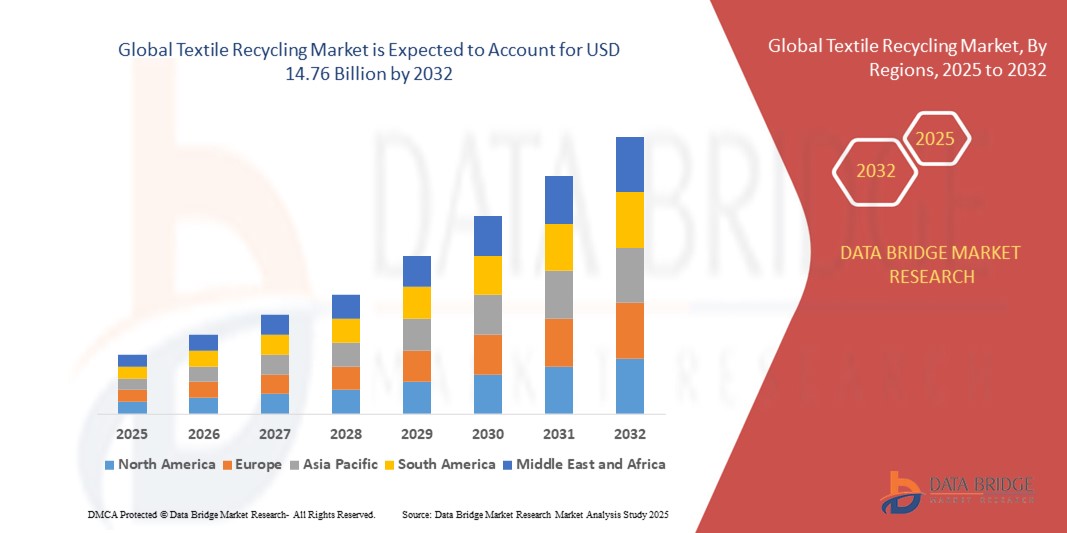

- The global textile recycling market size was valued at USD 7.92 billion in 2024 and is expected to reach USD 14.76 billion by 2032, at a CAGR of 8.1% during the forecast period

- The market growth is largely fueled by increasing environmental concerns, growing volumes of textile waste, and rising regulatory pressure promoting circular economy practices across the fashion and manufacturing sectors

- Furthermore, advancements in both mechanical and chemical recycling technologies are enabling more efficient processing of blended textiles, while heightened consumer demand for sustainable and recycled fibers is driving brands and manufacturers to incorporate circular materials, thereby significantly boosting the industry's growth

Textile Recycling Market Analysis

- Textile recycling involves the recovery of fibers and materials from discarded clothing and other textiles for reuse in new products. This process reduces landfill waste, conserves resources, and supports the development of sustainable textile value chains across industries such as fashion, automotive, and home furnishings

- The accelerating demand for recycled textiles is primarily driven by increasing awareness of sustainability among consumers, government policies supporting recycling, and growing industry commitments to reduce dependence on virgin fibers and lower carbon emissions

- Europe dominated the textile recycling market with a share of 29.9% in 2024, due to strict environmental regulations, robust recycling infrastructure, and growing consumer demand for sustainable fashion and circular textiles

- Asia-Pacific is expected to be the fastest growing region in the textile recycling market during the forecast period due to rising textile production and growing environmental concerns in emerging economies

- Mechanical segment dominated the market with a market share of 70.9% in 2024, due to its widespread adoption, lower operational costs, and suitability for recycling natural fibers such as cotton and wool. This process requires less energy and involves no chemical treatment, making it an environmentally and economically viable option for mass textile recycling. Mechanical recycling is particularly effective for converting pre- and post-consumer textile waste into products such as insulation, wiping cloths, and nonwoven materials, which supports high-volume demand across industrial applications. Its well-established infrastructure and ease of scalability continue to reinforce its market dominance

Report Scope and Textile Recycling Market Segmentation

|

Attributes |

Textile Recycling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Textile Recycling Market Trends

Rapid Emergence of Textile-To-Textile Recycling Technologies

- The textile recycling market is experiencing accelerated innovation in textile-to-textile recycling technologies that enable the conversion of used textiles directly back into reusable fibers, promoting circularity and reducing dependency on virgin raw materials

- For instance, companies such as Lenzing AG, Renewcell, and Worn Again Technologies are pioneering advanced chemical and enzymatic recycling processes that regenerate high-quality fibers from cotton and blended fabrics for new garment production

- Mechanical recycling methods are becoming more refined, incorporating advanced sorting and shredding technologies that improve fiber quality retention and enable scalable recycling operations

- Integration of digital sorting technologies using AI and near-infrared spectroscopy enhances sorting precision, facilitating efficient separation of fabric types and colors which increases recycling yield and quality

- Increased collaboration between fashion brands, recyclers, and technology providers is fostering innovation ecosystems that accelerate adoption of next-generation textile recycling solutions

- Supportive policies and regulations encouraging circular economy principles are incentivizing investments in textile recycling infrastructure and R&D to scale textile-to-textile recycling technologies

Textile Recycling Market Dynamics

Driver

Increasing Amount of Textile Waste

- Growing global textile production, fast fashion cycles, and increased consumer consumption have contributed to a surge in textile waste, driving the need for improved recycling solutions to manage environmental impact

- For instance, according to industry data, major apparel companies such as Patagonia and H&M have implemented extensive take-back and recycling programs to collect obsolete textiles for reprocessing into new products

- Rising awareness among consumers and businesses about the environmental cost of textile waste boosts demand for sustainable recycling practices and recycled fiber content in apparel

- Government regulations and voluntary commitments mandate increasing amounts of textile waste diversion from landfills, supporting growth in recycling infrastructure and technologies

- Expansion of textile waste collection systems and recycling facilities in key regions such as Europe, North America, and Asia Pacific is enabling higher recycling rates and efficient resource recovery

Restraint/Challenge

Difficulty in Recycling Mixed-Fiber Fabrics

- The heterogeneous nature of many textiles, particularly mixed-fiber and blended fabrics (e.g., cotton-polyester blends), presents significant technical challenges for recycling, limiting the efficiency and quality of recycled outputs

- For instance, companies such as Hyosung and Birla Cellulose face ongoing difficulties in economically separating and processing blended fibers, which often require complex chemical recycling techniques still in early commercial stages

- Inadequate sorting and separation infrastructure further complicate feedstock quality, causing contamination and reducing the value of recycled fibers

- High costs and energy consumption associated with advanced chemical recycling processes needed for mixed fibers limit wide-scale adoption and economic viability in many markets

- The lack of uniform industry standards and labeling for fiber content makes sorting and recycling process automation difficult, impeding circularity goals

Textile Recycling Market Scope

The market is segmented on the basis of material, source, and process.

- By Material

On the basis of material, the textile recycling market is segmented into cotton, polyester, wool, polyamide, and others. The cotton segment dominated the largest market revenue share of 69.8% in 2024, owing to the high volume of cotton used in global apparel production and its biodegradable nature, making it a key focus for sustainable recycling initiatives. Recycled cotton is in demand due to its reduced environmental impact compared to virgin cotton, particularly in water and energy usage. Its widespread use in both pre- and post-consumer waste also makes it a significant contributor to the overall recycled textile volume.

The polyester segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by the surging consumption of synthetic fibers in the fashion industry and growing concerns over plastic pollution. Recycled polyester (rPET) is gaining traction as a cost-effective, eco-friendly alternative to virgin polyester, especially in performance and fast-fashion garments. Technological advancements in fiber-to-fiber recycling processes are also driving the increased recovery and reuse of polyester textiles.

- By Source

On the basis of source, the textile recycling market is segmented into apparel waste, home furnishing waste, automotive waste, and others. The apparel waste segment accounted for the largest revenue share in 2024, attributed to the massive volume of discarded garments from both pre-consumer (production scraps) and post-consumer (used clothing) sources. Rising global awareness around the environmental consequences of fast fashion, alongside growing second-hand and circular fashion trends, is prompting increased collection and recycling of clothing waste.

The automotive waste segment is expected to register the fastest growth from 2025 to 2032, driven by the increasing use of technical textiles in vehicle interiors and the growing focus on end-of-life vehicle (ELV) regulations. Many automakers are now emphasizing sustainable disposal practices and integrating recycled textile materials in new vehicle models, accelerating demand for automotive textile recycling.

- By Process

On the basis of process, the textile recycling market is segmented into mechanical and chemical. The mechanical segment held the largest revenue share of 70.9% in 2024, driven by its widespread adoption, lower operational costs, and suitability for recycling natural fibers such as cotton and wool. This process requires less energy and involves no chemical treatment, making it an environmentally and economically viable option for mass textile recycling. Mechanical recycling is particularly effective for converting pre- and post-consumer textile waste into products such as insulation, wiping cloths, and nonwoven materials, which supports high-volume demand across industrial applications. Its well-established infrastructure and ease of scalability continue to reinforce its market dominance.

The chemical segment is anticipated to grow at the fastest rate from 2025 to 2032, owing to its potential to regenerate high-quality fibers from blended or synthetic fabrics, which are traditionally difficult to recycle mechanically. Innovations in depolymerization and solvent-based recycling technologies are allowing for the extraction of virgin-equivalent fibers such as regenerated polyester and nylon. This method is increasingly seen as a key enabler of circularity in complex textile blends, attracting investments from major fashion brands and recyclers.

Textile Recycling Market Regional Analysis

- Europe dominated the textile recycling market with the largest revenue share of 29.9% in 2024, driven by strict environmental regulations, robust recycling infrastructure, and growing consumer demand for sustainable fashion and circular textiles

- Governments and industries across the region are actively promoting textile waste recovery and extended producer responsibility (EPR) schemes, accelerating investment in both mechanical and chemical recycling technologies

- The presence of major fashion retailers and brands focusing on closed-loop systems and recycled content in products has further stimulated market growth, positioning Europe as a leader in textile circularity initiatives

U.K. Textile Recycling Market Insight

The U.K. textile recycling market is expected to grow steadily during the forecast period, supported by heightened awareness of clothing waste and increased efforts by both public and private sectors to enhance textile collection and reuse. The country’s commitment to achieving sustainability targets and reducing landfill dependence is encouraging the adoption of advanced recycling methods. In addition, initiatives by major fashion retailers to establish take-back schemes and use recycled fibers are reinforcing demand.

Germany Textile Recycling Market Insight

Germany’s textile recycling market captured the largest share in 2024, fueled by its well-established recycling infrastructure and strong environmental policy framework. The country places high emphasis on innovation and sustainability, encouraging investment in chemical recycling for synthetic textiles and fiber recovery from blends. The push for sustainable sourcing in both fashion and automotive sectors is further amplifying the market demand.

North America Textile Recycling Market Insight

The North America textile recycling market is projected to expand at a strong CAGR from 2025 to 2032, driven by increasing consumer consciousness about environmental impact and rising textile waste volumes. The region is witnessing a surge in collection programs, resale platforms, and sustainable product labeling. Government initiatives and brand-led recycling campaigns are fostering a circular economy approach in the apparel and home furnishing sectors.

U.S. Textile Recycling Market Insight

The U.S. textile recycling market held the largest share within North America in 2024, supported by growing demand for sustainable fashion and robust advancements in sorting and recycling technologies. Brands are increasingly incorporating recycled fibers into product lines, and initiatives around secondhand markets and repair services are gaining momentum. Federal and state policies focusing on landfill diversion and zero-waste goals are also contributing to market expansion.

Asia-Pacific Textile Recycling Market Insight

The Asia-Pacific textile recycling market is anticipated to witness the fastest growth during the forecast period of 2025 to 2032, led by rising textile production and growing environmental concerns in emerging economies. Countries such as China, India, and Japan are experiencing a shift towards sustainable manufacturing practices, spurred by regulatory pressure and export market demand. Local innovations in low-cost recycling processes are also enabling broader adoption across the region.

China Textile Recycling Market Insight

China dominated the Asia-Pacific textile recycling market in 2024, attributed to its massive textile manufacturing base and increasing policy push toward sustainability. National regulations aimed at reducing industrial waste and carbon emissions are driving investment in recycling infrastructure. Moreover, the integration of recycled materials in fast fashion and sportswear is expanding, supported by consumer demand for greener alternatives.

India Textile Recycling Market Insight

India’s textile recycling market is growing rapidly, fueled by its role as a global textile exporter and increasing awareness around sustainability. The country is leveraging its large informal recycling sector alongside emerging formal operations to scale mechanical and chemical recycling. Government initiatives promoting circular economy practices and resource efficiency are further accelerating market development.

Textile Recycling Market Share

The textile recycling industry is primarily led by well-established companies, including:

- Worn Again Technologies (U.K.)

- Lenzing Group (Austria)

- Birla Cellulose (India)

- BLS Ecotech (India)

- The Woolmark Company (Australia)

- iinouiio Ltd (U.K.)

- Ecotex Group (Canada)

- The Boer Group (Netherlands)

- Unifi, Inc. (U.S.)

- Textile Recycling International (U.K.)

- Renewcell (Sweden)

- Pistoni S.r.l. (Italy)

- REMONDIS SE & Co. KG (Germany)

- Martex Fiber (U.S.)

- HYOSUNG TNC (South Korea)

Latest Developments in Global Textile Recycling Market

- In March 2025, Worn Again Technologies advanced the textile recycling market by unveiling a cutting-edge chemical process that separates and purifies polyester and cotton from blended fabrics. This innovation enables the production of virgin-equivalent materials, enhancing recyclability and supporting a circular economy. With applications extending beyond fashion into automotive and packaging sectors, the development aligns with rising regulatory and industry demands for sustainable raw material sourcing

- In December 2024, Tell-Tex AG, one of Switzerland’s largest clothing collectors, announced the construction of a next-generation textile recycling facility, set to open in 2026. Designed to process 20,000 tons annually, the center will feature automated sorting and fiber-to-fiber recycling technologies. This move reinforces Switzerland's transition to a circular textile economy and addresses the growing pressure from EU and national Extended Producer Responsibility (EPR) regulations

- In September 2024, UNIFI, Inc. expanded its influence on the global textile recycling market by introducing two innovations—white-dyeable filament yarn and ThermaLoop insulation—under its REPREVE brand. Leveraging its proprietary Textile Takeback process, these additions strengthen the scalability of textile-to-textile recycling and position UNIFI as a leader in performance-based sustainable materials

- In January 2024, BASF and Inditex marked a milestone in textile circularity with the launch of loopamid, the first fully circular polyamide 6 (nylon 6) made entirely from textile waste. Zara introduced a globally available jacket crafted solely from loopamid components. This initiative exemplifies the “design for recycling” approach and sets a new benchmark for large-scale commercialization of 100% recycled apparel

- In May 2023, Lenzing, in collaboration with ARA, Salesianer Miettex, Caritas, and Södra, launched Austria’s largest textile recycling project. Using OnceMore and REFIBRA technologies, the initiative targets the processing of 50,000 tonnes of used textiles annually by 2027. It accelerates fiber recovery and circular manufacturing in the region and also supports social inclusion by creating employment for people with disabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Textile Recycling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Textile Recycling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Textile Recycling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.