Global Thermal Injection Enhanced Oil Recovery Market

Market Size in USD Billion

CAGR :

%

USD

11.99 Billion

USD

22.37 Billion

2024

2032

USD

11.99 Billion

USD

22.37 Billion

2024

2032

| 2025 –2032 | |

| USD 11.99 Billion | |

| USD 22.37 Billion | |

|

|

|

|

Thermal Injection Enhanced Oil Recovery Market Size

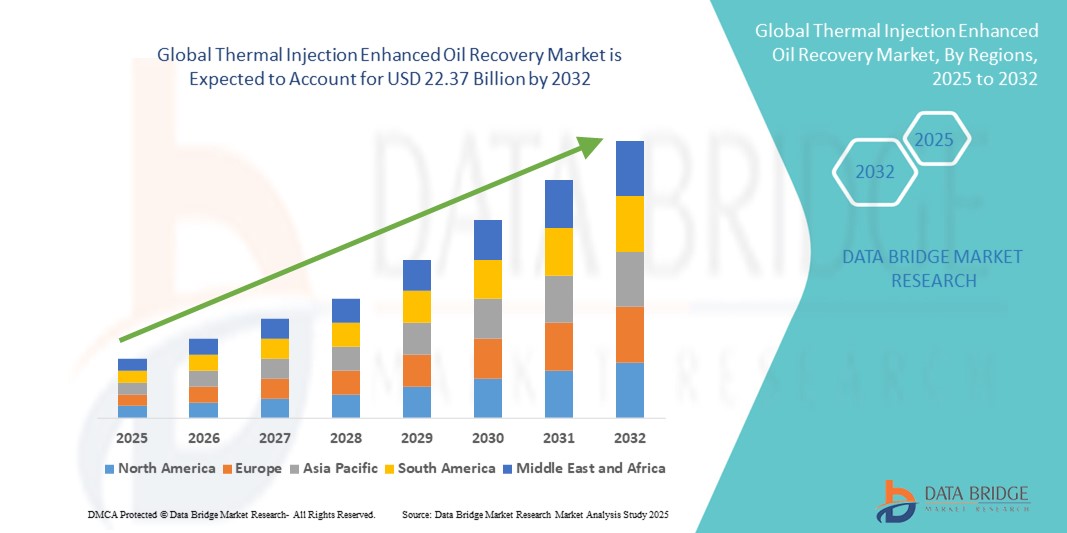

- The global thermal injection enhanced oil recovery market size was valued at USD 11.99 billion in 2024 and is expected to reach USD 22.37 billion by 2032, at a CAGR of 8.10% during the forecast period

- The market growth is largely fuelled by the rising demand for improved oil recovery from mature reservoirs, increasing crude oil consumption, and advancements in steam injection technologies that enhance extraction efficiency

- Supportive government initiatives and favorable policies promoting advanced oil recovery methods to maximize domestic production and reduce dependence on oil imports are further driving market adoption globally

Thermal Injection Enhanced Oil Recovery Market Analysis

- The market is witnessing significant growth as oil producers increasingly adopt thermal injection techniques such as steam flooding and cyclic steam stimulation to extend the productive life of oilfields

- These methods are particularly effective in heavy and viscous oil reservoirs, where conventional recovery approaches yield low extraction rates

- Growing investments in upstream oil production, coupled with technological innovations aimed at improving thermal efficiency and reducing operational costs, are expected to accelerate market expansion over the forecast period

- North America dominated the thermal injection enhanced oil recovery (EOR) market with the largest revenue share in 2024, driven by extensive heavy crude oil reserves and the widespread implementation of advanced recovery techniques to boost production efficiency

- Asia-Pacific region is expected to witness the highest growth rate in the global thermal injection enhanced oil recovery market, driven by expanding oilfield operations, growing demand for crude oil from developing economies, and increasing adoption of advanced thermal recovery technologies to enhance production efficiency

- The steam injection segment dominated the market with the largest market revenue share of 56.8% in 2024, driven by its proven efficiency in reducing oil viscosity and enhancing flow rates, especially in heavy crude oil reservoirs. Steam injection’s adaptability to large-scale operations and compatibility with mature oil fields further strengthens its market position as a preferred thermal recovery method.

Report Scope and Thermal Injection Enhanced Oil Recovery Market Segmentation

|

Attributes |

Thermal Injection Enhanced Oil Recovery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Investments in Advanced Thermal Recovery Technologies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Thermal Injection Enhanced Oil Recovery Market Trends

Integration of Digital Monitoring in Thermal EOR Operations

- The adoption of digital monitoring and automation technologies is transforming thermal injection enhanced oil recovery (EOR) processes by enabling real-time reservoir performance tracking. These systems allow operators to optimize steam injection parameters, improving efficiency and reducing operational costs while enhancing oil recovery rates

- Increasing deployment of advanced sensors and IoT-enabled devices in remote oilfields allows continuous monitoring of temperature, pressure, and fluid composition. This data-driven approach helps in early detection of operational inefficiencies and equipment failures, leading to reduced downtime and extended asset life

- The demand for automated control systems is growing, particularly in mature fields where maximizing output from declining wells is essential. These solutions help operators fine-tune steam cycles and manage reservoir pressure, resulting in higher recovery without excessive energy use

- For instance, in 2023, a Middle Eastern oil major implemented a fully integrated digital monitoring system across its steam-assisted gravity drainage (SAGD) operations. The deployment led to a 12% increase in recovery efficiency while lowering steam-to-oil ratios, ultimately reducing fuel consumption and carbon emissions

- While digitalization in thermal EOR is delivering measurable results, its full potential depends on addressing cybersecurity risks, ensuring skilled workforce availability, and lowering technology integration costs. Companies focusing on scalable and adaptable digital platforms are likely to gain a competitive advantage in the evolving market

Thermal Injection Enhanced Oil Recovery Market Dynamics

Driver

Rising Demand for Maximizing Output from Mature Oilfields

• With a growing share of global oil production coming from aging reservoirs, the need to extend their productive life is driving demand for thermal injection EOR methods. Techniques such as steam flooding, cyclic steam stimulation, and in-situ combustion are proving effective in unlocking heavy oil and reducing residual saturation

• National oil companies and private operators are investing heavily in thermal EOR to sustain production levels amid tightening exploration budgets. The ability to recover an additional 20–40% of original oil in place (OOIP) makes thermal injection a strategic choice for boosting profitability

• Government initiatives in oil-rich nations are promoting EOR adoption through tax incentives, joint ventures, and funding for technology upgrades, further accelerating market growth

• For instance, in 2022, the U.S. Department of Energy launched a funding program to support EOR innovation in depleted domestic reservoirs, aiming to strengthen energy security while reducing reliance on imports

• Although rising investment is driving adoption, operators must balance recovery efficiency with environmental sustainability by integrating carbon management strategies and optimizing steam generation methods

Restraint/Challenge

High Capital Requirements and Environmental Concerns

• The significant upfront investment required for setting up thermal injection systems, including boilers, steam generators, and distribution infrastructure, is a major barrier for small and mid-sized operators. High operating costs, particularly fuel expenses for steam production, further limit adoption

• Environmental concerns related to greenhouse gas emissions and high water usage in steam-based EOR processes are prompting stricter regulatory scrutiny. Compliance with emission limits and water recycling mandates increases operational complexity and costs

• In remote oilfield locations, logistical challenges such as transporting equipment, securing water resources, and maintaining steam quality reduce operational efficiency and slow project deployment

• For instance, in 2023, several proposed SAGD projects in Canada faced delays due to environmental approval processes, water sourcing challenges, and opposition from local communities concerned about ecological impact

• Addressing these challenges requires innovation in low-carbon steam generation, integration of renewable energy sources, and adoption of closed-loop water recycling systems to make thermal injection more sustainable and cost-effective

Thermal Injection Enhanced Oil Recovery Market Scope

The market is segmented on the basis of method, utility, and application.

- By Method

On the basis of method, the global thermal injection enhanced oil recovery market is segmented into steam injection, in-situ combustion, hot water injection, and electrical heating. The steam injection segment dominated the market with the largest market revenue share of 56.8% in 2024, driven by its proven efficiency in reducing oil viscosity and enhancing flow rates, especially in heavy crude oil reservoirs. Steam injection’s adaptability to large-scale operations and compatibility with mature oil fields further strengthens its market position as a preferred thermal recovery method.

The in-situ combustion segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its ability to utilize in-reservoir combustion to generate heat, reducing operational costs and minimizing external energy inputs. This method is increasingly being adopted in remote oil fields where infrastructure for steam generation is limited, offering a viable and sustainable alternative for enhanced oil recovery.

- By Utility

On the basis of utility, the global thermal injection enhanced oil recovery market is segmented into light crude oil, medium crude oil, heavy crude oil, and extra heavy crude oil. The heavy crude oil segment held the largest market revenue share in 2024, supported by the growing number of mature oil fields and the method’s efficiency in improving the mobility of highly viscous oil. The use of thermal injection in heavy crude oil recovery is further boosted by rising global energy demand and the need to maximize output from existing reservoirs.

The extra heavy crude oil segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing investments in unconventional oil resources. Thermal injection methods, particularly steam injection, are proving effective in mobilizing extra heavy crude, making these reserves commercially viable and expanding the scope of recovery projects.

- By Application

On the basis of application, the global thermal injection enhanced oil recovery market is segmented into onshore and offshore. The onshore segment dominated the market in 2024, attributed to lower operational complexities, reduced development costs, and the presence of large mature oil fields that are ideal candidates for thermal injection methods. Onshore projects also benefit from easier access to infrastructure and supply chains, supporting their large-scale deployment.

The offshore segment is expected to witness the fastest growth rate from 2025 to 2032, driven by technological advancements in subsea thermal recovery systems and rising investments in offshore exploration and production activities. The need to maximize extraction efficiency from offshore reservoirs with challenging oil properties is fostering the adoption of thermal injection methods in this segment.

Thermal Injection Enhanced Oil Recovery Market Regional Analysis

• North America dominated the thermal injection enhanced oil recovery (EOR) market with the largest revenue share in 2024, driven by extensive heavy crude oil reserves and the widespread implementation of advanced recovery techniques to boost production efficiency.

• The region benefits from established oilfield infrastructure, favorable regulatory support for enhanced recovery methods, and significant investment in technological advancements.

• High energy demand, coupled with the need to maximize output from mature oilfields, further strengthens North America’s leadership position in the market.

U.S. Thermal Injection Enhanced Oil Recovery Market Insight

The U.S. thermal injection EOR market captured the largest revenue share within North America in 2024, fueled by the abundance of mature onshore fields and the country’s strong emphasis on maximizing recovery rates. The presence of leading oilfield service companies, coupled with robust R&D in steam injection and in-situ combustion technologies, supports market expansion. In addition, favorable crude oil prices and strategic government support for domestic production continue to drive adoption of thermal EOR methods across key oil-producing states.

Europe Thermal Injection Enhanced Oil Recovery Market Insight

The Europe thermal injection EOR market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the need to enhance recovery rates from declining oilfields in the North Sea and other mature basins. Investments in environmentally sustainable recovery methods and the adoption of energy-efficient technologies are further influencing growth. The integration of carbon capture and storage (CCS) with thermal EOR operations is also gaining momentum, positioning Europe as a leader in low-carbon oil recovery initiatives.

U.K. Thermal Injection Enhanced Oil Recovery Market Insight

The U.K. thermal injection EOR market is expected to witness the fastest growth rate from 2025 to 2032, supported by the extension of production life in offshore fields and a focus on optimizing output from mature assets. Government policies encouraging the application of enhanced recovery methods and collaborations with technology providers are bolstering the adoption of steam and hot water injection techniques in offshore oilfields.

Germany Thermal Injection Enhanced Oil Recovery Market Insight

The Germany thermal injection EOR market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s emphasis on sustainable energy practices and innovation in recovery methods. While Germany’s crude oil production is limited compared to other regions, its strong engineering capabilities and involvement in EOR technology development for international projects provide steady growth opportunities.

Asia-Pacific Thermal Injection Enhanced Oil Recovery Market Insight

The Asia-Pacific thermal injection EOR market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing investment in heavy crude oil extraction in countries such as China, Indonesia, and India. Rapid industrialization, rising domestic energy demand, and government-backed exploration projects are encouraging the adoption of steam injection and in-situ combustion technologies. The region also benefits from cost-effective manufacturing of EOR equipment, enhancing accessibility for local operators.

Japan Thermal Injection Enhanced Oil Recovery Market Insight

The Japan thermal injection EOR market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s strategic partnerships with oil-producing nations and investment in advanced recovery technologies for overseas projects. While domestic crude oil production is limited, Japanese companies play a significant role in engineering and supplying high-efficiency thermal EOR systems for global markets.

China Thermal Injection Enhanced Oil Recovery Market Insight

The China thermal injection EOR market accounted for the largest revenue share in Asia-Pacific in 2024, supported by vast heavy crude oil reserves, government-backed production enhancement programs, and large-scale adoption of steam injection technology. Domestic oil companies are investing heavily in both onshore and offshore EOR projects, while the rapid expansion of oilfield service capabilities strengthens China’s position as a key global player in thermal EOR operations.

Thermal Injection Enhanced Oil Recovery Market Share

The Thermal Injection Enhanced Oil Recovery industry is primarily led by well-established companies, including:

- SLB (U.S.)

- Halliburton Company (U.S.)

- ExxonMobil Corporation (U.S.)

- Chevron Corporation (U.S.)

- Royal Dutch Shell plc (U.K.)

- BP p.l.c. (U.K.)

- ConocoPhillips (U.S.)

- Occidental Petroleum Corporation (U.S.)

- Cenovus Energy Inc. (Canada)

- Suncor Energy Inc. (Canada)

- Petróleos Mexicanos (Mexico)

- LUKOIL (Russia)

- China National Petroleum Corporation (China)

Latest Developments in Global Thermal Injection Enhanced Oil Recovery Market

- In July 2023, SLB entered into a strategic partnership with Enivibes, a subsidiary of Eni, to deploy the e-vpms technology, a vibroacoustic pipeline monitoring system designed to provide real-time analysis and leak detection for pipelines worldwide. This collaboration aims to enhance operational reliability, reduce downtime, and improve safety across global pipeline networks, thereby strengthening the adoption of advanced monitoring solutions in the thermal injection enhanced oil recovery market.

- In July 2023, ExxonMobil announced its acquisition of Denbury, a leading specialist in carbon capture, utilization, and storage (CCUS) solutions, in an all-stock transaction valued at USD 4.9 billion. This acquisition is set to significantly expand ExxonMobil's Low Carbon Solutions portfolio, enhance its CCUS capabilities, and accelerate the deployment of sustainable technologies, driving growth and innovation within the enhanced oil recovery sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.