Global Therapeutic Proteins And Oral Vaccines Market

Market Size in USD Billion

CAGR :

%

USD

6.41 Billion

USD

10.76 Billion

2025

2033

USD

6.41 Billion

USD

10.76 Billion

2025

2033

| 2026 –2033 | |

| USD 6.41 Billion | |

| USD 10.76 Billion | |

|

|

|

|

Therapeutic Proteins and Oral Vaccines Market Size

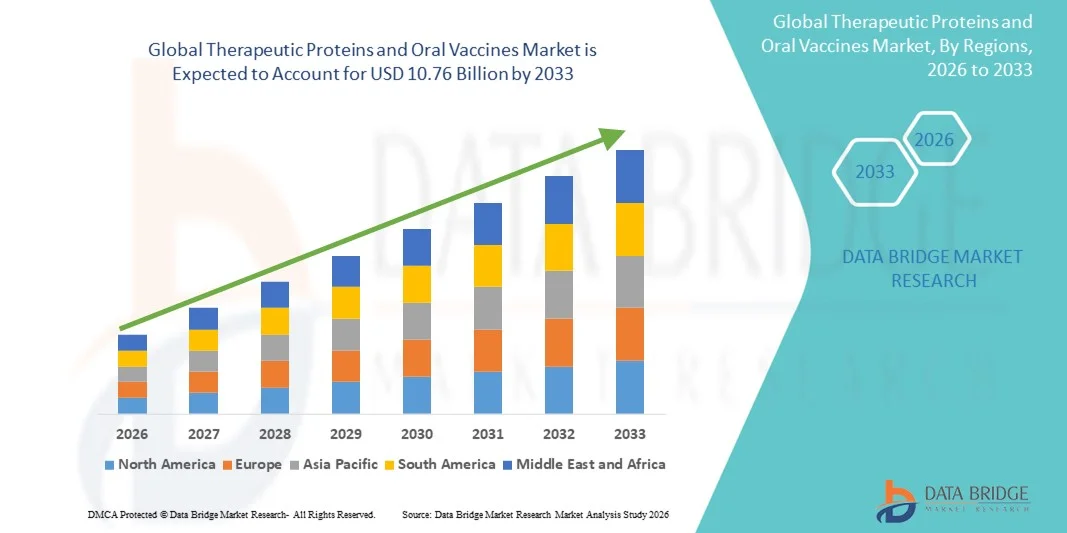

- The global therapeutic proteins and oral vaccines market size was valued at USD 6.41 billion in 2025 and is expected to reach USD 10.76 billion by 2033, at a CAGR of6.70% during the forecast period

- The market growth is largely fueled by rising prevalence of chronic and infectious diseases, increasing demand for targeted therapies, and continuous advancements in biotechnology and genetic engineering, leading to higher adoption of therapeutic proteins and oral vaccines across both preventive and curative healthcare segments

- Furthermore, growing government immunization programs, expanding research in protein-based therapies, and rising preference for non-invasive and patient-friendly drug delivery methods are establishing therapeutic proteins and oral vaccines as essential tools in modern disease management. These converging factors are accelerating the uptake of Therapeutic Proteins and Oral Vaccines solutions, thereby significantly boosting the industry's overall growth

Therapeutic Proteins and Oral Vaccines Market Analysis

- Therapeutic proteins and oral vaccines, which play a crucial role in the prevention and treatment of a wide range of chronic and infectious diseases, are becoming increasingly important components of modern healthcare systems due to their targeted action, higher efficacy, and improved patient compliance compared to traditional therapies

- The rising demand for therapeutic proteins and oral vaccines is primarily driven by increasing prevalence of cancer, autoimmune disorders, and infectious diseases, alongside strong investments in biotechnology, vaccine research, and advanced drug delivery technologies

- North America dominated the therapeutic proteins and oral vaccines market with the largest revenue share of 38.6% in 2025, supported by a well-established biopharmaceutical industry, strong R&D funding, favorable regulatory frameworks, and high adoption of advanced biologic therapies, with the U.S. witnessing substantial growth in the use of both recombinant proteins and oral vaccines across hospitals, clinics, and research institutions

- Asia-Pacific is expected to be the fastest growing region at a CAGR of 23.4% during the forecast period, driven by an expanding biotechnology sector, rising government immunization initiatives, growing awareness about preventive healthcare, and increasing healthcare access in countries such as China and India

- The therapeutic proteins segment dominated the largest market revenue share of 48.5% in 2025, driven by increasing adoption in chronic and rare disease management

Report Scope and Therapeutic Proteins and Oral Vaccines Market Segmentation

|

Attributes |

Therapeutic Proteins and Oral Vaccines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Pfizer (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Therapeutic Proteins and Oral Vaccines Market Trends

Enhanced Accessibility Through Advances in Oral Biologics and Targeted Therapeutics

- A significant and accelerating trend in the global therapeutic proteins and oral vaccines market is the increasing focus on developing patient-friendly delivery formats, particularly oral and non-invasive dosage forms. Continuous advancements in formulation technologies are enabling proteins and vaccines to be administered more conveniently, improving patient compliance and expanding accessibility beyond traditional injectable therapies

- For instance, novel oral biologic formulations are being explored to enhance stability in the gastrointestinal environment, allowing therapeutic proteins and vaccines to withstand enzymatic degradation and deliver effective immune responses. These developments are enabling wider application in mass immunization programs and chronic disease management, particularly in regions with limited healthcare infrastructure

- Innovations in encapsulation technologies, nanoparticle carriers, and protective coatings are helping to improve bioavailability and target specificity. These advancements support more efficient absorption of therapeutic proteins in the body and improved immune activation in the case of oral vaccines, resulting in better treatment outcomes and longer-lasting immunity

- The expansion of oral vaccine research for diseases such as polio, cholera, rotavirus, and emerging infectious diseases is contributing to the growing acceptance of non-injectable vaccination methods. These formulations simplify storage, transportation, and large-scale distribution compared to traditional injectable vaccines, particularly in low- and middle-income regions

- Pharmaceutical and biotechnology companies are increasingly collaborating with academic institutions and research laboratories to accelerate the development of next-generation oral protein and vaccine platforms. This collaborative ecosystem is fostering innovation and reducing the development timeline for new therapies

- This trend towards more accessible, stable, and patient-friendly therapeutic solutions is reshaping treatment standards across both preventive and therapeutic segments. As a result, the demand for oral vaccines and innovative therapeutic protein products is expected to rise steadily across pediatric, adult, and geriatric populations worldwide

Therapeutic Proteins and Oral Vaccines Market Dynamics

Driver

Rising Prevalence of Chronic Diseases and Growing Immunization Initiatives

- The growing burden of chronic diseases such as diabetes, cancer, autoimmune disorders, and genetic conditions is a major factor driving the increased demand for therapeutic proteins. These biologics play a crucial role in targeted treatment, disease management, and improving long-term patient outcomes, especially in conditions where conventional small-molecule drugs are less effective

- For instance, in May 2024, several healthcare organizations expanded national immunization and therapeutic programs aimed at increasing access to protein-based therapies and oral vaccines for both communicable and non-communicable diseases. These initiatives reflect the rising global emphasis on preventive healthcare and early intervention strategies

- In addition, the increasing frequency of infectious disease outbreaks and the continuous threat of pandemics have intensified global vaccine development efforts. Governments and international health agencies are investing heavily in oral vaccine research due to its practical advantages in mass vaccination campaign

- The expanding pediatric and geriatric populations, which are more vulnerable to infections and chronic illnesses, further contribute to the demand for safe and effective therapeutic proteins and oral vaccines. These age groups require convenient and less invasive treatment options, making oral and protein-based therapies highly suitable

- The growing awareness among populations regarding the importance of immunization and biologic therapies, combined with improved healthcare infrastructure in developing economies, is also playing a key role in driving market expansion

- Together, rising disease prevalence, strong government support, and growing public awareness are significantly boosting the adoption of therapeutic proteins and oral vaccines globally

Restraint/Challenge

Complex Manufacturing Processes and High Development Costs

- One of the major challenges facing the Therapeutic Proteins and Oral Vaccines market is the complexity associated with their manufacturing processes. These products require highly controlled environments, advanced technologies, and specialized expertise to maintain stability, purity, and efficacy, which significantly increases production costs

- For instance, the formulation of oral vaccines and therapeutic proteins demands sophisticated techniques to protect active ingredients from degradation caused by heat, moisture, and digestive enzymes. This requirement makes large-scale production and long-term storage more difficult compared to conventional pharmaceuticals

- Regulatory requirements for biologics and vaccines are highly stringent, involving extensive clinical trials, stability testing, and quality control measures. While these regulations are essential for safety and efficacy, they also prolong product development cycles and increase overall costs for manufacturers

- In addition, limited cold-chain infrastructure in remote and developing regions can restrict market penetration, especially for protein-based products that are sensitive to temperature variations. This creates significant logistical challenges in rural and underserved areas

- Although technological advancements are gradually improving stability and reducing production expenses, the high initial investment required for research and manufacturing facilities continues to act as a barrier for small and mid-sized companies entering the market

- Overcoming these challenges through continuous innovation in formulation, scalable manufacturing technologies, and global healthcare investments will be critical for sustaining long-term growth in the Therapeutic Proteins and Oral Vaccines market

Therapeutic Proteins and Oral Vaccines Market Scope

The market is segmented on the basis of drug class, application, end-users, and distribution channel.

- By Drug Class

On the basis of drug class, the Therapeutic Proteins and Oral Vaccines market is segmented into therapeutic proteins and oral vaccines. The therapeutic proteins segment dominated the largest market revenue share of 48.5% in 2025, driven by increasing adoption in chronic and rare disease management. Therapeutic proteins are highly effective in targeted treatment, supporting conditions such as oncology, hematology, and immunology. Their dominance is also fueled by ongoing clinical research, improved manufacturing capabilities, and a growing preference for biologics over conventional small-molecule drugs. Strong patent pipelines and strategic collaborations among biotechnology companies further support sustained revenue growth. These proteins offer better efficacy, lower side effects, and longer-term treatment outcomes, encouraging healthcare providers to prioritize them in treatment protocols. Demand is highest in developed regions due to better healthcare infrastructure, reimbursement policies, and awareness of advanced biologics. Additionally, scalability of production and availability of advanced delivery methods such as oral and subcutaneous formulations are expanding adoption across hospitals, clinics, and specialty care centers. The segment continues to benefit from government support, growing patient populations, and a rising focus on personalized medicine. Overall, therapeutic proteins remain the backbone of the global biologics market.

The oral vaccines segment is expected to witness the fastest CAGR of 20.4% from 2026 to 2033, driven by the growing need for non-invasive, patient-friendly immunization solutions. Oral vaccines offer significant advantages such as ease of administration, higher patient compliance, and suitability for mass immunization programs. Increasing awareness of preventable infectious diseases, particularly in pediatric populations, and expanding government vaccination initiatives are fueling adoption. Ongoing innovations in formulation technology, encapsulation methods, and stabilizing agents improve vaccine efficacy and shelf life, further boosting market penetration. Developing regions are witnessing accelerated growth due to simplified logistics, reduced cold-chain dependency, and rising immunization programs. Collaborations between pharmaceutical companies and public health organizations are accelerating distribution and outreach. Oral vaccines are increasingly being explored for novel indications such as emerging infectious diseases and combination immunizations, adding to rapid adoption. The segment’s robust pipeline of clinical trials and strategic partnerships supports high growth potential. Adoption is also accelerated by increasing public-private initiatives for global immunization coverage. Patient-friendly administration methods reduce hospital visits and associated healthcare costs. Technology-driven delivery improvements enhance the stability and shelf life of oral vaccines. These factors collectively contribute to oral vaccines being the fastest-growing drug class globally.

- By Application

On the basis of application, the market is segmented into cardiovascular disease, hematology, immunology, oncology, infectious disease, endocrinology, and others. The oncology segment accounted for the largest market revenue share of 35.7% in 2025, driven by rising cancer prevalence and the effectiveness of therapeutic proteins in targeted therapies. Advanced biologics are increasingly integrated into standard oncology protocols, offering higher survival rates and reduced systemic toxicity. The segment benefits from strong R&D pipelines, government support for cancer treatment initiatives, and growing patient awareness. Continuous clinical trials support adoption of innovative biologics. Accessibility of treatment in hospitals, specialized centers, and research hospitals further enhances market share. Availability of combination therapies strengthens treatment outcomes. Rising investment in oncology-focused pharmaceutical research fuels therapeutic adoption. Public-private collaborations expand access to advanced therapies. Oncology biologics adoption is accelerated by regulatory approvals and breakthrough therapy designations. Development of monoclonal antibodies and recombinant proteins increases segment penetration. Healthcare providers prefer oncology biologics due to proven efficacy and patient outcomes.

The infectious disease segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, driven by global vaccination programs, rising awareness of preventable diseases, and development of novel oral vaccines. Pediatric vaccination initiatives are expanding adoption in emerging economies. Governments are supporting mass immunization campaigns with funding and public-private partnerships. Ongoing clinical trials for new oral vaccines enhance market confidence. Distribution improvements reduce cold-chain dependency and reach remote areas. Awareness campaigns educate populations on vaccine benefits. Immunization programs target both seasonal and emerging diseases. Expanded disease indications for oral vaccines increase adoption. Partnerships with NGOs accelerate vaccination outreach. Technology-enabled delivery improves shelf-life and efficacy. Reduced invasiveness and pain-free administration encourage acceptance. These factors collectively drive the segment’s high growth potential globally.

- By End-Users

On the basis of end-users, the market is segmented into clinics, hospitals, and others. The hospital segment dominated with a 52.6% revenue share in 2025, supported by advanced infrastructure, large patient inflow, and specialized departments for chronic and infectious diseases. Hospitals provide trained personnel, cold-chain facilities, and clinical monitoring for therapeutic proteins and oral vaccines. Hospitals also integrate biologics into inpatient and outpatient care programs. Adoption is accelerated by government initiatives and reimbursement policies. Strong clinical trial support ensures availability of latest therapies. Large-scale procurement by hospitals ensures steady supply. Hospitals act as primary vaccination and treatment centers. Demand is highest in urban and developed regions. Hospitals serve as central hubs for distribution and education. They support continuous monitoring of therapy outcomes. Hospital pharmacies maintain safety and quality standards. Overall, hospitals remain critical for market adoption.

The clinic segment is expected to witness the fastest CAGR of 18.7% from 2026 to 2033, driven by increased adoption of outpatient therapies, home-based care models, and community immunization programs. Clinics provide accessible, cost-effective care in urban and semi-urban regions. Adoption is supported by telemedicine and mobile healthcare units. Clinics enable direct patient engagement and education. Community vaccination campaigns expand reach. Reduced dependency on hospital infrastructure enhances flexibility. Clinics serve as first points of contact for preventive care. Growing awareness of oral vaccines increases clinic utilization. Clinics also support chronic disease management programs. Partnerships with local governments improve service coverage. Increased clinic adoption reduces healthcare burden on hospitals. Convenience and personalized care drive patient preference. These factors collectively make clinics the fastest-growing end-user segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. Hospital pharmacies held the largest share of 46.8% in 2025, owing to integrated hospital services, centralized procurement, and close monitoring of biologic therapies. Hospital pharmacies ensure proper storage, dosing, and administration protocols. Regulatory oversight ensures compliance and safety. Hospitals maintain high patient trust and adherence. Bulk procurement reduces treatment costs. Availability of specialized staff ensures correct administration. Hospital pharmacies are primary points for both therapeutic proteins and oral vaccines. Centralized logistics improve reliability. Partnerships with manufacturers secure continuous supply. Hospitals support clinical trials and new therapy introductions. Integration with inpatient and outpatient programs strengthens adoption. These factors collectively support dominance of hospital pharmacies.

The online pharmacy segment is expected to witness the fastest CAGR of 21.2% from 2026 to 2033, fueled by growing e-commerce adoption, convenience of home delivery, and increasing telemedicine services for prescription fulfillment. Online pharmacies improve access in remote areas. Patients can order medications with minimal travel. Integration with mobile apps simplifies prescriptions. Teleconsultations enhance adherence. Increasing awareness of therapeutic proteins and oral vaccines supports growth. Reduced dependency on hospital visits accelerates adoption. Online pharmacies offer competitive pricing. Efficient logistics ensure product stability. Subscription models encourage repeat orders. Digital platforms provide patient support and reminders. Rapid expansion in emerging markets supports CAGR. These factors collectively position online pharmacies as the fastest-growing distribution channel globally.

Therapeutic Proteins and Oral Vaccines Market Regional Analysis

- North America dominated the therapeutic proteins and oral vaccines market with the largest revenue share of 38.6% in 2025, supported by a well-established biopharmaceutical industry, strong R&D funding, favorable regulatory frameworks, and high adoption of advanced biologic therapies. The wide use of recombinant proteins and oral vaccines across hospitals, clinics, and research institutions continues to strengthen the region’s leadership

- The presence of major pharmaceutical and biotechnology companies, along with continuous innovation in protein engineering and vaccine development, is accelerating product adoption and expanding therapeutic applications across chronic and infectious diseases

- High healthcare expenditure, advanced research infrastructure, and increasing focus on preventive healthcare are further reinforcing the region’s market dominance

U.S. Therapeutic Proteins and Oral Vaccines Market Insight

The U.S. therapeutic proteins and oral vaccines market captured the largest share within North America in 2025, driven by significant investments in biotechnology research, rapid commercialization of novel biologics, and strong demand for effective and targeted therapies. The country’s emphasis on precision medicine, along with extensive clinical trial activity and government support for vaccine development, is contributing to sustained market expansion.

Europe Therapeutic Proteins and Oral Vaccines Market Insight

The Europe therapeutic proteins and oral vaccines market is projected to expand at a substantial CAGR during the forecast period, supported by strong regulatory support for biologics, increasing prevalence of chronic diseases, and rising vaccination initiatives. Countries across Europe are witnessing growing demand for advanced protein-based therapies in oncology, immunology, and rare disease treatment.

U.K. Therapeutic Proteins and Oral Vaccines Market Insight

The U.K. therapeutic proteins and oral vaccines market is anticipated to grow steadily during the forecast period, fueled by increasing government investment in life sciences, expanding pharmaceutical manufacturing capabilities, and rising awareness about preventive immunization programs. Collaborations between academic institutions and biotech firms are also supporting innovation in oral vaccine technologies.

Germany Therapeutic Proteins and Oral Vaccines Market Insight

The Germany therapeutic proteins and oral vaccines market is expected to expand at a considerable CAGR, driven by a strong pharmaceutical sector, advanced research facilities, and high adoption of innovative biologic drugs. Germany’s emphasis on technological advancement and quality healthcare delivery is encouraging the integration of next-generation therapeutic proteins into clinical practice.

Asia-Pacific Therapeutic Proteins and Oral Vaccines Market Insight

The Asia-Pacific therapeutic proteins and oral vaccines market is poised to grow at the fastest CAGR of 23.4% during the forecast period, driven by an expanding biotechnology sector, rising government immunization initiatives, growing awareness about preventive healthcare, and increasing healthcare access in countries such as China and India. Rapid urbanization and improvements in healthcare infrastructure are further supporting market growth across the region.

Japan Therapeutic Proteins and Oral Vaccines Market Insight

The Japan therapeutic proteins and oral vaccines market is gaining momentum due to strong government support for biotechnology innovation, an aging population requiring advanced therapies, and increasing focus on preventive medicine. Rising adoption of novel protein-based therapeutics and continuous investment in vaccine research are key factors driving market expansion.

China Therapeutic Proteins and Oral Vaccines Market Insight

The China therapeutic proteins and oral vaccines market accounted for a significant share in Asia-Pacific in 2025, attributed to rapid growth in the domestic biopharmaceutical industry, large-scale vaccination programs, and increasing government funding for biologics research. The expanding middle-class population and growing healthcare awareness are further accelerating the demand for therapeutic proteins and oral vaccines across the country.

Therapeutic Proteins and Oral Vaccines Market Share

The Therapeutic Proteins and Oral Vaccines industry is primarily led by well-established companies, including:

• Pfizer (U.S.)

• Moderna (U.S.)

• AstraZeneca (U.K.)

• Johnson & Johnson (U.S.)

• GlaxoSmithKline (U.K.)

• Sanofi (France)

• CureVac (Germany)

• BioNTech (Germany)

• Novo Nordisk (Denmark)

• Merck & Co. (U.S.)

• Novartis (Switzerland)

• Bharat Biotech (India)

• Serum Institute of India (India)

• Sinovac Biotech (China)

• Sinopharm (China)

• Shionogi & Co. (Japan)

• Takeda Pharmaceutical (Japan)

• Celltrion (South Korea)

• Arcturus Therapeutics (U.S.)

• Valneva SE (Austria)

Latest Developments in Global Therapeutic Proteins and Oral Vaccines Market

- In July 2022, Nuvaxovid — a protein-based (non-mRNA) COVID-19 vaccine from Novavax — received conditional marketing authorization in the European Union for adolescents aged 12–17. This marked one of the first times a purely protein-subunit vaccine was cleared for wide use in younger populations under rigorous regulatory review

- In November 2022, the World Health Organization (WHO) updated its Emergency Use Listing for Nuvaxovid, approving it as a primary vaccine series in adolescents and as a booster in adults. This broadened the global acceptance of protein-based vaccines beyond initial emergency use contexts

- In October 2024, Novavax released an updated formulation of Nuvaxovid designed to target newer variants, and this updated vaccine received marketing authorization in the EU for use in individuals aged 12 and above. This demonstrates ongoing adaptation of protein-based vaccines to evolving viral strains, reinforcing their relevance in long-term immunization strategies

- In May 2025, the U.S. Food and Drug Administration (FDA) approved the Biologics License Application (BLA) for Nuvaxovid for certain high-risk groups (people 65 + and adults 12–64 with underlying conditions), making it the first recombinant protein-based, non-mRNA COVID-19 vaccine fully licensed in the U.S. This milestone underscores global regulatory confidence in protein-based vaccines’ safety and efficacy, offering a long-term biologics option for immunization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.