Global Thermal Barrier Coatings Market

Market Size in USD Billion

CAGR :

%

USD

16.23 Billion

USD

31.12 Billion

2024

2032

USD

16.23 Billion

USD

31.12 Billion

2024

2032

| 2025 –2032 | |

| USD 16.23 Billion | |

| USD 31.12 Billion | |

|

|

|

|

Thermal Barrier Coatings Market Size

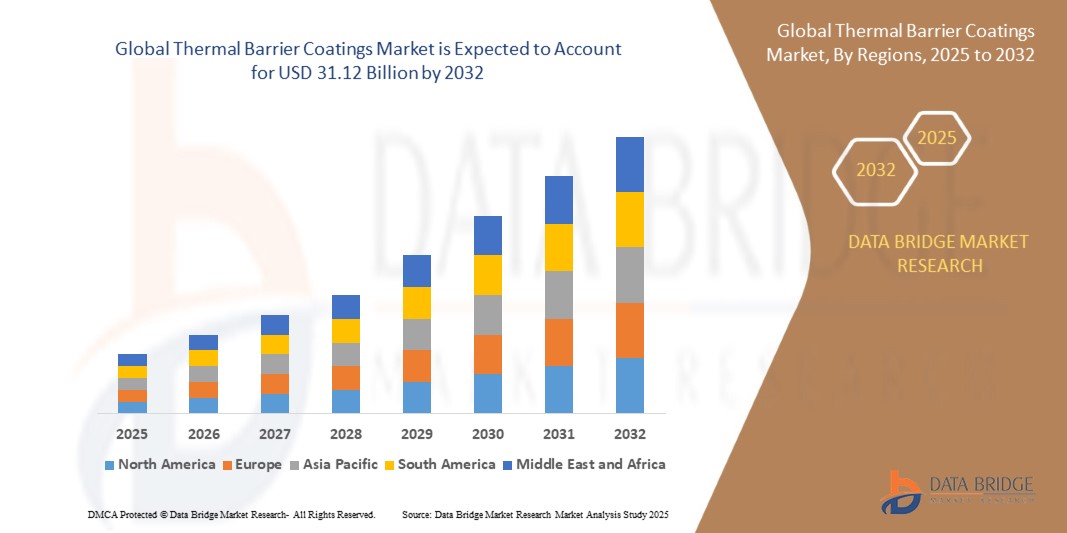

- The Global Thermal Barrier Coatings Market size was valued at USD 16.23 billion in 2024 and is expected to reach USD 31.12 billion by 2032, at a CAGR of 7.5% during the forecast period

- The market growth is largely fueled by rapid upsurge in the automobile production on account of growing demand from emerging economies

- Furthermore, the increasing worldwide power demand, mostly in the emerging economies and the increasing technological innovation is further anticipated to propel the growth of the Thermal Barrier Coatings Market

Thermal Barrier Coatings Market Analysis

- Thermal barrier coating is largely used to protect the metal structural component from severe elevated temperatures. They resourcefully manage the heat exhaust and usually have four layers metallic bond coat, ceramic top coat, metal substrate and oxide developed thermally.

- They are also used in the automotive industry to decrease the heat from the exhaust system. Polymers, zirconia, aluminates and resins are used to produce thermal barrier coatings.

- The thermal barrier coatings market is rising in demand due to rapidly rising demand for thermal barrier coatings in various applications such as energy, automotive and aerospace

- North America dominates the Thermal Barrier Coatings Market with the largest revenue share of 37.07% in 2025, characterized by the robust aerospace and defense industries and increasing turbine engine applications.

- Asia-Pacific is expected to be the fastest growing region in the Thermal Barrier Coatings Market during the forecast period due to rapid industrialization, energy demand, and increased investment in aerospace and automotive manufacturing

- Ceramic segment is expected to dominate the thermal barrier coatings market with a market share of 45.8% in 2025, driven by its superior thermal insulation properties, resistance to oxidation, and stability at elevated temperatures

Report Scope and Thermal Barrier Coatings Market Segmentation

|

Attributes |

Thermal Barrier Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Thermal Barrier Coatings Market Trends

“Integration of Advanced Materials and Smart Coating Technologies”

- A significant and emerging trend in the Global Thermal Barrier Coatings (TBCs) Market is the integration of advanced ceramic composites and smart coatings with self-healing and temperature-sensing capabilities. These innovations are enhancing the performance, longevity, and reliability of TBCs in extreme environments.

- For instance, nanostructured yttria-stabilized zirconia coatings and gadolinium zirconate materials are gaining traction due to their superior thermal insulation and resistance to high-temperature oxidation.

- Smart TBCs embedded with sensors are being developed to monitor degradation and enable predictive maintenance in aerospace and power generation sectors.

- The growing focus on reducing carbon emissions and improving energy efficiency is pushing OEMs and tier-1 suppliers to adopt next-generation coatings that perform under harsher thermal and mechanical stresses.

- Manufacturers like Praxair Surface Technologies and A&A Coatings are investing in research to optimize coating microstructures for turbine engines, automotive exhausts, and industrial furnaces.

- The demand for durable, multifunctional coatings is reshaping R&D and driving competition among TBC providers, leading to continuous innovation and improved service life of components in critical applications.

Thermal Barrier Coatings Market Dynamics

Driver

“Increasing Demand from Aerospace and Gas Turbine Industries”

- A key driver for the global Thermal Barrier Coatings Market is the growing demand from the aerospace and power generation sectors, particularly for gas turbines operating at higher temperatures.

- TBCs play a vital role in protecting turbine blades, nozzles, and combustors from thermal fatigue and oxidation, allowing engines to run hotter and more efficiently.

- For instance, with rising air travel and defense budgets, OEMs are ramping up production of advanced jet engines that rely heavily on robust TBC systems.

- Additionally, power utilities are retrofitting turbines to improve performance and lower maintenance costs by incorporating plasma-sprayed and electron beam physical vapor deposition (EB-PVD) coatings.

- As turbine inlet temperatures rise to increase power output, the demand for more resilient and thermally stable coatings is expected to grow substantially.

Restraint/Challenge

“High Cost and Complex Application Processes”

- A major challenge hindering the growth of the Thermal Barrier Coatings Market is the high cost associated with coating materials and complex deposition techniques like EB-PVD and plasma spraying.

- These processes require specialized equipment, skilled labor, and stringent process controls, which can increase manufacturing time and expenses.

- Small manufacturers and industries with low production volumes may find it uneconomical to adopt advanced TBC systems due to these barriers.

- Furthermore, achieving consistent coating quality and adhesion on complex geometries remains a technical challenge, often leading to rework or rejection.

- For instance, the use of rare earth oxides in topcoats and multi-layer structures adds to the material cost, especially for high-temperature aerospace applications.

- Efforts to reduce cost through simplified coating architectures, alternative materials, and automation are ongoing but still face scalability issues.

- Addressing these cost and process complexities will be essential for broadening TBC adoption across various industrial segments.

Thermal Barrier Coatings Market Scope

The market is segmented on the basis of product type, technology, coating combination, and application.

- By Product Type

On the basis of product type, the thermal barrier coatings market is segmented into metal, ceramic, intermetallic, and others. The ceramic segment dominates the largest market revenue share of 45.8% in 2025, driven by its superior thermal insulation properties, resistance to oxidation, and stability at elevated temperatures. Ceramics are widely used in aerospace and power generation sectors for protecting components from extreme heat exposure. The market also benefits from ongoing research in ceramic composites that enhance durability and extend coating life cycles.

The intermetallic segment is anticipated to witness the fastest growth rate of 20.3% from 2025 to 2032, fueled by rising demand in turbine and engine applications. Intermetallics offer a unique combination of strength, oxidation resistance, and thermal stability, making them ideal for high-performance engines in both defense and energy industries. Advances in intermetallic-based coatings further expand their usage across harsh environments.

- By Technology

On the basis of technology, the thermal barrier coatings market is segmented into High-Velocity Oxy-Fuel (HVOF), vapor deposition, air plasma, and others. The air plasma segment held the largest market revenue share in 2025, driven by its cost-effectiveness and compatibility with a wide range of coating materials. It is widely adopted in both aerospace and industrial gas turbine applications due to its ability to form dense, durable coatings. The use of air plasma technology also supports easy customization for complex component geometries.

The vapor deposition segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for highly uniform and adherent coatings. Vapor deposition techniques provide exceptional control over microstructure and thickness, making them suitable for critical engine parts in aerospace and advanced manufacturing sectors.

- By Coating Combination

On the basis of coating combination, the thermal barrier coatings market is segmented into ceramic YSZ, aluminum oxide, MCrAlY, and mullite-based. The ceramic YSZ (yttria-stabilized zirconia) segment held the largest market revenue share in 2025, due to its proven performance in high-heat environments, especially in jet engines and gas turbines. Its low thermal conductivity and high thermal expansion compatibility make it a standard choice for topcoats in multi-layer systems.

The mullite-based coatings are projected to witness the fastest CAGR from 2025 to 2032, driven by their excellent resistance to thermal shock and chemical degradation. These coatings are increasingly adopted in applications where environmental barrier properties are critical, especially in aerospace and high-efficiency combustion systems.

- By Application

On the basis of application, the thermal barrier coatings market is segmented into stationary power plants, aerospace, automotive, and others. The aerospace segment accounted for the largest market revenue share in 2025, driven by the rising production of jet engines and demand for fuel efficiency. Thermal barrier coatings help in reducing cooling requirements, improving component life, and supporting higher operating temperatures in turbines. Their critical role in reducing engine weight and emissions also supports long-term adoption.

The automotive segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing adoption in high-performance vehicles and electric vehicles. Coatings enhance the thermal efficiency of engine components and protect parts from high exhaust gas temperatures, contributing to performance optimization and reduced maintenance.

Thermal Barrier Coatings Market Regional Analysis

- North America dominates the Thermal Barrier Coatings Market with the largest revenue share of 37.07% in 2024, driven by the robust aerospace and defense industries and increasing turbine engine applications.

- Advanced manufacturing technologies, alongside strong investments in thermal efficiency and emission control, support high adoption of TBCs across industrial gas turbines and automotive sectors.

- The U.S. leads due to strong demand from OEMs, government funding for energy-efficient technologies, and a mature aviation market needing high-performance coatings. These factors collectively fuel the dominance of TBCs across the region.

U.S. Thermal Barrier Coatings Market Insight

The U.S. Thermal Barrier Coatings Market captured the largest revenue share of 82.11% within North America in 2025, fueled by the widespread adoption across military and commercial aircraft manufacturing. The presence of key OEMs, such as GE Aviation and Pratt & Whitney, and a focus on high-efficiency jet engines are critical growth factors. Additionally, growing R&D investments in advanced ceramic materials and next-gen turbine coatings continue to drive innovation, reinforcing the U.S. position as the leading market within the region.

Europe Thermal Barrier Coatings Market Insight

The European Thermal Barrier Coatings Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the region’s focus on sustainability and emission reduction. The automotive and energy sectors are investing in thermal management to meet EU regulations. TBCs are extensively used in gas turbines and exhaust systems to improve energy efficiency and reduce maintenance frequency. Integration of environmentally compliant, high-temperature coating solutions across Germany, France, and the U.K. is fostering innovation and market growth across multiple industrial verticals.

U.K. Thermal Barrier Coatings Market Insight

The U.K. Thermal Barrier Coatings Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by innovations in turbine coatings and thermal insulation for defense and power generation. With high demand for low-emission engines and stricter carbon regulations, TBCs are becoming vital. The region’s significant investments in aviation and renewable energy sectors are creating lucrative opportunities. U.K.-based research institutions and companies are developing next-generation coatings with enhanced durability, spallation resistance, and temperature stability, aligning with national sustainability goals and boosting adoption.

Germany Thermal Barrier Coatings Market Insight

The German Thermal Barrier Coatings Market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s emphasis on industrial efficiency and decarbonization. As a hub for automotive and power equipment manufacturing, Germany employs TBCs in gas turbines, diesel engines, and manufacturing equipment to reduce heat loss and improve performance. Innovations in ceramic coating materials and automation in application techniques support high-precision demand. The local market thrives on partnerships between OEMs and research labs, advancing multi-layered coating technologies that improve service life in extreme environments.

Asia-Pacific Thermal Barrier Coatings Market Insight

The Asia-Pacific thermal barrier coatings market is poised to grow at the fastest CAGR of over 24.35% in 2025, driven by rapid industrialization, energy demand, and increased investment in aerospace and automotive manufacturing. China, Japan, and India are actively deploying TBCs in turbines, internal combustion engines, and industrial gas turbines to improve thermal efficiency and longevity. Government initiatives supporting clean energy technologies and infrastructure modernization are creating favorable conditions. The growing presence of TBC manufacturers and research hubs is accelerating innovation and adoption.

Japan Thermal Barrier Coatings Market Insight

The Japan thermal barrier coatings market is gaining momentum due to technological maturity, high-quality manufacturing standards, and strong energy infrastructure. The country’s demand for fuel-efficient engines and gas turbines drives the use of ceramic coatings with high thermal stability. Government-funded R&D in smart coatings and corrosion-resistant materials for aerospace and defense further bolsters demand. Japan’s precision-driven industrial ecosystem and commitment to high-temperature thermal insulation in manufacturing equipment make it a key player in the regional market.

China Thermal Barrier Coatings Market Insight

The China Thermal Barrier Coatings Market accounted for the largest market revenue share in Asia Pacific in 2025, driven by aggressive expansion in aerospace, automotive, and energy production. As the world’s largest turbine manufacturing and jet engine components producer, China is increasingly using TBCs to extend component lifespans. Government policies supporting localized production and technological self-sufficiency, along with a surge in smart manufacturing initiatives, are promoting domestic innovations in TBC application. Cost-effective solutions from local suppliers are also helping to penetrate regional and global markets.

Thermal Barrier Coatings Market Share

The Thermal Barrier Coatings industry is primarily led by well-established companies, including:

- A&A Thermal Spray Coatings (U.S.)

- Praxair S.T. Technology, Inc. (U.S.)

- Höganäs AB (Sweden)

- ASB Industries, Inc. (U.S.)

- Zircotec (U.K.)

- Flame Spray Coating Company (U.S.)

- Integrated Global Services, Inc. (U.S.)

- Thermion (U.S.)

- Metallisation Limited (U.K.)

- Metallizing Equipment Co. Pvt. Ltd. (India)

- Honeywell International Inc. (U.S.)

- Metallic Bonds, Ltd. (U.S.)

- Chromalloy Gas Turbine LLC (U.S.)

- KOBE STEEL, LTD. (Japan)

- DW Pearce Enterprises Ltd. (U.K.)

- Starshield Technologies Private Limited (India)

- TST Engineered Coating Solutions (U.S.)

- The Fisher Borton Group (U.S.)

- TWI Ltd (U.K.)

- CTS, Inc. (U.S.)

Latest Developments in Global Thermal Barrier Coatings Market

- In May 2023, Cabot Corporation launched its ENTERA aerogel particle product line—an advanced thermal insulation additive designed for ultra-thin thermal barriers in lithium-ion batteries used in electric vehicles (EVs). The ENTERA portfolio includes three aerogel solutions that can be formulated into various thermal barrier forms, such as pads, sheets, films, blankets, foams, and coatings.

- In March 2023, Zircotec introduced its Thermohold ceramic thermal barrier coating. This new solution is compatible with a wide range of substrates, including metals such as cast iron, steel alloys, aluminum, and titanium, as well as composites like carbon-fiber-reinforced polymers (CFRPs) and high-temperature plastics.

- In December 2022, OC Oerlikon Management AG unveiled plans to build a cutting-edge production and assembly facility in Switzerland dedicated to its surface solutions and equipment segment. Scheduled for completion in 2025, the site will support the delivery of Oerlikon Metco technologies, including thermal barrier coatings, alongside equipment assembly and manufacturing services.

- In January 2021, ASB Industries entered a joint venture with Hannecard, forming Hannecard Roller Coatings, Inc. Through this partnership, Hannecard aims to extend ASB’s well-established technologies across Asia, Europe, and Africa. Concurrently, ASB will broaden Hannecard’s current product lineup by incorporating a wide selection of roller coatings—rubber, polyurethane, and thermal spray—across multiple industries, leveraging Hannecard’s global expertise and R&D capabilities.

- In March 2020, Praxair Surface Technologies (PST), based in the U.S., signed a comprehensive coating service agreement with Germany’s Siemens. Under this contract, PST will apply its slurry, aluminizing, platinum aluminizing, and thermal spray technologies to various Siemens components, including casings, vanes, blades, and discs used in aerospace and industrial gas turbines.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Thermal Barrier Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Thermal Barrier Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Thermal Barrier Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.