Global Thermal Transfer Overprinter Market

Market Size in USD Million

CAGR :

%

USD

433.95 Million

USD

676.14 Million

2025

2033

USD

433.95 Million

USD

676.14 Million

2025

2033

| 2026 –2033 | |

| USD 433.95 Million | |

| USD 676.14 Million | |

|

|

|

|

What is the Global Thermal Transfer Overprinter Market Size and Growth Rate?

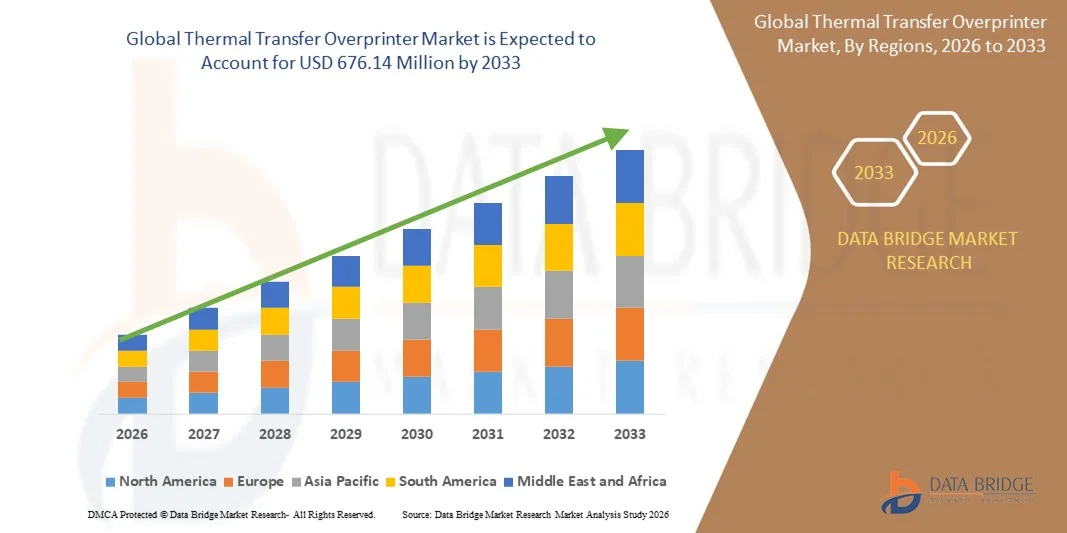

- The global thermal transfer overprinter market size was valued at USD 433.95 million in 2025 and is expected to reach USD 676.14 million by 2033, at a CAGR of 5.7% during the forecast period

- The increasing demand of the print packaging in the food and beverage and pharmaceutical industries will help to boost the thermal transfer overprinter market

- The availability of the other technologies for the printing of the barcodes on the packaging products can restrain the market growth for the thermal transfer overprinter market.

What are the Major Takeaways of Thermal Transfer Overprinter Market?

- The innovation of the eco-friendly marking ink manufacturers will also be able to help government for the sustainable environment and also help to reduce wastage during printing which is the opportunity for the thermal transfer overprinter market

- The use of the high temperature in the process can result in the adhesion on the surface which makes the code blurry acting as the challenge for the thermal transfer overprinter market

- The Asia-Pacific region dominated the thermal transfer overprinter market with the largest revenue share of 43.1% in 2025, driven by the rapid industrialization, expansion of FMCG, pharmaceutical, and food packaging sectors, and high adoption of automated coding and labeling solutions

- The North America region is projected to witness the fastest growth rate of 9.6% during 2026–2033, fueled by the rising adoption of high-speed packaging, stringent labeling regulations, and increasing integration of smart printing solutions in food, pharmaceutical, and beverage sectors

- The BOPP (Biaxially Oriented Polypropylene) segment dominated the market with a revenue share of 41.3% in 2025, due to its superior print quality, high clarity, durability, and excellent heat resistance

Report Scope and Thermal Transfer Overprinter Market Segmentation

|

Attributes |

Thermal Transfer Overprinter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Thermal Transfer Overprinter Market?

Rising Demand for High-Speed, Sustainable, and Flexible Thermal Transfer Overprinter Solutions

- The thermal transfer overprinter market is witnessing a transformation driven by the need for high-speed, precise, and sustainable printing solutions across packaging, labeling, and industrial coding applications. Companies are adopting TTO systems that ensure accuracy, efficiency, and compliance with evolving regulations

- For instance, manufacturers are increasingly using eco-friendly ribbons, inks, and substrates that reduce waste and support sustainability goals while maintaining print quality

- The demand for flexible TTO solutions capable of handling diverse packaging types—such as pouches, cartons, and sachets—is rising, allowing manufacturers to switch between product lines quickly without compromising output speed

- Integration of advanced features, including real-time barcode verification, serialization, and IoT-enabled connectivity, is enhancing traceability, production efficiency, and operational monitoring

- Growing adoption of TTO solutions for food, beverage, pharmaceutical, and consumer goods packaging highlights the importance of combining speed, accuracy, and compliance

- Overall, the shift toward high-performance, sustainable, and digitally connected TTO solutions is redefining operational efficiency, reducing waste, and meeting industrial coding demands globally

What are the Key Drivers of Thermal Transfer Overprinter Market?

- Increasing demand for precise and high-speed product coding and labeling across industries, including food, pharmaceuticals, and consumer goods, is driving Thermal Transfer Overprinter adoption

- Growing regulatory requirements for product traceability, expiration dates, and safety labeling are creating strong demand for reliable TTO solutions that ensure compliance with FDA, EU, and ISO standards

- The need for flexible and versatile printing on various packaging types, including flexible films, cartons, and paperboard, is pushing manufacturers to invest in multi-format TTO systems

- Rising awareness of sustainable operations encourages the use of eco-friendly ribbons and energy-efficient TTO machines, reducing operational costs and environmental impact

- Technological advancements such as automated ribbon change, inline verification, serialization, and IoT-enabled monitoring improve production efficiency, reduce errors, and enhance supply chain transparency

- As industries prioritize high-quality, sustainable, and traceable packaging, the demand for advanced and versatile Thermal Transfer Overprinter systems is expected to accelerate globally

Which Factor is Challenging the Growth of the Thermal Transfer Overprinter Market?

- High initial investment costs for advanced TTO machines, along with specialized maintenance requirements, limit adoption, particularly among small and medium-sized enterprises

- Integration of TTO systems into existing production lines can be complex, requiring technical expertise and temporary downtime, which increases operational costs

- Fluctuations in raw material prices, including ribbons and specialty substrates, can impact overall production costs and profitability

- Strict and evolving industry regulations for labeling, serialization, and traceability require continuous system upgrades and software maintenance

- Limited standardization across global markets creates challenges for manufacturers operating internationally, leading to varied compliance requirements

- To overcome these challenges, companies are investing in modular, automated, and IoT-enabled TTO solutions, focusing on training programs and service support, which enhances adoption and reduces long-term operational risks

How is the Thermal Transfer Overprinter Market Segmented?

The market is segmented on the basis of film, type, type of ribbon, type of printing, capacity, distribution channel and application.

- By Film

On the basis of film type, the thermal transfer overprinter market is segmented into LLDPE, LDPE, and BOPP. The BOPP (Biaxially Oriented Polypropylene) segment dominated the market with a revenue share of 41.3% in 2025, due to its superior print quality, high clarity, durability, and excellent heat resistance. BOPP films are widely used across food, pharmaceutical, and industrial packaging, enabling crisp barcode, batch, and date coding while maintaining package integrity.

The LLDPE segment is expected to witness the fastest CAGR from 2026 to 2033, driven by its flexibility, cost-effectiveness, and growing adoption in lightweight and sustainable packaging formats. Increasing demand for flexible packaging in food and snacks, coupled with advancements in recyclable and eco-friendly films, is propelling LLDPE adoption. Manufacturers are leveraging this growth by integrating TTO systems optimized for thin films to reduce ribbon consumption and maintain consistent print quality.

- By Type

On the basis of TTO system type, the market is segmented into Single Head and Multi Head printers. The Single Head segment dominated the market with 58.6% revenue share in 2025, as it is highly suitable for small-to-medium production lines, offering precision and cost efficiency. Single Head systems are widely used in food packaging, pharmaceuticals, and industrial labeling due to ease of installation, minimal maintenance, and reliable performance.

The Multi Head segment is expected to register the fastest growth from 2026 to 2033, driven by large-scale manufacturing, multi-lane packaging lines, and increasing automation in high-speed production. Multi Head TTO systems support simultaneous coding across multiple packaging lanes, enhancing throughput and operational efficiency, particularly in beverage, snack, and industrial packaging segments.

- By Type of Ribbon

Based on ribbon type, the thermal transfer overprinter market is categorized into Special, Resin, and Standard ribbons. The Resin ribbon segment dominated the market with a 47.2% revenue share in 2025, offering high durability, chemical resistance, and long-lasting print quality for industrial, pharmaceutical, and beverage packaging. Resin ribbons are preferred for applications requiring exposure to heat, moisture, or abrasion.

The Special ribbon segment is anticipated to grow at the fastest rate during 2026–2033, fueled by increasing demand for eco-friendly, scratch-resistant, and specialty-coated ribbons for premium packaging and luxury products. These ribbons provide improved print adhesion on challenging substrates and support sustainable initiatives by reducing material waste.

- By Type of Printing

On the basis of printing type, the market is segmented into Barcodes, Data Codes, Batch Codes, and Graphics. The Batch Codes segment dominated with 44.8% revenue share in 2025, driven by widespread use in regulatory compliance, production traceability, and expiration date labeling in pharmaceutical, food, and beverage industries.

The Graphics segment is projected to witness the fastest growth from 2026 to 2033, as manufacturers increasingly require high-resolution images, logos, and decorative elements to enhance branding on consumer products. Advances in TTO technology allow seamless printing of graphics alongside batch and data codes without slowing production lines.

- By Capacity

On the basis of capacity, the market is segmented into Less Than 800, 800–1200, and 1200 & Above prints per minute. The 800–1200 segment dominated with 51.5% revenue share in 2025, offering an optimal balance between speed, cost, and production flexibility across industries such as food, pharmaceuticals, and cosmetics.

The 1200 & Above segment is expected to grow at the fastest CAGR during 2026–2033, driven by high-speed production lines in snacks, beverages, and industrial sectors. High-capacity TTO systems meet the need for faster coding while maintaining print precision and minimizing ribbon wastage.

- By Distribution Channel

Based on distribution channels, the thermal transfer overprinter market is categorized into E-Commerce, B2B, Third Party Distributors, and Others. The B2B segment dominated the market with 53.2% revenue share in 2025, as large-scale industrial and packaging companies procure TTO systems directly from manufacturers to meet production-line requirements.

The E-Commerce segment is expected to grow at the fastest rate from 2026 to 2033, driven by the rising adoption of online purchasing for industrial equipment, increasing awareness of TTO technologies, and availability of remote support, spare parts, and installation services through digital platforms.

- By Application

On the basis of application, the market is segmented into Food, Fresh Food, Snacks & Savoury, Pharmaceutical, Cosmetics & Personal Care, Beverage, Industrial, Tobacco, and Others. The Food segment dominated with 38.7% revenue share in 2025, due to strict labeling, batch tracking, and expiration date requirements across packaged food products.

The Pharmaceutical segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing regulatory mandates for traceability, serialization, and anti-counterfeiting. TTO systems in pharmaceuticals enable precise printing on blister packs, cartons, and flexible packaging while ensuring compliance with FDA, EU, and WHO standards.

Which Region Holds the Largest Share of the Thermal Transfer Overprinter Market?

- The Asia-Pacific region dominated the thermal transfer overprinter market with the largest revenue share of 43.1% in 2025, driven by the rapid industrialization, expansion of FMCG, pharmaceutical, and food packaging sectors, and high adoption of automated coding and labeling solutions

- The region benefits from cost-effective manufacturing, strong local equipment suppliers, and rising demand for high-speed production lines across countries such as China, India, and Japan

- Continuous innovations in energy-efficient, sustainable TTO systems and increased focus on industrial automation have strengthened Asia-Pacific’s leadership in the global market

China Thermal Transfer Overprinter Market Insight

China is a major contributor within Asia-Pacific, supported by its robust manufacturing base, large-scale packaging production, and increasing exports of TTO equipment. Rising demand for advanced printing technologies, including high-resolution barcodes, graphics, and industrial coding solutions, is fueling market expansion. Local companies are investing in custom TTO solutions to cater to growing e-commerce, food, pharmaceutical, and cosmetic packaging sectors, solidifying China’s dominant position.

India Thermal Transfer Overprinter Market Insight

India is witnessing strong demand for TTO systems, driven by expanding food, pharmaceutical, and FMCG industries. Government initiatives promoting “Make in India” and industrial automation are boosting domestic production and adoption of modern coding and printing equipment. Companies are increasingly deploying TTO solutions for efficient batch, expiry, and serialization labeling. Rising urbanization, growing retail infrastructure, and the need for compliance with global packaging standards are enhancing India’s contribution to Asia-Pacific’s market share.

North America Thermal Transfer Overprinter Market Insight

The North America region is projected to witness the fastest growth rate of 9.6% during 2026–2033, fueled by the rising adoption of high-speed packaging, stringent labeling regulations, and increasing integration of smart printing solutions in food, pharmaceutical, and beverage sectors. Growing demand for serialization, tamper-evident coding, and sustainable ribbon materials is supporting rapid market expansion. The U.S. and Canada are focusing on automated TTO systems for e-commerce, B2B packaging, and industrial applications.

U.S. Thermal Transfer Overprinter Market Insight

The U.S. is the largest contributor within North America, supported by widespread industrial automation, advanced packaging lines, and strict FDA regulations on product labeling. Companies are investing in multi-head TTO systems and eco-friendly ribbons to improve production efficiency, compliance, and sustainability. Rising adoption in the food, pharmaceutical, and cosmetics sectors is accelerating market growth.

Canada Thermal Transfer Overprinter Market Insight

Canada continues to grow steadily, driven by demand from food, beverage, and pharmaceutical manufacturers requiring high-quality, durable, and tamper-evident printing solutions. Manufacturers are increasingly investing in modular and energy-efficient TTO systems, aligning with the country’s sustainability and regulatory standards.

Europe Thermal Transfer Overprinter Market Insight

The Europe market is expanding moderately due to high adoption of TTO systems in the food, pharmaceutical, and tobacco sectors. Countries such as Germany, Italy, and the U.K. are prioritizing compliance, product traceability, and sustainable packaging practices. Investment in recyclable ribbons and compact TTO systems is driving adoption, while industrial automation and premium product labeling continue to grow.

Germany Thermal Transfer Overprinter Market Insight

Germany leads Europe due to its strong industrial manufacturing base and high adoption of automated coding and labeling equipment in the food and pharmaceutical sectors. The country focuses on energy-efficient, eco-friendly TTO solutions, and compliance with EU packaging and labeling standards, reinforcing its regional leadership.

U.K. Thermal Transfer Overprinter Market Insight

The U.K. market is supported by increasing demand for traceable, serialized, and branded packaging across food, cosmetics, and pharmaceutical products. Companies are leveraging high-resolution, multi-head TTO systems and sustainable ribbons to meet evolving regulatory and consumer requirements. Post-Brexit flexibility allows faster adoption of innovative technologies.

Latin America Thermal Transfer Overprinter Market Insight

Latin America is witnessing steady growth due to expanding industrial, food, and beverage sectors in Brazil, Mexico, and Argentina. The rising adoption of modern TTO systems for batch coding, barcodes, and graphics, coupled with compliance with regional labeling regulations, is driving market expansion. Local companies are increasingly focusing on cost-effective and durable TTO solutions.

Middle East & Africa Thermal Transfer Overprinter Market Insight

The Middle East & Africa region is in the early adoption phase, with countries such as South Africa, Israel, and the U.A.E. showing the most progress. Industrial, food, and pharmaceutical companies are gradually deploying TTO solutions for batch, date, and barcode printing. Rising awareness of sustainable packaging, industrial automation, and compliance requirements is expected to fuel market development over the next decade.

Which are the Top Companies in Thermal Transfer Overprinter Market?

The thermal transfer overprinter industry is primarily led by well-established companies, including:

- ID Technology, LLC (U.S.)

- EDM CORPORATION (U.S.)

- Linx Printing Technologies (U.K.)

- Domino Printing Sciences plc (U.K.)

- Markem Imaje (Switzerland)

- FlexPackPRO (U.S.)

- Squid Ink (U.S.)

- ITW Diagraph (U.S.)

- Hitachi Industrial Equipment Marking Solutions Inc. (Japan)

- Koenig & Bauer Coding GmbH (Germany)

- CONTROL PRINT LTD. (U.K.)

- Videojet Technologies, Inc. (U.S.)

- MULTIVAC (Germany)

What are the Recent Developments in Global Thermal Transfer Overprinter Market?

- In April 2025, Source Technologies announced the acquisition of AMT Datasouth's printer assets, strengthening its position in the thermal printing industry and expanding its portfolio to include label, barcode, and receipt printing solutions. This strategic move is expected to enhance Source Technologies’ market reach and product offerings globally

- In March 2025, Distribution Management (DM) revealed the expansion of its product portfolio through a partnership with Brother, incorporating Brother’s thermal desktop and industrial printers. This collaboration leverages DM’s extensive reseller network to extend Brother’s reach across sectors such as state and local government, reinforcing their joint growth strategy

- In October 2024, Munbyn launched two new label printers designed for small and medium-sized businesses. The Realwriter RW402 minimizes paper jams to under 0.01% and reduces downtime, while the FM226 offers portability and long-lasting battery life for on-the-go custom branding labels, strengthening Munbyn’s SMB solutions

- In April 2024, Kite Packaging introduced a new range of thermal labels and printers, featuring both direct thermal and thermal transfer options. The lineup includes desktop and mobile printers from multiple brands, as well as Kite’s own entry-level models, broadening options for packaging and labeling applications

- In January 2024, Munbyn launched the RW401AP wireless label printer for small and medium-sized businesses, offering 300dpi high-resolution printing for clearer images and logistics labels. This release reinforces Munbyn’s commitment to providing high-quality, reliable printing solutions for growing enterprises

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Thermal Transfer Overprinter Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Thermal Transfer Overprinter Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Thermal Transfer Overprinter Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.